Puerto Rico Invoice of Handyman

Description

Form popularity

FAQ

Puerto Rico operates under its own tax system and does not fully report to the IRS like the states do. However, certain income types may have to be reported, especially when related to a Puerto Rico Invoice of Handyman for services performed. It is vital to understand which forms to file and how this affects your overall tax responsibilities.

The 183-day rule in Puerto Rico helps determine residency for tax purposes. If you are present in Puerto Rico for more than 183 days during the tax year, you may be considered a resident for tax liability, which can affect income reported via a Puerto Rico Invoice of Handyman. Understanding this rule aids in proper compliance with local tax laws.

Yes, non-US citizens can receive 1099 forms if they earn U.S.-sourced income. For instance, if a non-citizen completes handyman work in Puerto Rico and issues a Puerto Rico Invoice of Handyman, they may need to report this income. Always consult a tax professional who understands the intricacies of filing as a non-citizen to stay compliant.

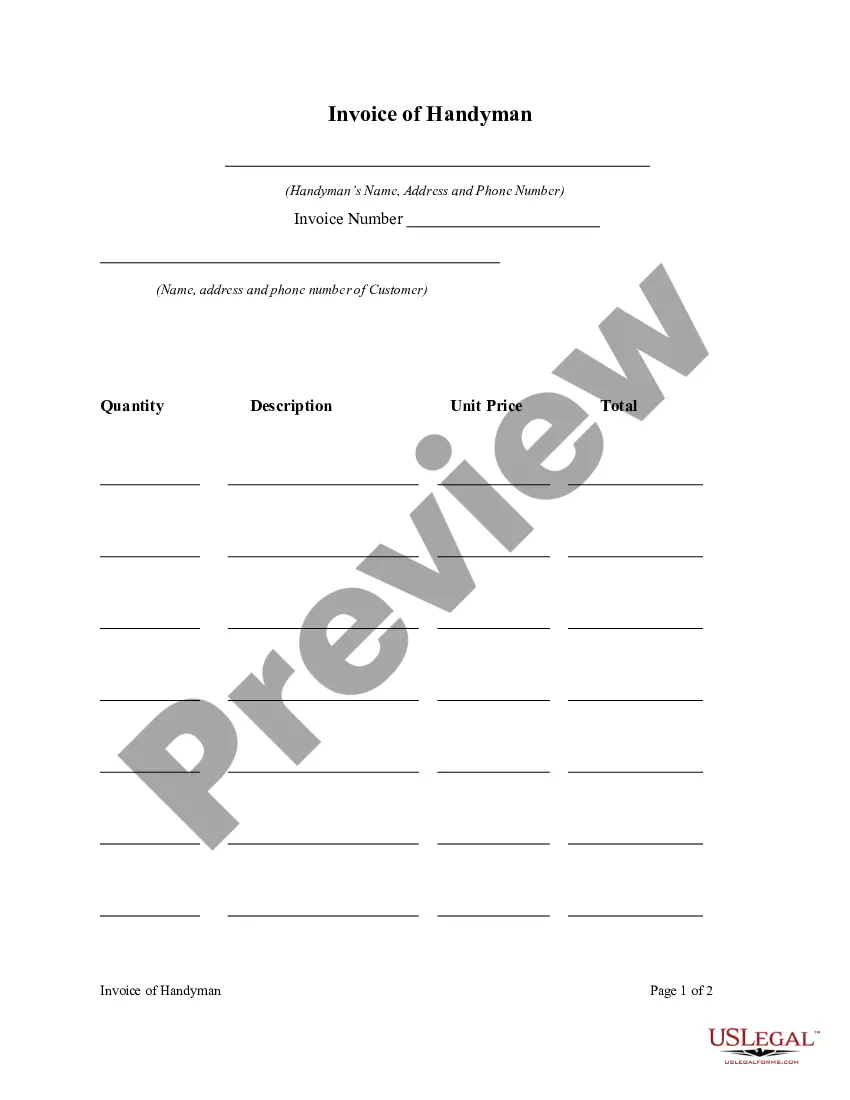

To create a contractor invoice, focus on detailing the work completed and the materials used. Alongside your contact information, provide an itemized breakdown of each service or product, ensuring transparency. For those in Puerto Rico, using a specialized Puerto Rico invoice of handyman template can streamline this process, ensuring accuracy and professionalism.

Creating an invoice for handyman services in Puerto Rico is straightforward. Start by including your business name and contact information at the top. Clearly list the services provided, quantities, and respective costs. To enhance clarity, utilize a Puerto Rico invoice of handyman that makes it easy for your clients to understand their charges.

Filling out a service invoice begins with your contact information and the client's details. List the services provided, including dates, descriptions, and rates, ensuring transparency. Concluding with a total amount due and payment terms will foster positive relationships with clients when using a Puerto Rico Invoice of Handyman.

As a contractor, filling out an invoice means providing a breakdown of work completed, costs incurred, and payment options. Ensure your business name and contact details are present, along with the client’s information. Properly formatting your Puerto Rico Invoice of Handyman can improve your professionalism and enhance client trust.

A contractor agreement should detail the scope of work, payment schedule, and timelines for completion. Additionally, include information about materials, various roles, and legal disclaimers where applicable. For your convenience, you can find templates on platforms like uslegalforms to make this process easier.

Writing a labor invoice involves detailing the work completed along with the hours spent on each task. Include the rate per hour and any material costs as separate line items. Use straightforward language and clear descriptions, making it easy for your clients to understand what they are paying for in the Puerto Rico Invoice of Handyman.

Using an invoice example can simplify the process. You can find templates specifically for a Puerto Rico Invoice of Handyman, which typically include sections for services provided, hours worked, materials used, and total costs. Make sure to personalize the example with your details and ensure all necessary elements are included for legal compliance.