The articles of amendment shall be executed by the corporation by an officer of the corporation.

Puerto Rico Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation

Description

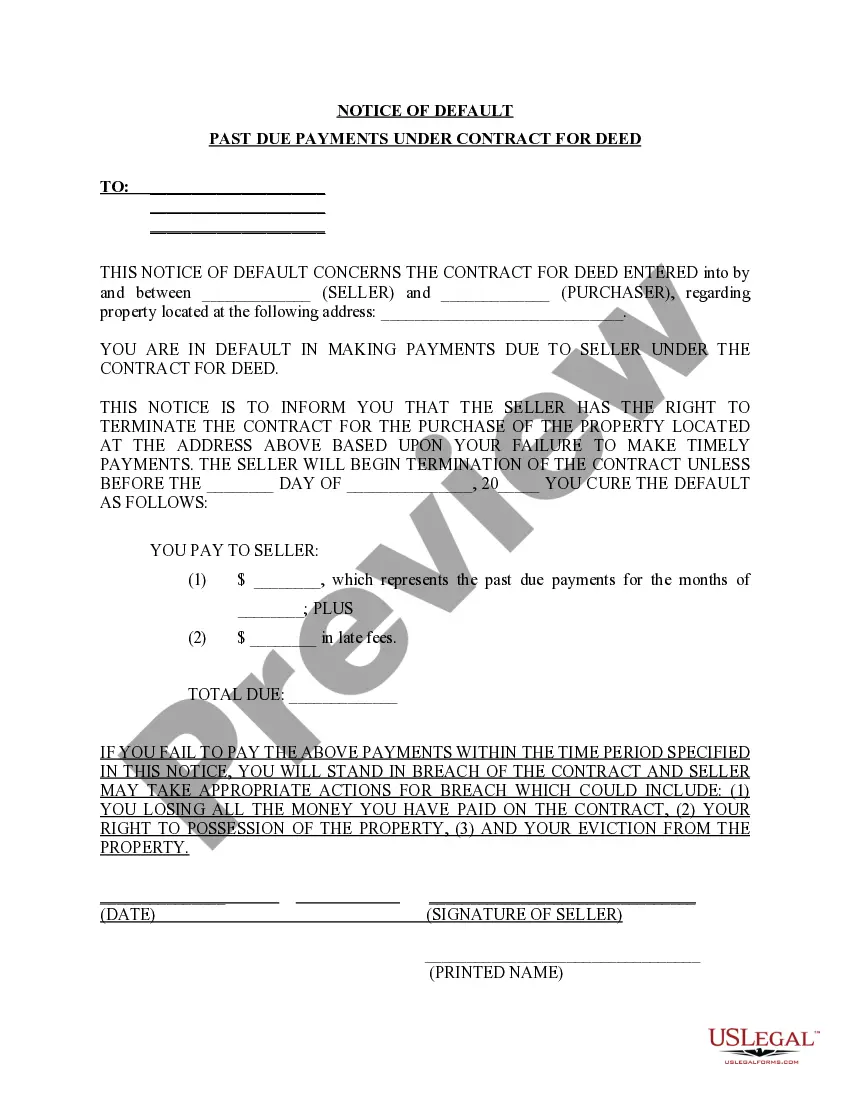

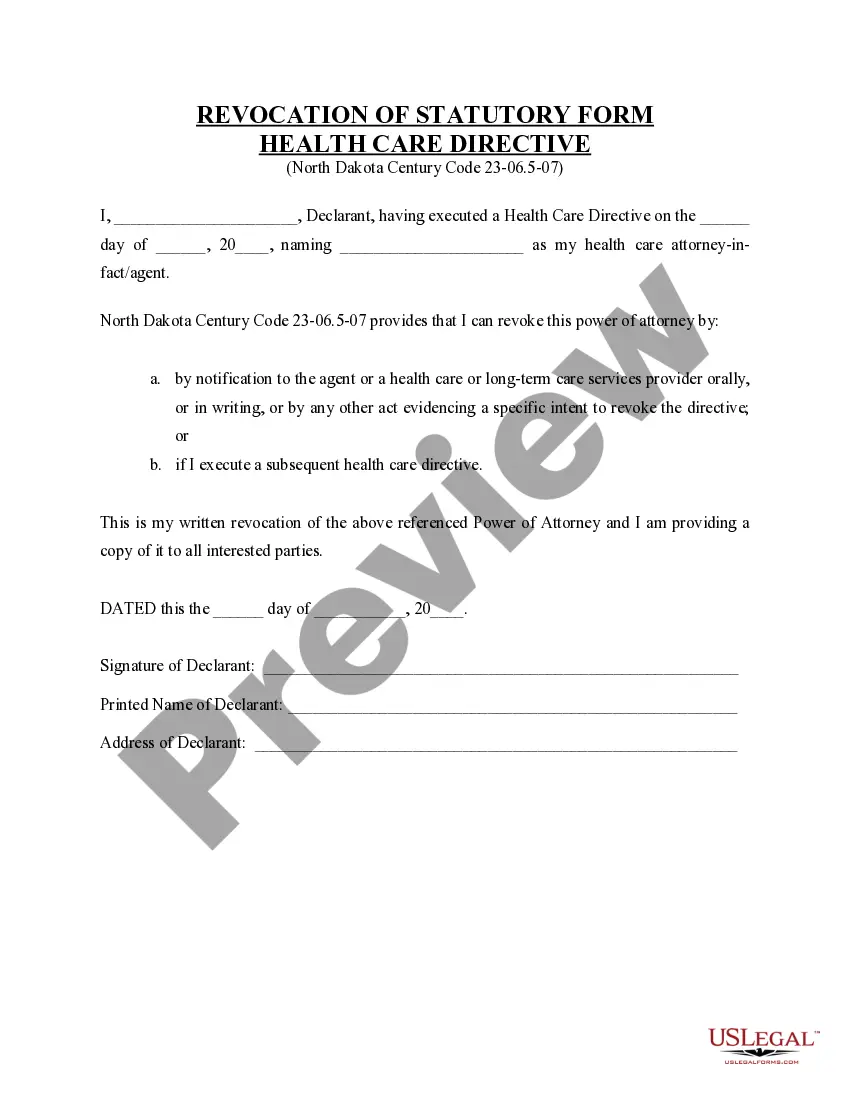

How to fill out Articles Of Amendment To The Articles Of Incorporation Of Church Non-Profit Corporation?

If you want to total, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Take advantage of the site’s simple and user-friendly search to locate the documents you need.

Various templates for business and personal uses are categorized by types and states, or keywords.

Each legal document template you receive is yours forever. You will have access to every form you obtained in your account.

Be proactive and download, and print the Puerto Rico Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation using US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Use US Legal Forms to obtain the Puerto Rico Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation within a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to retrieve the Puerto Rico Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation.

- You can also access forms you previously acquired from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to examine the form’s content. Remember to read the overview.

- Step 3. If the form does not meet your requirements, utilize the Search field at the top of the screen to find other types of your legal form template.

- Step 4. After locating the form you need, click on the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of your legal form and download it onto your device.

- Step 7. Complete, review, and print or sign the Puerto Rico Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation.

Form popularity

FAQ

Filling out the certificate of amendment to the articles of organization involves several steps. First, gather all necessary information about your organization, including its current official name and any changes you want to make. Next, visit the uslegalforms platform to find a user-friendly template for the Puerto Rico Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation. Completing the form accurately and submitting it will ensure your changes are legally recognized.

As a protected U.S. Territory, Puerto Rico offers unique benefits to its corporation including: no U.S. taxes for selling products in the U.S., duty free importing of products from the U.S., low corporate tax rates, real estate and personal property taxes are exempt during the first year, one shareholder can form a

Filing and forming an LLC in Puerto Rico requires a $250 filing fee. Under Puerto Rico law, an LLC uses a limited liability company agreement, or LLCA, to govern the internal affairs and administration of the LLC. This is valid regardless of what it is called, but the law says that they must be written.

Annual reports must be filed electronically by accessing the Department of State website at . A $150 annual fee is payable when filing the report. The payment method is a major credit card or any other method provided at the Department of State website.

Ready to Start an LLC in Puerto Rico?Name Your LLC.Submit LLC Certificate of Formation.Write an LLC Operating Agreement.Get an EIN.Open a Bank Account.Fund the LLC.File reports + taxes.

Start a Nonprofit in Puerto RicoStep One: Choose a Name.Step Two: File for Incorporation.Step Three: Prepare Your Bylaws.Step Four: Hold First Meeting.Step Five: Create a Records Book.Step Six: Apply for Federal Tax Exemption.Step Seven: State Tax Exemption.Step Eight: Register as a Charitable Organization.

A U.S. company that wishes to do business in Puerto Rico may choose to either form a new subsidiary entity or register an existing company. In order to determine the best option, the company should consult an attorney familiar with tax laws and the company's business activities and structure.

To register a foreign LLC in Puerto Rico, you must file a Puerto Rico Certificate of Authorization for Doing Business in Puerto Rico with the Puerto Rico Department of State. You can submit this document by mail or online. The Certificate of Authorization costs $150 to file by mail and $250 to file online.

Sole member nonprofits can be an incredibly effective way to both accomplish something wonderful in your community and to also protect founders who are putting it all on the line to make it happen. They're complicated to set up, and they are definitely not a do-it-yourself project.

How do I start a nonprofit organization?Step 1: Do Your Homework. Conduct a needs analysis.Step 2: Build a Solid Foundation. Draft your mission statement.Step 3: Incorporate Your Nonprofit.Step 4: File for 501(c)(3) Tax-Exempt Status.Step 5: Ongoing Compliance.