Puerto Rico Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits

Description

How to fill out Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits?

Choosing the right legitimate document template can be quite a battle. Needless to say, there are plenty of templates available on the Internet, but how would you get the legitimate develop you want? Utilize the US Legal Forms website. The services provides thousands of templates, including the Puerto Rico Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits, which you can use for organization and private requirements. All the forms are checked out by pros and meet up with state and federal specifications.

Should you be already authorized, log in to the bank account and click on the Down load button to find the Puerto Rico Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits. Make use of your bank account to appear throughout the legitimate forms you have purchased in the past. Check out the My Forms tab of the bank account and acquire one more version from the document you want.

Should you be a brand new customer of US Legal Forms, here are basic instructions for you to stick to:

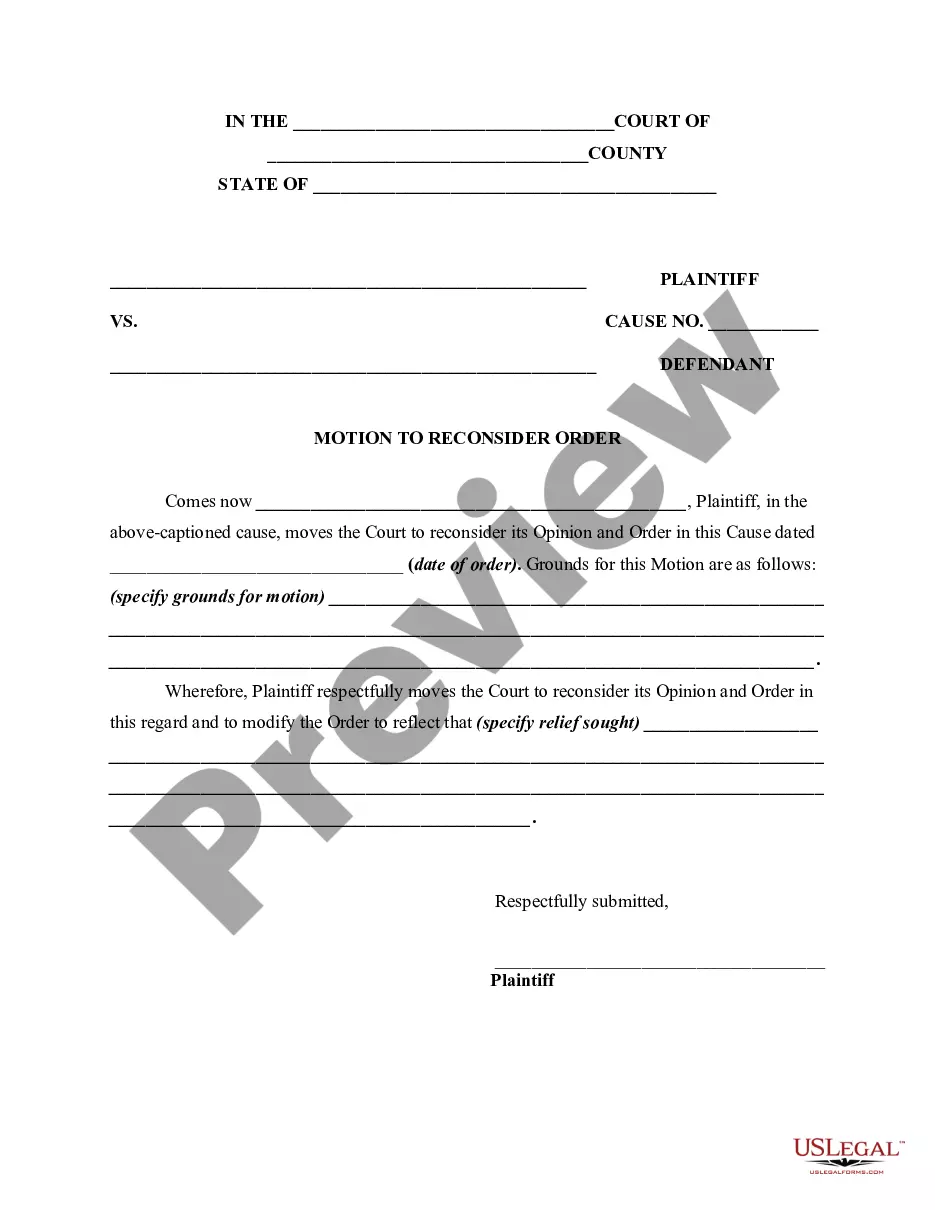

- Initially, make certain you have chosen the proper develop for your city/county. You may look through the form using the Review button and browse the form explanation to ensure this is the best for you.

- If the develop is not going to meet up with your expectations, take advantage of the Seach discipline to obtain the right develop.

- Once you are sure that the form is proper, select the Purchase now button to find the develop.

- Opt for the prices strategy you desire and enter in the essential info. Make your bank account and pay for the transaction making use of your PayPal bank account or bank card.

- Pick the data file structure and acquire the legitimate document template to the gadget.

- Total, edit and produce and indicator the acquired Puerto Rico Jury Instruction - Possession Or Transfer Of Non-Tax-Paid Distilled Spirits.

US Legal Forms will be the greatest collection of legitimate forms that you can find different document templates. Utilize the service to acquire skillfully-made files that stick to status specifications.

Form popularity

FAQ

PR is a domestic flight. No Customs, just TSA when you are boarding. No different than flying into Orlando. Alcohol laws are very relaxed.

The U.S. tax code (Section 933) allows a bona fide resident of Puerto Rico to exclude Puerto Rico-source income from his or her U.S. gross income for U.S. tax purposes.

A 100% exemption from state excise tax and sales and use taxes is provided for raw materials, machinery and equipment, fuel used for the generation of energy, chemicals used in the treatment of waste water, and energy-efficient equipment.

Puerto Rico sales tax details Puerto Rico (PR) is not a state but a commonwealth. The Puerto Rico sales and use tax rate is 10.5%. Puerto Rico has been an unincorporated territory of the United States since 1898, when it was acquired from Spain in the aftermath of the Spanish American War.

Commonwealth taxes The main body of domestic statutory tax law in Puerto Rico is the Codigo de Rentas Internas de Puerto Rico (Internal Revenue Code of Puerto Rico).

Bona Fide Residents of Puerto Rico: Generally, you are a bona fide resident of Puerto Rico if during the tax year, you: ? Meet the presence test ? Do not have a tax home outside Puerto Rico, and ? Do not have a closer connection to the United States or to a foreign country than to Puerto Rico.

The Tax Incentive Code, known as ?Act 60?, provides tax exemptions to businesses and investors that relocate to, or are established in, Puerto Rico.

Employers and non-employers in Puerto Rico file this form to obtain an Employer Identification Number (EIN).