Puerto Rico Agreement to Incorporate as an S Corp and as Small Business Corporation with Qualification for Section 1244 Stock

Description

How to fill out Agreement To Incorporate As An S Corp And As Small Business Corporation With Qualification For Section 1244 Stock?

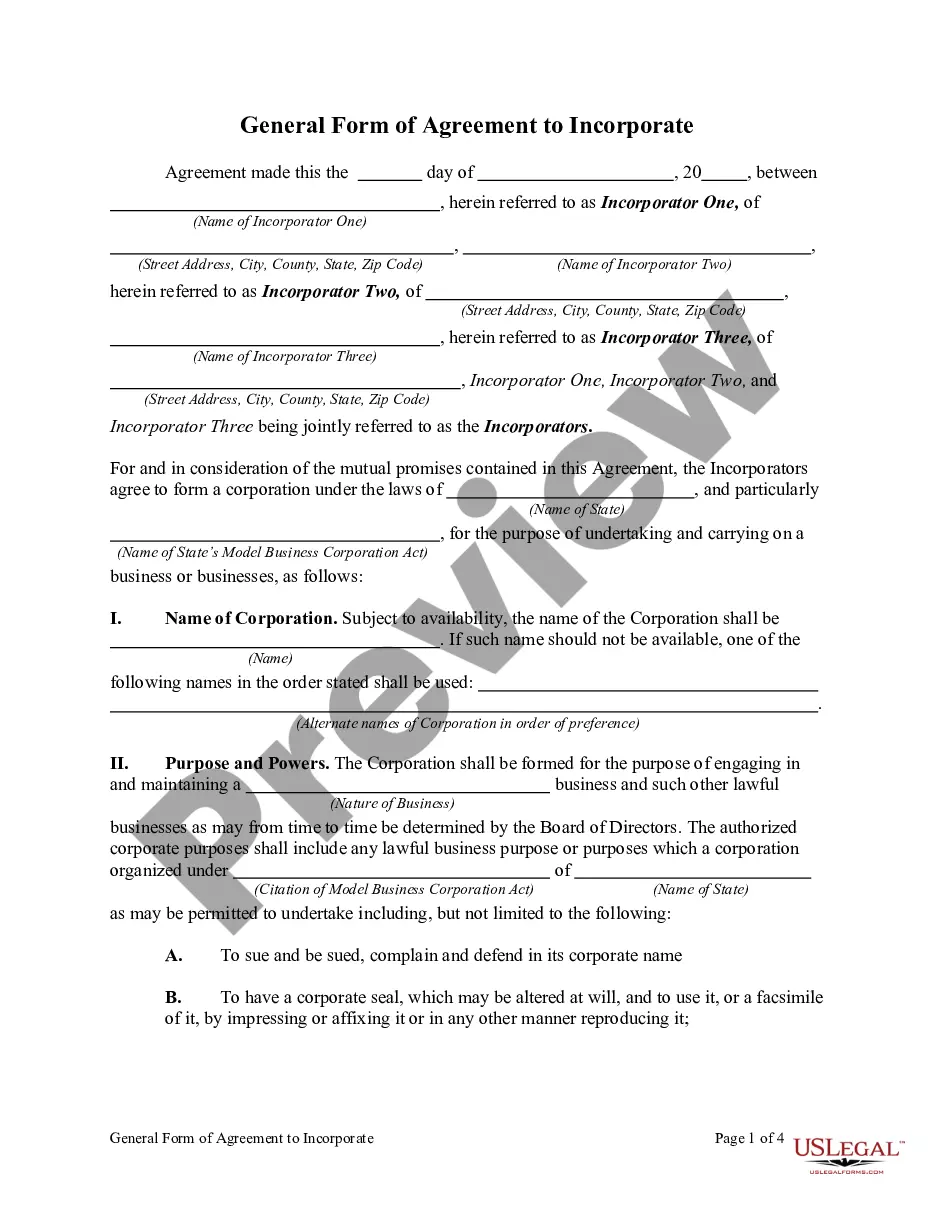

Selecting the ideal authentic document template can be quite challenging. Clearly, there are numerous designs available online, but how can you obtain the genuine template you need? Utilize the US Legal Forms site. The service offers thousands of formats, including the Puerto Rico Agreement to Form as an S Corp and as a Small Business Corporation with Eligibility for Section 1244 Stock, which can be utilized for business and personal needs. All of the forms are vetted by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click on the Acquire button to access the Puerto Rico Agreement to Form as an S Corp and as a Small Business Corporation with Eligibility for Section 1244 Stock. Use your account to search through the legal forms you may have previously purchased. Go to the My documents section of your account and obtain another copy of the document you need.

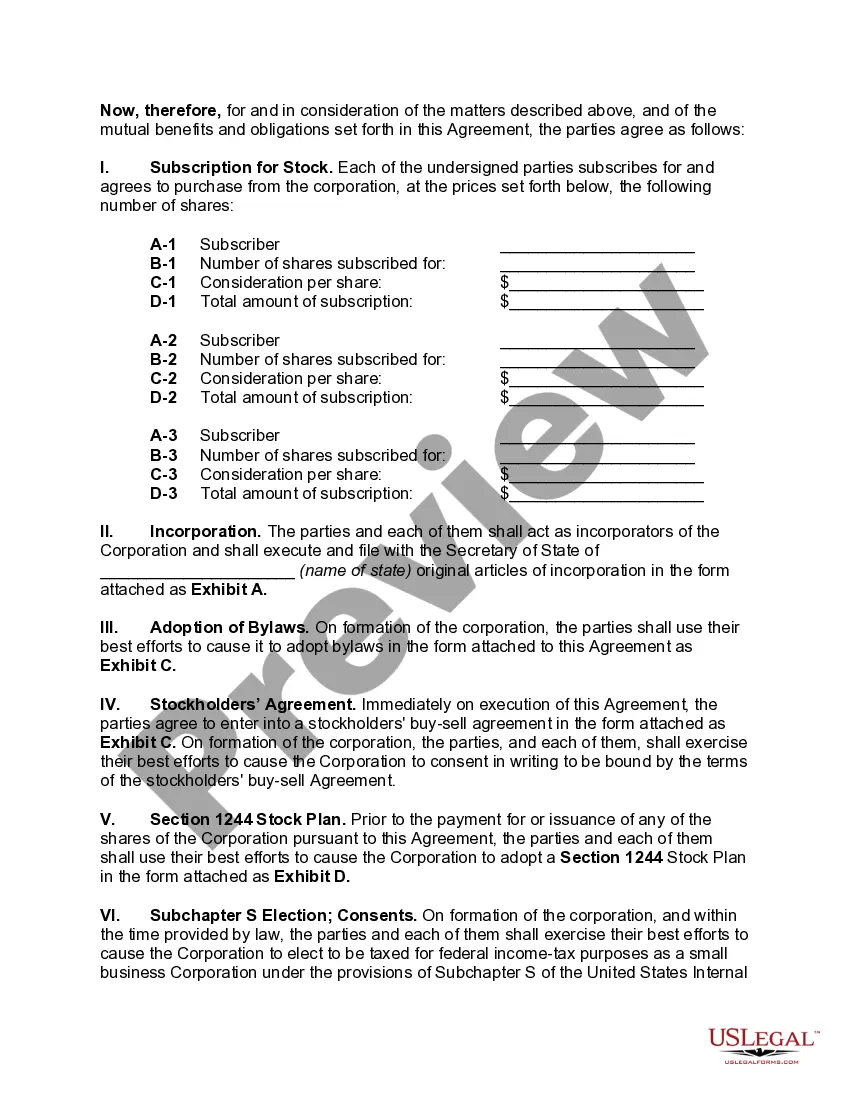

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, make sure you have selected the correct document for the area/region. You can review the document using the Preview button and read the document description to ensure it is the appropriate one for you. If the document does not meet your requirements, use the Search box to find the correct form. Once you are confident that the document is suitable, click the Acquire now button to get the document. Choose the pricing plan you prefer and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, and print and sign the received Puerto Rico Agreement to Form as an S Corp and as a Small Business Corporation with Eligibility for Section 1244 Stock.

- Choose the right document for your area/region.

- Review the document with the Preview button.

- Use the Search box if it doesn't meet your needs.

- Ensure it is suitable before clicking Acquire now.

- Select a pricing plan and provide necessary information.

- Pay via PayPal or credit card.

- Download the legal document template.

Form popularity

FAQ

1244 stock is issued to S corporations, such corporations and their shareholders may not treat losses on such stock as ordinary losses. This is so notwithstanding IRC Sec. 1363, which provides that the taxable income of an S corporation must be computed in the same manner as that of an individual.

In general, corporations aren't allowed to be shareholders. The only exception that allows an S corp to own another S corp is when one is a qualified subchapter S subsidiary, also known as a QSSS. In order to be considered a QSSS, all of the shares of the owned S corp have to be owned by one S corp.

Section 1244 of the Internal Revenue Code is the small business stock provision enacted to allow shareholders of domestic small business corporations to deduct a loss on the disposal of such stock as an ordinary loss rather than as a capital loss, which is limited to only $3,000 annually.

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

Qualifying for Section 1244 StockThe stock must be issued by U.S. corporations and can be either a common or preferred stock.The corporation's aggregate capital must not have exceeded $1 million when the stock was issued and the corporation cannot derive more than 50% of its income from passive investments.More items...

In order to qualify as §1244 stock, the stock must be issued, and the consideration paid by the shareholder must consist of money or other property, not services. Stock and other securities are not "other property" for this purpose. However, cancellation of indebtedness may be sufficiently valid consideration.

Section 1244 stock is common or preferred stock issued for money or other property by a domestic small business corporation (which can be a C or S corporation) that meets a gross receipts test. Common stock does not include securities convertible into common stock, nor common stock convertible into other securities.

Section 1244 stock is a stock transaction pursuant to the Internal Revenue Code provision that allows shareholders of an eligible small business corporation to treat up to $50,000 of losses (or, in the case of a husband and wife filing a joint return, $100,000) from the sale of stock as ordinary losses instead of

HW: How are gains from the sale of § 1244 stock treated? losses? The general rule is that shareholders receive capital gain or loss treatment upon the sale or exchange of stock. However, it is possible to receive an ordinary loss deduction if the loss is sustained on small business stock (A§ 1244 stock).

Under the current 2020 tax tables, a long-term capital gain that results from the sale of this Section 1244 stock will be taxed at the regular preferential rate of 15% for most individuals or 20% for high-income individuals with taxable income over $441,450. The 3.8% Net Investment Income Tax (NIIT) may also be due.