Puerto Rico Employee Evaluation Form for Construction

Description

How to fill out Employee Evaluation Form For Construction?

Have you ever found yourself in a circumstance where you require documents for both business or personal purposes nearly every time.

There are numerous legitimate document templates accessible online, but identifying ones you can rely on isn't straightforward.

US Legal Forms offers thousands of form templates, including the Puerto Rico Employee Evaluation Form for Construction, that are designed to comply with federal and state regulations.

If you locate the appropriate form, click Acquire now.

Choose the payment plan you prefer, enter the required information to create your account, and complete your purchase with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Puerto Rico Employee Evaluation Form for Construction template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct city/state.

- Use the Review button to examine the form.

- Check the information to confirm that you have selected the correct form.

- If the form isn't what you're looking for, utilize the Search section to find the form that meets your needs and requirements.

Form popularity

FAQ

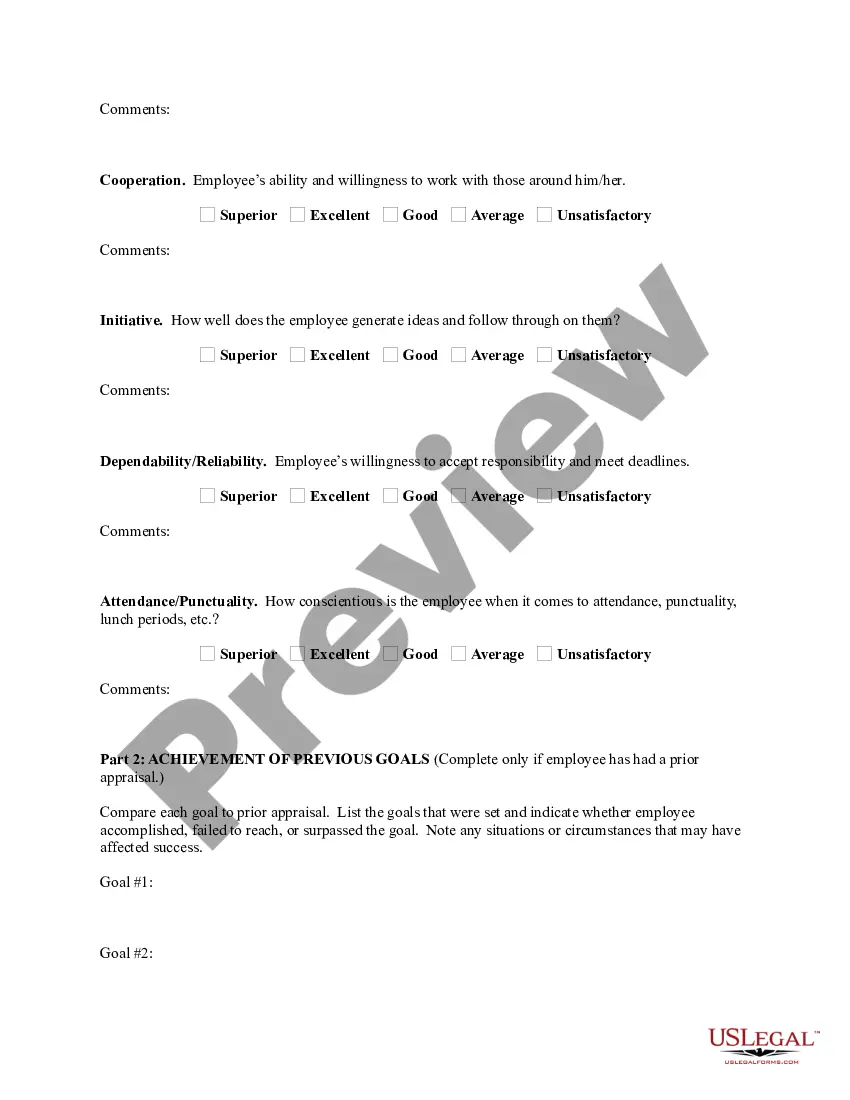

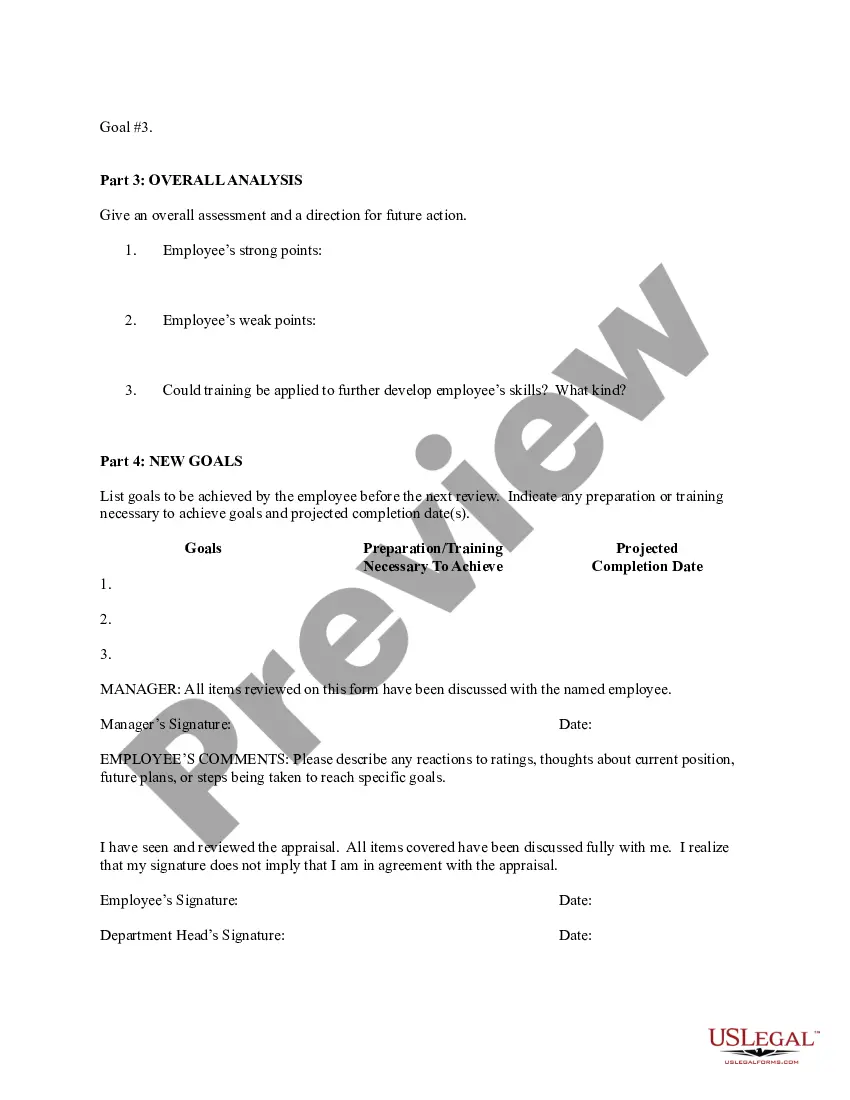

The form should include clear guidelines and instructions to allow managers and employees to know exactly what information to provide, the meaning of the ratings, and how to get the information they need. When designing your evaluation form, consider your primary purpose for conducting performance reviews.

$6.55 / hour Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

What to Include in an Employee Evaluation Form?Employee and reviewer information. The form must have basic information about both parties involved.Review period.An easy-to-understand rating system.Evaluation points.Goals.Extra space for comments.Signatures.Scorecard.More items...?

The minimum wage under the Fair Labor Standards Act (FLSA) is generally applicable to any state, territory, or possession of the United States such as Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands (CNMI).

In Puerto Rico, the payroll frequency is bi-weekly, monthly or semi-monthly. An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory.

What to Include in an Employee Evaluation Form?Employee and reviewer information. The form must have basic information about both parties involved.Review period.An easy-to-understand rating system.Evaluation points.Goals.Extra space for comments.Signatures.Scorecard.More items...?

Puerto RicoRegister your business name and file articles of incorporation.File for local bank accounts.Learn and keep track of the local employment laws.Set up local payroll.Hire local accounting, legal, and HR people.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.