This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Puerto Rico Agreement Between Sales Representative and Magazine to Sale Advertising

Description

How to fill out Agreement Between Sales Representative And Magazine To Sale Advertising?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

While navigating the website, you can discover thousands of forms for business and personal use, categorized by types, states, or keywords.

You can access the latest versions of forms like the Puerto Rico Agreement Between Sales Representative and Magazine for Sale Advertising in just a few seconds.

If the form does not meet your needs, use the Search box at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your selection by clicking the Buy Now button.

- If you already have a subscription, Log In and download the Puerto Rico Agreement Between Sales Representative and Magazine for Sale Advertising from the US Legal Forms archive.

- The Download button will be available on each form you view.

- You can find all previously saved forms in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are some simple instructions to get started.

- Ensure you have selected the correct form for your city/county.

- Click the Review button to examine the form’s content.

Form popularity

FAQ

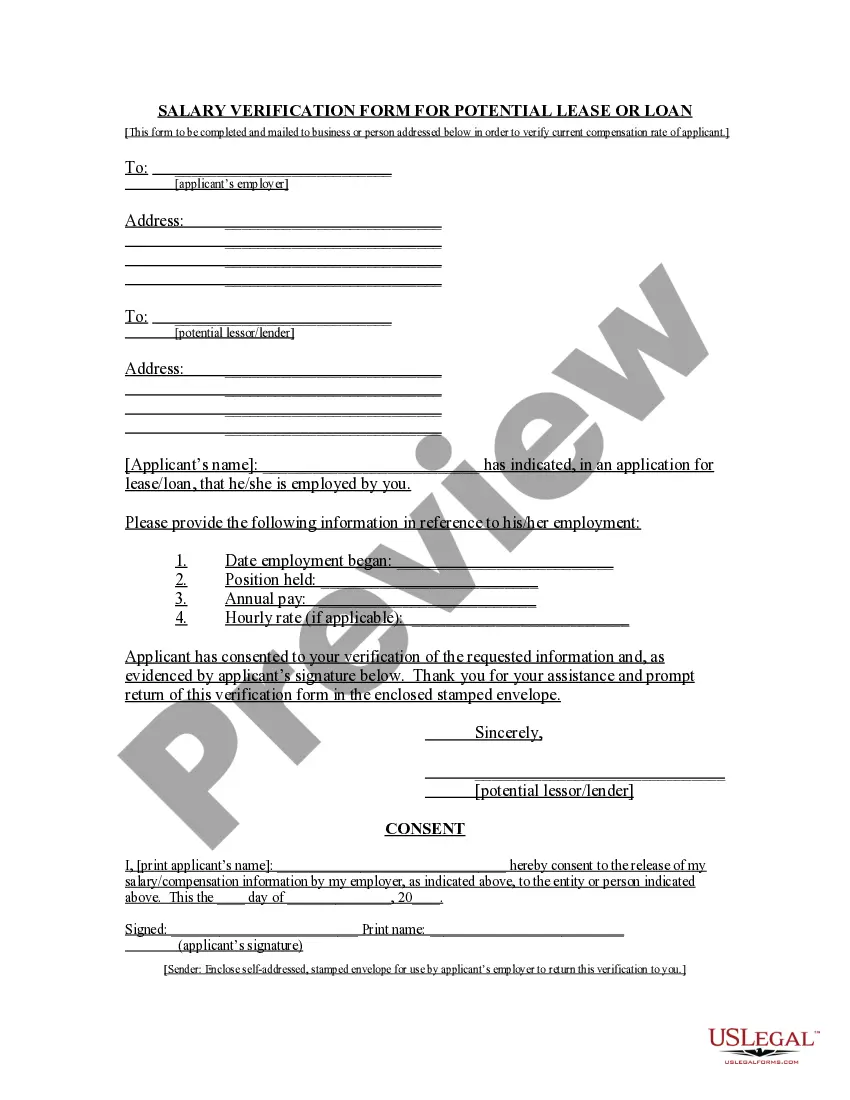

Puerto Ricans can be exempt from several types of taxes, depending on their status and the nature of their purchases. For instance, certain essential goods, like food and medicines, are often exempt from sales tax. Additionally, tax exemptions may also apply under specific agreements such as the Puerto Rico Agreement Between Sales Representative and Magazine to Sale Advertising. Acquiring the right legal forms can streamline the process and provide clarity on applicable exemptions.

In Puerto Rico, the general sales tax rate for business-to-business transactions is typically around 11.5%. However, this can vary depending on specific circumstances outlined in agreements like the Puerto Rico Agreement Between Sales Representative and Magazine to Sale Advertising. Businesses should stay informed about the varying rates and applicable exemptions that can influence their overall tax obligations. Utilizing tools from the uslegalforms platform can be beneficial in navigating these complexities.

Yes, certain individuals and organizations can qualify for sales tax exemption in Puerto Rico. Generally, non-profit organizations and specific governmental entities often enjoy this status. It's crucial to understand how the Puerto Rico Agreement Between Sales Representative and Magazine to Sale Advertising outlines exemptions to ensure compliance. Proper documentation is key to securing these exemptions, helping businesses operate legally and efficiently.

Sales tax nexus refers to the connection a business has with Puerto Rico, which determines whether it must collect sales tax. Businesses that have a physical presence, such as an office or employee in Puerto Rico, often establish this nexus. The Puerto Rico Agreement Between Sales Representative and Magazine to Sale Advertising may influence how sales taxes are accounted for within this context. Understanding these requirements can help businesses avoid penalties and ensure compliance.

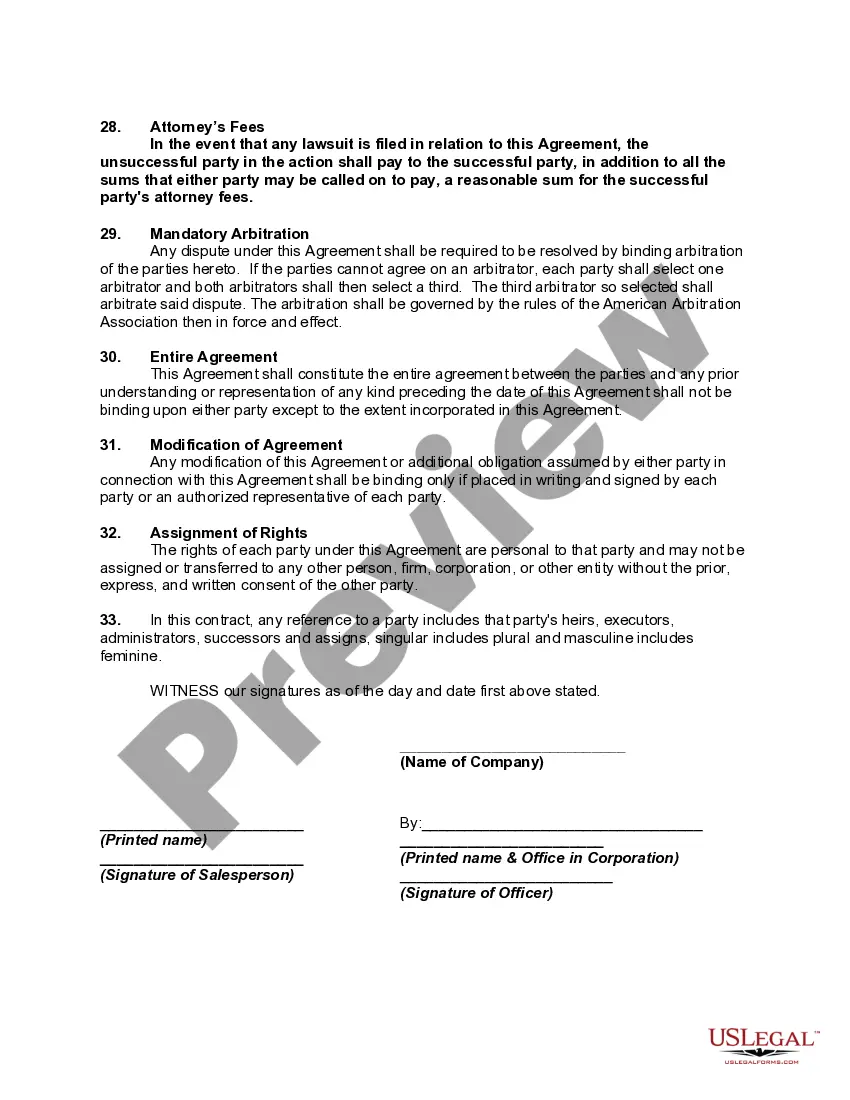

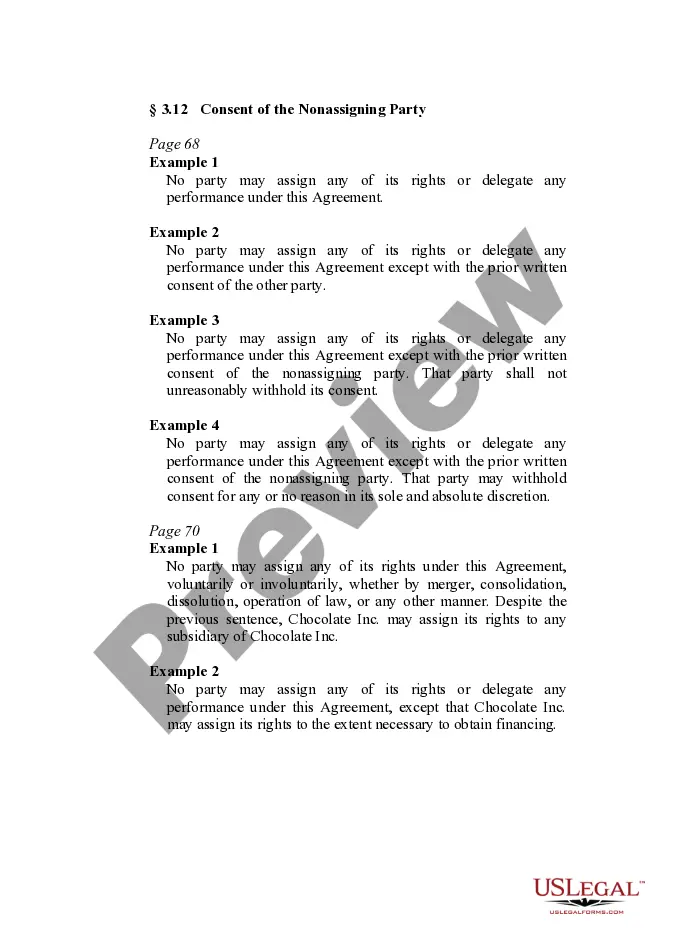

To write a simple commission agreement, focus on the essentials: the scope of work, commission percentage, payment schedule, and any specific terms related to the sales process. Ensure that the agreement reflects the mutual understanding of the parties, similar to the Puerto Rico Agreement Between Sales Representative and Magazine to Sale Advertising. Utilizing legal resources from uslegalforms can provide additional support in drafting a straightforward yet comprehensive agreement.

Creating a contract for commissions involves several key steps. First, outline the commission rates and sales goals clearly to avoid any misunderstandings. Next, incorporate conditions for payment and services expected from the sales representative. By framing this as the Puerto Rico Agreement Between Sales Representative and Magazine to Sale Advertising, you ensure it aligns well with your business objectives, fostering a positive selling environment.

A typical sales commission contract defines the relationship between a sales representative and a magazine. It outlines the terms of compensation, including the commission percentage for advertising sales. This Puerto Rico Agreement Between Sales Representative and Magazine to Sale Advertising serves to protect both parties by specifying roles and responsibilities. Understanding these elements helps ensure a successful partnership.

A sales representative agreement is a contract outlining the relationship between a sales representative and a company. This agreement details the rights, responsibilities, and commission structures involved in selling products or services. In the case of the Puerto Rico Agreement Between Sales Representative and Magazine to Sale Advertising, this contract serves as a foundational element for successful sales strategies.

The Nexus threshold is the specific point at which a business establishes a tax obligation. Factors include sales amounts or frequency of business activities that signal a tax responsibility. For sales representatives, understanding how the Nexus threshold impacts the Puerto Rico Agreement Between Sales Representative and Magazine to Sale Advertising can lead to better financial planning and compliance.

Rule 60 relates to deductions available to businesses in Puerto Rico, particularly in areas of business expenses and income generation. This rule helps assessors determine the fair value of businesses according to their operational costs. Sales representatives should be familiar with Rule 60 when structuring the Puerto Rico Agreement Between Sales Representative and Magazine to Sale Advertising, as it affects overall financial outcomes.