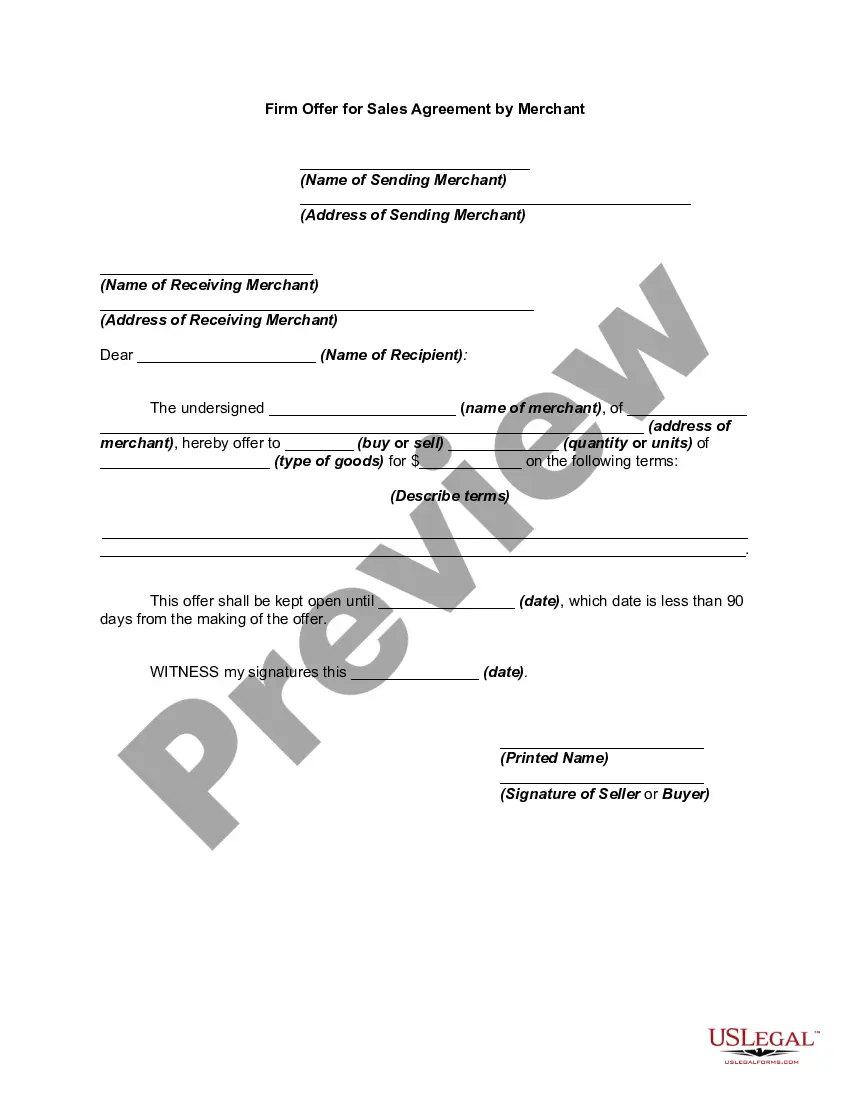

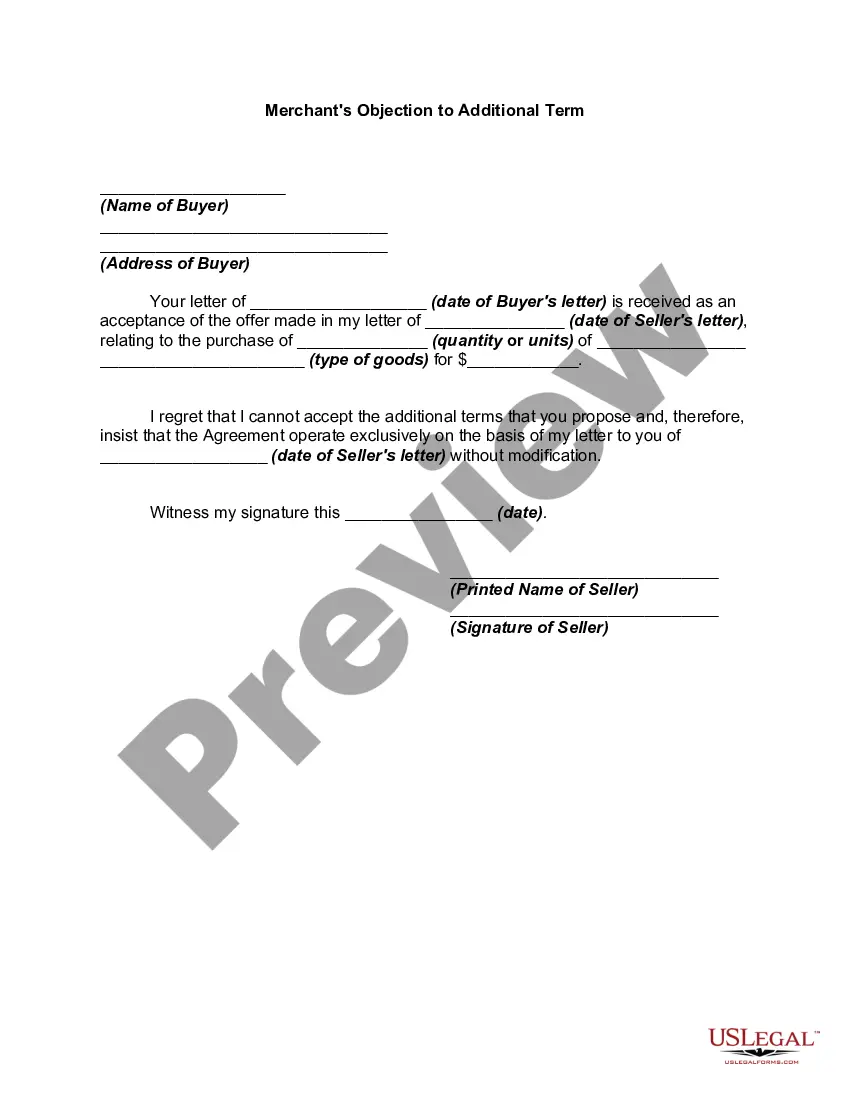

Unless it is expressly specified that an offer to buy or sell goods must be accepted just as made, the offeree may accept an offer and at the same time propose an additional term. This is contrary to general contract law. Under general contract law, the proposed additional term would be considered a counteroffer and the original offer would be rejected. Under Article 2 of the UCC, the new term does not reject the original offer. A contract arises on the terms of the original offer, and the new term is a counteroffer. The new term does not become binding until accepted by the original offeror. If, however, the offer states that it must be accepted exactly as made, the ordinary contract law rules apply.

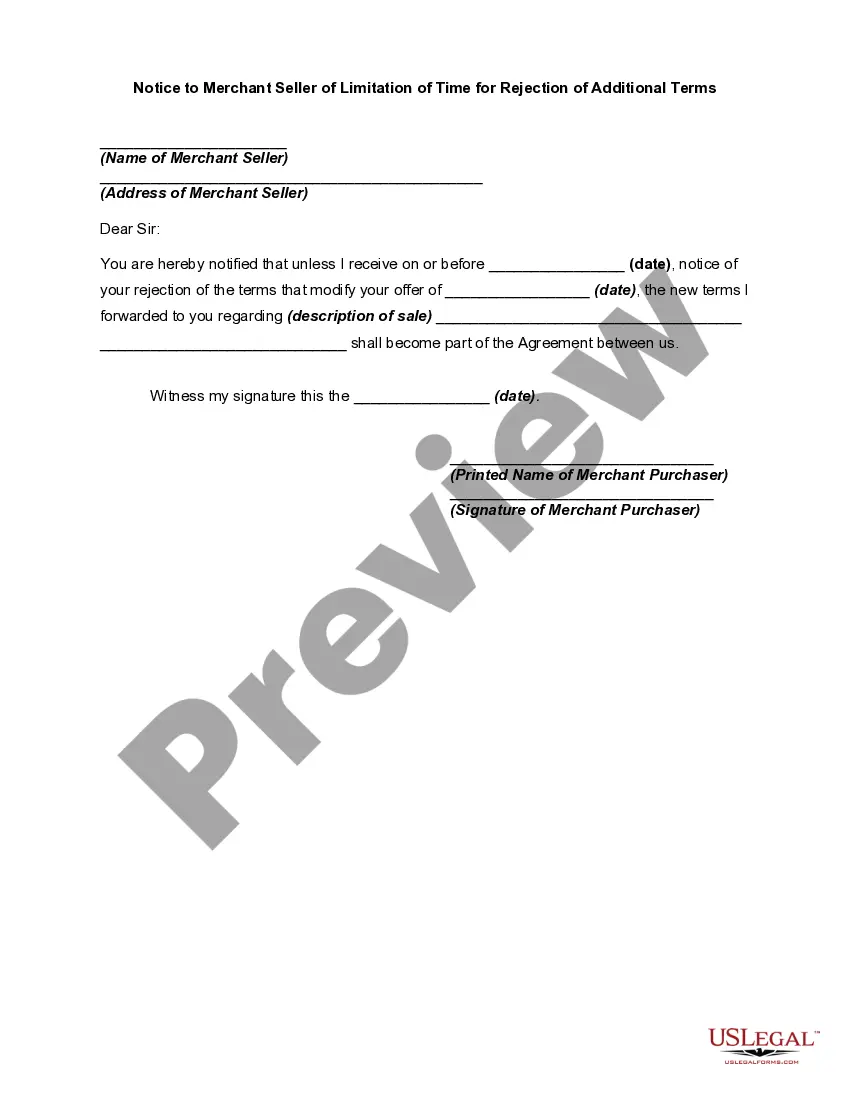

In a transaction between merchants, the additional term becomes part of the contract if that term does not materially alter the offer and no objection is made to it. However, if such an additional term from the seller operates solely to the seller’s advantage, it is a material term and must be accepted by the buyer to be effective. A buyer may expressly or by conduct agree to a term added by the seller to the acceptance of the buyer‘s offer. The buyer may agree orally or in writing to the additional term. There is an acceptance by conduct if the buyer accepts the goods with knowledge that the term has been added by the seller.