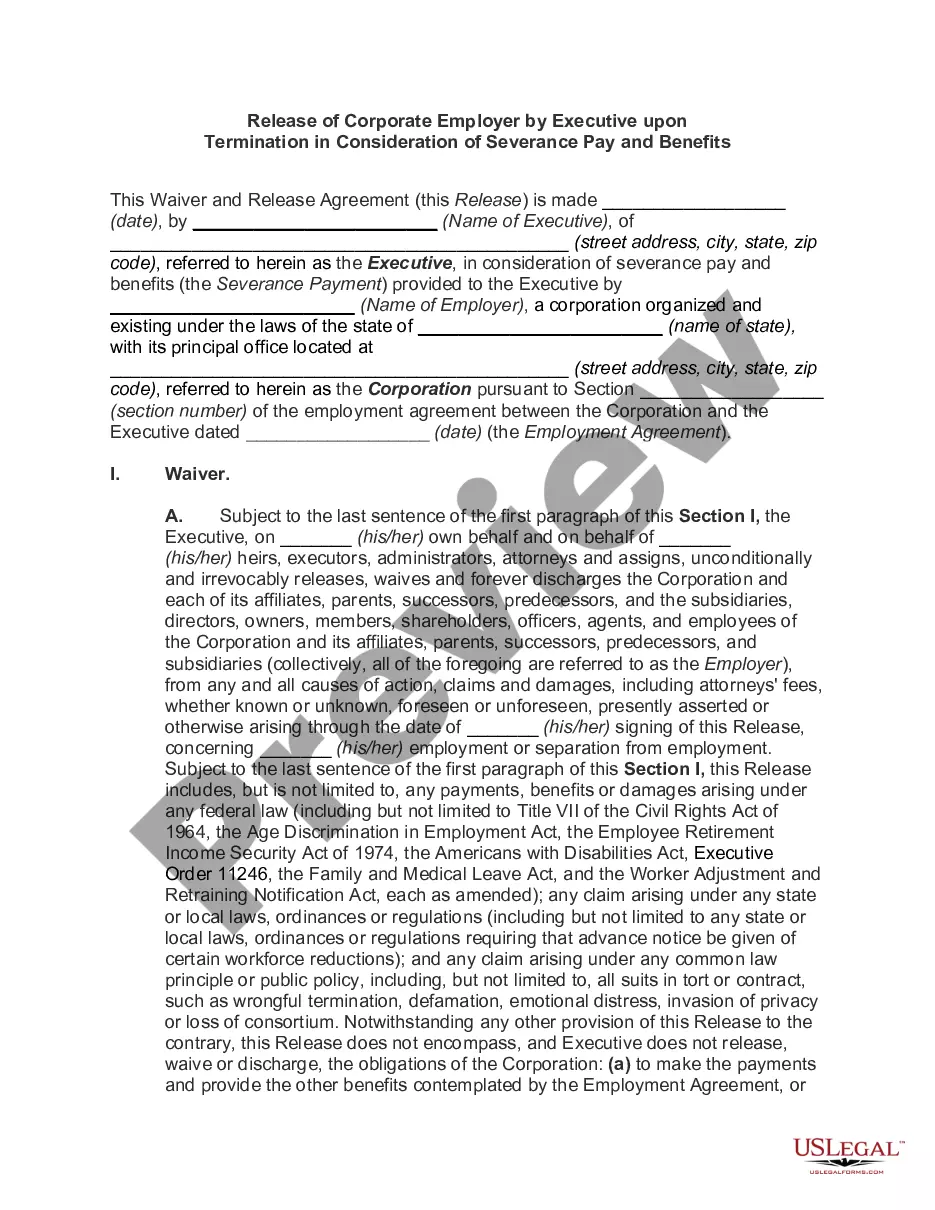

Puerto Rico Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits

Description

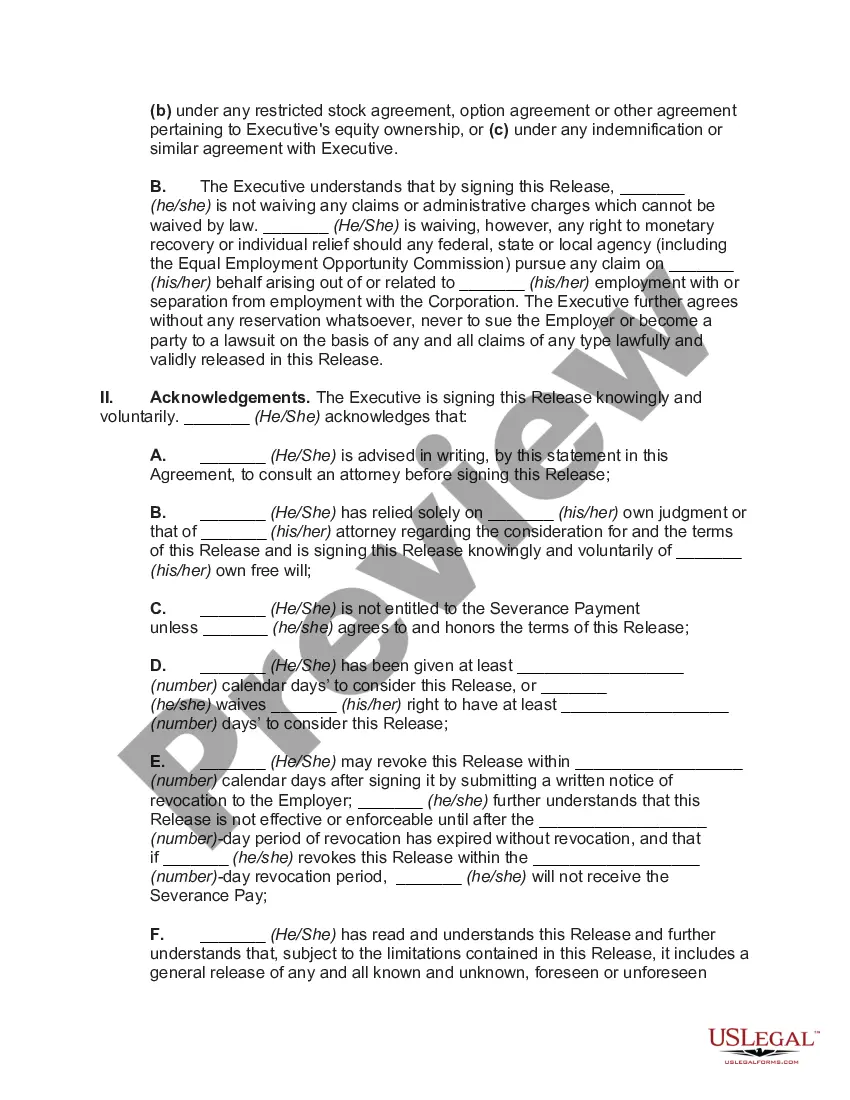

How to fill out Release Of Corporate Employer By Executive Upon Termination In Consideration Of Severance Pay And Benefits?

You can spend hours online looking for the legal document template that satisfies the state and federal requirements you need.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

It is easy to obtain or print the Puerto Rico Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits from my service.

If available, use the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and hit the Acquire button.

- After that, you can complete, modify, print, or sign the Puerto Rico Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits.

- Every legal document template you obtain is yours permanently.

- To obtain an additional copy of a purchased form, visit the My documents section and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for the region/area of your choice.

- Review the document description to confirm you have chosen the right form.

Form popularity

FAQ

Whether you receive severance pay upon leaving your company often depends on your employment contract and company policies. In Puerto Rico, the Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits is a crucial factor. It typically outlines the terms of severance and any benefits you might qualify for. Always check your agreement or consult with a legal expert to understand your rights in these situations.

Act 80 is a crucial piece of legislation in Puerto Rico that outlines the rights of employees who are terminated. This law specifically addresses the circumstances under which employees can receive severance pay and benefits. Under the Puerto Rico Release of Corporate Employer by Executive upon Termination in Consideration of Severance Pay and Benefits, employees may be entitled to compensation based on the length of their employment and the conditions surrounding their termination. Understanding Act 80 can help both employers and employees navigate their rights and responsibilities effectively.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

Yes, severance pay is taxable in the year that you receive it. Your employer will include this amount on your Form W-2 and will withhold appropriate federal and state taxes.

Paying income tax when you get severance pay as a salary This means your regular pay and benefits will continue for a set amount of time after you leave your job. You pay income tax on this type of severance payment like you would on regular employment income.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

My employer deceived me into signing a claim of releases that I didn't want to sign. What can I do? Fraud, misrepresentation, duress, or unconscionability are common defenses you can use if you want to void a severance agreement that you already signed.

In addition, severance payments are classified as "supplemental wages" for income tax purposes. Employers must withhold income tax from such payments at a flat 22% rate and pay the money to the IRS.

While many companies offer 1-2 weeks of severance pay for every year worked, you can ask for more. A good rule of thumb is to request 4 weeks of severance pay for each year worked. However, other benefits, like continued health insurance, may be more important to you.