A debt collector may not use unfair or unconscionable means to collect a debt. This includes depositing a postdated check prior to the date on the check.

Puerto Rico Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check

Description

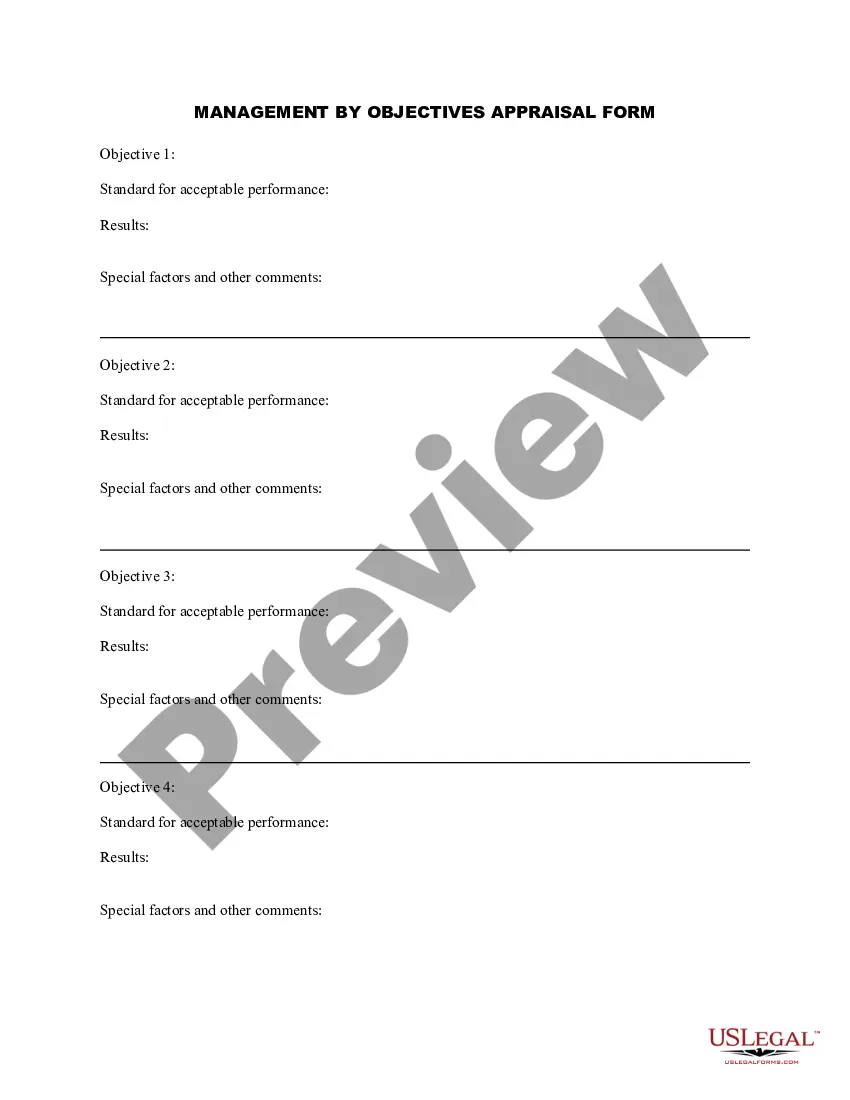

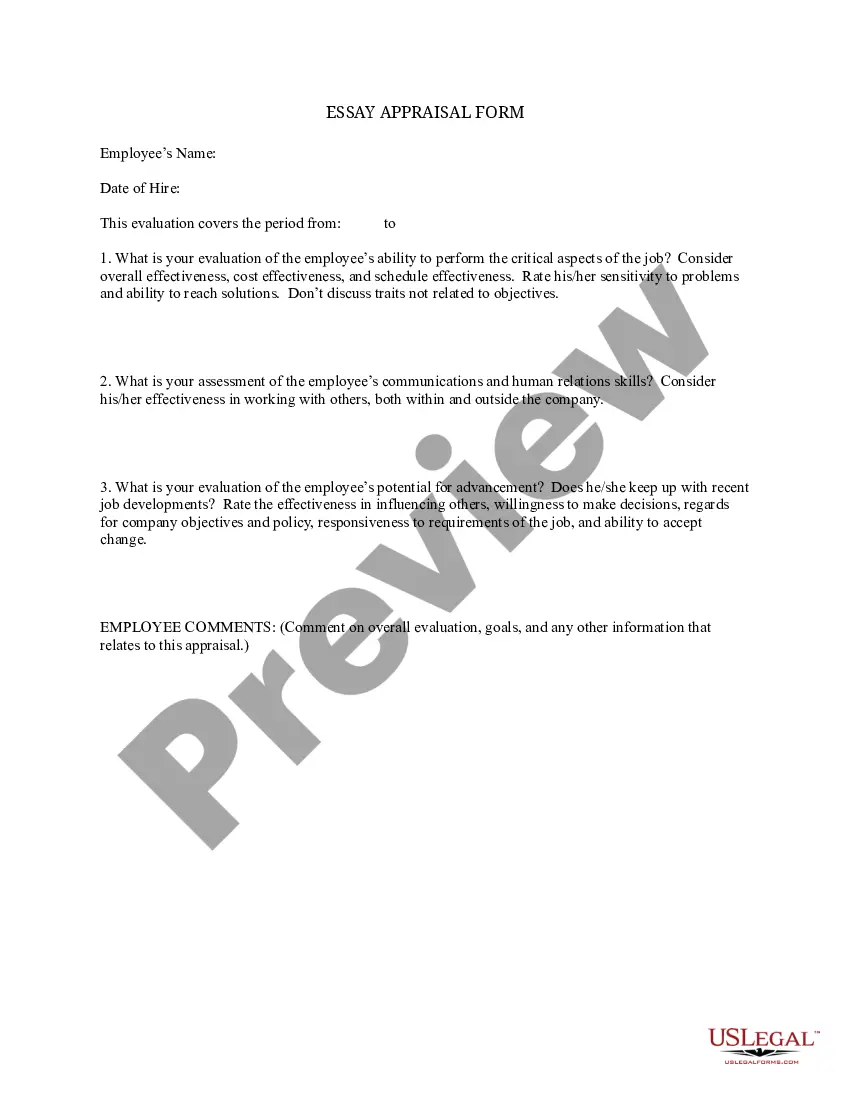

How to fill out Notice To Debt Collector - Depositing A Postdated Check Prior To The Date On The Check?

Are you presently in a position that requires documents for either corporate or personal purposes nearly every day.

There are numerous legal document templates available online, but finding trustworthy forms can be challenging.

US Legal Forms offers a wide array of template forms, such as the Puerto Rico Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check, which are designed to comply with state and federal regulations.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Puerto Rico Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check at any time, if needed. Simply click the desired form to download or print the document template. Utilize US Legal Forms, which boasts one of the largest selections of legal templates, to save time and avoid mistakes. The service provides expertly crafted legal document templates that can be employed for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Puerto Rico Notice to Debt Collector - Depositing a Postdated Check Prior to the Date on the Check template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Acquire the form you need and ensure it is for the correct city/area.

- Utilize the Preview button to examine the form.

- Read the description to confirm you have selected the right document.

- If the form does not meet your criteria, use the Search box to find the form that suits your needs.

- Once you find the correct form, click on Get now.

- Select the pricing option you desire, fill out the required details to create your account, and complete the transaction using your PayPal or credit card.

Form popularity

FAQ

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Federal law restricts what a debt collector can and cannot do with your postdated check. Specifically, under the Fair Debt Collection Practices Act (FDCPA), a debt collector cannot: coerce you into making a postdated payment by threatening or instituting criminal prosecution.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

Debts that may not be covered are those that are not incurred voluntarily, such as income taxes, parking and speeding tickets, and domestic support obligations like child support and alimony, or spousal support.

The FDCPA broadly prohibits a debt collector from using 'any false, deceptive, or misleading representation or means in connection with the collection of any debt. ' 15 U.S.C. § 1692e. The statute enumerates several examples of such practices, 15 U.S.C.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.