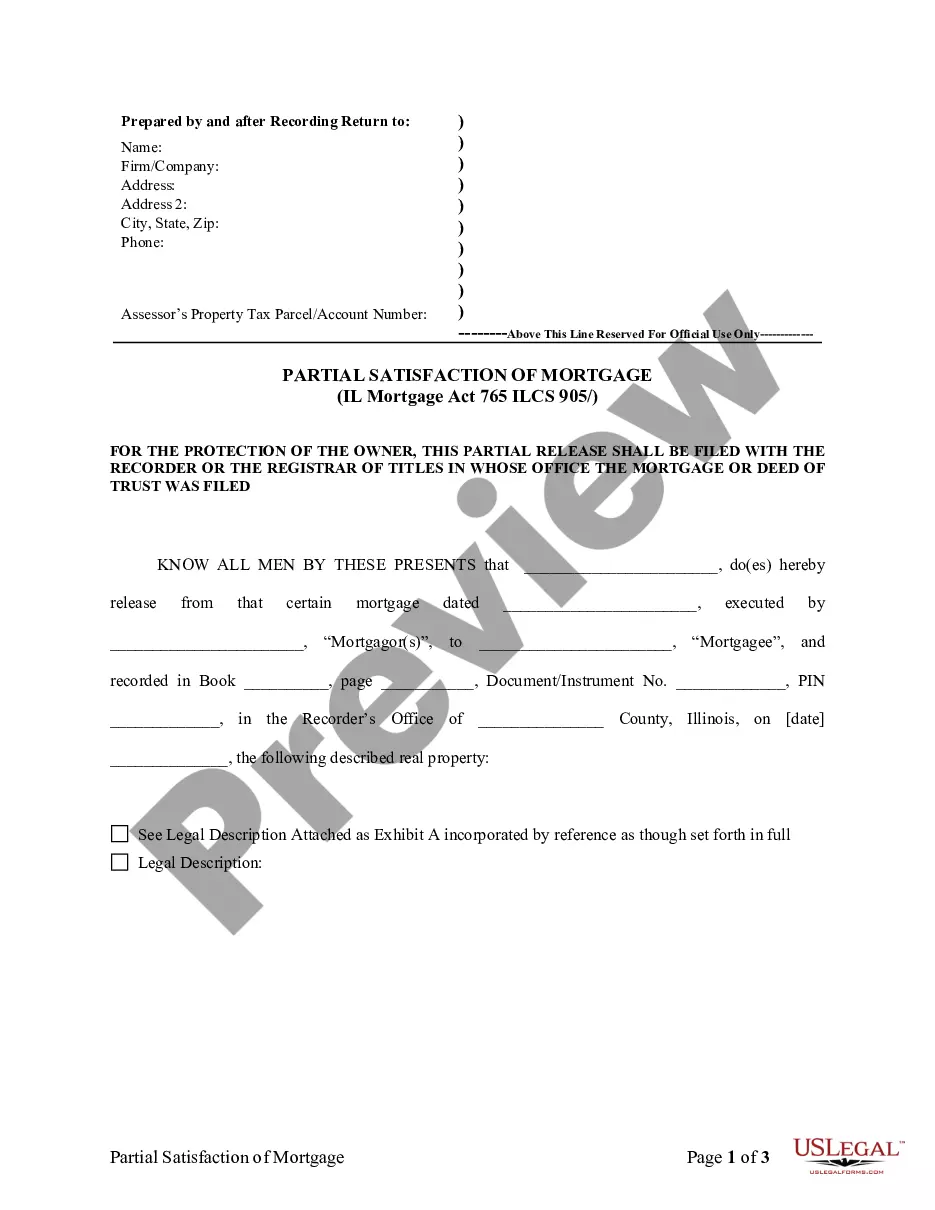

Illinois Partial Release of Property From Mortgage for Corporation

Description

How to fill out Illinois Partial Release Of Property From Mortgage For Corporation?

Searching for Illinois Partial Discharge of Property From Mortgage for Corporation documents and completing them can be daunting.

To save time, expenses, and effort, utilize US Legal Forms to locate the suitable template specifically tailored for your state in just a few clicks.

Our legal experts prepare all paperwork, so you only need to complete them. It's truly that straightforward.

Choose your subscription plan on the pricing page and set up an account. Decide how you want to pay, whether by card or through PayPal. Download the template in your desired format. You can print the Illinois Partial Discharge of Property From Mortgage for Corporation template or complete it using any online editor. Don't worry about errors, as your template can be used and submitted, and printed as many times as you like. Visit US Legal Forms for access to over 85,000 state-specific legal and tax documents.

- Log into your account and navigate back to the form's webpage to save the document.

- All your saved templates are stored in My documents and are always accessible for future use.

- If you have not yet registered, consider signing up.

- Review our comprehensive instructions on obtaining the Illinois Partial Discharge of Property From Mortgage for Corporation template within minutes.

- Check the sample for eligibility based on your state.

- Use the Preview feature (if available) to view the example.

- If a description exists, read it to understand the key details.

- Press the Buy Now button if you found what you need.

Form popularity

FAQ

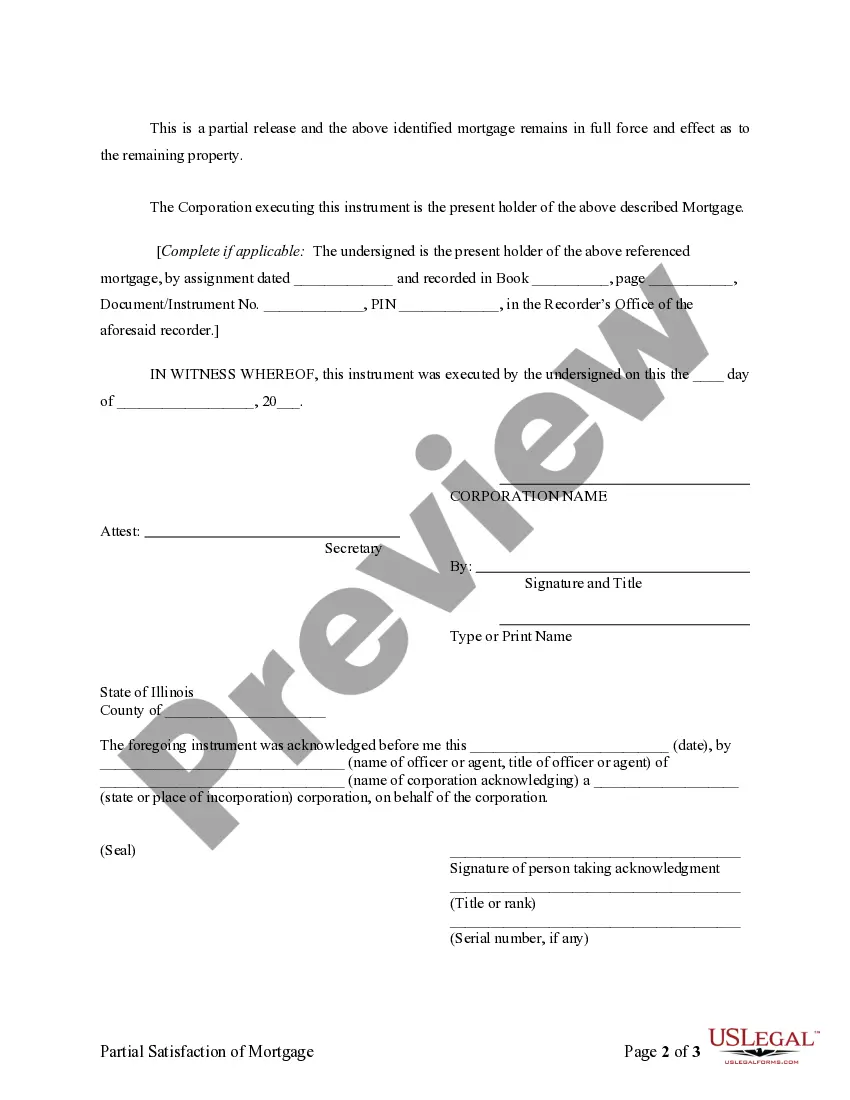

A Mortgage Release is where you, the homeowner, voluntarily transfer the ownership of your property to the owner of your mortgage in exchange for a release from your mortgage loan and payments.Depending on your situation, you may be required to make a financial contribution to receive a mortgage release.

Partial Release Clause is a provision under which the mortgagee agrees to release certain parcels from the lien of the blanket mortgage upon payment of a certain sum of money by the mortgagor. It's frequently found in tract development construction loans.

A partial reconveyance is to reconvey a portion of the land subject to a deed of trust, not the loan amount.He will have to wait to pay off the full loan before the property is granted back to him.

When you pay off your loan and you have a mortgage, the lender will send you or the local recorder of deeds or office that handles the filing of real estate documents a release of mortgage.On the other hand, when you have a trust deed or deed of trust, the lender files a release deed.

If you are approved for the partial mortgage release, you will receive notification within two to six weeks.

In most cases, the lien holder (the lender in this case) should send the release to be recorded within 30-90 days. If you aren't sure what the requirements are in your area, reach out to your real estate agent, title agent, or real estate attorney for guidance.

A partial release is a mortgage provision that allows some of the collateral to be released from a mortgage after the borrower pays a certain amount of the loan. Lenders require proof of payment, a survey map, appraisal, and a letter outlining the reason for the partial release.