Puerto Rico Plan of Merger between two corporations

Description

How to fill out Plan Of Merger Between Two Corporations?

US Legal Forms - among the biggest libraries of legal varieties in the United States - gives a variety of legal document themes you are able to acquire or print out. Utilizing the site, you can find a huge number of varieties for business and person purposes, sorted by classes, states, or key phrases.You can find the most up-to-date versions of varieties much like the Puerto Rico Plan of Merger between two corporations in seconds.

If you already possess a membership, log in and acquire Puerto Rico Plan of Merger between two corporations through the US Legal Forms collection. The Download option can look on every single kind you perspective. You get access to all previously downloaded varieties in the My Forms tab of your respective bank account.

If you wish to use US Legal Forms the very first time, here are straightforward recommendations to get you began:

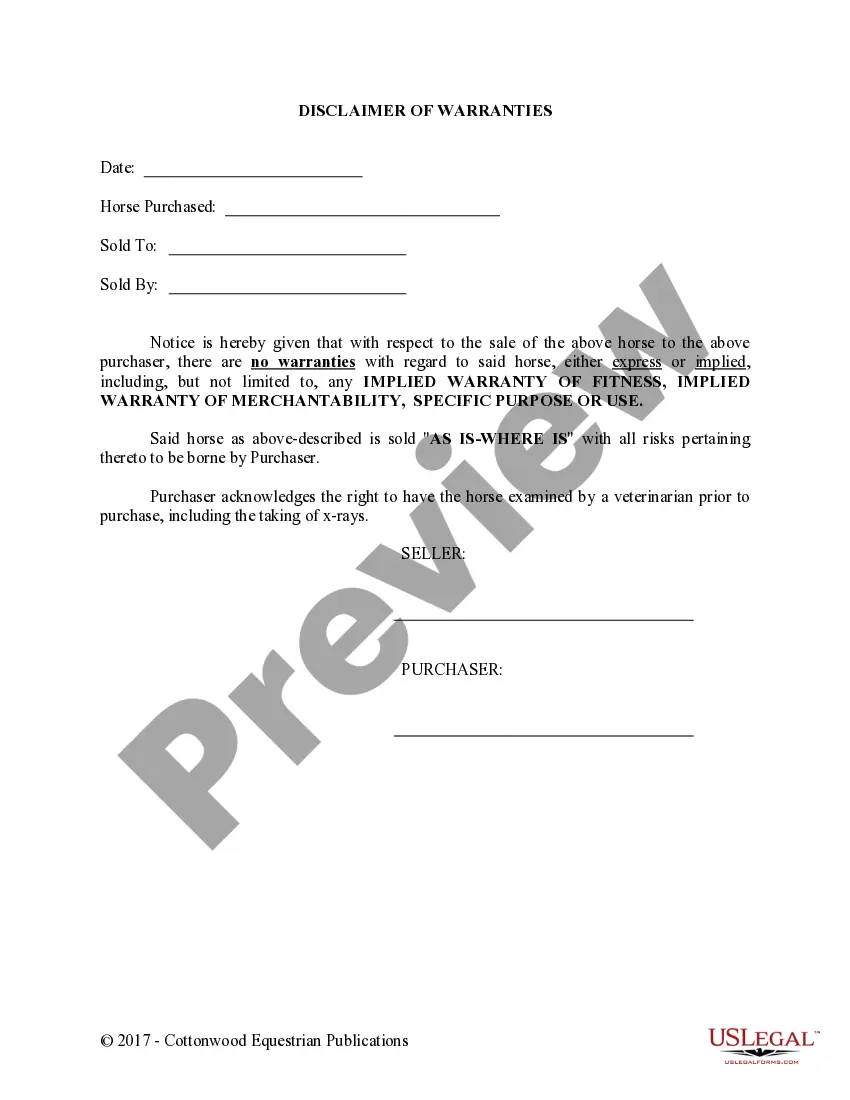

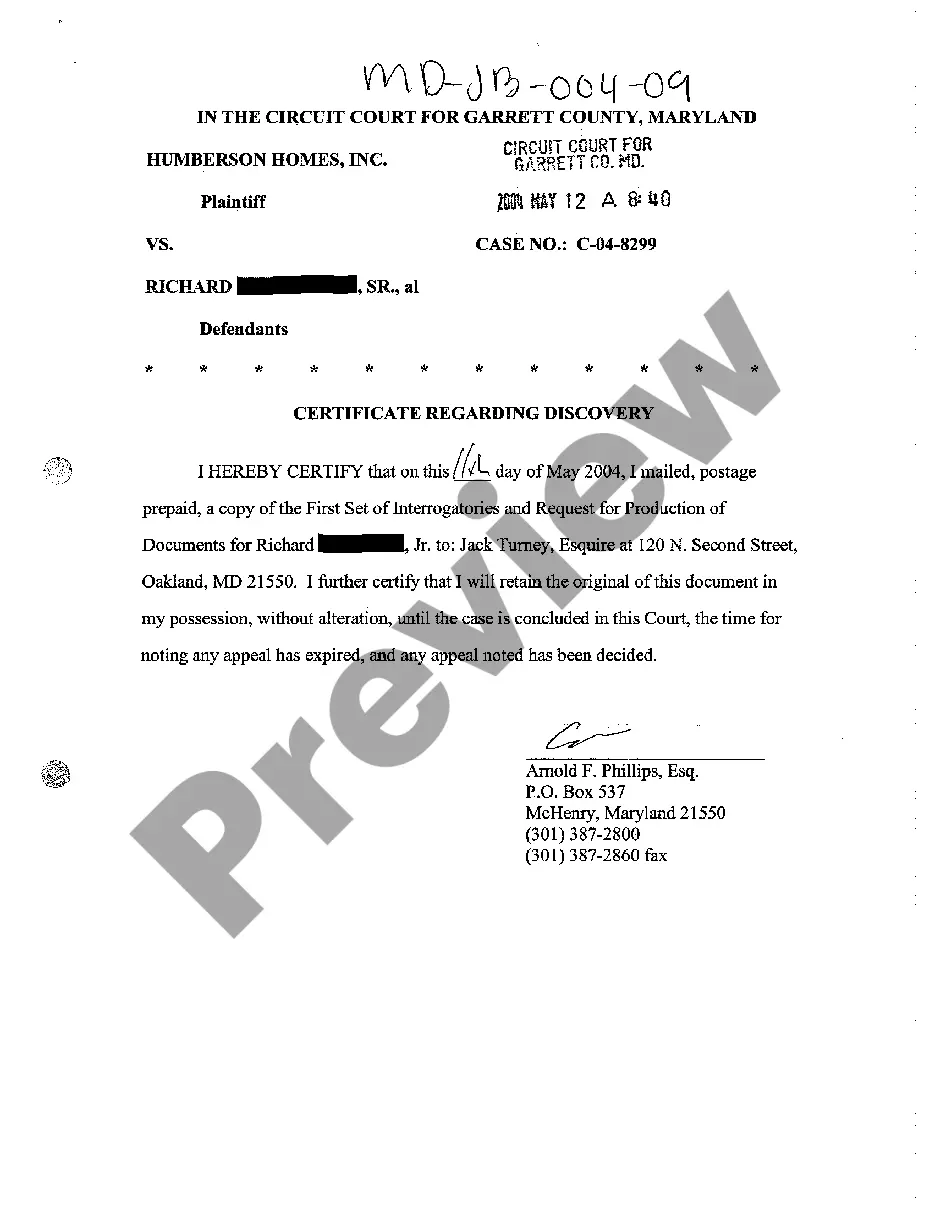

- Be sure you have picked out the proper kind for the city/area. Click the Preview option to examine the form`s articles. Look at the kind information to ensure that you have selected the right kind.

- When the kind does not satisfy your demands, take advantage of the Research field on top of the screen to obtain the the one that does.

- If you are satisfied with the shape, affirm your decision by clicking on the Acquire now option. Then, choose the rates plan you favor and provide your references to register on an bank account.

- Method the deal. Use your bank card or PayPal bank account to perform the deal.

- Pick the formatting and acquire the shape in your product.

- Make changes. Load, change and print out and indicator the downloaded Puerto Rico Plan of Merger between two corporations.

Every single format you included with your account does not have an expiry date and it is yours forever. So, if you want to acquire or print out an additional duplicate, just proceed to the My Forms section and then click about the kind you want.

Gain access to the Puerto Rico Plan of Merger between two corporations with US Legal Forms, probably the most considerable collection of legal document themes. Use a huge number of skilled and status-certain themes that meet up with your organization or person demands and demands.

Form popularity

FAQ

Puerto Ricans do pay federal taxes, but the majority of them do not contribute to income taxes which are only paid by Puerto Rico residents who work for the federal government, those who are in the U.S. military, others who earn money from outside the country and those who work with the federal government.

Before conducting business locally, all corporations or limited liability companies must register at the Puerto Rico State Department. Puerto Rico corporations are treated as foreign corporations for U.S. income tax purposes.

Audited financial statements Accounting records must be prepared in ance with the GAAP followed in the United States.

While the Commonwealth government has its own tax laws, Puerto Rico residents are also not required to pay US federal taxes, but most residents do not have to pay the federal personal income tax.

Accounting records must be prepared in ance with the GAAP followed in the United States.

An agreement setting out steps of a merger of two or more entities including the terms and conditions of the merger, parties, the consideration, conversion of equity, and information about the surviving entity (such as its governing documents).

A foreign corporation may be engaged in trade or business in Puerto Rico as a division or branch of that foreign corporation, or as a separate corporation or subsidiary.