Puerto Rico Overtime Authorization Form

Description

How to fill out Overtime Authorization Form?

Have you been in a situation where you require documentation for occasional business or specific purposes almost every day.

There are numerous lawful document templates accessible online, but finding ones you can rely on is not simple.

US Legal Forms provides a vast array of form templates, including the Puerto Rico Overtime Authorization Form, which are crafted to adhere to state and federal regulations.

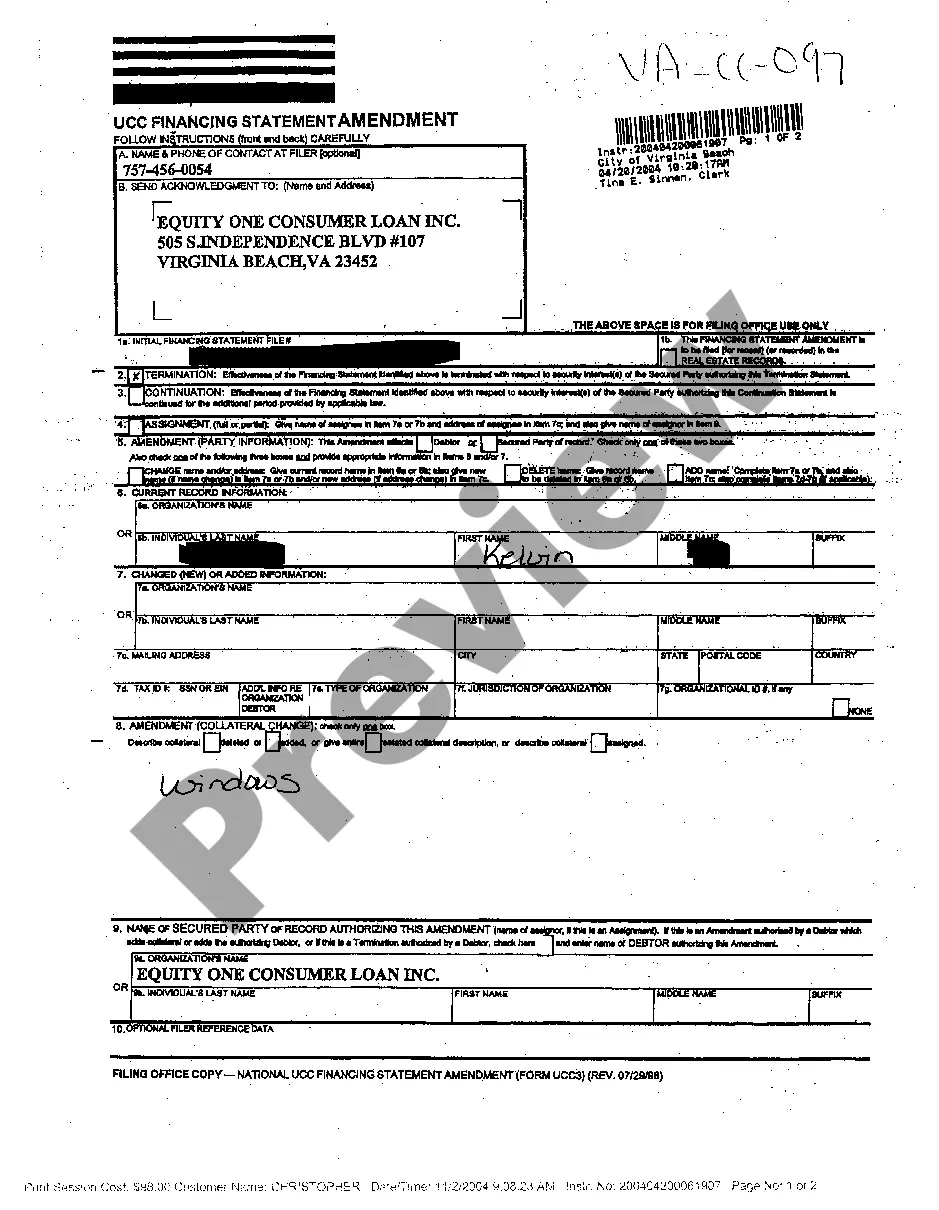

Once you find the appropriate form, click Get now.

Select the pricing plan you prefer, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card. Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can obtain the Puerto Rico Overtime Authorization Form template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to review the form.

- Check the details to confirm that you have selected the correct form.

- If the form is not what you are searching for, use the Search section to locate the form that meets your needs.

Form popularity

FAQ

Law 52 establishes regulations for the protection of workers who need to balance work and family responsibilities. It mandates employers to provide necessary accommodations for employees dealing with health or family issues. Understanding Law 52 is beneficial for both employers and employees, as it interacts with provisions like the Puerto Rico Overtime Authorization Form that ensure fair labor practices.

An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory. Employers with a workforce in excess of 21 employees must by law pay a 13th-month salary in December equating to 2% of the employees' wages or not more than 600 USD.

Domestic workers, government employees, and white-collar executive, professional, or administrative workers are all completely exempt from overtime pay under Puerto Rico law.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

$6.55 / hour Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

Act 80 (the Unjust Dismissal Act) regulates employment termination of employees hired for an indefinite term. Puerto Rico is not an 'employment at will' jurisdiction.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

If your contract says you have compulsory overtime but it's 'non-guaranteed', your employer doesn't have to offer overtime. But if they do, you must accept and work it. Your employer could take disciplinary action or dismiss you if you don't do the overtime you've agreed to.

2.3 Working Hours. According to Puerto Rico Act Number 379 of (Law No 379), which covers non-exempt (hourly) employees, eight hours of work constitutes a regular working day in Puerto Rico and 40 hours of work constitutes a workweek. Working hours exceeding these minimums must be compensated as overtime.