Puerto Rico Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank

Description

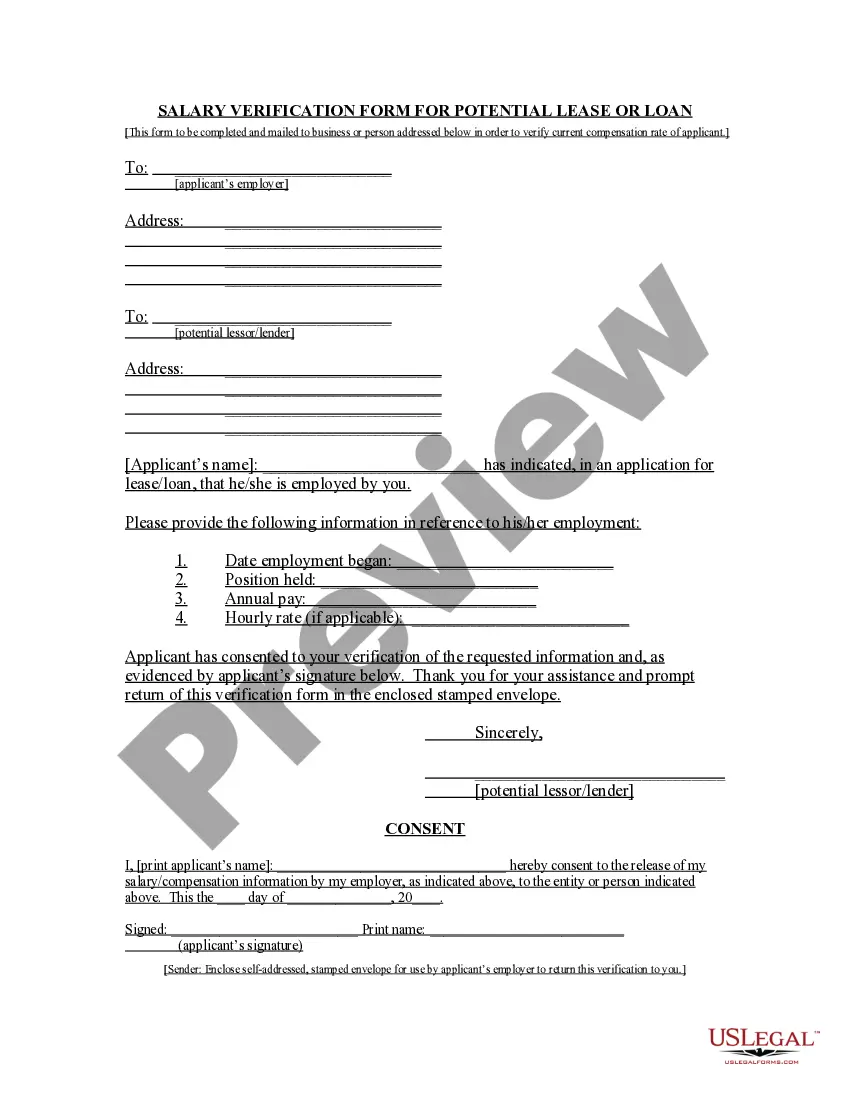

How to fill out Form Of Agreement And Plan Of Merger By Regional Bancorp, Inc., Medford Interim, Inc., And Medford Savings Bank?

Choosing the right authorized file web template might be a have a problem. Naturally, there are a variety of templates accessible on the Internet, but how will you obtain the authorized form you will need? Make use of the US Legal Forms internet site. The services provides thousands of templates, like the Puerto Rico Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank, that you can use for business and personal needs. Each of the types are checked out by pros and meet up with federal and state demands.

Should you be previously signed up, log in to your bank account and click on the Acquire button to have the Puerto Rico Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank. Make use of your bank account to appear throughout the authorized types you may have purchased earlier. Go to the My Forms tab of your bank account and have another copy of the file you will need.

Should you be a fresh customer of US Legal Forms, listed below are easy recommendations that you should stick to:

- Very first, make certain you have chosen the proper form for the town/region. You may look through the shape utilizing the Preview button and study the shape description to ensure it is the right one for you.

- If the form will not meet up with your requirements, use the Seach field to discover the right form.

- Once you are positive that the shape is suitable, select the Buy now button to have the form.

- Choose the pricing program you need and type in the essential information and facts. Design your bank account and buy the order utilizing your PayPal bank account or charge card.

- Select the file formatting and down load the authorized file web template to your product.

- Full, change and print out and signal the attained Puerto Rico Form of Agreement and Plan of Merger by Regional Bancorp, Inc., Medford Interim, Inc., and Medford Savings Bank.

US Legal Forms may be the largest library of authorized types for which you can find numerous file templates. Make use of the service to down load appropriately-created paperwork that stick to condition demands.