Puerto Rico Notice of Special Enrollment Rules

Description

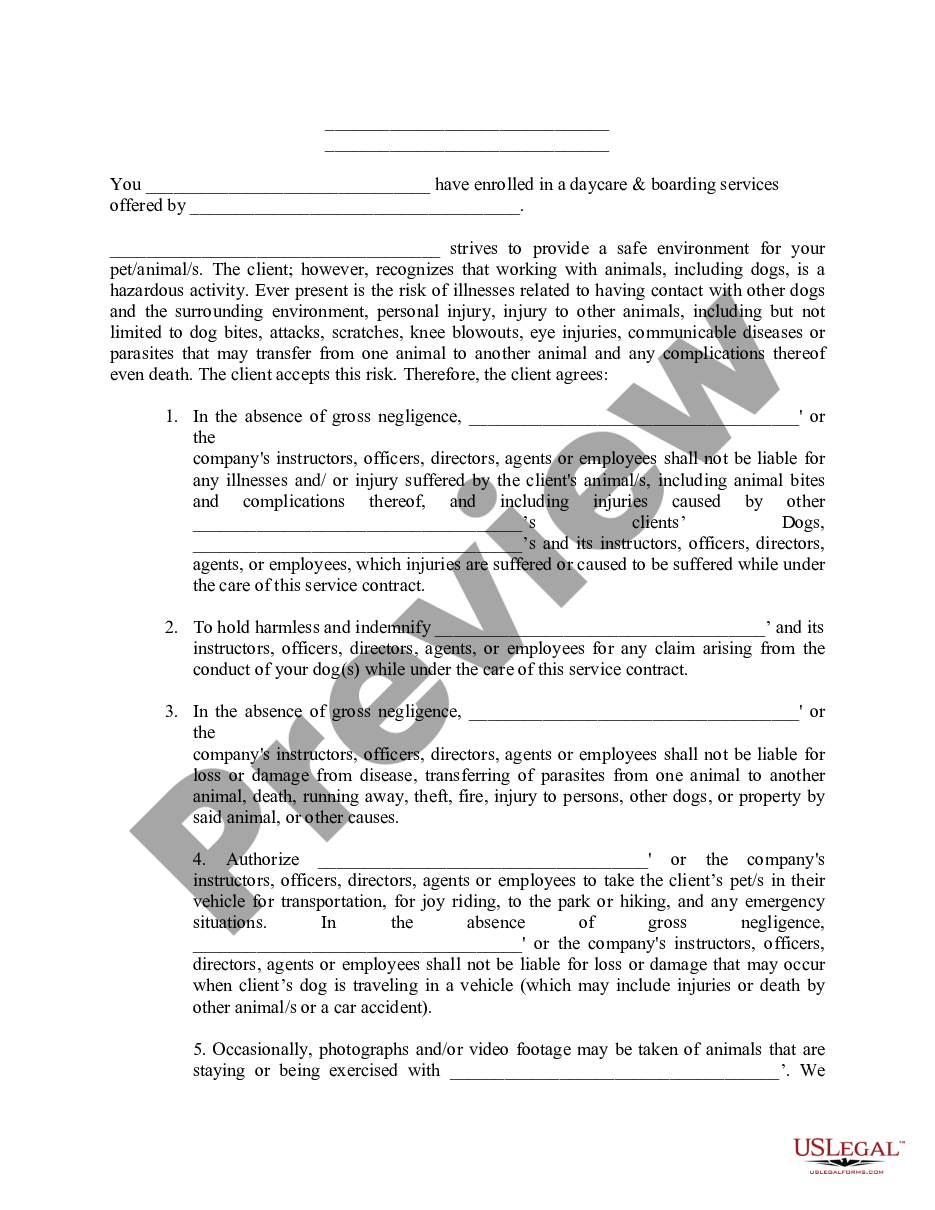

How to fill out Notice Of Special Enrollment Rules?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad selection of legal template forms that you can download or print.

By using the website, you can access thousands of forms for business and personal needs, organized by categories, states, or keywords. You can find the latest versions of forms, such as the Puerto Rico Notice of Special Enrollment Rules, in moments.

If you have an account, Log In and download the Puerto Rico Notice of Special Enrollment Rules from the US Legal Forms collection. The Download button will appear on every form you view.

Once you are satisfied with the form, confirm your selection by clicking the Buy Now button. Then, choose the pricing plan you prefer and provide your credentials to create an account.

Complete the payment process. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make edits. Fill out, modify, and print, then sign the downloaded Puerto Rico Notice of Special Enrollment Rules. Each template you add to your account has no expiration date, so it is yours indefinitely. Therefore, if you want to download or print another copy, simply go to the My documents section and click on the form you need. Access the Puerto Rico Notice of Special Enrollment Rules with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a multitude of professional and state-specific templates that cater to your business or personal requirements.

- If you are using US Legal Forms for the first time, here are simple guidelines to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

- Read the form description to confirm you have chosen the right form.

- If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

Form popularity

FAQ

Income requirements for Medicaid in Puerto Rico depend on multiple factors, including family size and other eligibility criteria. Generally, individuals need to provide proof of income and may need to meet a resource limit. By understanding the Puerto Rico Notice of Special Enrollment Rules, you can navigate the application process and determine if you qualify for Medicaid supports.

The income limit for Medicaid in Puerto Rico varies based on the household composition and the program you apply for. Typically, it is set around 200% of the Federal Poverty Level, but it’s important to verify specific thresholds as they can change annually. Keeping informed about the Puerto Rico Notice of Special Enrollment Rules also helps candidates understand their eligibility for coverage.

Yes, US doctors can work in Puerto Rico. They must be licensed by the Puerto Rico Department of Health and comply with local regulations. Familiarizing yourself with the Puerto Rico Notice of Special Enrollment Rules can help physicians understand the healthcare landscape while considering where to practice.

To apply for Medicare Part B during the special enrollment period, gather your documents and complete the application online or at your local Social Security office. You'll need to provide information regarding your current health coverage and any relevant personal details. The Puerto Rico Notice of Special Enrollment Rules is crucial here, as it outlines the specific times when you can enroll without facing penalties.

Yes, Puerto Rico has a variety of public records, including court documents, property records, and vital statistics. These records can generally be accessed online through official sources operated by the Puerto Rican government. Familiarizing yourself with the Puerto Rico Notice of Special Enrollment Rules can help you determine what legal documents you may need to collect for enrollment or other legal processes.

You can look up criminal records in Puerto Rico by accessing the Department of Justice's website or visiting local courthouses. Many resources are available online, but some records may require direct inquiries to law enforcement agencies. Knowing about the Puerto Rico Notice of Special Enrollment Rules can also aid in understanding your rights and protections.

Social Security Income (SSI) does not extend to Puerto Rico due to its unique territorial status. This means residents do not receive the same federal SSI benefits as those in the mainland United States. Understanding these distinctions, including information on the Puerto Rico Notice of Special Enrollment Rules, can provide clarity on what services and assistance are available.

To find public records in Puerto Rico online, you can utilize various official government websites. Many of these platforms provide access to property records, court documents, and vital records. The Puerto Rico Notice of Special Enrollment Rules may also be helpful as you explore the necessary documentation for enrollment or benefits.

Yes, you can use your Blue Cross Blue Shield plan in Puerto Rico. It’s important to verify the specific network coverage available in Puerto Rico beforehand. Additionally, understanding the Puerto Rico Notice of Special Enrollment Rules can help you navigate your healthcare options while ensuring you receive the necessary care.

Several events qualify as a special enrollment period including losing your health plan, moving to a different area, or changes in household dynamics. Each of these situations allows for enrollment under the Puerto Rico Notice of Special Enrollment Rules. It's crucial to recognize these qualifying events to ensure you maintain adequate health coverage.