Puerto Rico Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust

Description

How to fill out Disclaimer Of Right To Inherit Or Inheritance - All Property From Estate Or Trust?

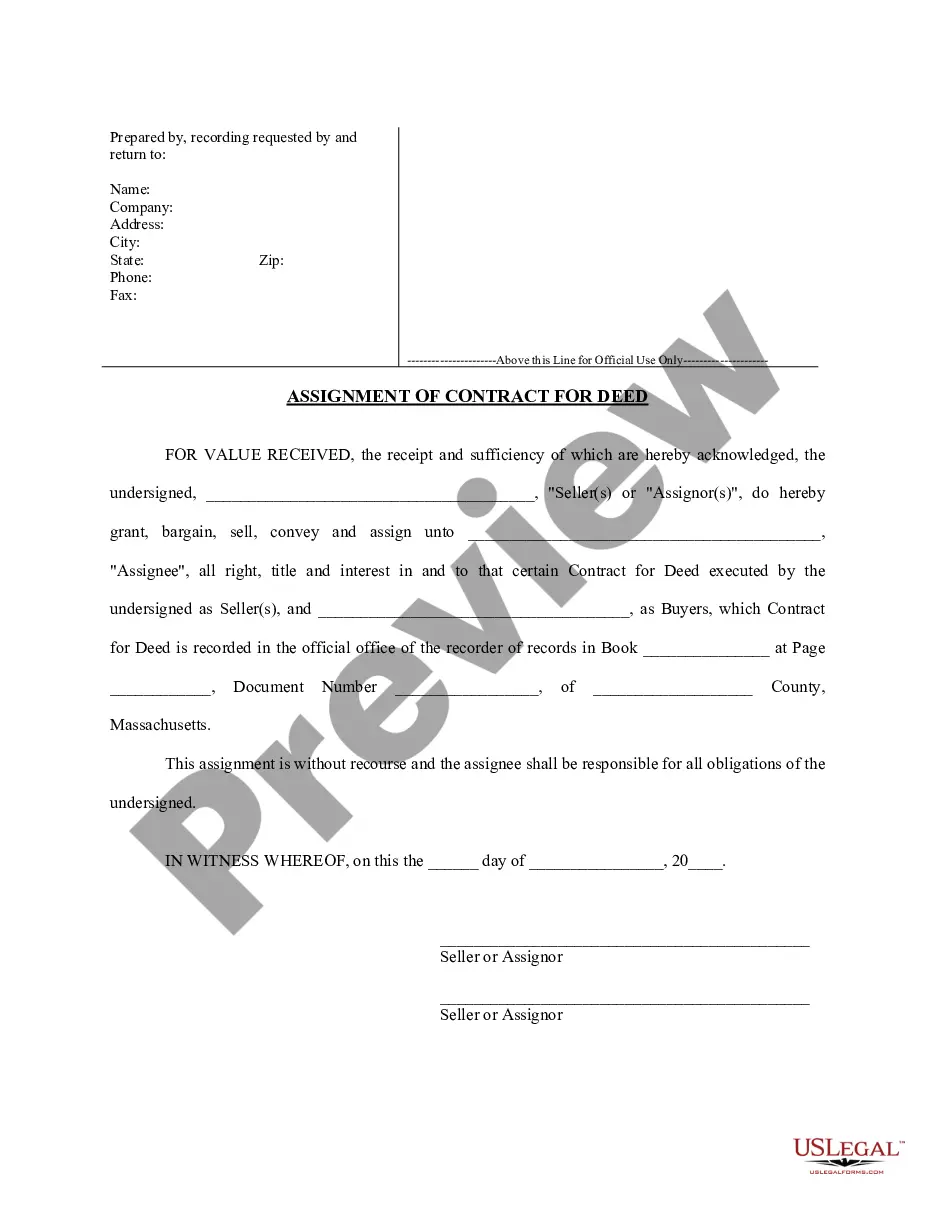

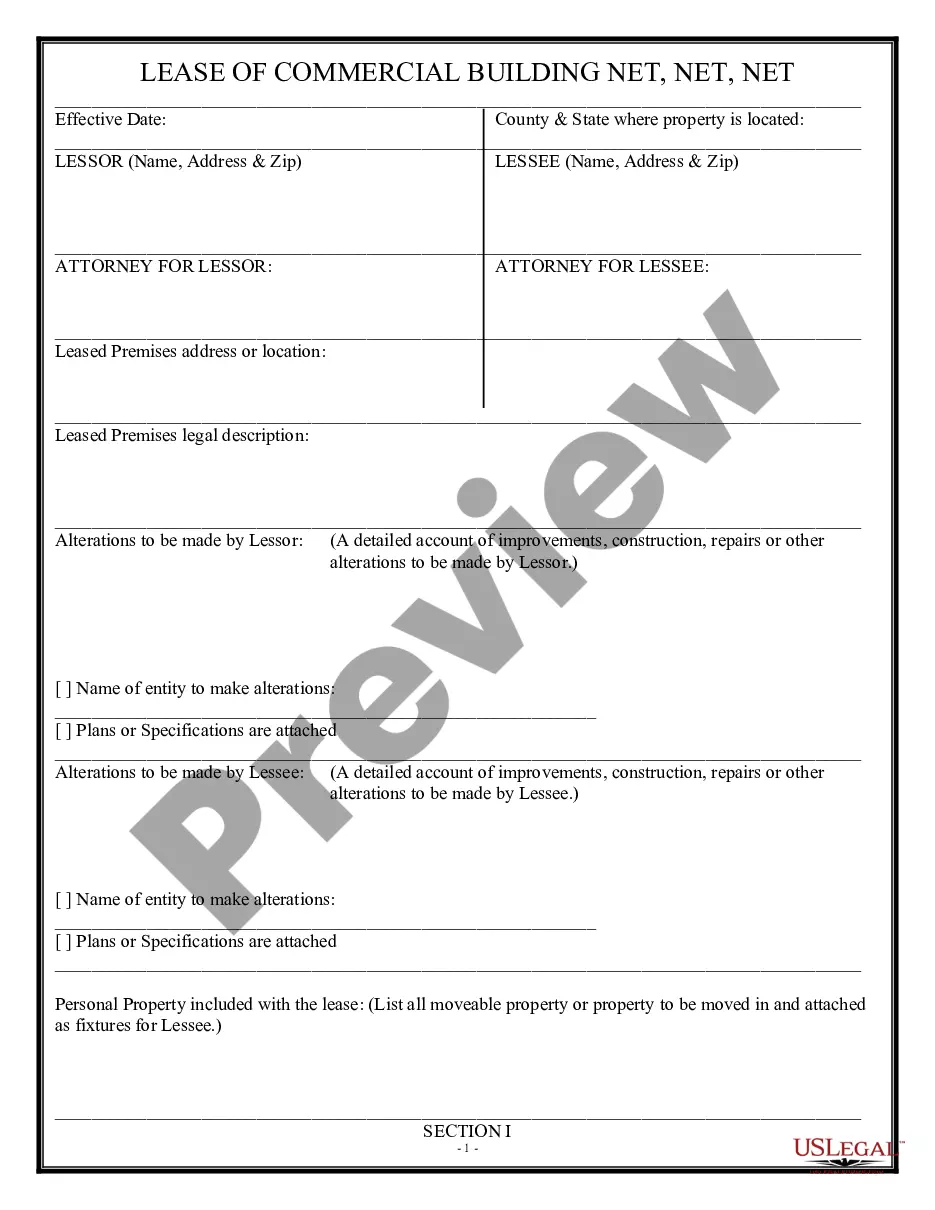

US Legal Forms - one of several most significant libraries of lawful kinds in America - delivers a variety of lawful record themes you are able to download or print out. Making use of the internet site, you will get 1000s of kinds for organization and specific purposes, categorized by categories, suggests, or keywords and phrases.You will discover the latest types of kinds such as the Puerto Rico Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust in seconds.

If you already possess a membership, log in and download Puerto Rico Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust through the US Legal Forms local library. The Obtain option will appear on every develop you view. You have access to all formerly delivered electronically kinds in the My Forms tab of your respective accounts.

In order to use US Legal Forms initially, allow me to share basic directions to help you get started out:

- Ensure you have selected the best develop to your city/county. Click the Review option to examine the form`s information. Browse the develop explanation to actually have selected the right develop.

- In the event the develop doesn`t fit your demands, use the Search industry towards the top of the screen to obtain the one that does.

- If you are pleased with the shape, confirm your decision by visiting the Get now option. Then, pick the prices program you favor and give your accreditations to sign up for the accounts.

- Approach the transaction. Make use of charge card or PayPal accounts to perform the transaction.

- Select the file format and download the shape in your device.

- Make changes. Fill out, edit and print out and indication the delivered electronically Puerto Rico Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust.

Each and every design you put into your bank account lacks an expiration date and is your own eternally. So, in order to download or print out another copy, just proceed to the My Forms area and then click in the develop you want.

Gain access to the Puerto Rico Disclaimer of Right to Inherit or Inheritance - All Property from Estate or Trust with US Legal Forms, by far the most substantial local library of lawful record themes. Use 1000s of skilled and status-certain themes that meet your company or specific demands and demands.

Form popularity

FAQ

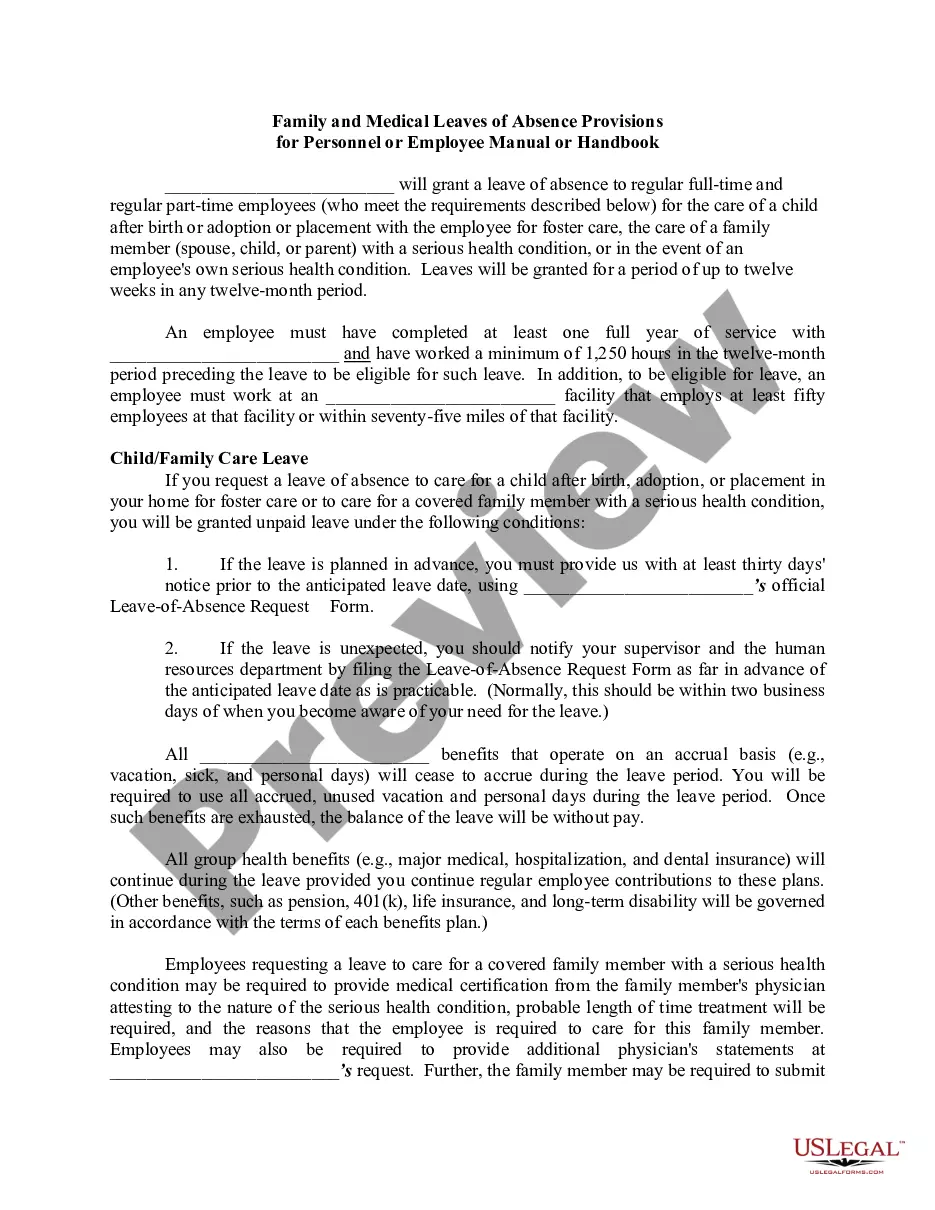

Puerto Rico is a territory of the United States. Those born in Puerto Rico carry U.S. passports. But, from an estate planning perspective, they hold a unique place. If a Puerto Rican is living in the United States, they are estate taxed just like other U.S. citizens.

No, the IRS does not impose taxes on foreign inheritance or gifts if the recipient is a U.S. citizen or resident alien. However, you may need to pay taxes on your inheritance depending on your state's tax laws.

In general, any inheritance you receive does not need to be reported to the IRS. You typically don't need to report inheritance money to the IRS because inheritances aren't considered taxable income by the federal government. That said, earnings made off of the inheritance may need to be reported.

For example, if someone dies without a valid will, the probate court sees that the deceased person's assets are distributed ing to the laws of the state. If someone dies with a valid will, the probate court is charged with ensuring the deceased person's assets are distributed ing to their wishes.

If no Puerto Rican will exists, then the court will issue a resolution declaring who are the heirs, commonly known as a "Declaratoria de Herederos". There is a possibility that an additional hearing may be needed before the judge can decide who are the heirs.

Sections 2021.01 and 2041.01 impose a ten percent (10%) tax on every person who transfers property through estate or gift. Act 76 eliminates the 10% tax on transfers that occur after December 31, 2017, for both residents and nonresidents of Puerto Rico.

As of November 28, 2020, inheritances are distributed in two parts. 50% is of free disposition and the other half (legitimate) is divided equally among the forced heirs, which are the children and now include the widow or widower.

As of November 28, 2020, inheritances are distributed in two parts. 50% is of free disposition and the other half (legitimate) is divided equally among the forced heirs, which are the children and now include the widow or widower.