Puerto Rico Sample Letter for Notification to Creditor to Probate and Register Claim

Description

How to fill out Sample Letter For Notification To Creditor To Probate And Register Claim?

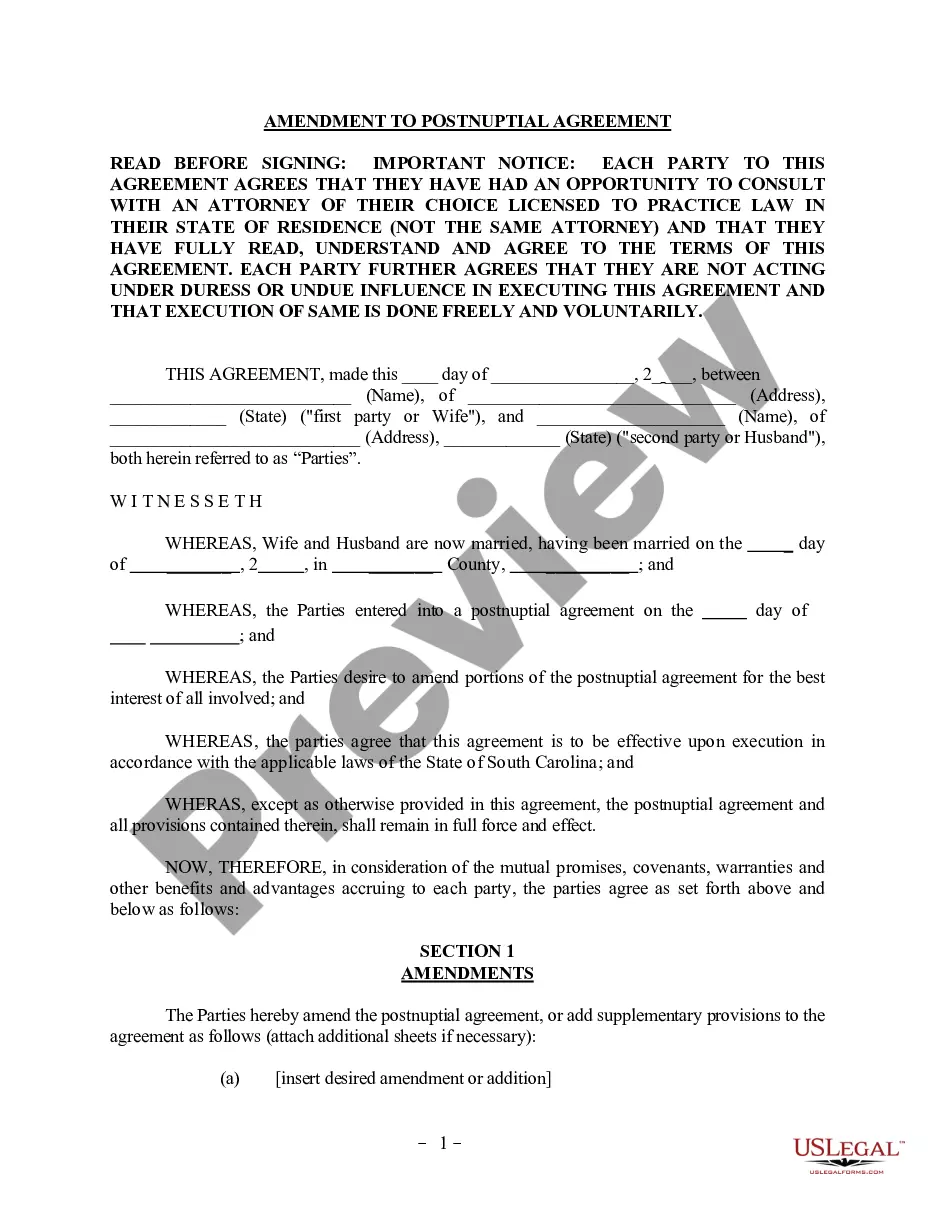

Are you currently in the place where you need to have documents for sometimes company or person reasons nearly every time? There are a lot of legitimate document templates available on the net, but finding types you can depend on isn`t effortless. US Legal Forms delivers thousands of form templates, much like the Puerto Rico Sample Letter for Notification to Creditor to Probate and Register Claim, which are written to fulfill federal and state needs.

If you are presently knowledgeable about US Legal Forms web site and possess a free account, merely log in. Following that, you may download the Puerto Rico Sample Letter for Notification to Creditor to Probate and Register Claim design.

Unless you offer an account and would like to start using US Legal Forms, abide by these steps:

- Discover the form you need and make sure it is for that proper metropolis/state.

- Make use of the Review key to check the form.

- Browse the outline to actually have chosen the right form.

- In the event the form isn`t what you are searching for, take advantage of the Research discipline to find the form that suits you and needs.

- Once you obtain the proper form, click Get now.

- Select the rates plan you want, submit the required information and facts to make your money, and buy the order making use of your PayPal or credit card.

- Select a convenient document file format and download your duplicate.

Get each of the document templates you have purchased in the My Forms menu. You can obtain a additional duplicate of Puerto Rico Sample Letter for Notification to Creditor to Probate and Register Claim any time, if needed. Just click the required form to download or print out the document design.

Use US Legal Forms, by far the most extensive selection of legitimate forms, to conserve some time and prevent errors. The assistance delivers professionally manufactured legitimate document templates that can be used for a variety of reasons. Create a free account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

The Connecticut statute of limitations for a claim against a decedent's estate is the earlier of the (i) date the applicable statute of limitations for such claim expires, or (ii) two years from the date of the decedent's death if such claim is or could have been asserted during the decedent's lifetime, or two years ...

Spouse and children -- spouse takes 1/2 the estate. If the children are also the spouse's, the spouse also takes $100,000. If they are not, spouse only takes 1/2. Whatever remains is divided equally among the children in the same generation.

Probate or administration is not granted after ten years from the decedent's death unless either: ? On a petition to the court, the court allows it. of limitations may be extended to allow one year after the minor reaches majority to begin a probate or an administration.

Creditors have 150 days to file a claim in a Connecticut estate going through probate unless the Executor sends the creditor the letter described above. A creditor can't just ignore the Executor and march into any court other than the probate court and get a judgment for payment.

Example letter I am sorry that I am unable to keep up my monthly payments to your company. I'm sick and unable to work. I've claimed benefits and I'm waiting to hear the outcome of my claim. My situation is unlikely to improve for at least 3 months.

Within six months after the date of death, the Executor must file a Connecticut estate tax return regardless of the value of the estate. Connecticut has a $2.6 million estate tax exemption. It is based on the taxable estate after deductions.