Puerto Rico Sample Letter for Dormant Letter

Description

How to fill out Sample Letter For Dormant Letter?

Are you presently in a role that necessitates documents for either corporate or personal reasons almost every business day.

There are numerous authentic document formats accessible online, but finding reliable ones can be challenging.

US Legal Forms offers a vast array of form templates, such as the Puerto Rico Sample Letter for Dormant Letter, designed to comply with state and federal regulations.

Once you acquire the appropriate form, click Purchase now.

Choose the pricing plan you require, complete the necessary information to create your account, and process your order using your PayPal or credit card. Select a convenient file format and download your copy. Locate all the document templates you have purchased in the My documents section. You can obtain another copy of the Puerto Rico Sample Letter for Dormant Letter anytime, if required. Click on the desired form to download or print the document template. Take advantage of US Legal Forms, the most extensive collection of official forms, to save time and prevent errors. This service provides professionally crafted legal document templates that you can utilize for a variety of purposes. Create an account on US Legal Forms and begin simplifying your life.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Puerto Rico Sample Letter for Dormant Letter template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Identify the form you need and verify it applies to the correct city/county.

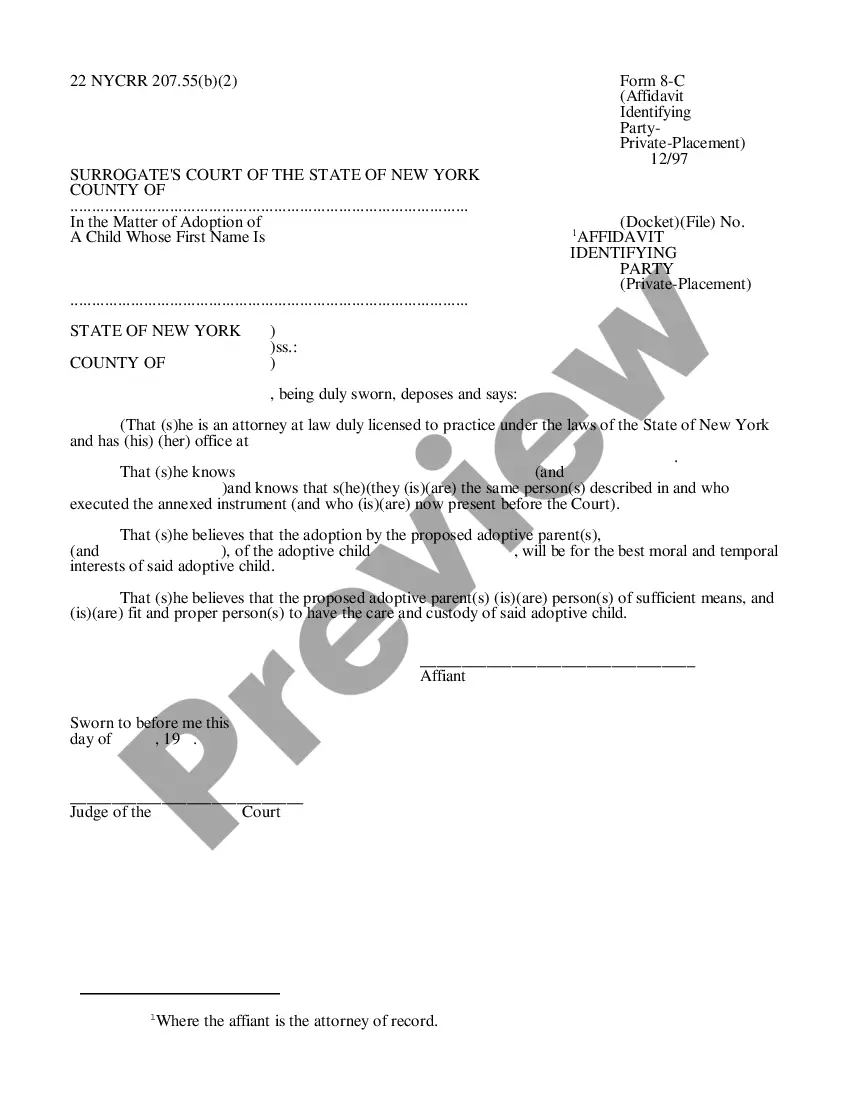

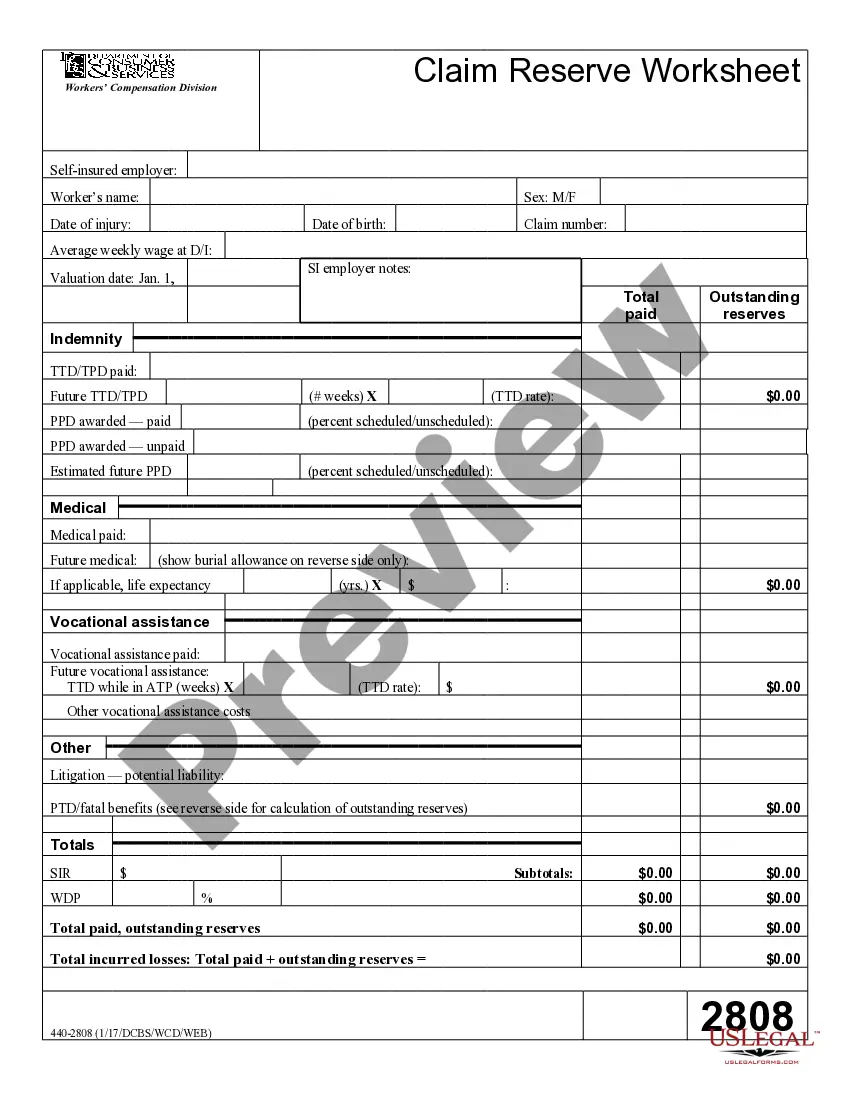

- Utilize the Preview feature to examine the form.

- Review the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Lookup field to find a form that meets your needs and criteria.

Form popularity

FAQ

Filling out a dormant form involves providing accurate information about your identity, account details, and the nature of your inactivity. Reference the Puerto Rico Sample Letter for Dormant Letter for guidance on what specifics to include. Ensure all required fields are completed and consider attaching the letter if necessary. Following these steps will help facilitate the reactivation process and restore access to your account.

To write a dormant account letter, include essential details such as your account number, the name of your financial institution, and your request to reactivate your account. Use the Puerto Rico Sample Letter for Dormant Letter as a guide, ensuring you clearly express your intentions. Make sure to include your contact information and any relevant identification to help the institution process your request swiftly. This letter serves as an effective communication tool to address your dormant account status.

When writing a letter to reactivate your account, start with your personal details and account information. Clearly state your intent to reactivate the account and include any supporting documentation. It’s important to be concise but thorough in your request. Using a Puerto Rico Sample Letter for Dormant Letter can help you structure your letter correctly and make a strong case for reactivation.

Common documents needed to activate your dormant account include a government-issued ID, proof of address, and sometimes original account documentation. Your financial institution may have specific forms to fill out as well. Being prepared with these documents can expedite the reactivation process. For added clarity in your request, consider using a Puerto Rico Sample Letter for Dormant Letter, ensuring you include all required information.

Reactivating a dormant account generally involves submitting a formal request to your financial institution. You will need to provide personal identification and possibly proof of address or account ownership. It’s beneficial to inquire directly with your bank regarding any specific procedures. Using a Puerto Rico Sample Letter for Dormant Letter can help articulate your reactivation request effectively.

Activating a dormant equity account usually requires some basic information, including your identification and any associated account details. You may also need to submit a request or application to the financial institution. It is essential to understand the specific requirements of your provider, as they can vary. Utilizing a Puerto Rico Sample Letter for Dormant Letter can streamline this process and ensure all necessary information is included.

To qualify as dormant, an account typically must show no activity for a certain period, often ranging from six months to one year. Financial institutions monitor accounts regularly, so maintaining an active account can prevent it from becoming dormant. If your account is classified as dormant, it may have restrictions on withdrawals or other transactions. For reactivation, consider using a Puerto Rico Sample Letter for Dormant Letter, which outlines your request clearly.

A dormant account is primarily defined as an account that has had no activity or customer contact over a specified period, often ranging from six months to several years. Financial institutions may classify such accounts to protect against fraud and manage account upkeep. Knowing what defines a dormant account can guide you in maintaining your financial health. A Puerto Rico Sample Letter for Dormant Letter can be a useful step toward reactivation.

Dormant accounts typically show no recent transactions or interactions. You may notice a status indicating inactivity, which can vary by institution. It's essential to monitor your accounts regularly, as awareness can help prevent unintended dormancy. A Puerto Rico Sample Letter for Dormant Letter can aid in clarifying your account's status to your institution.

To close a dormant account, you usually need to contact your financial institution and request closure. This process may require you to provide identification and account information. Additionally, consider confirming whether there are any fees associated with closing dormant accounts. Using a Puerto Rico Sample Letter for Dormant Letter can streamline your request, ensuring clarity in communication.