Puerto Rico Space, Net, Net, Net - Triple Net Lease

Description

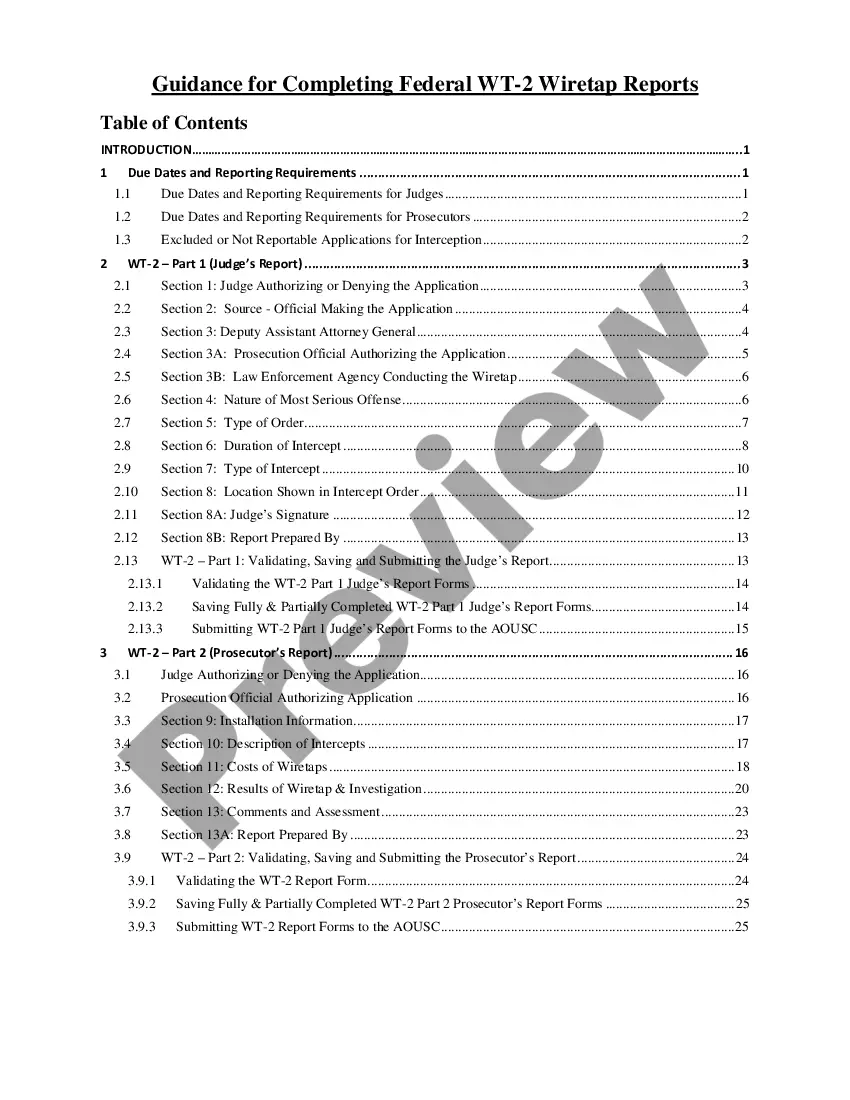

How to fill out Space, Net, Net, Net - Triple Net Lease?

If you wish to finalize, acquire, or print valid document templates, utilize US Legal Forms, the most extensive selection of legal forms available online.

Make use of the site’s straightforward and efficient search function to obtain the documents you require.

A variety of templates for business and personal purposes are organized by categories and states, or keywords.

Step 5. Process the payment. You may use your credit card or PayPal account to complete the transaction.

Step 6. Select the format of the legal form and download it to your device.

- Employ US Legal Forms to acquire the Puerto Rico Space, Net, Net, Net - Triple Net Lease with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Obtain button to receive the Puerto Rico Space, Net, Net, Net - Triple Net Lease.

- You can also retrieve forms you previously downloaded from the My documents tab of your profile.

- If you are using US Legal Forms for the first time, follow the instructions listed below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

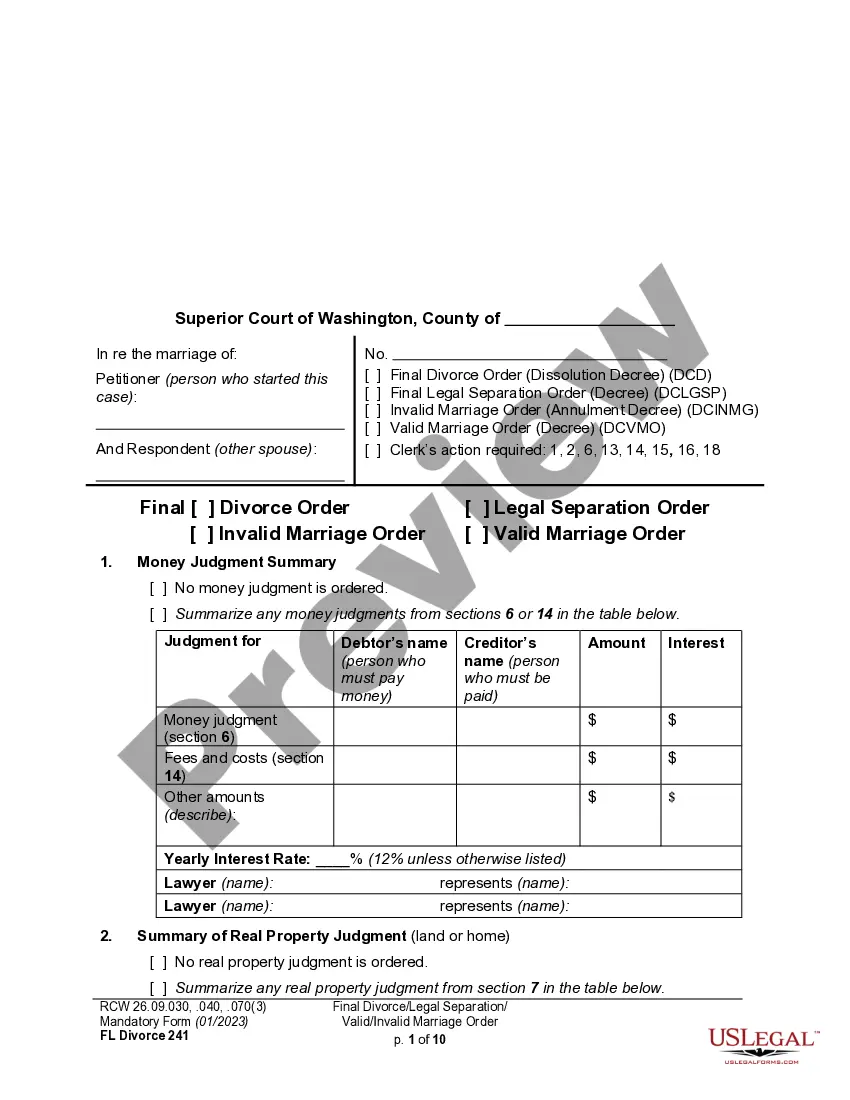

- Step 2. Utilize the Review option to examine the form’s content. Be sure to read the description.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find alternative templates from the legal form catalog.

- Step 4. Once you have located the required form, click the Buy now button. Choose the payment plan you prefer and provide your credentials to create an account.

Form popularity

FAQ

The main difference between a net net lease and a triple net lease lies in the financial responsibilities assumed by the tenant. In a net net lease, the tenant typically pays property taxes and insurance, while in a triple net lease, the tenant is responsible for all property expenses, including maintenance. Understanding these distinctions is crucial when leasing property in the Puerto Rico Space, Net, Net, Net - Triple Net Lease market. Consider using uslegalforms for detailed guidelines on lease types and responsibilities.

To acquire a triple net lease, first identify properties in the Puerto Rico Space that offer this leasing arrangement. Engage a real estate agent who specializes in commercial properties, as they can guide you through the process. Be prepared to negotiate lease terms, including the responsibilities for taxes, insurance, and maintenance. Tools like uslegalforms can provide templates for lease agreements to ensure clarity and compliance.

Structuring a triple net lease involves defining the responsibilities of both the landlord and tenant. Clearly outline the base rent amount and specify which operating expenses the tenant will cover, such as taxes and insurance. A well-structured Puerto Rico Space, Net, Net, Net - Triple Net Lease clearly delineates these terms to avoid future disputes. The US Legal Forms platform offers templates that simplify this process.

In Puerto Rico, the equivalent of a 1099 form is known as Form 480.6. This form serves to report various types of income, including payments to independent contractors and rental income from Puerto Rico Space, Net, Net, Net - Triple Net Lease agreements. Using this form helps you ensure that you meet reporting requirements and avoid potential penalties from local tax authorities.

Triple net lease income in Puerto Rico is generally subject to the local income tax rates, which can vary based on the income levels and specific circumstances. As you earn income from Puerto Rico Space, Net, Net, Net - Triple Net Lease properties, it's crucial to maintain accurate records and consult tax professionals for compliance. Understanding the tax implications can help you maximize the benefits of your investments.

Yes, a US company can do business in Puerto Rico because Puerto Rico is a territory of the United States. Establishing a presence there offers access to the Puerto Rico Space, Net, Net, Net - Triple Net Lease market, which can be beneficial for investment. Companies must comply with local regulations and tax obligations, but the process is often streamlined for US businesses.

Form 480.6 is a tax form used in Puerto Rico to report income for individuals and businesses involved in real estate transactions, particularly affecting investors in Puerto Rico Space, Net, Net, Net - Triple Net Lease agreements. This form allows you to declare rental income while ensuring compliance with local tax laws. If you engage in triple net leases in Puerto Rico, understanding this form's requirements is essential for accurate tax reporting.