Puerto Rico Employee Evaluation Form for Salary Increase

Description

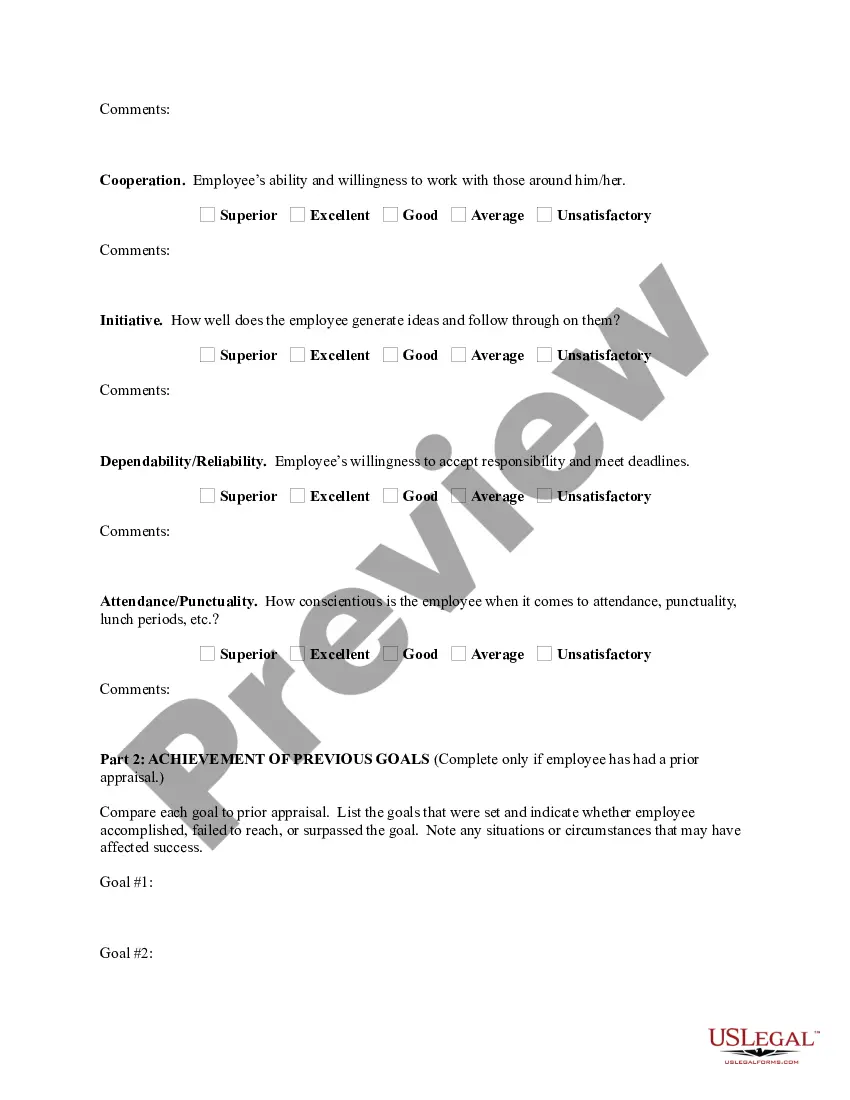

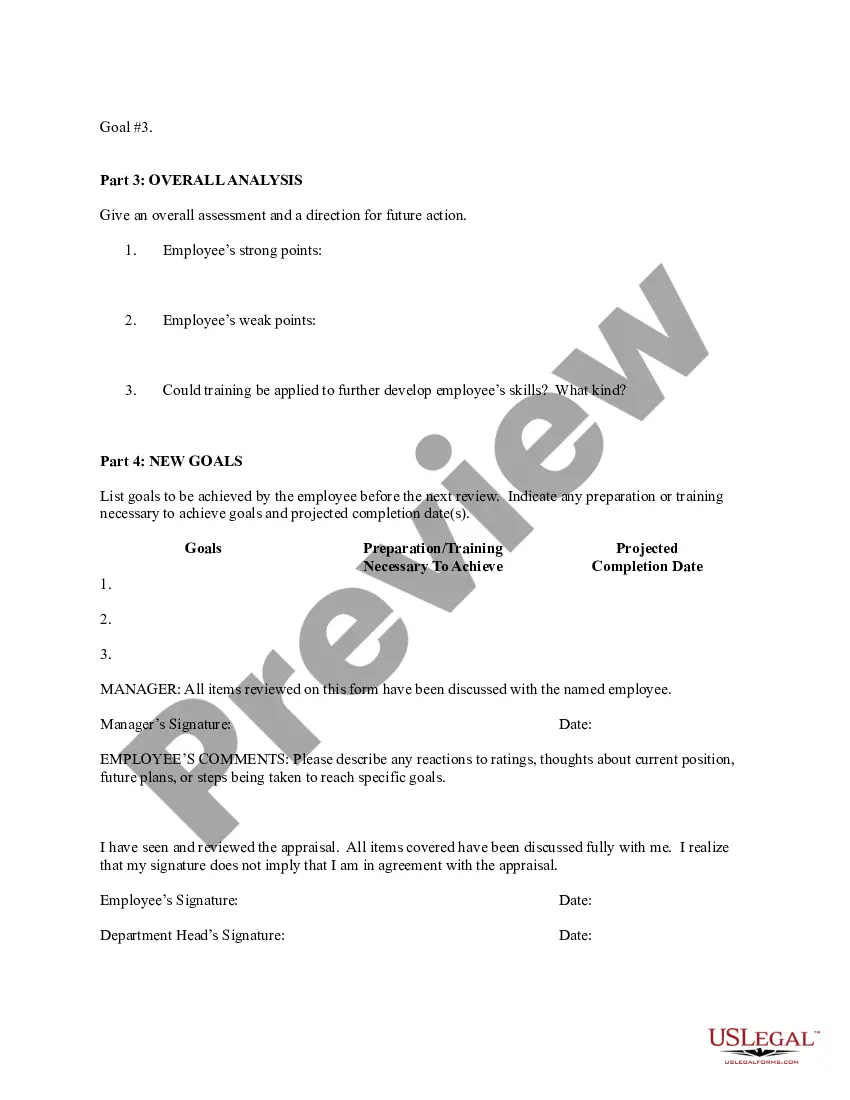

How to fill out Employee Evaluation Form For Salary Increase?

You can dedicate time online trying to locate the legal document template that meets your federal and state requirements. US Legal Forms provides a vast selection of legal forms that can be reviewed by experts.

You can easily download or print the Puerto Rico Employee Evaluation Form for Salary Increase from the service.

If you already have a US Legal Forms account, you can Log In and click the Acquire button. After that, you can complete, edit, print, or sign the Puerto Rico Employee Evaluation Form for Salary Increase. Each legal document template you acquire is yours permanently. To obtain an additional copy of the purchased form, visit the My documents tab and click the appropriate button.

Select the format of the document and download it to your device. Make adjustments to your document if possible. You can fill out, modify, sign, and print the Puerto Rico Employee Evaluation Form for Salary Increase. Download and print thousands of document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to meet your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your area/location of choice. Review the form details to ensure you have chosen the right one.

- If available, use the Preview button to review the document template as well.

- If you want to find another version of the form, utilize the Search field to locate the template that meets your needs and requirements.

- Once you have found the template you desire, click Acquire now to proceed.

- Choose the payment option you prefer, enter your credentials, and register for an account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to pay for the legal form.

Form popularity

FAQ

$6.55 / hour Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

Puerto Rico Minimum Wage for 2021, 2022. Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

Puerto RicoRegister your business name and file articles of incorporation.File for local bank accounts.Learn and keep track of the local employment laws.Set up local payroll.Hire local accounting, legal, and HR people.

ContributionsEmployer. 6.2% FICA Social Security (Federal) 1.45% FICA Medicare (Federal) 0.90%6.20% FICA Social Security (Federal) (Maximum 142,800 USD) 1.45% FICA Medicare (Federal) 0.90%Employee. Employee Income Tax. 0.00% Not over 9,000 USD. 7.00%

The minimum wage under the Fair Labor Standards Act (FLSA) is generally applicable to any state, territory, or possession of the United States such as Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands (CNMI).

An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory. Employers with a workforce in excess of 21 employees must by law pay a 13th-month salary in December equating to 2% of the employees' wages or not more than 600 USD.