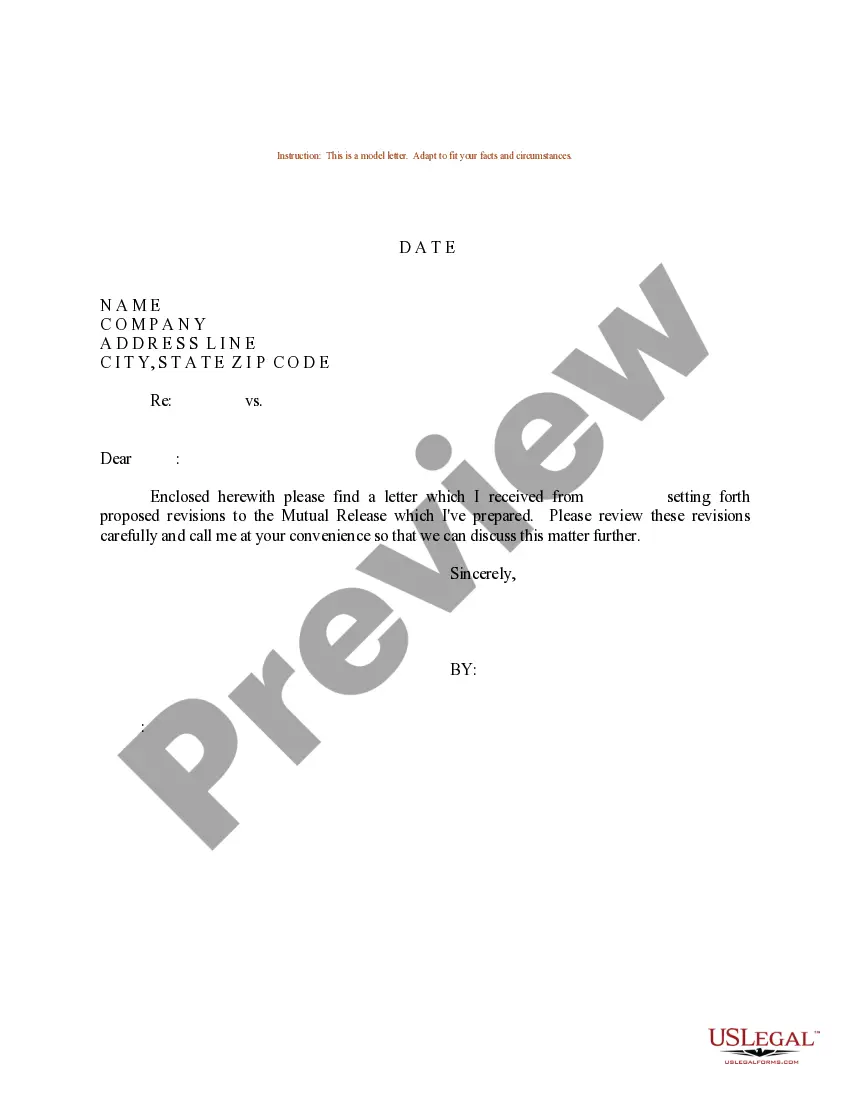

Ohio Sample Letter for Revised Promissory Note

Description

How to fill out Sample Letter For Revised Promissory Note?

Selecting the optimal legal document design can be challenging.

Clearly, there are many templates accessible online, but how can you find the legal format you require.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Ohio Sample Letter for Revised Promissory Note, suitable for business and personal needs.

If the document does not fulfill your requirements, utilize the Search field to find the appropriate form. Once you are certain that the form is correct, click on the Buy now button to purchase the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and finalize your order using your PayPal account or credit card. Select the file format and download the legal document design to your device. Complete, modify, print, and sign the acquired Ohio Sample Letter for Revised Promissory Note. US Legal Forms is the premier repository of legal documents where you can find various document templates. Use the service to download professionally crafted paperwork that complies with state regulations.

- All of the documents are reviewed by experts and meet state and federal requirements.

- If you are already registered, Log In to your account and click on the Download option to get the Ohio Sample Letter for Revised Promissory Note.

- Use your account to browse through the legal forms you have previously purchased.

- Navigate to the My documents section of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct document for your city/county. You can view the form using the Review option and read the document details to confirm this is suitable for your needs.

Form popularity

FAQ

How to Modify a Promissory NoteIdentify the terms of the note that are creating difficulty in repayment.Communicate your need to modify the terms of the note to the note holder.Have the holder of the note draft modifications to the original note.Sign and notarize the modified promissory note.

How to Modify a Promissory NoteIdentify the terms of the note that are creating difficulty in repayment.Communicate your need to modify the terms of the note to the note holder.Have the holder of the note draft modifications to the original note.Sign and notarize the modified promissory note.

Promissory notes are often renewed and extended without the express written consent of, or even notice to, the guarantors of the note.

A promissory note can become invalid if it excludes A) the total sum of money the borrower owes the lender (aka the amount of the note) or B) the number of payments due and the date each increment is due.

All Promissory Notes are valid only for a period of 3 years starting from the date of execution, after which they will be invalid. There is no maximum limit in terms of the amount which can be lent or borrowed.

Promissory note are a valid instrument in the court of law to claim your amount. payable at a certain time after date. So if in your promissory note is it stated that your friend will pay you the amount after a certain date then the instruments date is not very essential.

While the statute of limitations on an action in an obligation, liability, or contract is four years, Commercial Code Section 3118(a) gives a statute of limitations of six years for an action to be enforced on the party to pay their promissory note. This time period starts from the due date that's listed on the note.

An amended and restated promissory note is a legally binding addition to a promissory note that notes any significant changes and replaces the original agreement. Amended and restated promissory notes are seen as the most recent and up-to-date versions of the promise to pay between a borrower and a lender.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

Once the statute of limitations has ended, a creditor can no longer file a lawsuit related to the unpaid promissory note. However, he or she can still send letters and make phone calls to try to get the debt settled. The money does not stop being owed due to the statute of limitations being over.