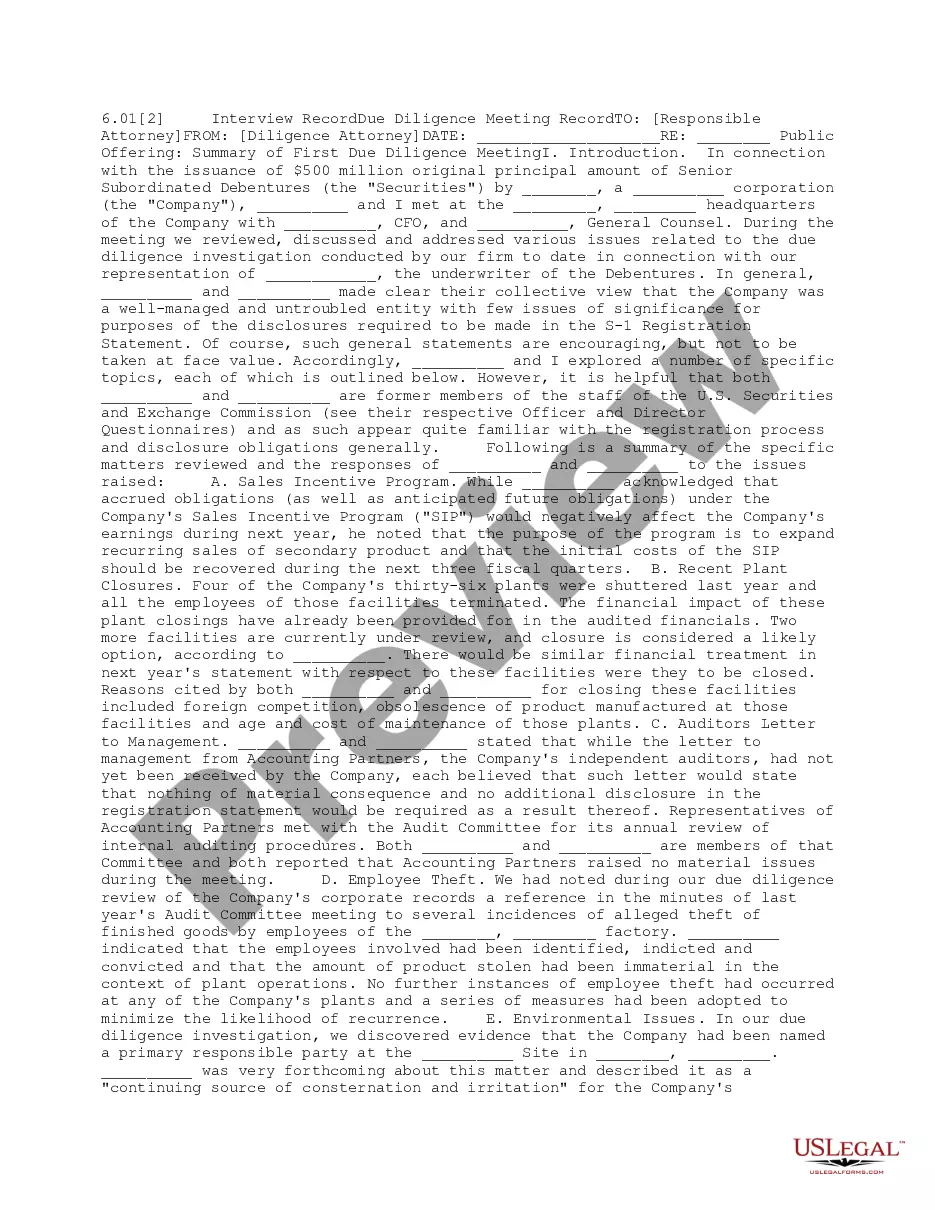

This form provides an outline of due diligence group members for departments within a company.

Puerto Rico Due Diligence Groups

Description

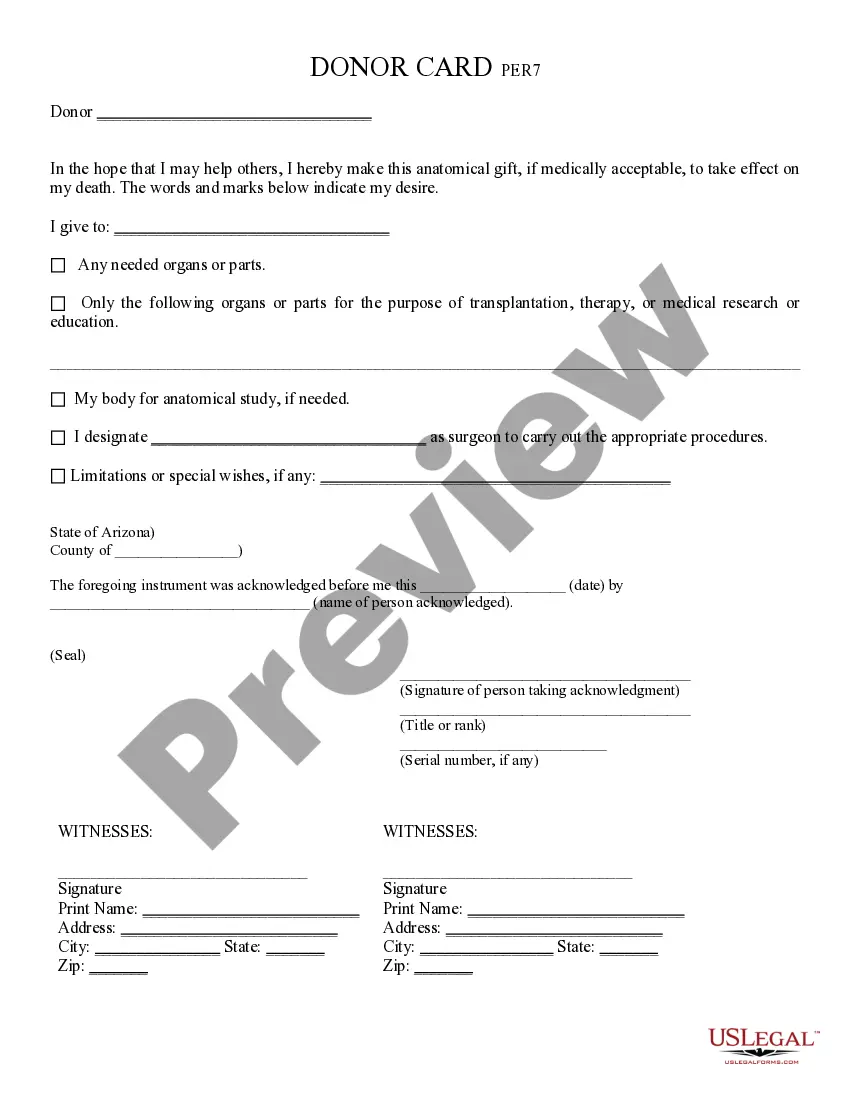

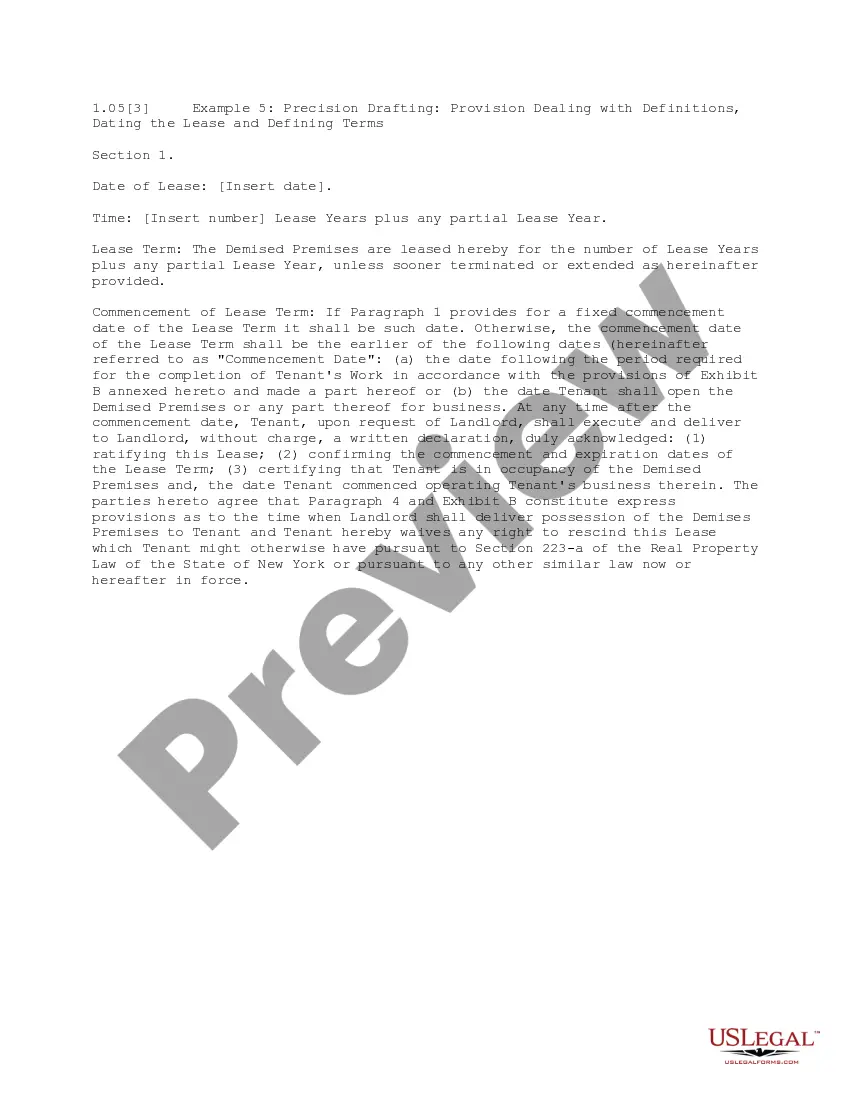

How to fill out Due Diligence Groups?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a variety of legal template formats that you can download or print.

While utilizing the website, you can access numerous forms for business and personal purposes, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Puerto Rico Due Diligence Groups within minutes.

Read the form description to confirm that you have chosen the appropriate form.

If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- If you already have a monthly subscription, Log In and download Puerto Rico Due Diligence Groups from the US Legal Forms library.

- The Download button will appear on every form you access.

- You can retrieve all previously downloaded forms from the My documents section of your account.

- If you're using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your region/county.

- Click the Review button to check the form's details.

Form popularity

FAQ

An IFE, or Individual Financial Entity, refers to an entity structured to take advantage of the tax incentives available in Puerto Rico. These organizations can benefit significantly under Act 60. Being part of Puerto Rico Due Diligence Groups provides you with insights on forming an IFE and optimizing its benefits.

The 183-day rule in Puerto Rico establishes residency requirements for tax purposes, stating that individuals must reside in Puerto Rico for at least 183 days to qualify for certain benefits under Act 60. This rule is crucial for anyone considering relocating. By utilizing Puerto Rico Due Diligence Groups, you can better understand how this rule applies to your situation.

While Act 60 presents many advantages, there are risks to consider, including potential changes in regulations and compliance challenges. Failure to meet the requirements can lead to loss of benefits. Collaborating with Puerto Rico Due Diligence Groups can help you identify these risks and develop strategies to mitigate them.

As of now, discussions regarding the extension of Act 60 are ongoing, with potential amendments to enhance its benefits. This act has proven successful in attracting investments, so staying updated on legislative changes is essential. Engaging with Puerto Rico Due Diligence Groups can keep you informed about potential extensions and changes to Act 60.

Rule 60 in Puerto Rico pertains to the eligibility criteria for tax incentives under Act 60. It provides specific guidelines for businesses and individuals seeking benefits, ensuring they adhere to the legal framework. By joining Puerto Rico Due Diligence Groups, you can stay informed about Rule 60 and its implications for your financial decisions.

The beneficiaries of Act 60 include new residents, businesses, and certain activities that qualify for tax incentives in Puerto Rico. This act aims to stimulate the local economy by attracting foreign investments. When you connect with Puerto Rico Due Diligence Groups, you can gain valuable insights into maximizing benefits from Act 60.

Act 60 in Puerto Rico targets individuals and businesses that meet specific criteria, including residency and investment requirements. The law attracts those looking to enjoy tax benefits while contributing to the economy. Engaging with Puerto Rico Due Diligence Groups can help you determine if you meet these qualifications and navigate the application process effectively.

Section 933 of Puerto Rico refers to a provision that offers certain tax incentives to businesses and individuals relocating to Puerto Rico. This section is important for those who participate in Puerto Rico Due Diligence Groups, as it outlines the requirements and benefits associated with tax exemptions. Understanding Section 933 can significantly impact your financial strategy when considering relocation to Puerto Rico.

A bank account in Puerto Rico is not classified as foreign since Puerto Rico is a U.S. territory. However, for tax purposes or reporting requirements, different rules may apply. It’s advisable to consult with Puerto Rico Due Diligence Groups to ensure you fully understand the implications of having a bank account in Puerto Rico.

To search property records in Puerto Rico, you can access the Puerto Rico Property Registry online or visit local municipal offices. Engaging with Puerto Rico Due Diligence Groups can simplify this process. They can help guide you through the necessary steps to ensure that your property inquiries are comprehensive and accurate.