When the parties have not clearly indicated whether or not their business constitutes a partnership, the law has determined several guidelines to aid Courts in determining whether the parties have created a partnership. The fact that the parties share profits and losses is strong evidence of a partnership.

Puerto Rico Disclaimer of Partnership

Description

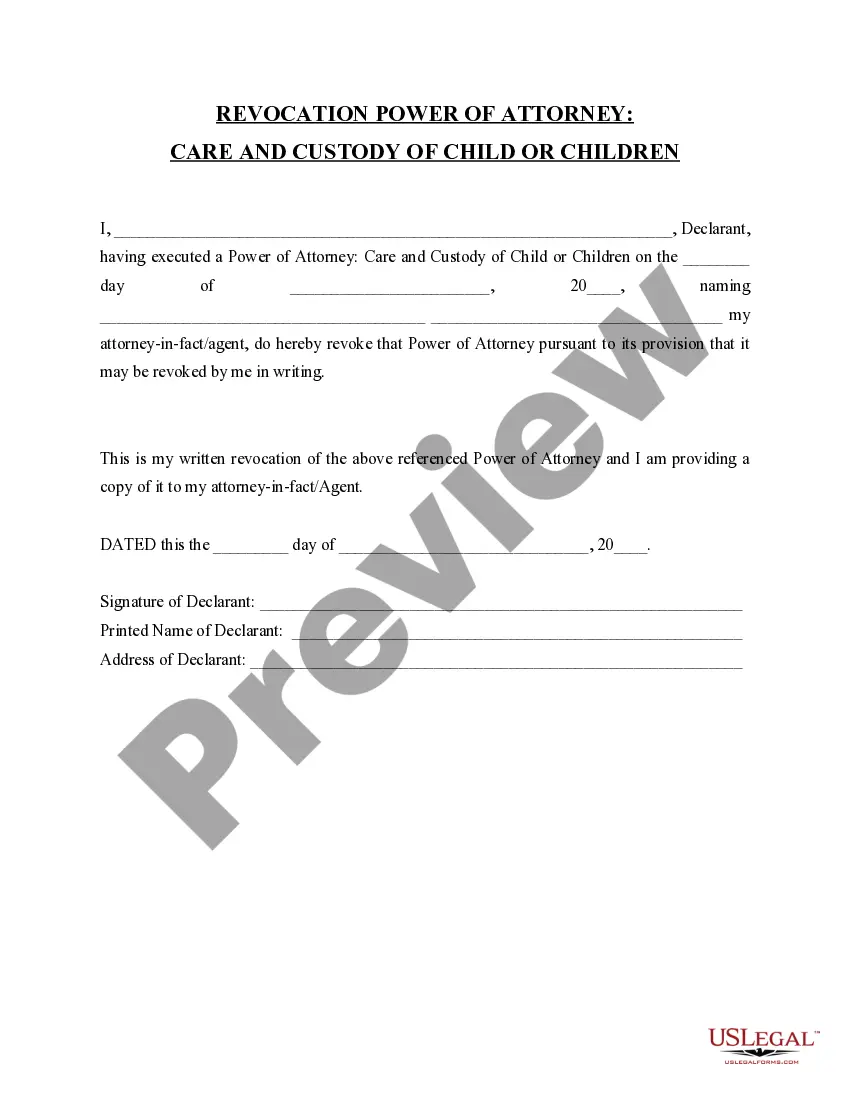

How to fill out Disclaimer Of Partnership?

You can devote a number of hours online trying to locate the approved document template that satisfies the federal and state criteria you require.

US Legal Forms offers thousands of legal documents that can be examined by experts.

You can obtain or generate the Puerto Rico Disclaimer of Partnership through their service.

If applicable, use the Preview button to examine the document template as well.

- If you already hold a US Legal Forms account, you can Log In and then press the Acquire button.

- Afterward, you can complete, modify, print, or sign the Puerto Rico Disclaimer of Partnership.

- Every legal document template you purchase is yours indefinitely.

- To obtain another copy of a purchased form, go to the My documents section and click the appropriate button.

- If you are utilizing the US Legal Forms site for the first time, follow the simple instructions below.

- First, confirm that you have selected the correct document template for the state/city of your choice.

- Check the form description to ensure you have chosen the correct form.

Form popularity

FAQ

Form 480.6 C is a declaration form that reports payments made by a business to non-residents. This form is crucial for managing tax withholdings and ensuring compliance with Puerto Rican tax regulations. If you are managing finances related to a Puerto Rico Disclaimer of Partnership, accurate completion of this form is essential.

Form 480.6 A is used to provide information about certain types of income earned in Puerto Rico. This document assists taxpayers in reporting various types of taxable income accurately to the Puerto Rican authorities. It’s particularly useful for individuals involved in a Puerto Rico Disclaimer of Partnership.

To file your Puerto Rico annual report online, you'll need to access the Puerto Rico Department of State’s website. Follow the prompts to complete the necessary forms and submit your report electronically. Utilizing a platform like US Legal Forms can simplify this process, especially for those with a Puerto Rico Disclaimer of Partnership.

Form 480.7 C is used to report income for withholding tax on payments made to non-residents. This form is essential for ensuring compliance with Puerto Rico’s tax laws, especially when dealing with partnerships or partnerships that may fall under a Puerto Rico Disclaimer of Partnership. It allows you to manage and report obligations accurately.

Individuals who establish bona fide residency in Puerto Rico typically qualify for tax exemptions. These exemptions can significantly reduce tax liabilities on income sourced from Puerto Rico. It’s important for anyone considering a Puerto Rico Disclaimer of Partnership to be aware of these qualifications for maximizing benefits.

Yes, there is a unique tax relationship between the US and Puerto Rico, which does not include a formal tax treaty. Puerto Rico operates under a special tax regime, and income earned there may not be subject to the same federal taxes as income from the mainland. Understanding this can be crucial if you’re navigating a Puerto Rico Disclaimer of Partnership.

A Schedule C tax form is used by sole proprietors to report income or loss from their business. This form helps you detail your revenue and expenses, allowing the IRS to assess your tax obligations. For those involved in a Puerto Rico Disclaimer of Partnership, it can clarify business income separate from partnership agreements.

For a partnership, you generally need to file Form 1065. This form details the partnership's income, deductions, and other tax information. Utilizing the Puerto Rico Disclaimer of Partnership can help you understand this process and ensure correct filing.

Form 1065 is specifically designed for partnerships and is not intended for S Corporations or C Corporations. S Corps and C Corps have different filing requirements and use different forms. If you are navigating the distinctions between partnership and corporate structures, the Puerto Rico Disclaimer of Partnership can provide clarity.

Partnerships typically need to fill out Form 1065 to report their income and expenses. This form is essential for submitting accurate tax information to the IRS and to inform partners about their individual tax obligations. With the guidance of the Puerto Rico Disclaimer of Partnership, you can confidently complete this form.