Puerto Rico Assignment of Accounts Receivable

Description

How to fill out Assignment Of Accounts Receivable?

Are you currently in a circumstance where you need documents for either business or personal purposes almost daily.

There are numerous legitimate document templates available online, but locating trustworthy ones can be challenging.

US Legal Forms provides thousands of template forms, including the Puerto Rico Assignment of Accounts Receivable, which are designed to meet both state and federal standards.

Once you find the right form, click on Buy now.

Choose the pricing plan you prefer, fill in the required information to create your account, and complete the purchase using PayPal or credit card. Choose a convenient document format and download your copy. Access all the document templates you have acquired in the My documents section. You can download another copy of the Puerto Rico Assignment of Accounts Receivable whenever necessary. Just click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service offers professionally crafted legal document templates that can be utilized for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Puerto Rico Assignment of Accounts Receivable template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and make sure it is for the correct city/state.

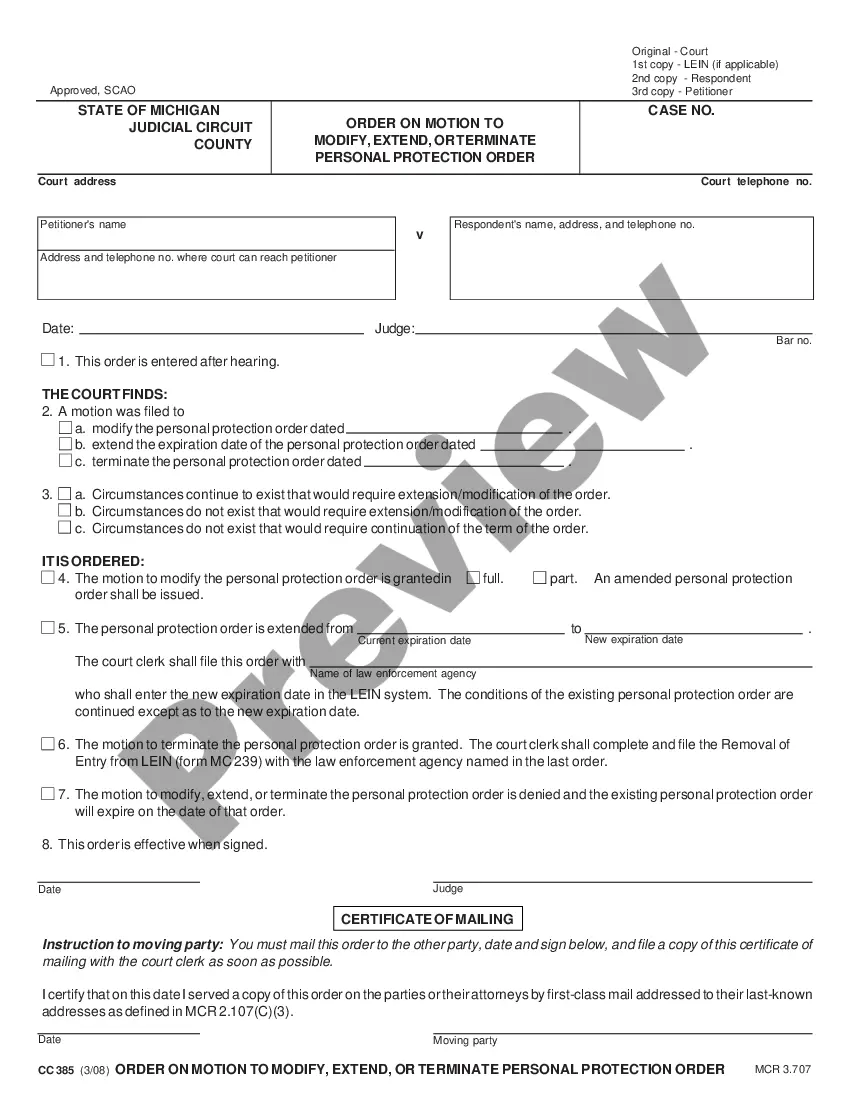

- Use the Preview button to review the document.

- Check the description to confirm that you have selected the correct form.

- If the form isn’t what you are looking for, use the Search box to find the form that suits your needs.

Form popularity

FAQ

Residents of Puerto Rico typically do not need to file US tax returns for income sourced within Puerto Rico. However, income from outside the territory may incur federal tax obligations. Utilizing platforms like USLegalForms can help clarify filing needs in context to your Assignment of Accounts Receivable transactions.

Individuals and businesses can qualify for tax exemptions in Puerto Rico based on several criteria, including residency and type of income. If you are actively managing accounts receivable, knowing the qualifications for tax exemptions can greatly benefit your financial strategy. Align your operations with these regulations to maximize your tax efficiency.

Yes, there are tax arrangements in place between the US and Puerto Rico. However, they are not traditional tax treaties. Understanding these regulations can provide clarity on tax obligations, especially if your business engages in the Puerto Rico Assignment of Accounts Receivable.

Puerto Rico form 482 is used to document the Assignment of Accounts Receivable officially. This form helps in securing funding by allowing creditors to access payment streams from accounts receivable. Its proper completion is vital for businesses seeking financial stability in Puerto Rico.

Form 480.6 C is utilized by individuals and businesses to report income that is exempt from taxation in Puerto Rico. This form is particularly relevant in the context of financial transactions, including the Assignment of Accounts Receivable, where understanding your tax liabilities can significantly impact your bottom line.

The 480.6 A form is specifically designed for taxpayers to report various types of income in Puerto Rico. For those involved in the Assignment of Accounts Receivable, this form is instrumental in reflecting your income and maintaining proper tax filings. Understanding its use can help alleviate tax-related concerns.

Form 480.7 C serves as a declaration for the withholding of taxes on payments made by Puerto Rico businesses. It is essential for businesses that handle accounts receivable and ensures compliance with tax obligations. Accurate use of this form can enhance the efficiency of your Puerto Rico Assignment of Accounts Receivable.

Form 482 in Puerto Rico is a crucial document used in the Assignment of Accounts Receivable process. This form enables a lender to formally record the assignment of receivables, thereby securing financing against those assets. When utilizing the Puerto Rico Assignment of Accounts Receivable, understanding form 482 can streamline your financial transactions.

The business income tax rate in Puerto Rico can also range from 4% to 30%, with standard rates applying to different income levels. It's crucial for businesses to be aware of these rates to avoid penalties. If you are involved in Puerto Rico Assignment of Accounts Receivable, staying informed about these taxes will assist in effective financial management.

The business tax in Puerto Rico generally varies from 4% to 30%, depending on the nature of the business and its income. Businesses must comply with these tax rates to operate legally. For those involved in Puerto Rico Assignment of Accounts Receivable, understanding the tax landscape is essential for financial planning.