Puerto Rico Agreement to Form Partnership in Future to Conduct Business

Description

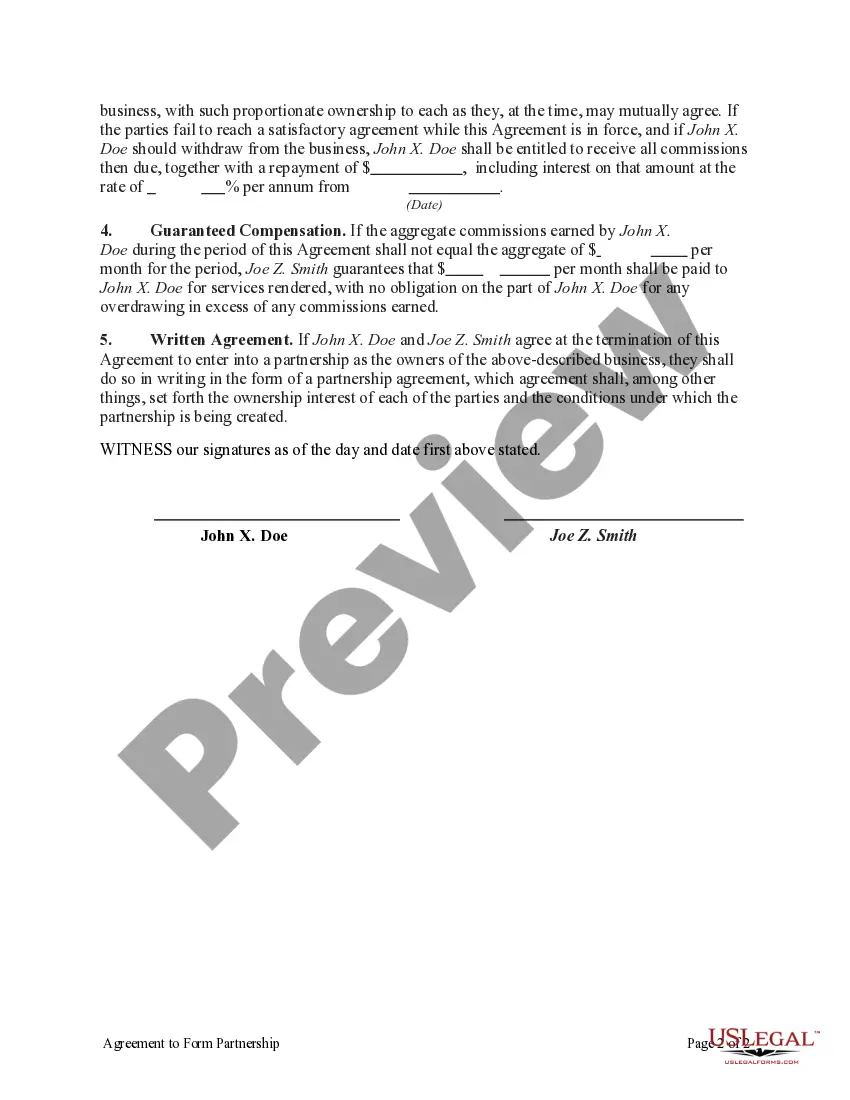

How to fill out Agreement To Form Partnership In Future To Conduct Business?

If you wish to compile, download, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms, available online.

Take advantage of the site's straightforward and convenient search to find the documents you require.

A variety of templates for business and personal uses are organized by categories, states, or keywords.

Step 4. After locating the form you need, click on the Acquire now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to finalize the transaction.

- Employ US Legal Forms to acquire the Puerto Rico Agreement to Form Partnership in Future to Conduct Business with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click the Obtain button to receive the Puerto Rico Agreement to Form Partnership in Future to Conduct Business.

- You may also access forms you have previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/region.

- Step 2. Use the Review option to examine the form's content.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternate versions of the legal form template.

Form popularity

FAQ

Yes, you will need a business license to operate legally in Puerto Rico. The specific type of license you need depends on your business activities and location. Obtaining a Puerto Rico Agreement to Form Partnership in Future to Conduct Business can help streamline this process, ensuring that you meet all regulatory requirements. Platforms like US Legal Forms provide convenient access to licensing information and necessary forms.

Yes, a US citizen can start a business in Puerto Rico without any special requirements. This favorable environment encourages entrepreneurship, making it easier for you to establish your Puerto Rico Agreement to Form Partnership in Future to Conduct Business. You need to fulfill local regulations and register your business. Using resources like US Legal Forms can simplify your startup experience.

To incorporate a company in Puerto Rico, you must select a unique company name and file the necessary paperwork with the Department of State. After submitting your Puerto Rico Agreement to Form Partnership in Future to Conduct Business, you will receive a certificate of incorporation. Additionally, consider forming an operating agreement to outline the terms of your partnership. Resources are available through platforms like US Legal Forms to help you navigate this process smoothly.

The 183 day rule in Puerto Rico refers to the IRS requirement for individuals to qualify as bona fide residents. According to this rule, if you spend 183 days or more in Puerto Rico during the tax year, you may be classified as a resident for tax purposes. This status can influence your Puerto Rico Agreement to Form Partnership in Future to Conduct Business and help you leverage local tax benefits. Using uslegalforms can help ensure compliance with this important rule.

To establish residency in Puerto Rico for tax purposes, you must fulfill the IRS criteria, including spending at least 183 days in the territory each year. You will also need to establish a primary home and a business presence. This can positively impact your Puerto Rico Agreement to Form Partnership in Future to Conduct Business, allowing you to take advantage of local tax incentives. Utilizing uslegalforms can guide you through the residency establishment process effectively.

Becoming a bona fide resident of Puerto Rico involves several steps. You must demonstrate that you have a primary residence in Puerto Rico, spend a required number of days on the island, and maintain significant connections to the territory. Your Puerto Rico Agreement to Form Partnership in Future to Conduct Business will be significantly enhanced by understanding how residency impacts your tax situation. Consulting uslegalforms can provide valuable insights during this process.

To establish bona fide residency in Puerto Rico, you need to meet specific requirements set by the IRS. These include being physically present in Puerto Rico for at least 183 days during the tax year and having a primary home in Puerto Rico. Additionally, your Puerto Rico Agreement to Form Partnership in Future to Conduct Business may benefit from understanding these residency rules to optimize tax obligations. Seeking guidance from uslegalforms can help clarify these requirements.

Yes, Puerto Rico does require a business license for most commercial activities. This license is typically obtained from the municipality where your business operates. It is important to ensure that your Puerto Rico Agreement to Form Partnership in Future to Conduct Business complies with local zoning and business regulations, as this can vary by location. Using uslegalforms can help you navigate these requirements effectively.

To register a foreign corporation in Puerto Rico, you should start by obtaining a Certificate of Good Standing from your home state. Next, you need to complete the necessary forms provided by the Puerto Rico Department of State, which include the Application for Authority to Transact Business. Lastly, confirm that your Puerto Rico Agreement to Form Partnership in Future to Conduct Business aligns with local regulations and submit the required fees. Using a service like uslegalforms can streamline this process for you.

Act 60, also known as the Puerto Rico Incentives Code, offers tax incentives to businesses and individual investors. It aims to promote economic development in Puerto Rico by providing tax breaks for qualifying businesses. Understanding these benefits can enhance your Puerto Rico Agreement to Form Partnership in Future to Conduct Business and lead to more lucrative opportunities.