Puerto Rico Letter to Debt Collector - Only Contact Me In Writing

Description

How to fill out Letter To Debt Collector - Only Contact Me In Writing?

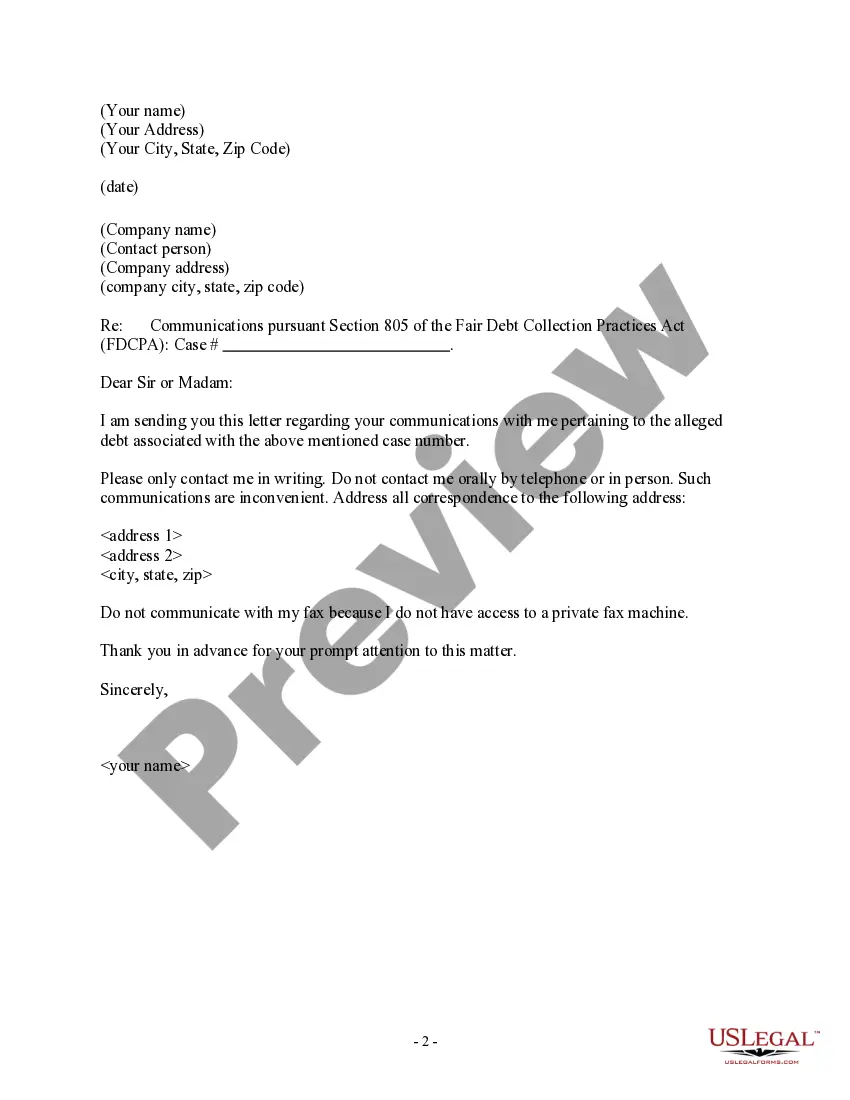

Finding the appropriate legitimate document template can be a challenge. Clearly, there are numerous designs available online, but how do you find the authentic form you require? Utilize the US Legal Forms website. This service offers a vast array of templates, including the Puerto Rico Letter to Debt Collector - Only Contact Me In Writing, which can serve both business and personal needs.

If you are already a registered user, Log In to your account and click the Acquire button to obtain the Puerto Rico Letter to Debt Collector - Only Contact Me In Writing. Use your account to access the legal forms you have purchased previously. Navigate to the My documents section of your profile and download another copy of the document you require.

If you are a new customer of US Legal Forms, here are some simple steps to follow: First, ensure that you have selected the correct form for your jurisdiction. You can examine the form using the Review option and check the form details to confirm it is the right one for you.

US Legal Forms is the largest repository of legal templates where you can find a variety of document designs. Utilize this service to download professionally-crafted documents that adhere to state requirements.

- If the form does not suit your requirements, use the Search field to locate the correct form.

- Once you are confident that the form is appropriate, click the Acquire now button to get the form.

- Select the pricing plan you prefer and fill in the required information.

- Create your account and complete your order using your PayPal account or a Visa or Mastercard.

- Choose the document format and download the legal document template to your device.

- Fill out, modify, print, and sign the downloaded Puerto Rico Letter to Debt Collector - Only Contact Me In Writing.

Form popularity

FAQ

What Does a Debt Verification Notice Include? A debt collector has to send you a written statement outlining the specifics of your debt that is in collection. Within five days of contacting you, a debt collector must send you this written notice with the amount of money you owe and the name of the original creditor.

No. Under federal law, a debt collector may contact other people but generally only to find out how to contact you. The CFPB's Debt Collection Rule clarifying certain provisions of the Fair Debt Collection Practices Act (FDCPA) became effective on November 30, 2021.

If, within the 30-day period, the consumer disputes in writing any portion of the debt or requests the name and address of the original creditor, the collector must stop all collection efforts until he or she mails the consumer a copy of a judgment or verification of the debt, or the name and address of the original

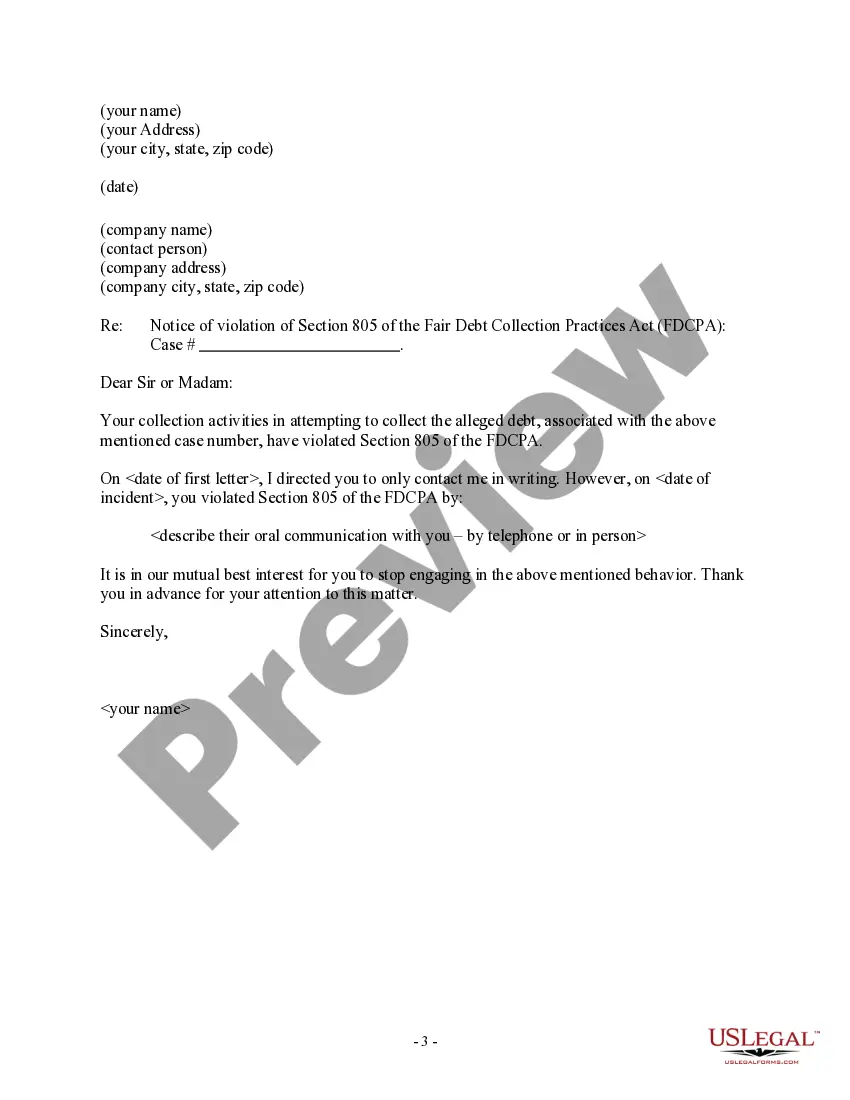

If the collection agency first contacts you by phone, insist that they contact you in writing. Do not give personal or financial information to the caller until you have confirmed it is a legitimate debt collector.

§ 1006.34 Notice for validation of debts.Deceased consumers.Bankruptcy proofs of claim.In general.Subsequent debt collectors.Last statement date.Last payment date.Transaction date.Assumed receipt of validation information.More items...

Debt collectors can call you on your mobile to discuss the debt, and if you happen to be at work when they call, this is not an offence. After all, they genuinely might not know you are at work. Moreover, debt collectors can call you at work as long as they do not reveal the reason they are calling.

I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

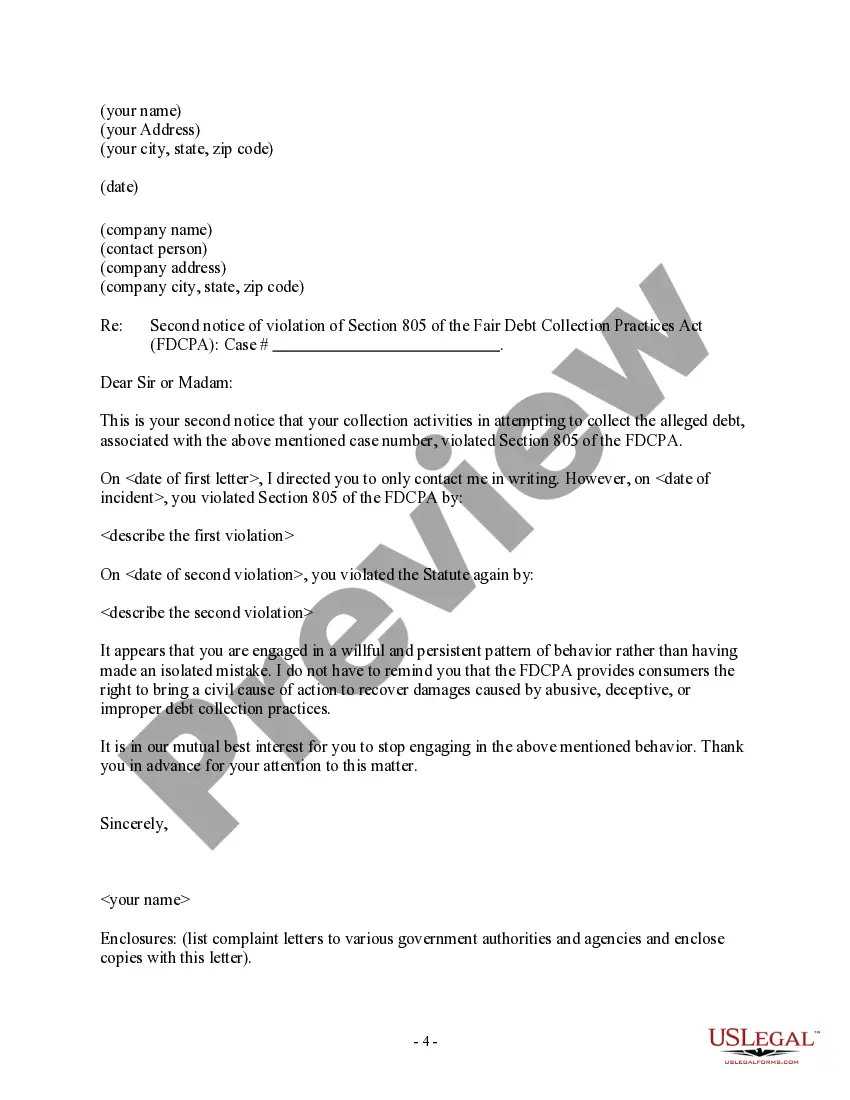

If the consumer notifies the debt collector in writing within the thirty-day period described in subsection (a) of this section that the debt, or any portion thereof, is disputed, or that the consumer requests the name and address of the original creditor, the debt collector shall cease collection of the debt, or any

A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of any debt.

What are debt collectors not allowed to do?Contact you at your workplace or via social media.Give you incorrect or misleading information.Contact you outside the hours of 8am-9pm on working days or at all on weekends and holidays.Tell other people such as family about your debt situation.More items...