Puerto Rico Disclaimer of Inheritance Rights for Stepchildren

Description

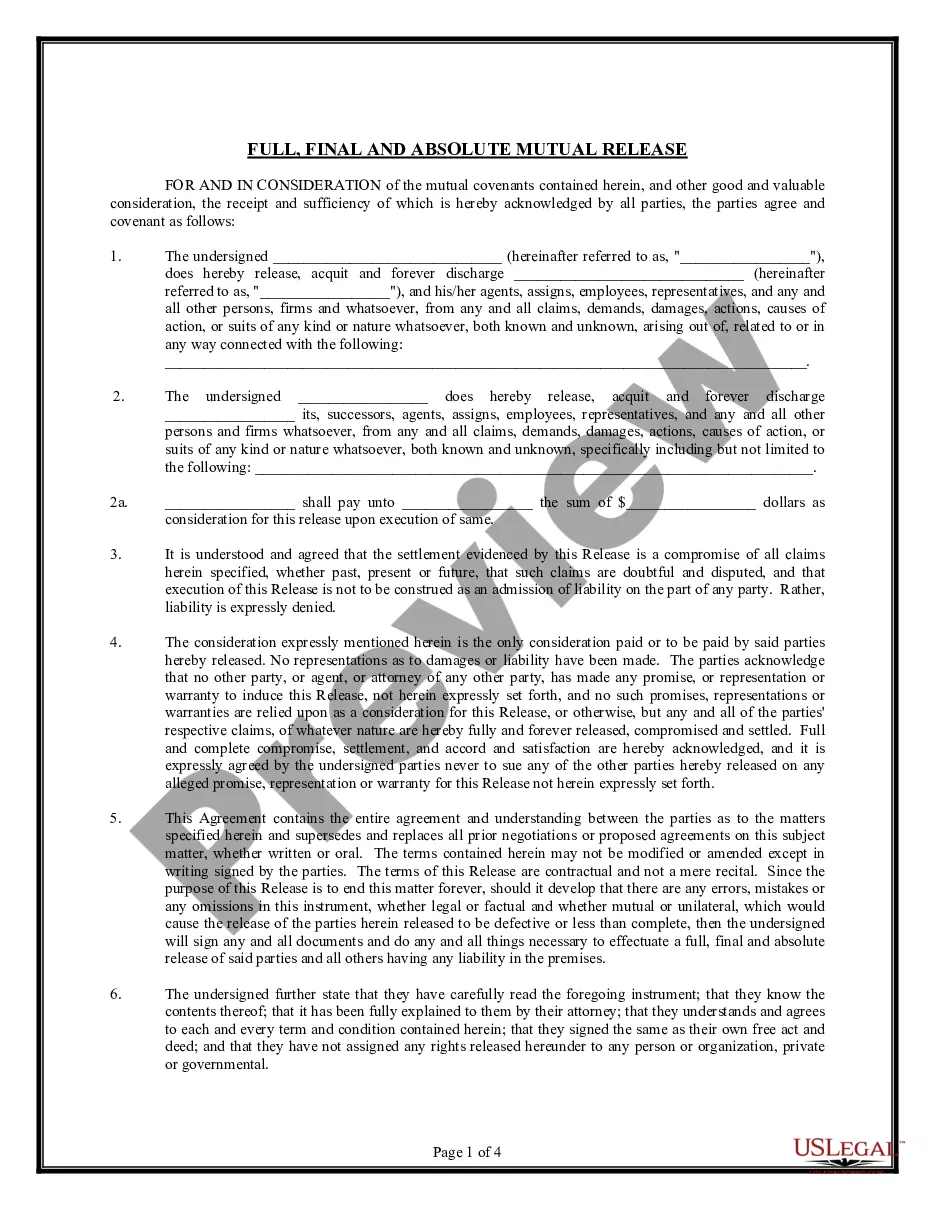

How to fill out Disclaimer Of Inheritance Rights For Stepchildren?

You can invest hrs on the Internet attempting to find the lawful document format that meets the federal and state requirements you will need. US Legal Forms provides a large number of lawful varieties that happen to be evaluated by specialists. It is simple to down load or printing the Puerto Rico Disclaimer of Inheritance Rights for Stepchildren from your services.

If you already possess a US Legal Forms accounts, you can log in and click the Acquire switch. Next, you can complete, edit, printing, or sign the Puerto Rico Disclaimer of Inheritance Rights for Stepchildren. Each lawful document format you acquire is yours permanently. To have another duplicate associated with a acquired develop, proceed to the My Forms tab and click the corresponding switch.

If you use the US Legal Forms internet site for the first time, follow the basic guidelines listed below:

- Very first, make sure that you have chosen the best document format for that area/town of your liking. Browse the develop outline to ensure you have picked out the proper develop. If accessible, utilize the Preview switch to appear with the document format as well.

- If you would like get another version of your develop, utilize the Lookup field to discover the format that suits you and requirements.

- Once you have located the format you want, simply click Get now to move forward.

- Pick the rates program you want, type your credentials, and sign up for your account on US Legal Forms.

- Total the deal. You can utilize your Visa or Mastercard or PayPal accounts to pay for the lawful develop.

- Pick the formatting of your document and down load it for your system.

- Make adjustments for your document if required. You can complete, edit and sign and printing Puerto Rico Disclaimer of Inheritance Rights for Stepchildren.

Acquire and printing a large number of document themes using the US Legal Forms website, which offers the biggest variety of lawful varieties. Use professional and express-distinct themes to take on your business or personal requires.

Form popularity

FAQ

If no Puerto Rican will exists, then the court will issue a resolution declaring who are the heirs, commonly known as a "Declaratoria de Herederos". There is a possibility that an additional hearing may be needed before the judge can decide who are the heirs.

One important change is that the new civil code gives protection to the surviving spouse and gives him/her the right to remain in the family home for life. This modification implies that the widow or widower can decide to stay in the house, instead of receiving 50% of the inheritance that corresponds to him or her.

First order were descendants, second ascendants and in the absence of both, surviving spouse was the heir. Surviving spouse is a forced heir. The Code adds the surviving spouse to the first order of succession as forced heir.

Property That May Avoid Probate Property held in a trust3 Jointly held property (but not common property) Death benefits from insurance policies (unless payable to the estate)4 Property given away before you die. Assets in a pay-on-death account. Retirement accounts with a named beneficiary.

No, the IRS does not impose taxes on foreign inheritance or gifts if the recipient is a U.S. citizen or resident alien. However, you may need to pay taxes on your inheritance depending on your state's tax laws.

In the absence of a will (intestate estate), estate is distributed equally among forced heirs. The portion reserved for forced heirs in a will is reduced to 50%. In the absence of a will, estate is still distributed equally among forced heirs.

All real estate in Puerto Rico is subject to the probate system. This system is based on a "forced heir" policy, that states that all children need to receive from the decedent (the person that died).

As of November 28, 2020, inheritances are distributed in two parts. 50% is of free disposition and the other half (legitimate) is divided equally among the forced heirs, which are the children and now include the widow or widower.