Puerto Rico Jury Instruction - Failure To File Tax Return

Description

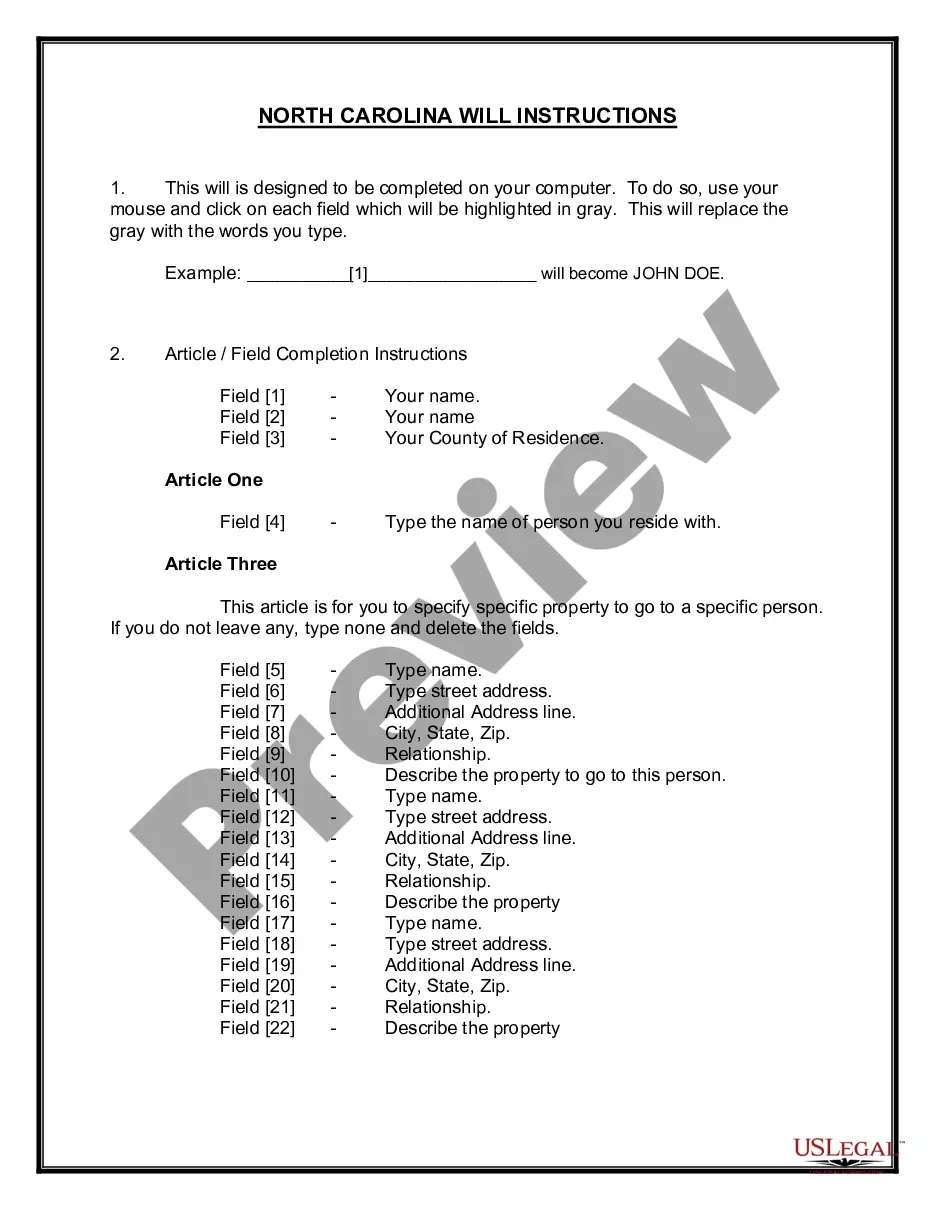

How to fill out Jury Instruction - Failure To File Tax Return?

You can commit time online attempting to find the authorized record format that suits the federal and state specifications you need. US Legal Forms offers 1000s of authorized forms that are reviewed by specialists. It is possible to obtain or printing the Puerto Rico Jury Instruction - Failure To File Tax Return from our support.

If you already possess a US Legal Forms account, you are able to log in and then click the Acquire button. Next, you are able to comprehensive, edit, printing, or indication the Puerto Rico Jury Instruction - Failure To File Tax Return. Each and every authorized record format you purchase is yours eternally. To have yet another backup for any purchased develop, proceed to the My Forms tab and then click the corresponding button.

Should you use the US Legal Forms internet site the first time, follow the simple recommendations under:

- Initially, ensure that you have selected the right record format for the area/metropolis of your liking. See the develop outline to make sure you have picked out the proper develop. If available, utilize the Review button to appear from the record format too.

- If you want to locate yet another version of your develop, utilize the Search area to discover the format that meets your requirements and specifications.

- Upon having located the format you want, click on Acquire now to proceed.

- Pick the costs strategy you want, key in your accreditations, and sign up for your account on US Legal Forms.

- Full the transaction. You can use your credit card or PayPal account to fund the authorized develop.

- Pick the structure of your record and obtain it to your product.

- Make changes to your record if required. You can comprehensive, edit and indication and printing Puerto Rico Jury Instruction - Failure To File Tax Return.

Acquire and printing 1000s of record web templates while using US Legal Forms site, which offers the biggest selection of authorized forms. Use skilled and state-certain web templates to take on your company or personal needs.

Form popularity

FAQ

If you're a bona fide resident of Puerto Rico during the entire tax year, you generally aren't required to file a U.S. federal income tax return if your only income is from sources within Puerto Rico.

Puerto Rico is an unincorporated territory of the United States and Puerto Ricans are U.S. citizens; however, Puerto Rico is not a U.S. state, but a U.S. insular area. Consequently, while all Puerto Rico residents pay federal taxes, many residents are not required to pay federal income taxes.

Specifically, a U.S. citizen who becomes a bona fide Puerto Rico resident and moves his or her business to Puerto Rico (thus, generating Puerto Rico sourced income) may benefit from a 4% corporate tax/fixed income tax rate, a 100% exemption on property taxes, and a 100% exemption on dividends from export services.

Generally, if you are a Puerto Rico bona fide resident, you must file a Puerto Rico tax return. If you are not a bona fide resident of Puerto Rico, you must file both a Puerto Rico tax return and a U.S. tax return. If you are a member of the United States Armed Forces, special tax rules may be applied.

Filing Puerto Rico & U.S. Tax Returns. Generally, if you are a Puerto Rico bona fide resident, you must file a Puerto Rico tax return. If you are not a bona fide resident of Puerto Rico, you must file both a Puerto Rico tax return and a U.S. tax return.

For foreign tax credit purposes, all qualified taxes paid to U.S. possessions are considered foreign taxes. For this purpose, U.S. possessions include Puerto Rico, the U.S. Virgin Islands, Guam, the Northern Mariana Islands and American Samoa.

In TaxSlayer Pro, to exclude Puerto Rico income from a return where the taxpayer is a bona fide resident of Puerto Rico, from the Main Menu of the tax return (Form 1040) select: Income. Other income. Section 933 Excluded Income from Puerto Rico.

More In Forms and Instructions Self-employed persons in Puerto Rico use Form 1040 (PR) to compute self-employment tax.