Puerto Rico Employee Performance Appraisal

Description

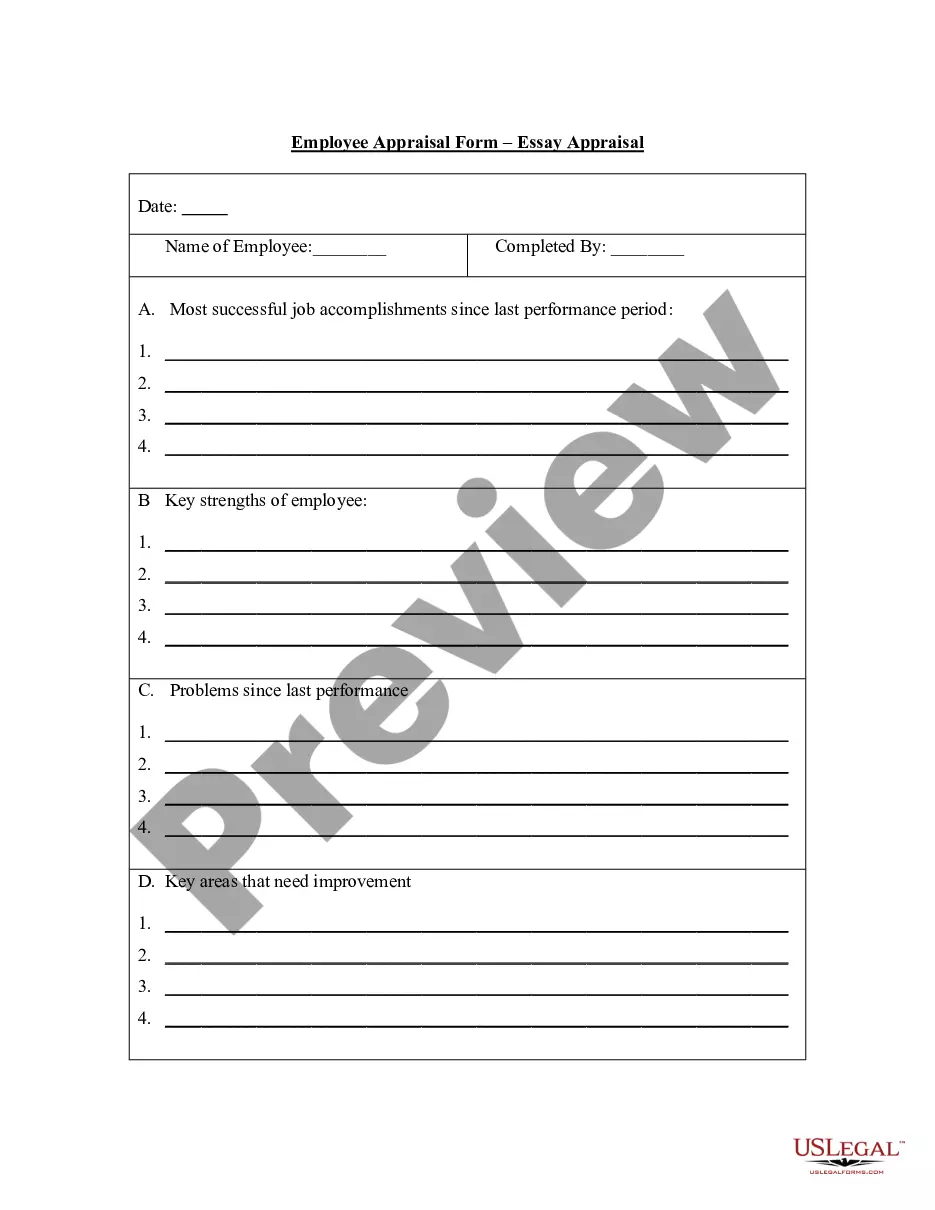

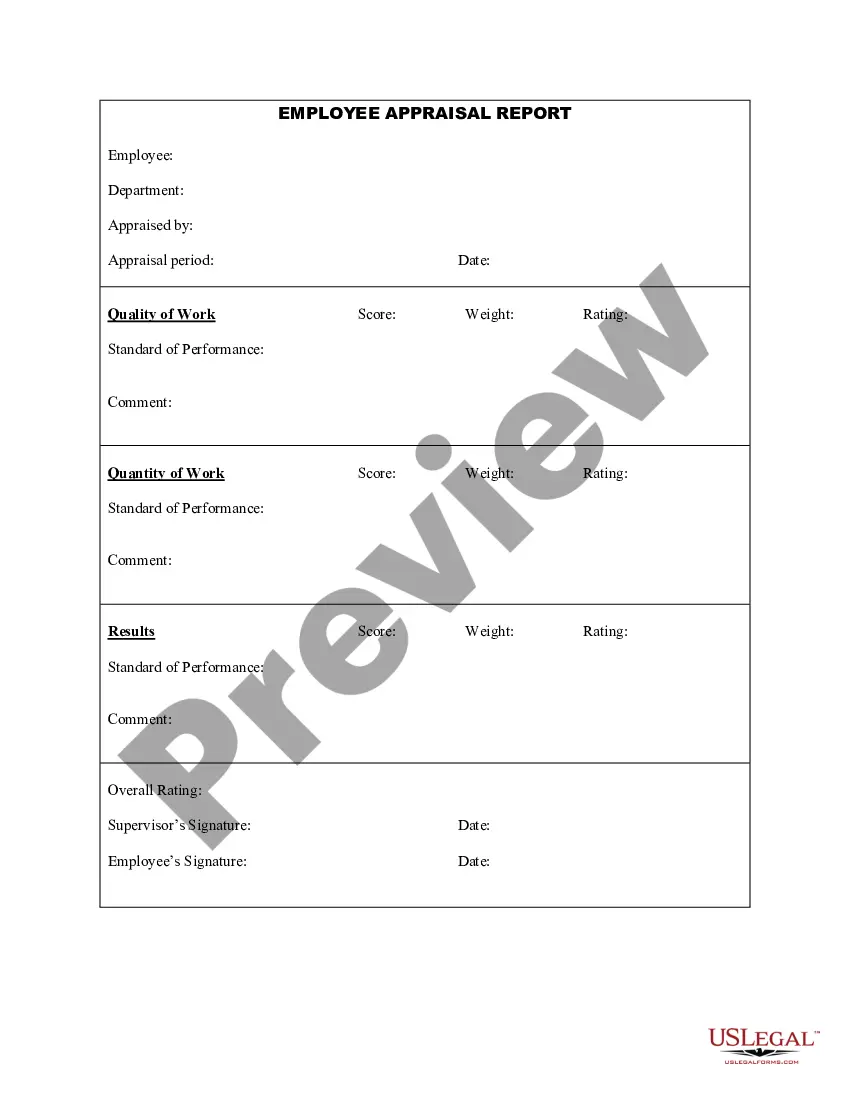

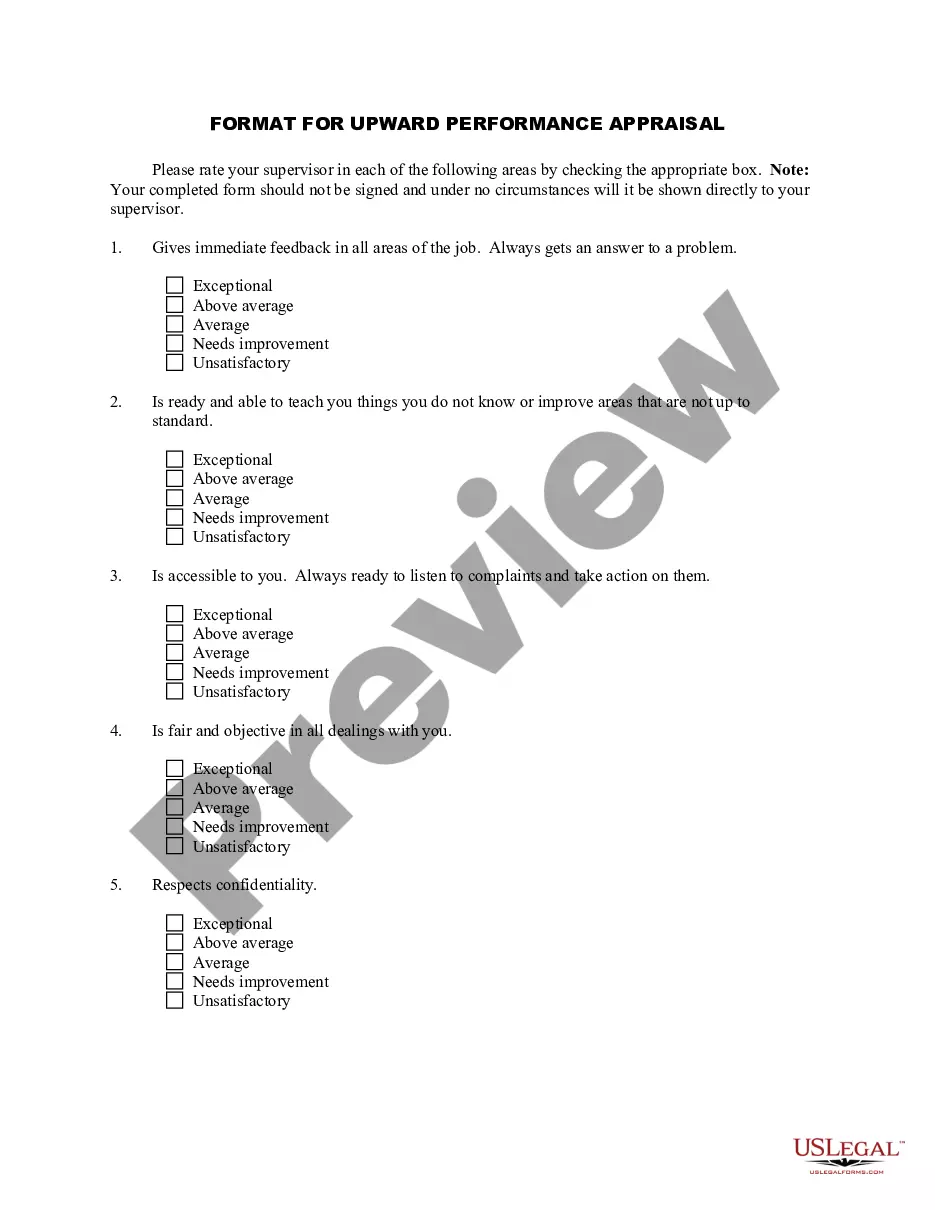

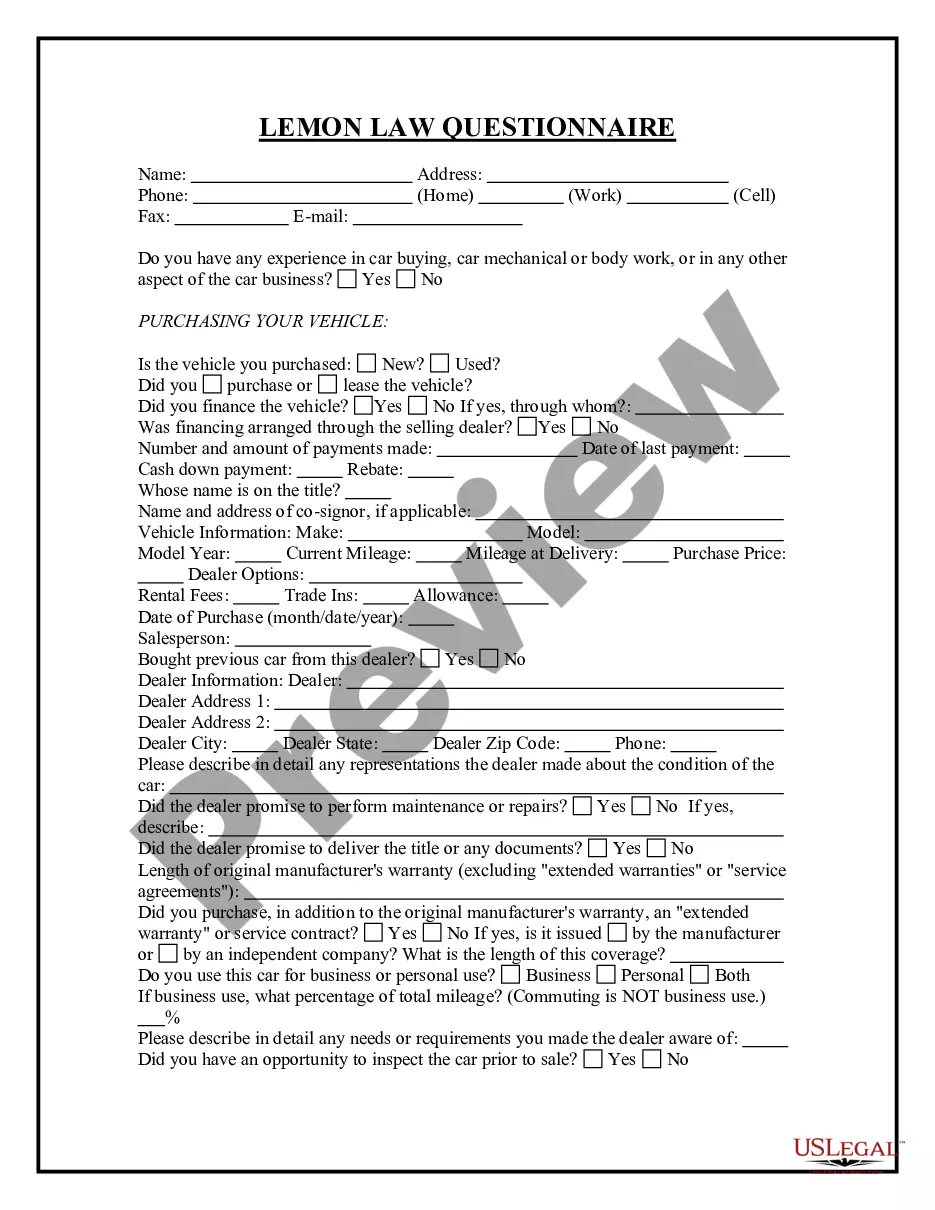

How to fill out Employee Performance Appraisal?

Finding the appropriate legal document template can be challenging.

Of course, there are numerous templates available online, but how do you obtain the legal document you require.

Utilize the US Legal Forms website. The service offers thousands of templates, such as the Puerto Rico Employee Performance Review, which can be utilized for both business and personal purposes.

You can view the form using the Review option and read the form description to confirm it is the right one for you.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Puerto Rico Employee Performance Review.

- Use your account to search through the legal forms you have previously acquired.

- Navigate to the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are straightforward instructions for you to follow.

- First, ensure you have selected the correct form for your locality.

Form popularity

FAQ

$6.55 / hour Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

If you are a U.S. citizen who is also a bona fide resident of Puerto Rico during the fiscal year but receive income as a U.S. government employee in Puerto Rico, you must file a federal tax return.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

The minimum wage under the Fair Labor Standards Act (FLSA) is generally applicable to any state, territory, or possession of the United States such as Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands (CNMI).

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

Form 499-R-1C (Adjustments to Income Tax Withheld Worksheet) Form 499R2/W2PR (Withholding Statement) - This withholding statement is the Puerto Rico equivalent of the U.S. Form W2 and should be prepared for every employee.

ContributionsEmployer. 6.2% FICA Social Security (Federal) 1.45% FICA Medicare (Federal) 0.90%6.20% FICA Social Security (Federal) (Maximum 142,800 USD) 1.45% FICA Medicare (Federal) 0.90%Employee. Employee Income Tax. 0.00% Not over 9,000 USD. 7.00%

In Puerto Rico, the payroll frequency is bi-weekly, monthly or semi-monthly. An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory.

Act 80 (the Unjust Dismissal Act) regulates employment termination of employees hired for an indefinite term. Puerto Rico is not an 'employment at will' jurisdiction.

Section 403 of PROMESA modified section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.