Puerto Rico Employee Action and Behavior Documentation

Description

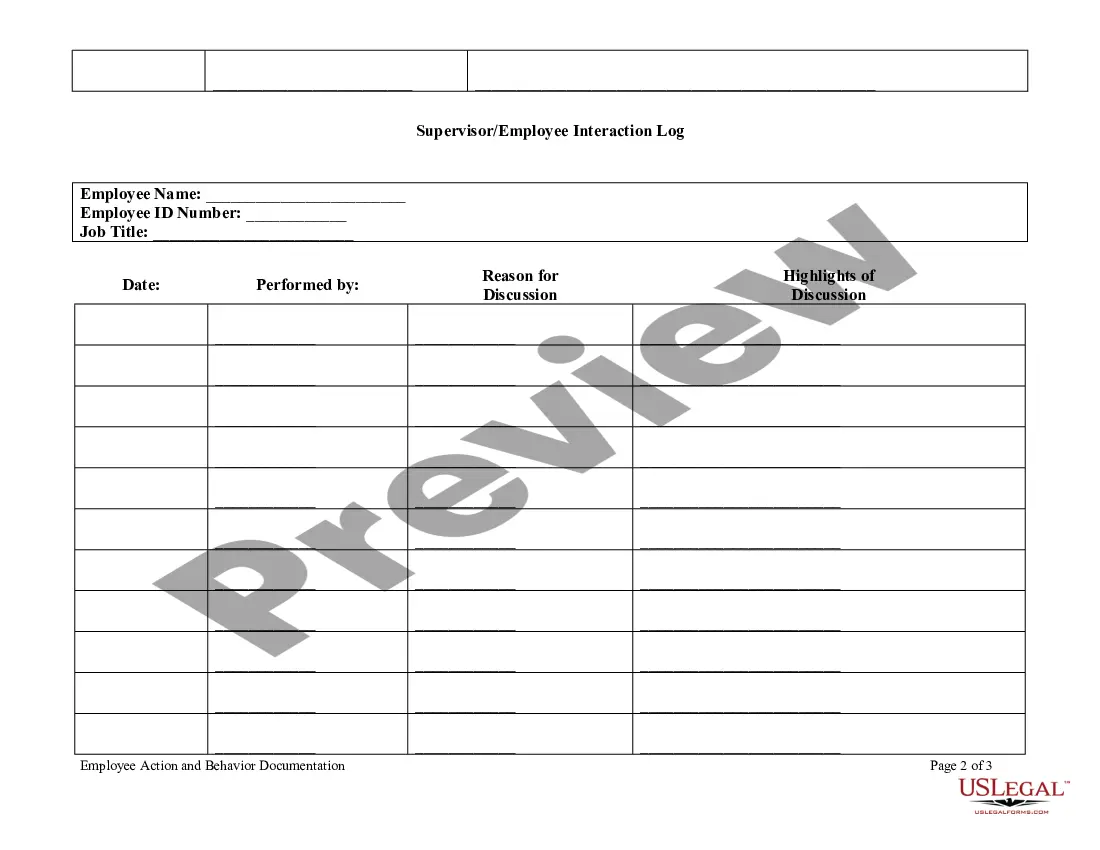

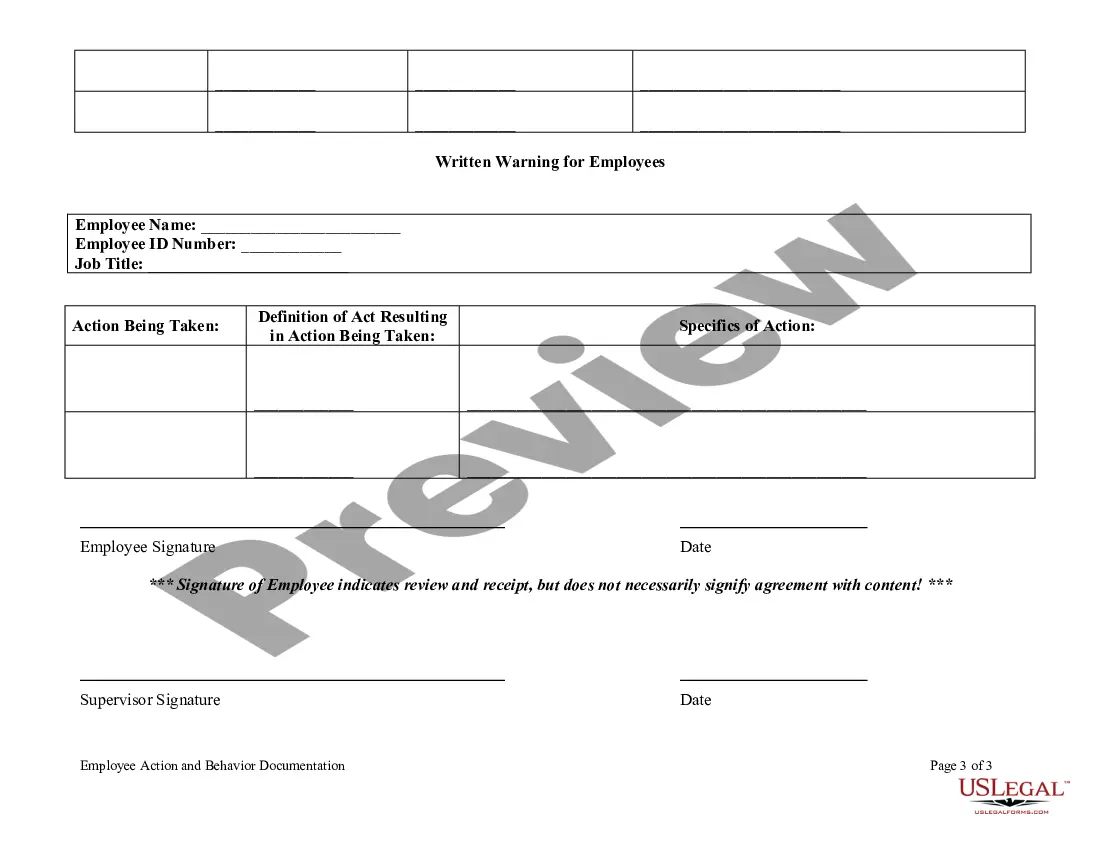

How to fill out Employee Action And Behavior Documentation?

It is feasible to spend hours online searching for the legitimate document template that meets the state and federal stipulations you require.

US Legal Forms offers thousands of legal forms that are evaluated by experts.

It is straightforward to obtain or print the Puerto Rico Employee Action and Behavior Documentation from the service.

If you want to find another version of your form, use the Search field to locate the template that suits you and your requirements.

- If you already possess a US Legal Forms account, you can Log In and click the Download button.

- After that, you can complete, modify, print, or sign the Puerto Rico Employee Action and Behavior Documentation.

- Every legal document template you purchase is yours permanently.

- To obtain an additional copy of any acquired document, visit the My documents tab and click the relevant button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have chosen the appropriate form. If available, utilize the Review button to view the document template as well.

Form popularity

FAQ

From an employment law perspective, this means federal statutes such as Title VII, FLSA, ADA, ADEA, FMLA, USERRA, OSHA, ERISA, COBRA, among others, apply to Puerto Rico.

$6.55 / hour Puerto Rico's state minimum wage rate is $8.50 per hour. This is greater than the Federal Minimum Wage of $7.25. You are entitled to be paid the higher state minimum wage.

Although the EPA does not apply outside the United States, such claims are covered by Title VII, which also prohibits discrimination in compensation on the basis of sex.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Puerto Rico is not an 'employment at will' jurisdiction. Thus, an indefinite-term employee discharged without just cause is entitled to receive a statutory discharge indemnity (or severance payment) based on the length of service and a statutory formula.

Section 403 of PROMESA modified Section 6(g) of the Fair Labor Standards Act (FLSA) to allow employers to pay employees in Puerto Rico who are under the age of 25 years a subminimum wage of not less than $4.25 per hour for the first 90 consecutive calendar days after initial employment by their employer.

Form 499-R-1C (Adjustments to Income Tax Withheld Worksheet) Form 499R2/W2PR (Withholding Statement) - This withholding statement is the Puerto Rico equivalent of the U.S. Form W2 and should be prepared for every employee.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.

Employment law in Puerto Rico is covered both by U.S. labor law and Puerto Rico's Constitution, which affirms the right of employees to choose their occupation, to have a reasonable minimum salary, a regular workday not exceeding eight hours, and to receive overtime compensation for work beyond eight hours.