Puerto Rico Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp.

Description

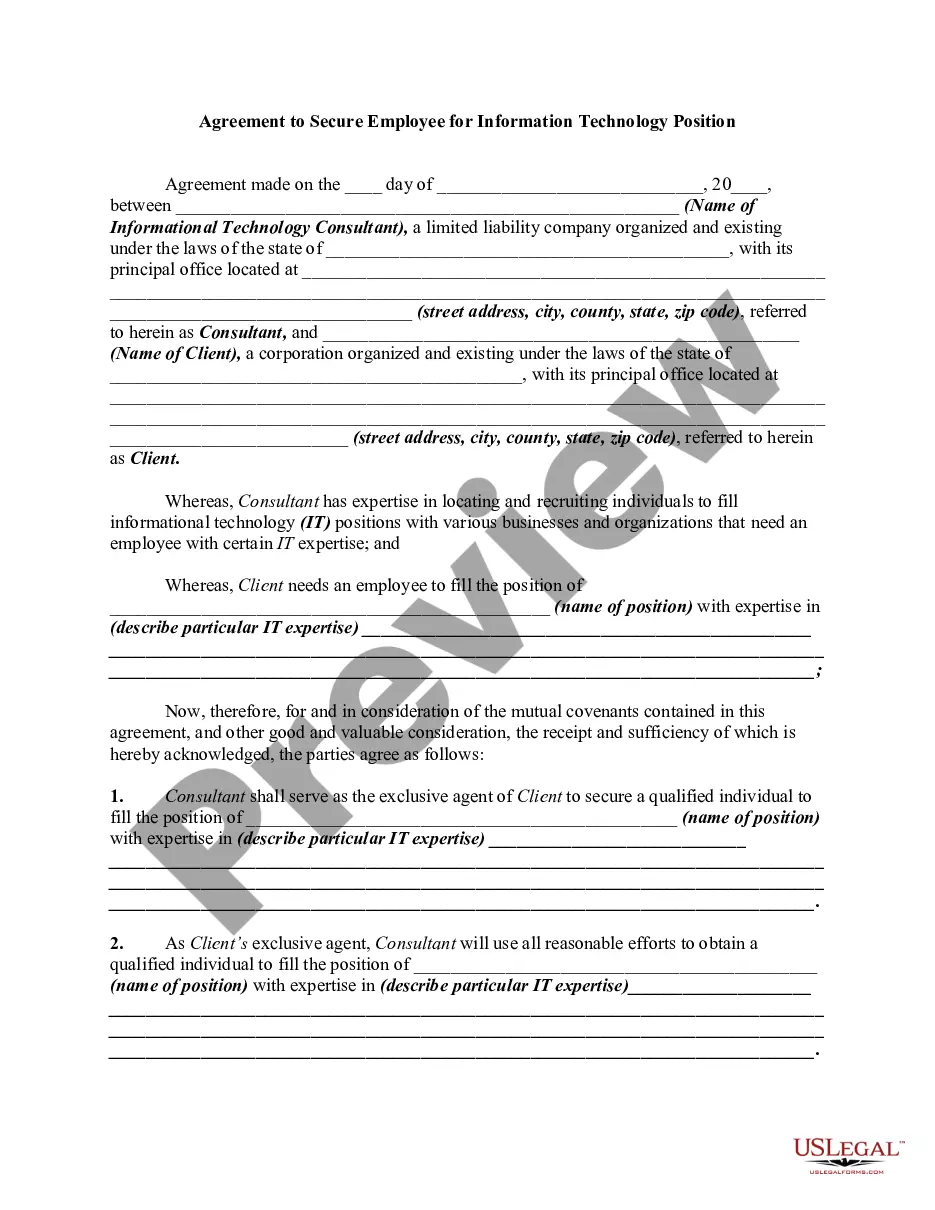

How to fill out Agreement And Plan Of Reorganization By Wedgestone Realty Investors Trust And Wedgestone Advisory Corp.?

Choosing the right legitimate file template can be a battle. Needless to say, there are plenty of layouts available on the Internet, but how can you obtain the legitimate form you will need? Utilize the US Legal Forms website. The assistance provides a large number of layouts, for example the Puerto Rico Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp., that you can use for company and private needs. All the types are inspected by professionals and meet up with state and federal demands.

Should you be previously authorized, log in to your profile and click the Download key to get the Puerto Rico Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp.. Make use of your profile to look throughout the legitimate types you have ordered previously. Go to the My Forms tab of your respective profile and acquire one more backup in the file you will need.

Should you be a brand new consumer of US Legal Forms, listed here are straightforward directions that you should adhere to:

- Initially, make sure you have selected the right form for your personal metropolis/county. You may look through the form utilizing the Preview key and study the form explanation to guarantee it is the right one for you.

- In the event the form does not meet up with your needs, use the Seach discipline to find the proper form.

- When you are certain that the form is suitable, go through the Purchase now key to get the form.

- Opt for the pricing prepare you want and enter in the needed details. Build your profile and purchase the transaction with your PayPal profile or credit card.

- Select the file file format and obtain the legitimate file template to your gadget.

- Comprehensive, change and print out and indicator the acquired Puerto Rico Agreement and Plan of Reorganization by Wedgestone Realty Investors Trust and Wedgestone Advisory Corp..

US Legal Forms will be the largest collection of legitimate types that you can see different file layouts. Utilize the company to obtain appropriately-made documents that adhere to state demands.

Form popularity

FAQ

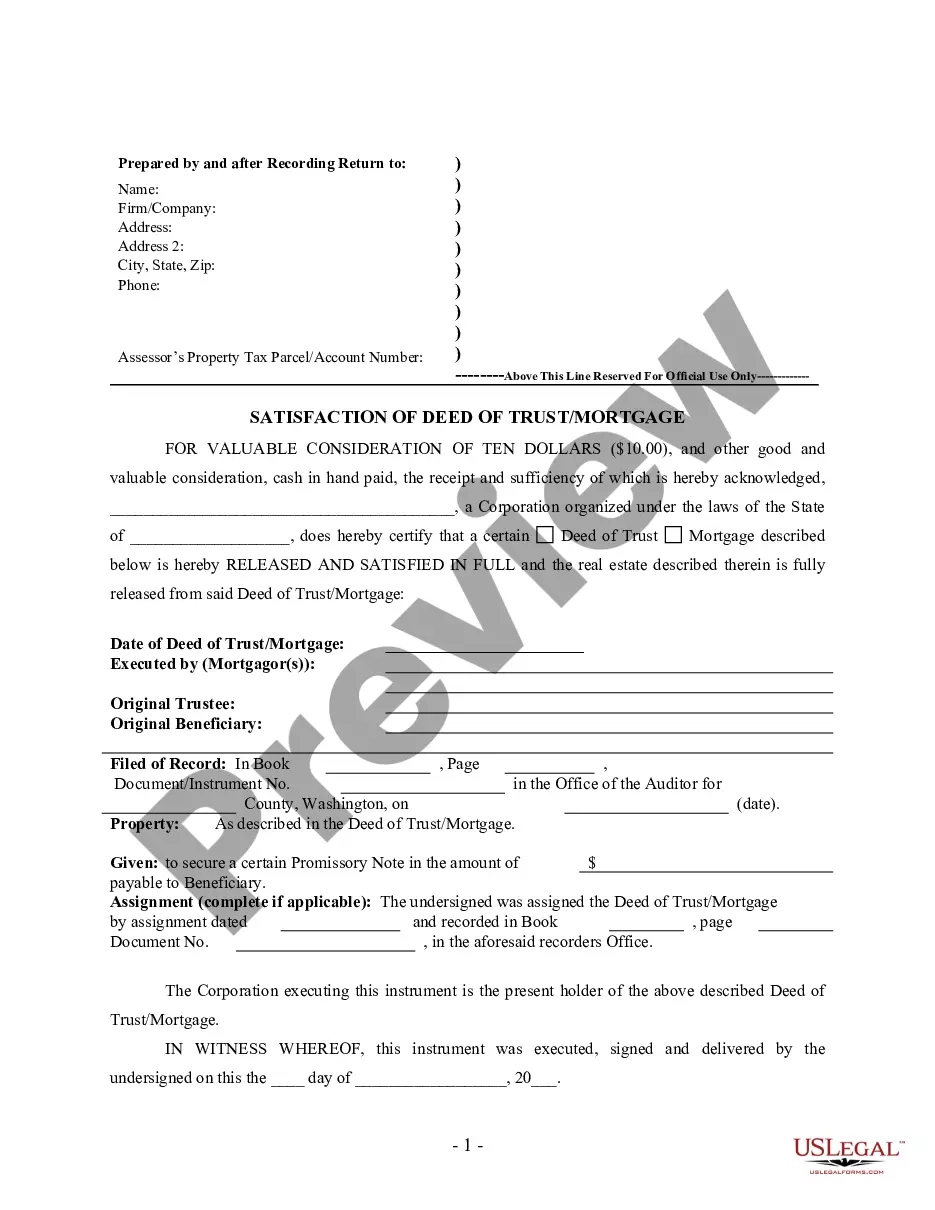

On January 18, 2022, Judge Laura Taylor Swain of the U.S. District Court for the District of Puerto Rico confirmed the Plan of Adjustment for the Commonwealth of Puerto Rico to restructure $33 billion of liabilities against the Commonwealth of Puerto Rico, the Public Building Authority (PBA), and the Employee ...

Therefore, in many cases, a U.S. citizen or resident cannot avoid U.S. income taxation on gains associated with appreciation in investment assets by establishing bona fide residence in Puerto Rico unless recognized after 10 years of bona fide residence in Puerto Rico.

The debt restructuring plan was approved by a federal judge in January. It reduces claims against Puerto Rico's government from $33 billion to just over $7.4 billion, with 7 cents of every taxpayer dollar going to debt service, compared with 25 cents previously.

Estates of residents of Puerto Rico who are considered citizens of the United States, under Subtitle B, Chapter II of the United States Internal Revenue Code, are allowed an exemption which is the greater of (i) $30,000.00 or (ii) that proportion of $60,000 which the value of that part of the decedent's gross estate ...

One of the greatest of many Puerto Rico tax benefits is the Act 60 Investor Resident Individual Tax Incentive (formerly Act 22), which allows you to pay 0% federal or Puerto Rico capital gains tax on all capital gains incurred during the time that you qualify as a bona fide Puerto Rico resident living in Puerto Rico.

75% property tax exemption for real and personal property. 50% municipal tax exemption. 100% exemption form income withholding taxes on payments of dividends and other profit distributions. Isolation of proceeds and benefits paid by international insurers are not subject to income taxes.

Specifically, a U.S. citizen who becomes a bona fide Puerto Rico resident and moves his or her business to Puerto Rico (thus, generating Puerto Rico sourced income) may benefit from a 4% corporate tax/fixed income tax rate, a 100% exemption on property taxes, and a 100% exemption on dividends from export services.

75% property tax exemption for real and personal property. 50% municipal tax exemption. 100% exemption form income withholding taxes on payments of dividends and other profit distributions. Isolation of proceeds and benefits paid by international insurers are not subject to income taxes.