Puerto Rico General Partnership Agreement - version 2

Description

How to fill out General Partnership Agreement - Version 2?

It is feasible to spend several hours online searching for the valid document template that meets the state and federal requirements you require.

US Legal Forms provides a vast array of valid forms that are reviewed by experts.

You can easily obtain or print the Puerto Rico General Partnership Agreement - version 2 from our service.

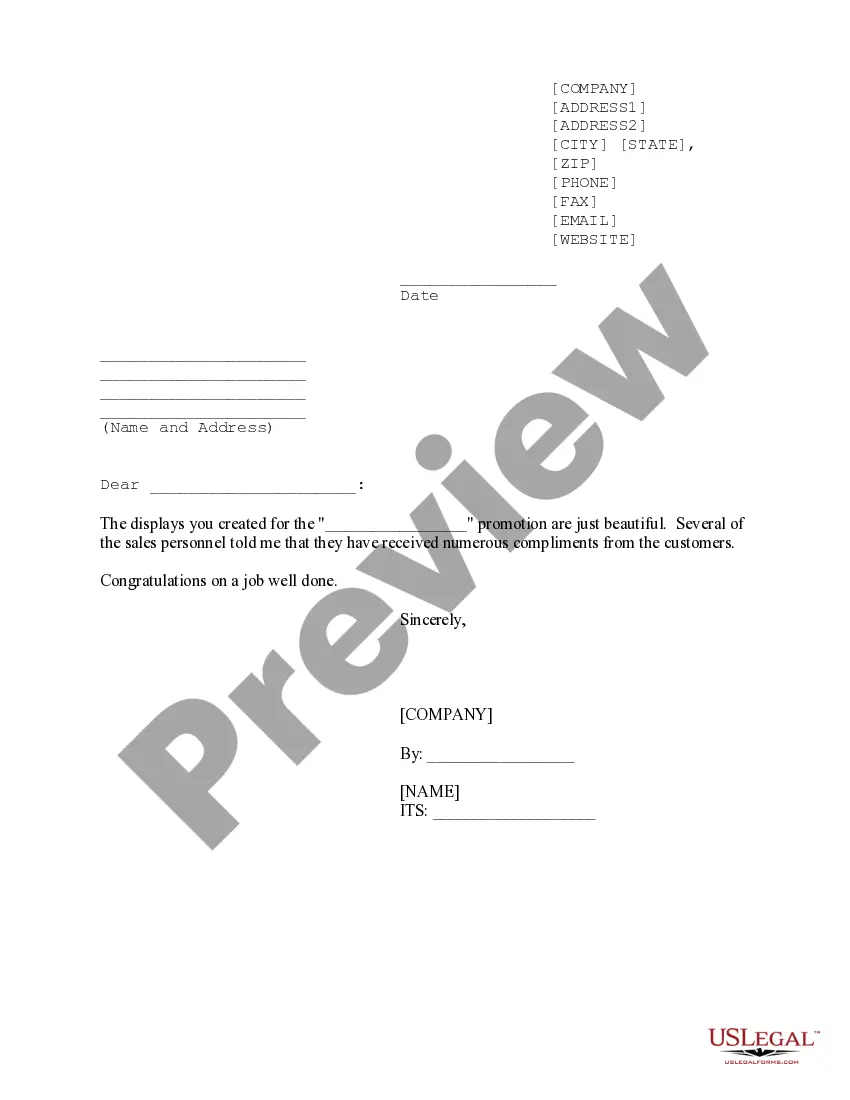

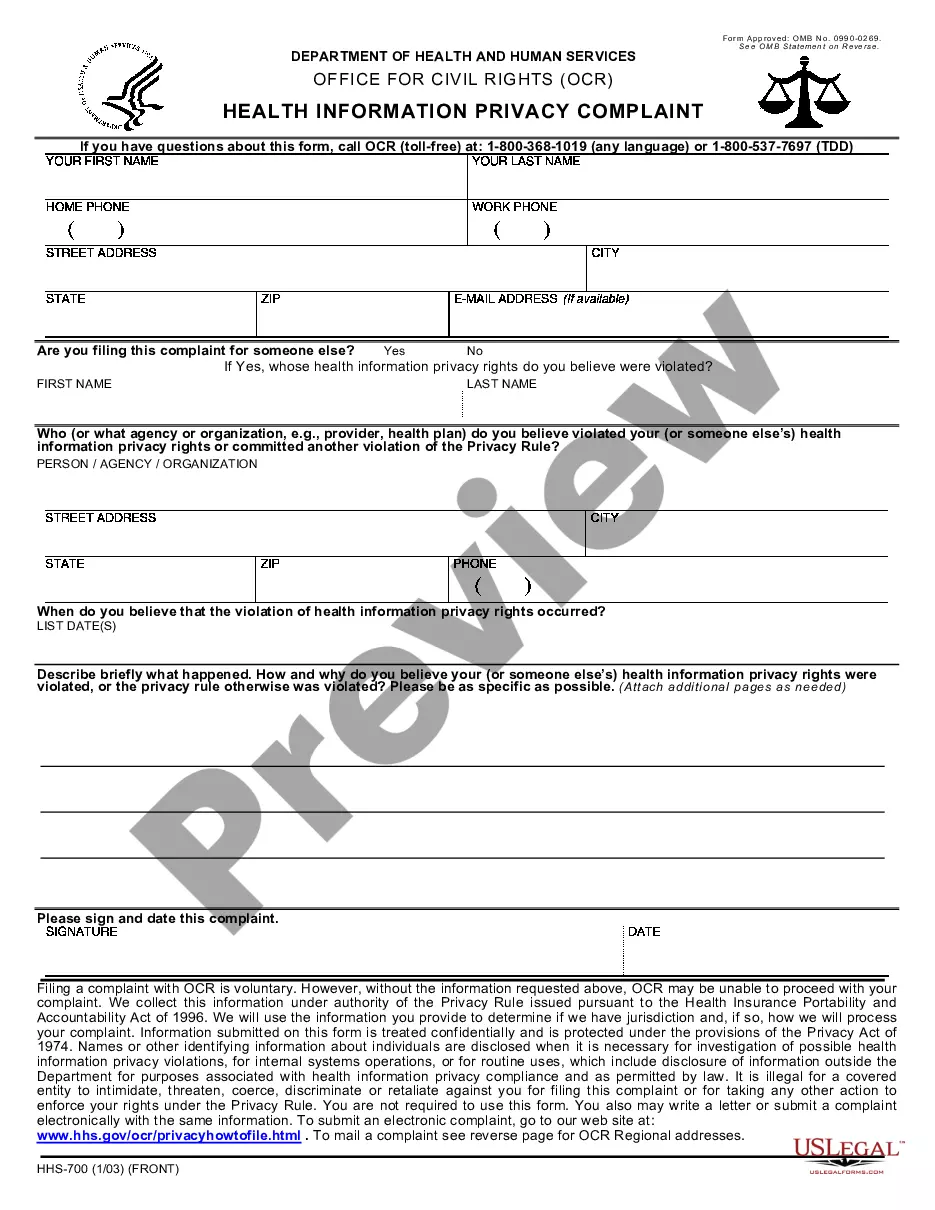

If available, utilize the Preview button to review the document template as well.

- If you already possess a US Legal Forms account, you may Log In and then click the Download button.

- Subsequently, you can complete, modify, print, or sign the Puerto Rico General Partnership Agreement - version 2.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any downloaded document, visit the My documents tab and click the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the state/city of your choice.

- Review the document description to confirm you have chosen the appropriate form.

Form popularity

FAQ

Yes, Puerto Rico imposes a 10.5% tax on certain business income, which is significant for partnerships. When drafting your Puerto Rico General Partnership Agreement - version 2, understanding this tax rate is crucial for effective financial planning. You will want to calculate potential taxes accurately to ensure your partnership remains financially viable.

Section 6072.01 outlines the tax obligations for partnerships established in Puerto Rico, including partnerships formed under the Puerto Rico General Partnership Agreement - version 2. This section details how income tax is assessed on partnerships and serves as a pivotal reference for tax compliance. Familiarizing yourself with this section can help you navigate your financial responsibilities more effectively.

In Puerto Rico, your LLC must submit an annual report to maintain its active status. While registering your Puerto Rico General Partnership Agreement - version 2, it's crucial to stay current with this requirement to avoid penalties. This annual registration demonstrates your commitment to compliance and helps your business thrive.

Yes, obtaining a business license is essential to operate legally in Puerto Rico. When you create your Puerto Rico General Partnership Agreement - version 2, you must ensure you register for any necessary licenses in your specific municipality. This process helps you comply with local regulations and enjoy peace of mind while running your business.

To legalize a partnership, start by creating a comprehensive partnership agreement that outlines all partners' roles and responsibilities. Next, register your partnership with the Puerto Rico Department of State and obtain any necessary licenses or permits for your business. By using resources like uslegalforms, you can easily access templates for a Puerto Rico General Partnership Agreement - version 2 and simplify this process.

Legalizing a partnership agreement involves ensuring it complies with local laws and regulations. In Puerto Rico, you should draft the agreement according to legal requirements, have all partners sign it, and file any necessary documents with the Department of State. Your Puerto Rico General Partnership Agreement - version 2 should encompass all required provisions to facilitate the legal approval process.

To make your partnership agreement legally binding, ensure all partners sign the document, reflecting their consent to the terms outlined. Clearly state the partnership's purpose, contributions, and profit-sharing arrangements. Incorporating these elements in your Puerto Rico General Partnership Agreement - version 2 will enforce the agreement's legality and provide clarity for all parties involved.

In Puerto Rico, a partnership agreement does not require notarization to be legally binding, but having it notarized can add an extra layer of authenticity. While it might not be mandatory, notarization helps prevent disputes by providing a formal record of what was agreed upon. Always consider including this step if you want to ensure the integrity of your Puerto Rico General Partnership Agreement - version 2.

A partnership agreement is valid when it outlines the roles, responsibilities, and contributions of each partner clearly. It must comply with Puerto Rico law and include essential elements such as the partnership name, purpose, and terms agreed upon by all partners. Ensuring these details are included in your Puerto Rico General Partnership Agreement - version 2 will strengthen its validity.

You can use your LLC in Puerto Rico by ensuring it is properly registered and compliant with local laws. This applies to both domestic and foreign LLCs. To facilitate your business setup, our Puerto Rico General Partnership Agreement - version 2 can help you outline the partnership terms effectively.