Puerto Rico Purchase Invoice

Description

How to fill out Purchase Invoice?

You might spend hours online looking for the authentic document template that meets the federal and state criteria you require.

US Legal Forms provides a vast array of valid forms that are reviewed by experts.

You can download or print the Puerto Rico Purchase Invoice from the platform.

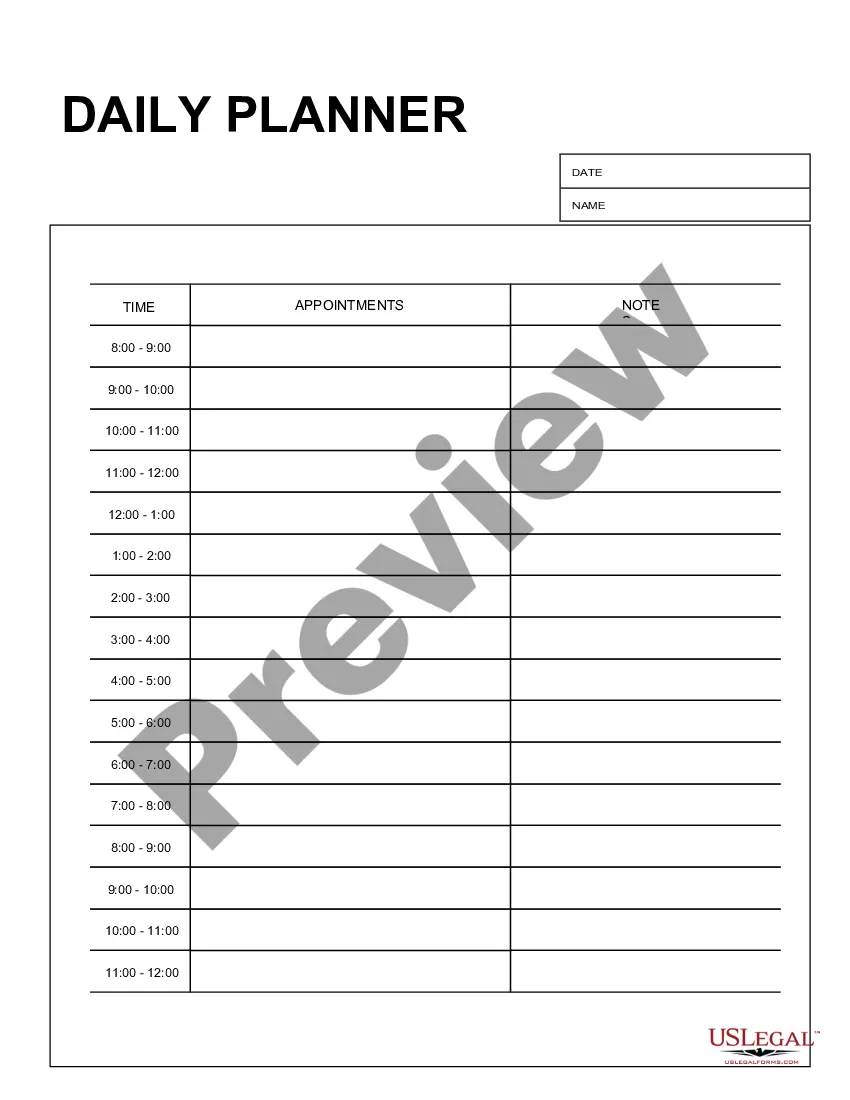

If available, use the Preview button to review the document template as well.

- If you already own a US Legal Forms account, you can sign in and click the Obtain button.

- After that, you can complete, modify, print, or sign the Puerto Rico Purchase Invoice.

- Every legal document template you purchase belongs to you indefinitely.

- To get another copy of any purchased form, go to the My documents section and click the corresponding button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the area/town you select.

- Review the form description to make sure you have selected the correct one.

Form popularity

FAQ

To secure a merchant certificate in Puerto Rico, visit the uslegalforms website for guidance. They offer a straightforward process to help you complete the Puerto Rico Purchase Invoice requirement. You'll need to gather specific documentation and submit your application through the platform. This approach streamlines the certification process, allowing you to focus on your business operations.

To obtain a digital invoice in Puerto Rico, you can use the online services provided by uslegalforms. Begin by accessing their platform and selecting the Puerto Rico Purchase Invoice option. After filling out the necessary details, you can download and store your invoice digitally. This process ensures that you maintain accurate financial records and simplifies your accounting tasks.

You indeed need a commercial invoice for shipments to Puerto Rico. This document provides necessary transaction details, ensuring customs processes go smoothly. A detailed Puerto Rico Purchase Invoice helps avoid potential issues by clearly stating the nature and value of the goods being shipped.

Yes, Puerto Rico is part of U.S. customs territory. Shipments to Puerto Rico must comply with U.S. customs regulations, just like any other U.S. state. Therefore, having a complete Puerto Rico Purchase Invoice is vital for ensuring that your shipment meets all customs requirements.

When shipping to Puerto Rico, you will need several essential documents. Typically, you require a commercial invoice, a bill of lading, and any relevant certifications for specific goods. Using a detailed Puerto Rico Purchase Invoice can streamline the process and help avoid delays at customs.

Yes, a commercial invoice is mandatory for shipping goods to Puerto Rico. This document details the transaction and helps customs officials determine the value and legality of the items being shipped. A well-prepared Puerto Rico Purchase Invoice not only simplifies customs clearance but also ensures compliance with both federal and local regulations.

One way to avoid sales tax in Puerto Rico is to ensure your purchases qualify for exemptions, such as certain educational materials or medical supplies. Additionally, businesses can look into specific tax incentives. When creating a Puerto Rico Purchase Invoice, it's beneficial to consult with a tax professional to navigate potential exemptions effectively.

Puerto Rico's educational grading system typically uses letters, where 'A' is the highest and 'F' indicates failure. This standard system helps evaluate student performance across various subjects. While this may not directly relate to a Puerto Rico Purchase Invoice, understanding educational costs and invoices can help families manage expenses efficiently.

The 7% in Puerto Rico restaurants refers to a specific variant of the sales tax applied to food and beverages for consumption on the premises. This tax is part of the broader sales tax framework in Puerto Rico. When patrons receive a Puerto Rico Purchase Invoice, it may include this 7% rate for dining to ensure transparency.

Puerto Rico has a sales tax rate of 11.5%, consisting of a state rate and municipal rates. This tax applies to the sale of goods and services, affecting both businesses and consumers. When preparing a Puerto Rico Purchase Invoice, ensure this percentage is calculated correctly to reflect total costs.