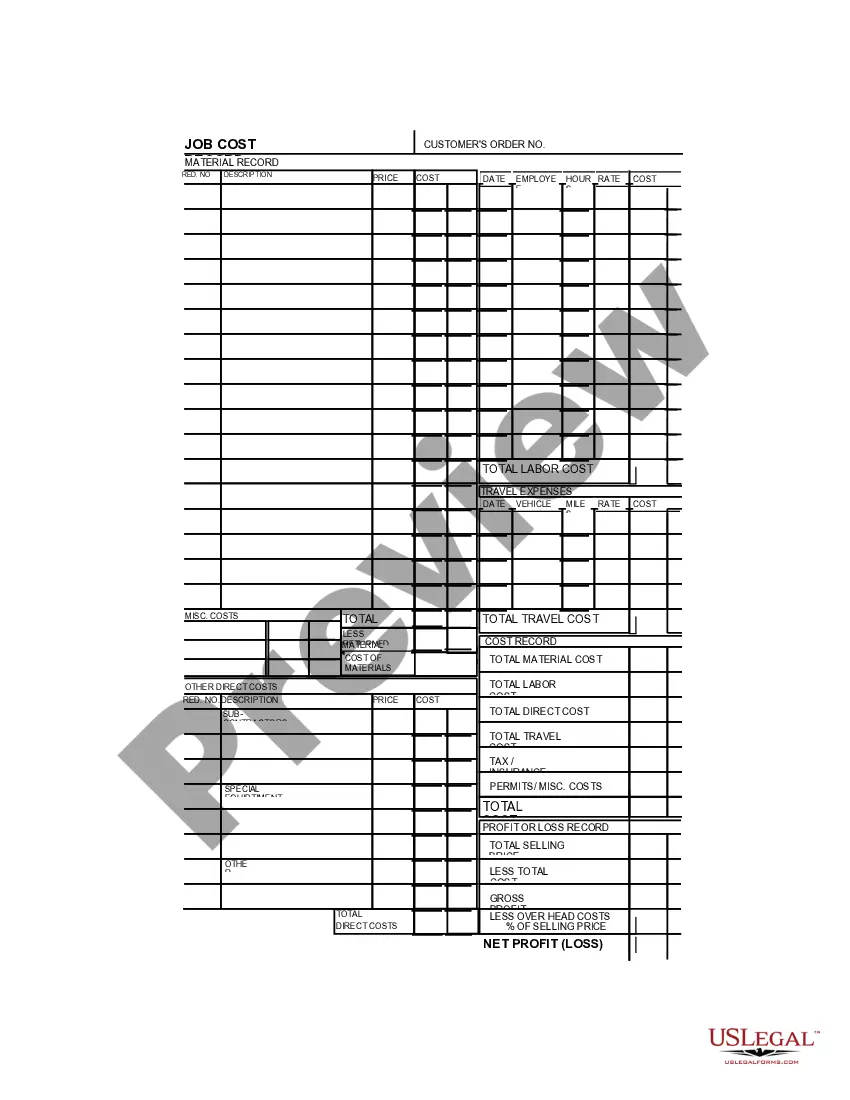

Puerto Rico Job Invoice - Long

Description

How to fill out Job Invoice - Long?

US Legal Forms - one of the several largest libraries of legal templates in the United States - provides a range of legal document formats you can obtain or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the most recent forms such as the Puerto Rico Job Invoice - Long within moments.

Review the form description to make sure that you have chosen the appropriate form.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you have a monthly subscription, sign in to access the Puerto Rico Job Invoice - Long from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these simple steps to get started.

- Ensure you have selected the correct form for your city/state.

- Click the Review button to evaluate the form's content.

Form popularity

FAQ

In Puerto Rico, the payroll frequency is bi-weekly, monthly or semi-monthly. An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory.

An employer must make the salary payments on the 15th of the month. In Puerto Rico, 13th-month payments are mandatory. Employers with a workforce in excess of 21 employees must by law pay a 13th-month salary in December equating to 2% of the employees' wages or not more than 600 USD.

For U.S. citizens, traveling to and working in Puerto Rico is like traveling to or working in another state. U.S. citizens only need a valid driver's license to travel to and work from Puerto Rico.

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

The current tax rate for Social Security is 6.2% for the employer and 6.2% for the employee, or 12.4% total. The current rate for Medicare is 1.45% for the employer and 1.45% for the employee, or 2.9% total.

Puerto RicoRegister your business name and file articles of incorporation.File for local bank accounts.Learn and keep track of the local employment laws.Set up local payroll.Hire local accounting, legal, and HR people.

Companies looking to hire workers from Puerto Rico must comply with Public Law 87. It requires employers who are recruiting on the island to obtain authorization by the Secretary of Labor and Human Resources of Puerto Rico, according to Odemaris Chacon, a labor attorney with Estrella, based in Puerto Rico.

Easy Guide To Hiring Remote Workers in Foreign CountriesSeting up Your Own Entity.Hiring through a Business Partner.Use a Global Employment Organization (GEO)Run Remote Payroll.Choosing your global employment solution.