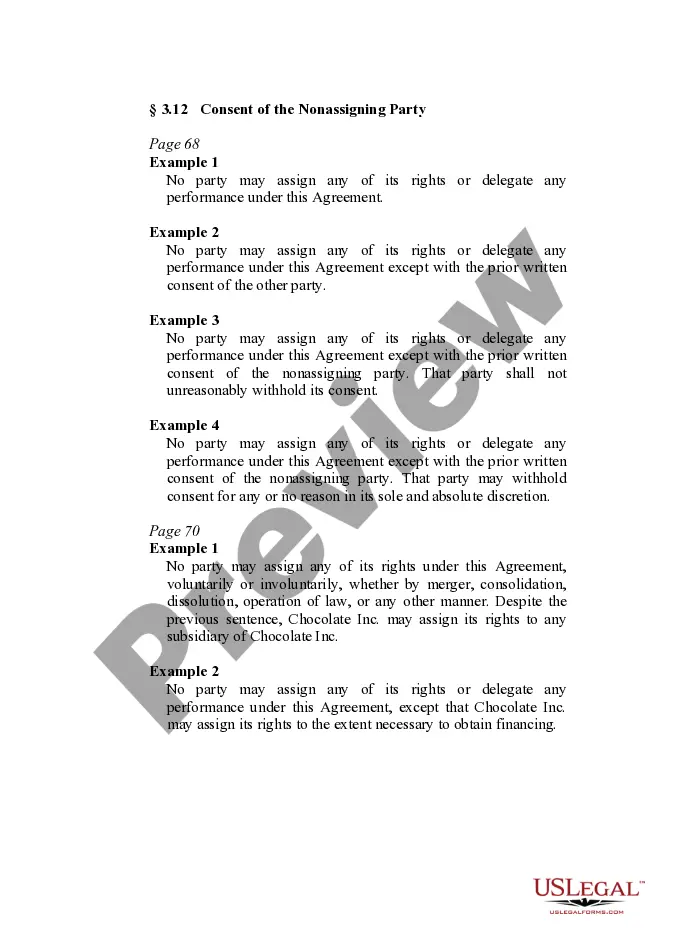

This form provides boilerplate contract clauses that outline consent requirements for any assignment or delegation of rights under a contract. Several different language options representing various levels of restriction are included to suit individual needs and circumstances.

Maryland Consent of the Nonassigning Party Provisions

Description

How to fill out Consent Of The Nonassigning Party Provisions?

You may devote time online attempting to find the authorized file web template that suits the state and federal needs you will need. US Legal Forms provides a large number of authorized kinds that happen to be reviewed by specialists. You can easily acquire or produce the Maryland Consent of the Nonassigning Party Provisions from our support.

If you have a US Legal Forms account, you are able to log in and click the Obtain key. Next, you are able to full, edit, produce, or signal the Maryland Consent of the Nonassigning Party Provisions. Each authorized file web template you buy is the one you have permanently. To have another duplicate associated with a purchased form, visit the My Forms tab and click the related key.

If you use the US Legal Forms site the very first time, adhere to the basic recommendations listed below:

- First, make certain you have selected the best file web template for your state/metropolis of your choosing. Look at the form explanation to make sure you have chosen the proper form. If readily available, make use of the Preview key to appear throughout the file web template too.

- If you would like get another model of the form, make use of the Search discipline to obtain the web template that meets your needs and needs.

- Once you have located the web template you want, just click Buy now to move forward.

- Pick the prices program you want, enter your accreditations, and register for an account on US Legal Forms.

- Total the transaction. You can utilize your credit card or PayPal account to pay for the authorized form.

- Pick the formatting of the file and acquire it for your device.

- Make alterations for your file if required. You may full, edit and signal and produce Maryland Consent of the Nonassigning Party Provisions.

Obtain and produce a large number of file themes using the US Legal Forms website, that offers the largest selection of authorized kinds. Use professional and express-certain themes to handle your business or specific requirements.

Form popularity

FAQ

First and foremost, there are a number of asset types that typically do not pass through probate. This includes life insurance policies, bank accounts, and investment or retirement accounts that require you to name a beneficiary.

If only the spouse survives, he/she is entitled to 1/2 of the decedent's augmented estate. Maryland has greatly expanded the types of assets to include when calculating the augmented estate. This broadening of the law is beneficial because the electing spouse may be entitled to receive more assets than before.

Non-probate property ? Property not subject to the terms of a decedent's Last Will and Testament, and which passes to a beneficiary outside of the probate process, such as property that had been transferred into trust prior to death, joint tenants by right of survivorship (or tenants by the entireties), payable on ...

Examples of assets that are subject to probate include: Real estate owned solely by the decedent or as a tenant in common. Personal property, such as vehicles, furniture, and collectibles. Bank accounts held solely in the decedent's name. Stocks, bonds, and other investments held in the decedent's name only.

In Maryland, you can make a living trust to avoid probate for virtually any asset you own?real estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

If there is a surviving spouse and the net value is under $100,000 a small estate is necessary. If the net value is over $50,000 and there is no surviving spouse, a regular estate is necessary.

Ideally, you should be able to close the estate within 13 months of the decedent's death. However, depending on the size and complexity of the estate, it may take longer. In any case, it's important to keep meticulous records throughout the process to prove to the court that you've fulfilled all your fiduciary duties.

Property outside of probate include assets like a family home that is owned as Joint Tenants because the surviving joint tenant becomes the owner of the property. Another example is Tenancy by the Entirety where assets are owned by a married couple. Beneficiary Designations on assets is yet another example.