Puerto Rico Commission Sales Agreement

Description

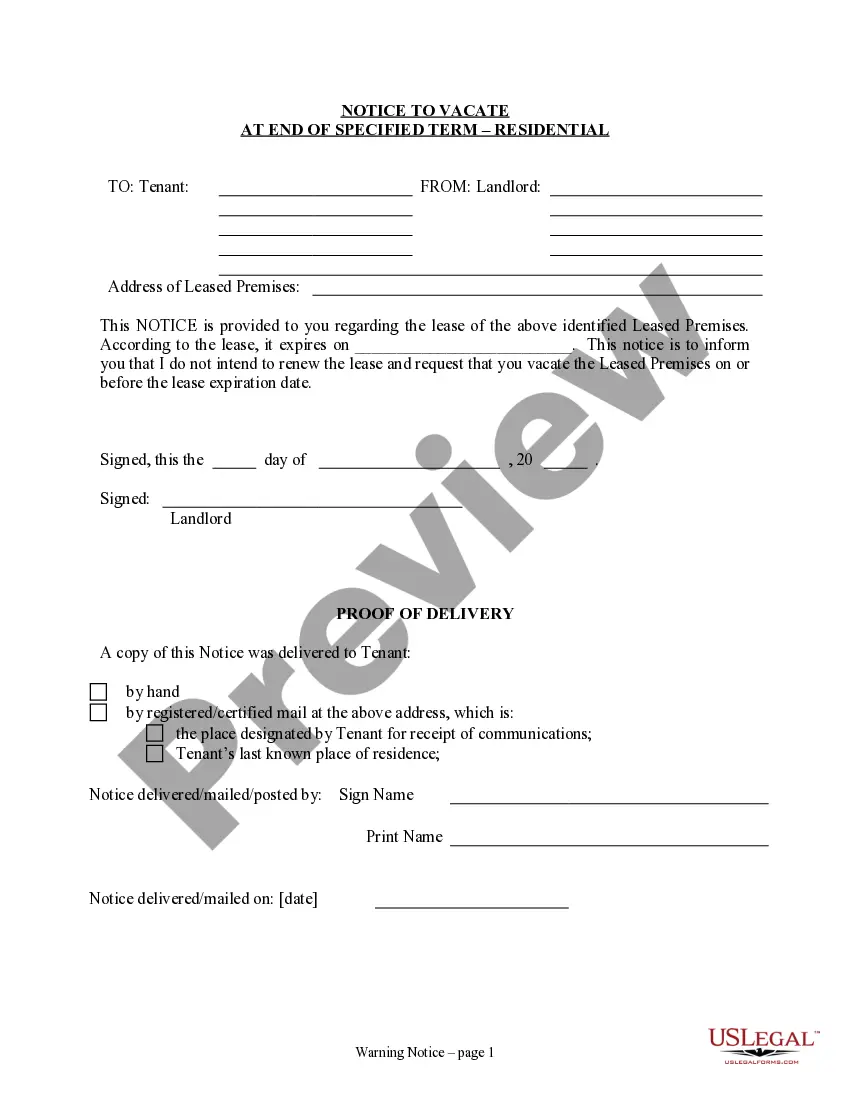

How to fill out Commission Sales Agreement?

Finding the appropriate legal document template can be quite challenging.

Clearly, there are numerous templates available online, but how do you obtain the legal form you need.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Puerto Rico Commission Sales Agreement, which can be utilized for both business and personal purposes.

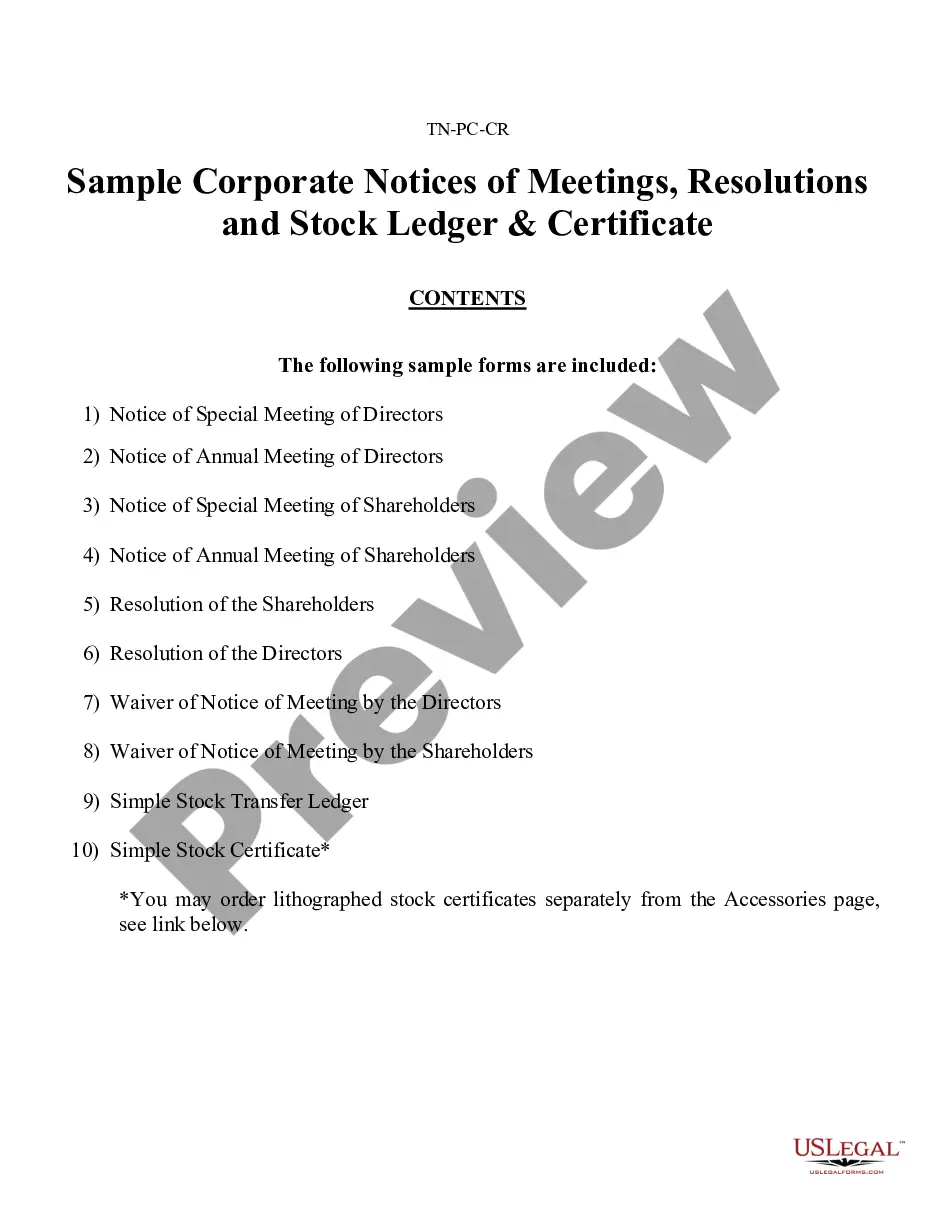

You can preview the form using the Preview button and read the form description to confirm it is suitable for your needs. If the form does not meet your requirements, utilize the Search field to locate the appropriate form. Once you are confident the form is right, click the Get now button to obtain it. Select the pricing plan you desire and enter the required details. Create your account and complete the purchase using your PayPal account or credit card. Choose the document format and download the legal document template to your device. Complete, revise, and print and sign the obtained Puerto Rico Commission Sales Agreement. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use this service to download professionally crafted forms that comply with state regulations.

- All the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to obtain the Puerto Rico Commission Sales Agreement.

- Use your account to view the legal forms you have ordered previously.

- Navigate to the My documents section of your account and download another copy of the document you need.

- For new users of US Legal Forms, here are a few simple guidelines to follow.

- First, ensure you have selected the correct form for your city/region.

Form popularity

FAQ

The Puerto Rico Sales and Use Tax (SUT, Spanish: Impuesto a las Ventas y Uso, IVU) is the combined sales and use tax applied to most sales in Puerto Rico. The Sales Tax is the amount that the consumer pays when buying items, services or when attending an entertainment venue, be it sports, recreation or exhibition.

A U.S. company that wishes to do business in Puerto Rico may choose to either form a new subsidiary entity or register an existing company. In order to determine the best option, the company should consult an attorney familiar with tax laws and the company's business activities and structure.

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

According to the Tax Foundation - a group of experts based in Washington, D.C. and whose purpose is to monitor the tax and expenditure policy of government agencies - the 11.5 percent IVU on the island is the highest in the United States, followed by Tennessee, Arkansas, Alabama, Louisiana, Washington, Oklahoma, New

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico. For stateside employers, that is the easy part.

Every merchant engaged in any business in Puerto Rico must register with the Puerto Rico Treasury Department by creating an account at the Unified System of Internal Revenues (SURI) website. Said registration must be made thirty (30) days before the commencement of business.

Excise tax: depends on the category of goods. Sales and use tax: 11.5 percent on most goods and services. 10.5 percent on goods and services not subject to municipal SUT.

The Puerto Rico Sales and Use Tax, or the "Impuesto a las Ventas y Uso (IVU)" in Spanish, consists of a 10.5% commonwealth-wide sales and use tax and a 1% local-option sales tax that is distributed to the city in which it is collected.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Puerto Rico holds a unique position as an unincorporated U.S. territory. Under Internal Revenue Code (IRC) §933, Puerto Rico source income is excluded from U.S. federal tax.