Puerto Rico Resolution of Meeting of LLC Members to Set Attendance Allowance

Description

How to fill out Resolution Of Meeting Of LLC Members To Set Attendance Allowance?

Finding the appropriate valid document template can be a challenge. Certainly, there are numerous templates accessible online, but how do you locate the correct version you require? Utilize the US Legal Forms website. The platform offers a vast array of templates, such as the Puerto Rico Resolution of Meeting of LLC Members to Establish Attendance Allowance, which can be utilized for both business and personal purposes. All forms are examined by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Puerto Rico Resolution of Meeting of LLC Members to Establish Attendance Allowance. Use your account to access the legal forms you have previously acquired. Visit the My documents section of your account to retrieve another copy of the document you need.

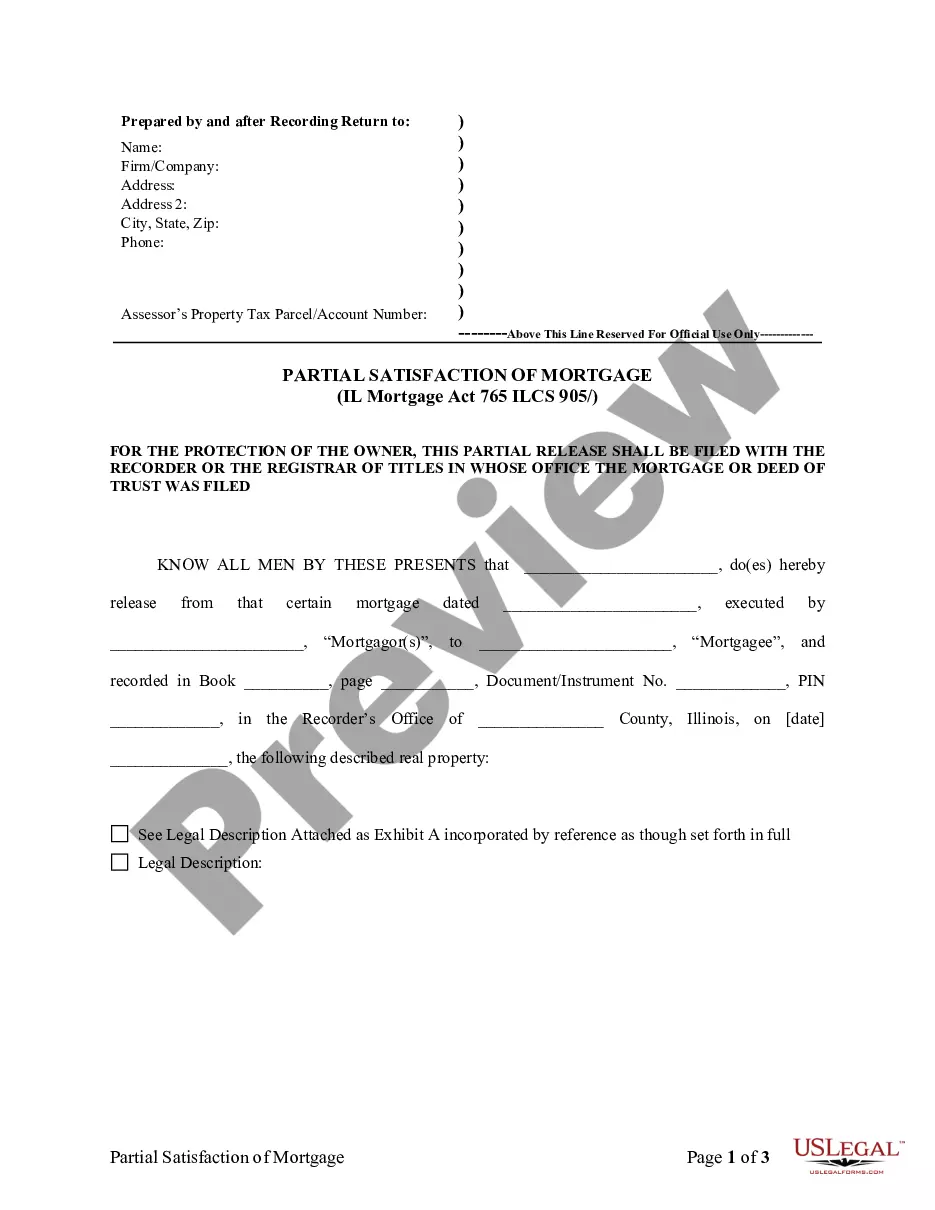

If you are a new user of US Legal Forms, here are some straightforward guidelines for you to follow: First, ensure that you have chosen the correct document for your locality/state. You can review the document using the Preview button and read the document description to confirm this is the correct one for you.

US Legal Forms is indeed the largest collection of legal documents where you can browse various file templates. Take advantage of the service to download professionally created paperwork that adheres to state requirements.

- If the document does not meet your requirements, use the Search field to find the appropriate document.

- Once you are confident that the document is suitable, click the Get now button to download the document.

- Select the pricing plan you prefer and enter the required information.

- Create your account and complete the payment using your PayPal account or credit card.

- Choose the file format and download the lawful document template to your device.

- Complete, edit, print, and sign the downloaded Puerto Rico Resolution of Meeting of LLC Members to Establish Attendance Allowance.

Form popularity

FAQ

An LLC is a limited liability company, which is a type of legal entity that can be used when forming a business. An LLC offers a more formal business structure than a sole proprietorship or partnership.

A limited liability company (LLC) is neither a corporation nor is it a sole proprietorship. Instead, an LLC is a hybrid business structure that combines the limited liability of a corporation with the simplicity of a partnership or sole proprietorship.

Ready to Start an LLC in Puerto Rico?Name Your LLC.Submit LLC Certificate of Formation.Write an LLC Operating Agreement.Get an EIN.Open a Bank Account.Fund the LLC.File reports + taxes.

An LLC does not have to make resolutions, but there are times it could be useful: An LLC member makes a decision regarding the business's organization. A member must establish their authority to open a bank account for the LLC. Members must prove their authority to sign a loan on the LLC's behalf.

Annual reports must be filed electronically by accessing the Department of State website at . A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

An LLC corporate resolution is a record of a decision made through a vote by the board of directors or LLC members. Limited liability companies (LLCs) enjoy specific tax and legal benefits modeled after a corporate structure, although they are not corporations.

An LLC is not a partnership, though many LLC owners casually refer to their co-owners as business partners." All LLC ownersknown formally as members"are protected from personal liability for business debts. Limited liability partnership. Most states allow limited liability partnerships.

A Limited Liability Company (LLC) is an entity created by state statute. Depending on elections made by the LLC and the number of members, the IRS will treat an LLC either as a corporation, partnership, or as part of the owner's tax return (a disregarded entity).

Forming an LLC provides small business owners with pass-through taxation perks. This means that profits associated with the business are reported on personal income tax returns and taxed at personal tax rates.