Puerto Rico Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit

Description

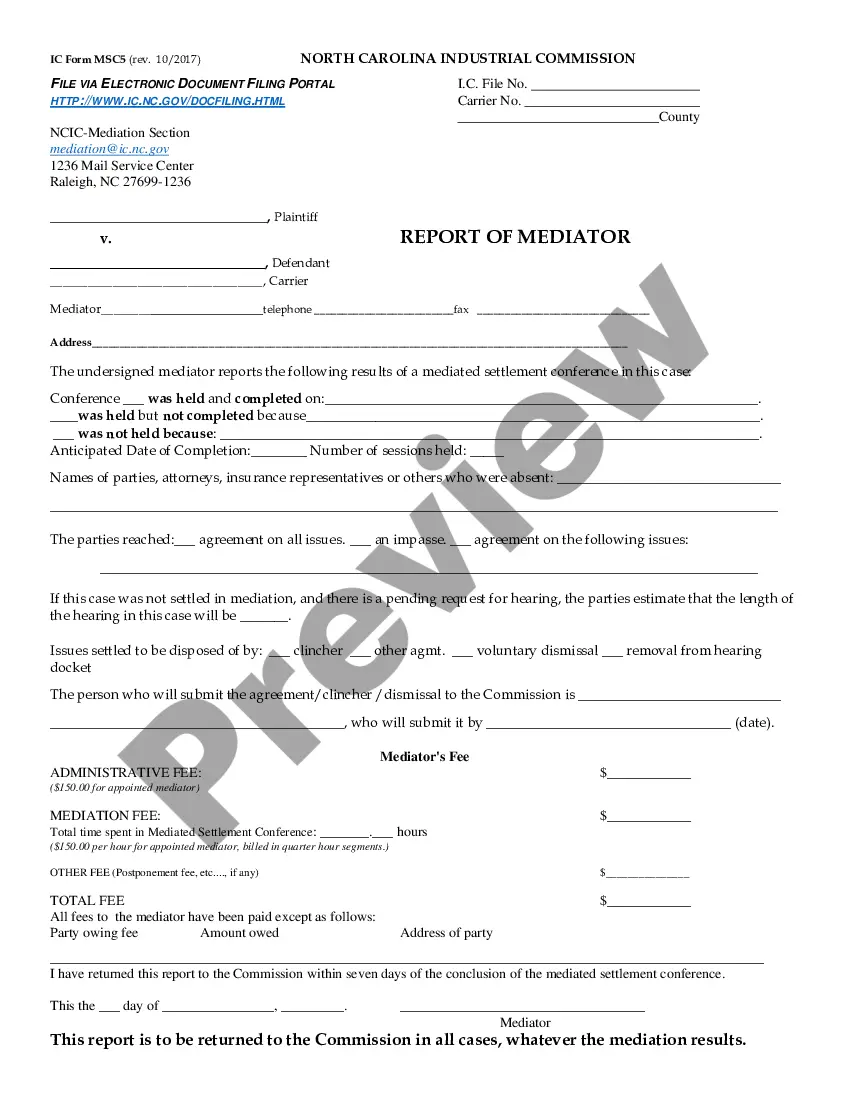

How to fill out Proposal To Amend Certificate To Reduce Par Value, Increase Authorized Common Stock And Reverse Stock Split With Exhibit?

Choosing the right legal document format can be a have difficulties. Naturally, there are a variety of templates available online, but how would you find the legal develop you require? Take advantage of the US Legal Forms web site. The services delivers 1000s of templates, like the Puerto Rico Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit, that can be used for organization and personal demands. Each of the varieties are checked by pros and meet state and federal demands.

When you are currently registered, log in in your accounts and click on the Down load switch to find the Puerto Rico Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit. Make use of your accounts to appear from the legal varieties you possess bought earlier. Check out the My Forms tab of your respective accounts and have an additional copy of the document you require.

When you are a brand new end user of US Legal Forms, allow me to share easy guidelines that you can adhere to:

- First, ensure you have selected the correct develop for the town/county. You may look through the shape using the Preview switch and browse the shape description to make certain it will be the best for you.

- In case the develop fails to meet your needs, utilize the Seach industry to obtain the correct develop.

- Once you are certain the shape is suitable, go through the Buy now switch to find the develop.

- Opt for the rates plan you would like and enter in the essential information and facts. Design your accounts and buy the order making use of your PayPal accounts or credit card.

- Pick the file formatting and obtain the legal document format in your system.

- Total, modify and print and sign the received Puerto Rico Proposal to amend certificate to reduce par value, increase authorized common stock and reverse stock split with Exhibit.

US Legal Forms will be the most significant catalogue of legal varieties for which you can see various document templates. Take advantage of the service to obtain professionally-manufactured paperwork that adhere to state demands.

Form popularity

FAQ

Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split). A stock split is exactly what it sounds like: a division of shares.

Key Takeaways. A reverse stock split consolidates the number of existing shares of stock held by shareholders into fewer shares. A reverse stock split does not directly impact a company's value (only its stock price). It can signal a company in distress since it raises the value of otherwise low-priced shares. Reverse Stock Split: What It Is, How It Works, and Examples - Investopedia investopedia.com ? terms ? reversesplit investopedia.com ? terms ? reversesplit

Reverse stock split The holder of an option contract will have the same number of contracts with an increase in strike price based on the reverse split value. The option contract will now represent a reduced number of shares based on the reverse stock split value.

Mullen's Common Stock will continue to trade on The Nasdaq Capital Market (?Nasdaq?) under the existing symbol ?MULN? and will begin trading on a split-adjusted basis when the market opens on August 11, 2023. The new CUSIP number for the Common Stock following the Reverse Stock Split will be 62526P 307. Mullen Automotive Inc. Announces 1-for-9 Reverse Stock Split ... Mullen | Press Release ? mullen-automotive-inc.-... Mullen | Press Release ? mullen-automotive-inc.-...

(NASDAQ: MULN) (?Mullen? or the ?Company?), an emerging electric vehicle (?EV?) manufacturer, announced today that it will effect a 1-for-9 reverse stock split (?Reverse Stock Split?) of its common stock, par value $0.001 per share (?Common Stock?), that will become effective on August 11, 2023, at a.m., Eastern ...

Stock split history for Mullen Automotive (MULN) Mullen Automotive stock (symbol: MULN) underwent a total of 4 stock splits. The most recent stock split occured on August 11th, 2023. One MULN share bought prior to May 25th, 2016 would equal to 4.4444444444444E-5 MULN shares today. Stock split history for Mullen Automotive (MULN) Companies Market Cap ? mullen-automotive Companies Market Cap ? mullen-automotive

The startup implemented a 1-for-25 reverse stock split in May, followed by a 1-for-9 reverse split in August, but still fell below the $1 threshold where it has remained since August 16. Due to this non-compliance, the Nasdaq has determined Mullen's stock must be delisted, but the company is of course, fighting back. Mullen Automotive gets Nasdaq determination, faces stock delisting electrek.co ? 2023/09/07 ? mullen-automotive-mu... electrek.co ? 2023/09/07 ? mullen-automotive-mu...

Will the reverse stock split change the par value of the share? Yes, the par value of each share will be increased proportionally to the exchange ratio, i.e. it will be multiplied by 20.