This form provides an outline of due diligence coordinators for departments within a company.

Puerto Rico Due Diligence Coordinators

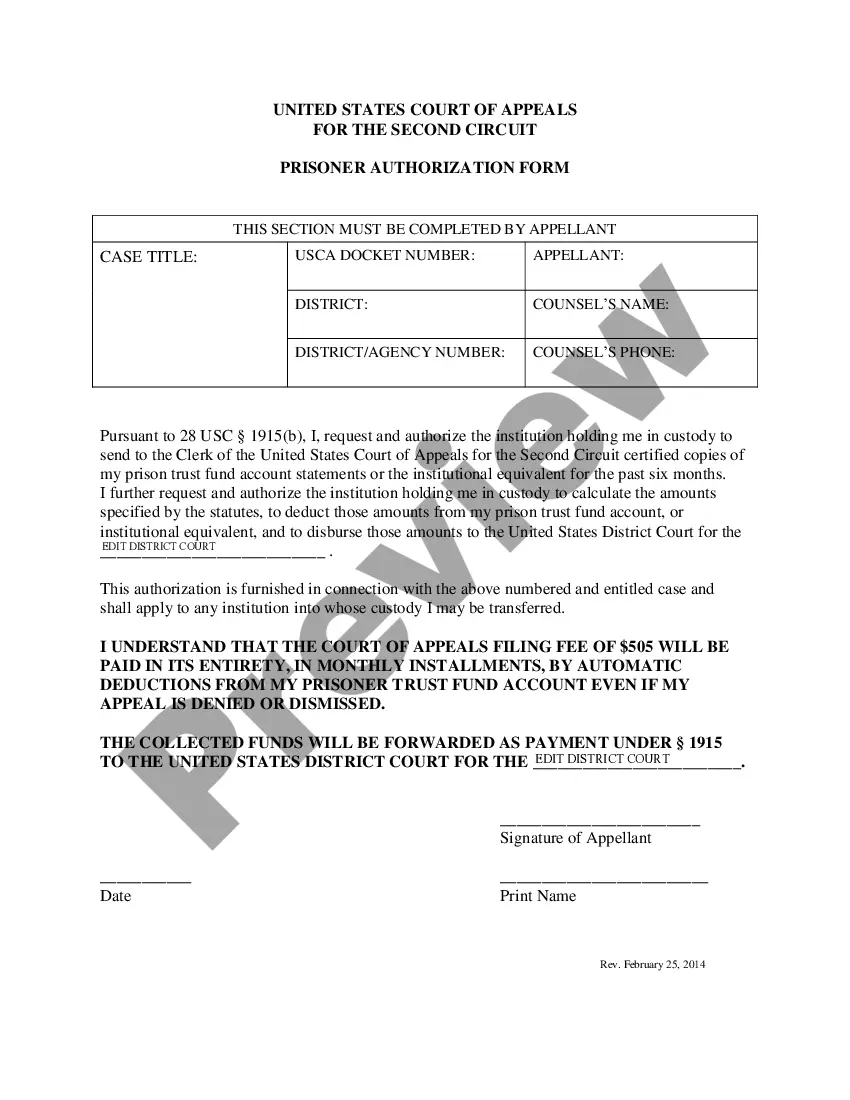

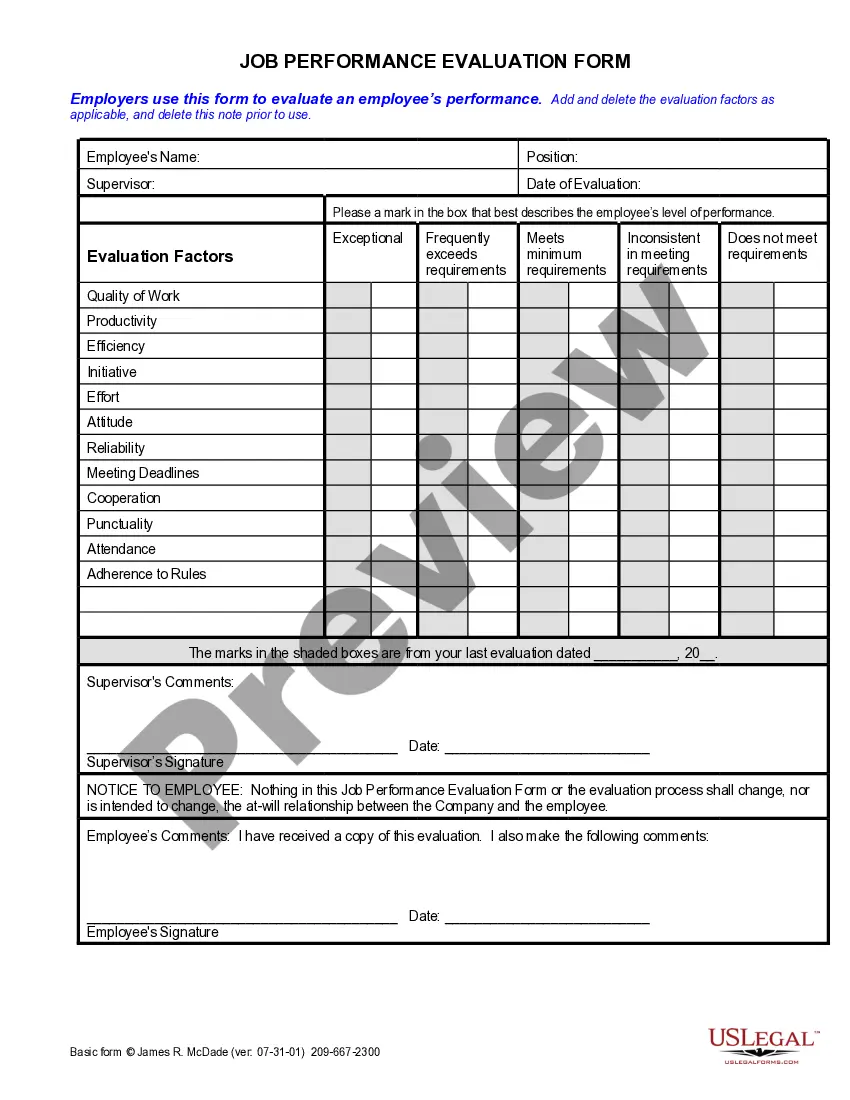

Description

How to fill out Due Diligence Coordinators?

If you need to thorough, acquire, or print legitimate document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site`s straightforward search to find the documents you require. A variety of templates for business and personal use are categorized by types and states, or keywords.

Employ US Legal Forms to access the Puerto Rico Due Diligence Coordinators in just a few clicks.

Every legal document template you obtain is yours indefinitely. You will have access to every form you purchased in your account. Select the My documents section and choose a form to print or download again.

Stay competitive and acquire, and print the Puerto Rico Due Diligence Coordinators with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log Into your account and click the Download option to locate the Puerto Rico Due Diligence Coordinators.

- You can also find forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Use the Preview feature to review the form`s content. Be sure to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search box at the top of the screen to find alternative forms in the legal document format.

- Step 4. Once you’ve found the form you want, click the Buy now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Finalize the transaction. You may use your Мisa or Ьastercard or PayPal account to complete the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Puerto Rico Due Diligence Coordinators.

Form popularity

FAQ

The 183 day rule in Puerto Rico refers to the criteria for determining a person's residency for tax purposes. If you reside in Puerto Rico for 183 days or more during the tax year, you may be considered a resident and might benefit from local tax rates. As Puerto Rico Due Diligence Coordinators, we can assist you in understanding how this rule impacts your business and financial planning.

Rule 60 in Puerto Rico refers to specific provisions regarding the reopening of cases in civil proceedings. It allows individuals to seek relief from judgments or orders under certain circumstances. If you are considering legal actions related to your business, consulting with Puerto Rico Due Diligence Coordinators can provide clarity and guidance through these legal processes.

Yes, a US citizen can easily start a business in Puerto Rico. The island offers a favorable business environment with various incentives and tax benefits. As Puerto Rico Due Diligence Coordinators, we can help you navigate through the local regulations and ensure compliance. This support will enhance your chances of success in establishing your business.

Section 933 of the Internal Revenue Code provides that bona fide residents of Puerto Rico may exclude certain types of income earned in Puerto Rico from their federal taxable income. This section is crucial for maximizing tax benefits. To navigate these regulations properly, engaging with Puerto Rico Due Diligence Coordinators is highly recommended.

The requirements for bona fide residency encompass three key tests: the presence test, the tax home test, and the closer connection test. You need to live in Puerto Rico for at least 183 days and show that your primary connections—like family, work, and social ties—are in Puerto Rico. Consulting Puerto Rico Due Diligence Coordinators can ensure you meet all these requirements effectively.

To qualify as a bona fide resident, you must satisfy the IRS criteria, which include physical presence, tax home in Puerto Rico, and a closer connection to Puerto Rico than to any other location. This means actively participating in local life and establishing community ties. Working with Puerto Rico Due Diligence Coordinators can aid you in achieving bona fide residency.

The IRS treats Puerto Rico differently than the states, as it is technically a U.S. territory. While residents of Puerto Rico file taxes differently than those in the states, they are still subject to U.S. tax laws for certain types of income. For a clearer understanding, Puerto Rico Due Diligence Coordinators can provide expert advice.

Moving to Puerto Rico can be financially beneficial due to potential tax incentives for certain residents. Many individuals and businesses take advantage of these benefits, which can lead to significant savings. However, it is crucial to assess your situation carefully and possibly consult with Puerto Rico Due Diligence Coordinators to understand if this move aligns with your financial goals.

Establishing residency in Puerto Rico requires you to make it your primary home, which involves living there and integrating into the community. Steps include obtaining a local driver's license, registering to vote, and starting a local bank account. Engaging with Puerto Rico Due Diligence Coordinators will provide insights on meeting residency requirements.

To become a bona fide resident of Puerto Rico, you must meet specific criteria established by the IRS. These criteria include living in Puerto Rico for at least 183 days during the tax year, having a tax home in Puerto Rico, and demonstrating that you do not have a closer connection to the mainland U.S. Consulting Puerto Rico Due Diligence Coordinators can help smooth this process.