Puerto Rico Employment Reference Release

Description

How to fill out Employment Reference Release?

Are you currently in a situation where you require documents for either professional or personal purposes on a daily basis.

There are numerous legal document templates accessible online, yet finding ones you can trust is not straightforward.

US Legal Forms provides thousands of form templates, such as the Puerto Rico Employment Reference Release, designed to comply with federal and state regulations.

Select the pricing plan you prefer, fill in the required information to set up your payment, and complete your order using your PayPal or credit card.

Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents menu. You can obtain an additional copy of the Puerto Rico Employment Reference Release anytime, if needed. Just go through the required form to download or print the document template. Utilize US Legal Forms, one of the most comprehensive collections of legal forms, to save time and avoid errors. The service offers properly drafted legal document templates for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and possess a free account, simply Log In.

- After that, you can download the Puerto Rico Employment Reference Release template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the appropriate city/state.

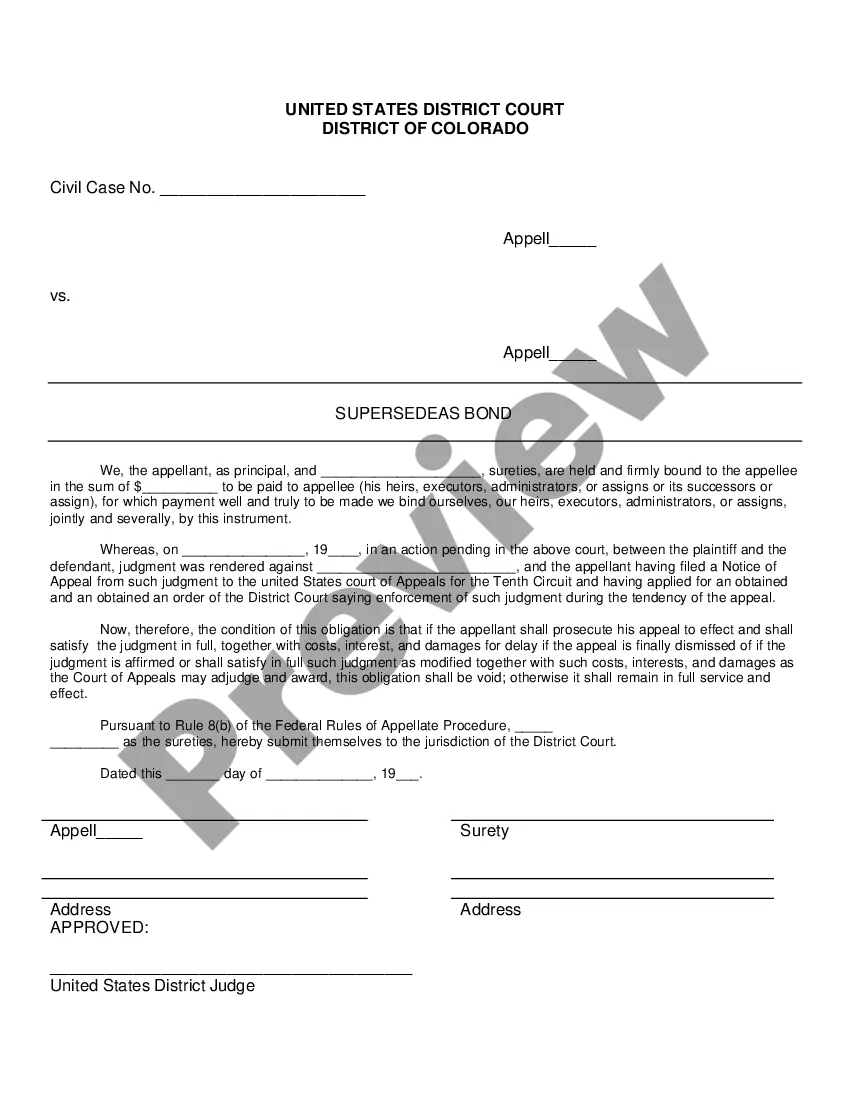

- Utilize the Review button to evaluate the form.

- Read the description to ensure you have selected the correct form.

- If the form isn’t what you are looking for, use the Lookup section to find the form that meets your needs and criteria.

- Once you find the correct form, simply click Buy now.

Form popularity

FAQ

The 183-day rule pertains to tax residency in Puerto Rico, dictating how long one must reside on the island to be taxed as a resident. Under this rule, spending 183 days or more in Puerto Rico usually results in being considered a resident for tax purposes. Understanding your residency status is vital for tax planning. A Puerto Rico Employment Reference Release can provide clarity on this rule.

A noncitizen national of the United States is someone who holds a unique status that allows them to work in the country without needing additional work authorization. When completing an I-9 form, these individuals can present their documentation to verify their rights. It’s important to reference the Puerto Rico Employment Reference Release for guidance on how this status impacts employment procedures.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

$6.55 / hour Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

The minimum wage under the Fair Labor Standards Act (FLSA) is generally applicable to any state, territory, or possession of the United States such as Puerto Rico, the Virgin Islands, Guam, American Samoa, and the Commonwealth of the Northern Mariana Islands (CNMI).

Although the EPA does not apply outside the United States, such claims are covered by Title VII, which also prohibits discrimination in compensation on the basis of sex.

Effective January 1, 2018, California law prohibits employers from seeking (on their own or through third parties) and relying on job applicants' past pay information as a factor to determine whether to give a person a job and payment terms of that job.