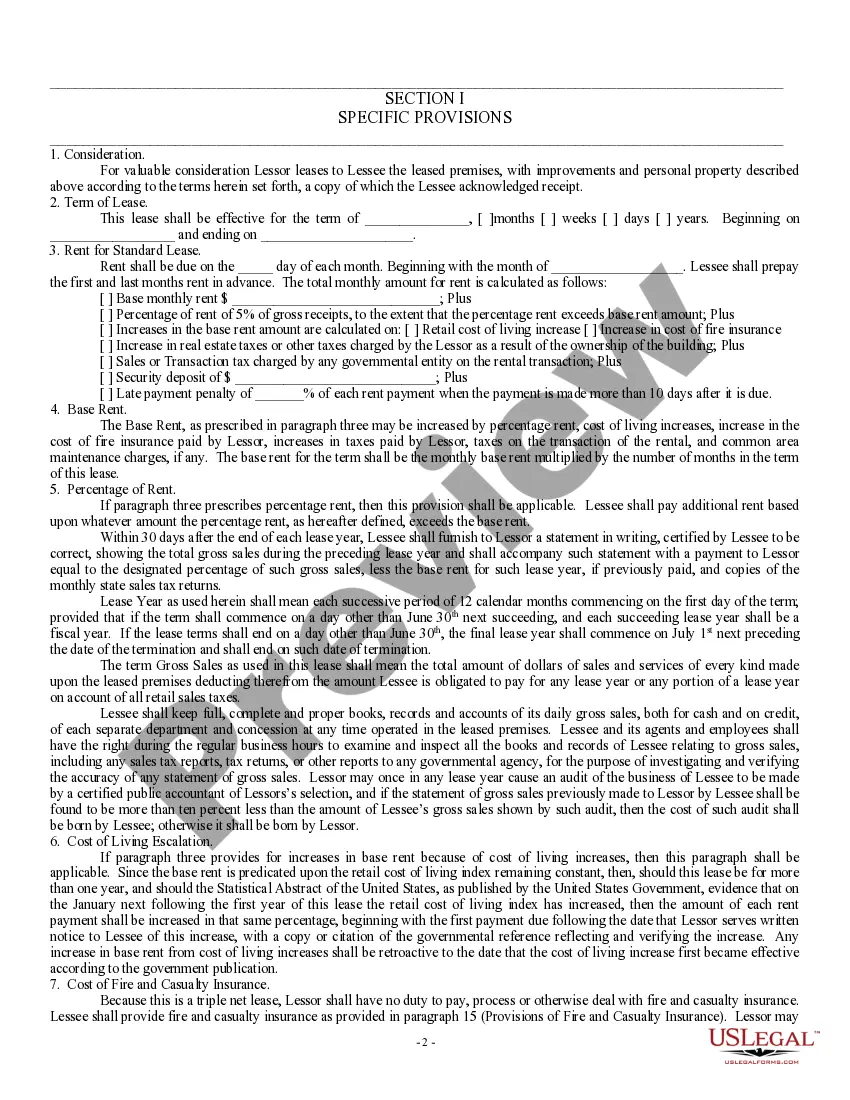

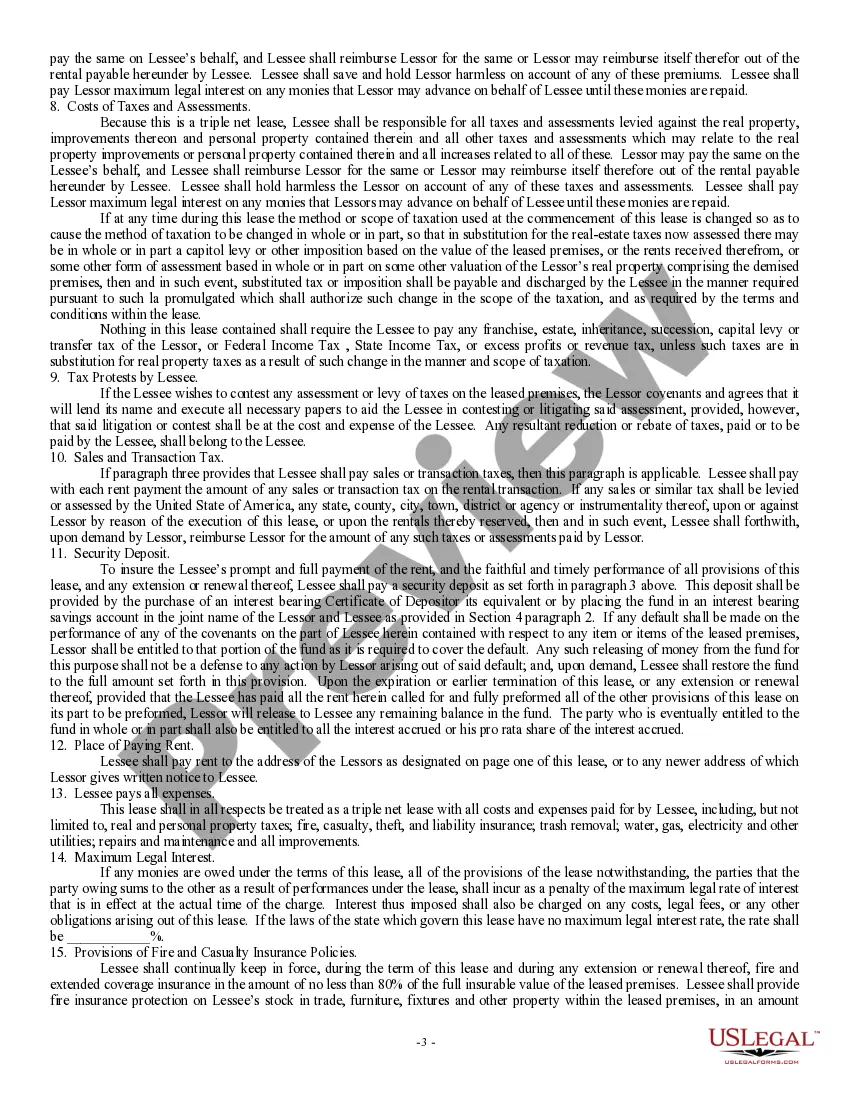

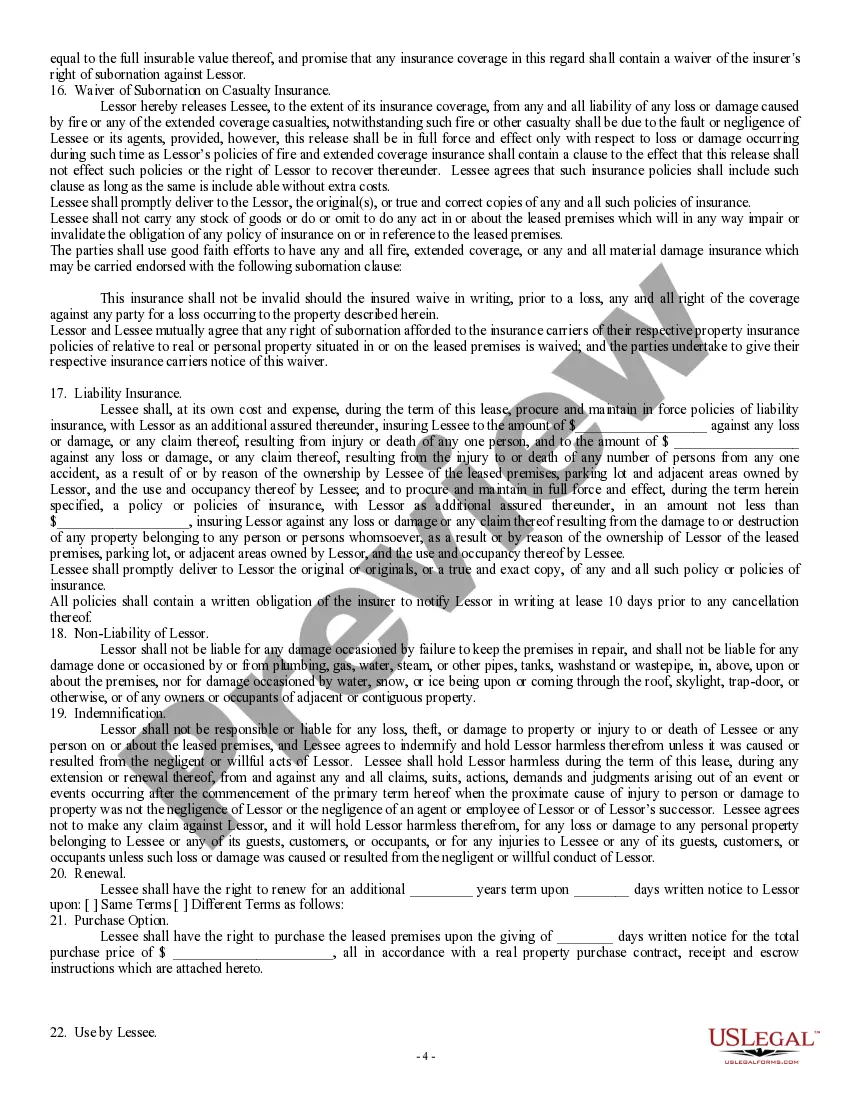

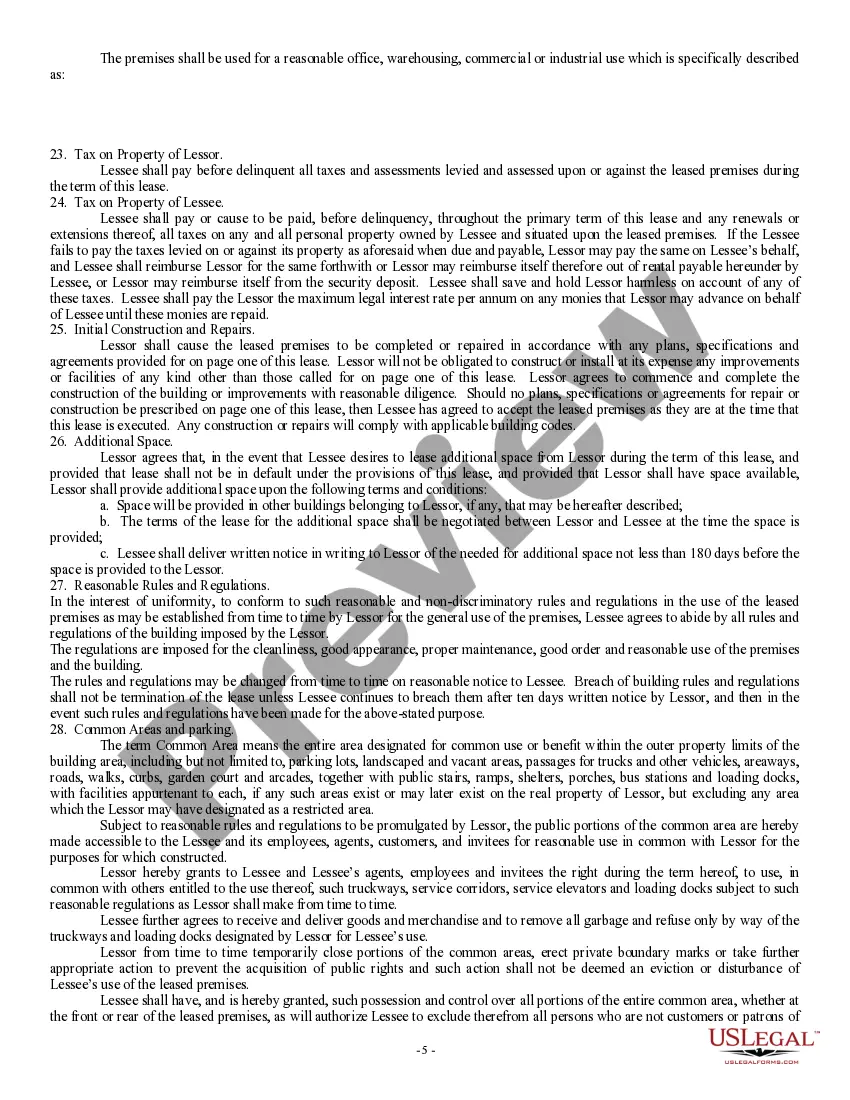

Puerto Rico Triple Net Lease for Industrial Property

Description

How to fill out Triple Net Lease For Industrial Property?

Have you found yourself in a scenario where you require documents for either an organization or an individual on a nearly daily basis.

There is a plethora of legal document templates accessible online, but locating ones you can rely on isn't straightforward.

US Legal Forms offers a wide array of form templates, such as the Puerto Rico Triple Net Lease for Industrial Property, designed to comply with state and federal regulations.

Once you locate the appropriate form, click Download now.

Choose the pricing plan you desire, fill in the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- If you're already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Puerto Rico Triple Net Lease for Industrial Property template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Obtain the form you need and ensure it is for your specific city/state.

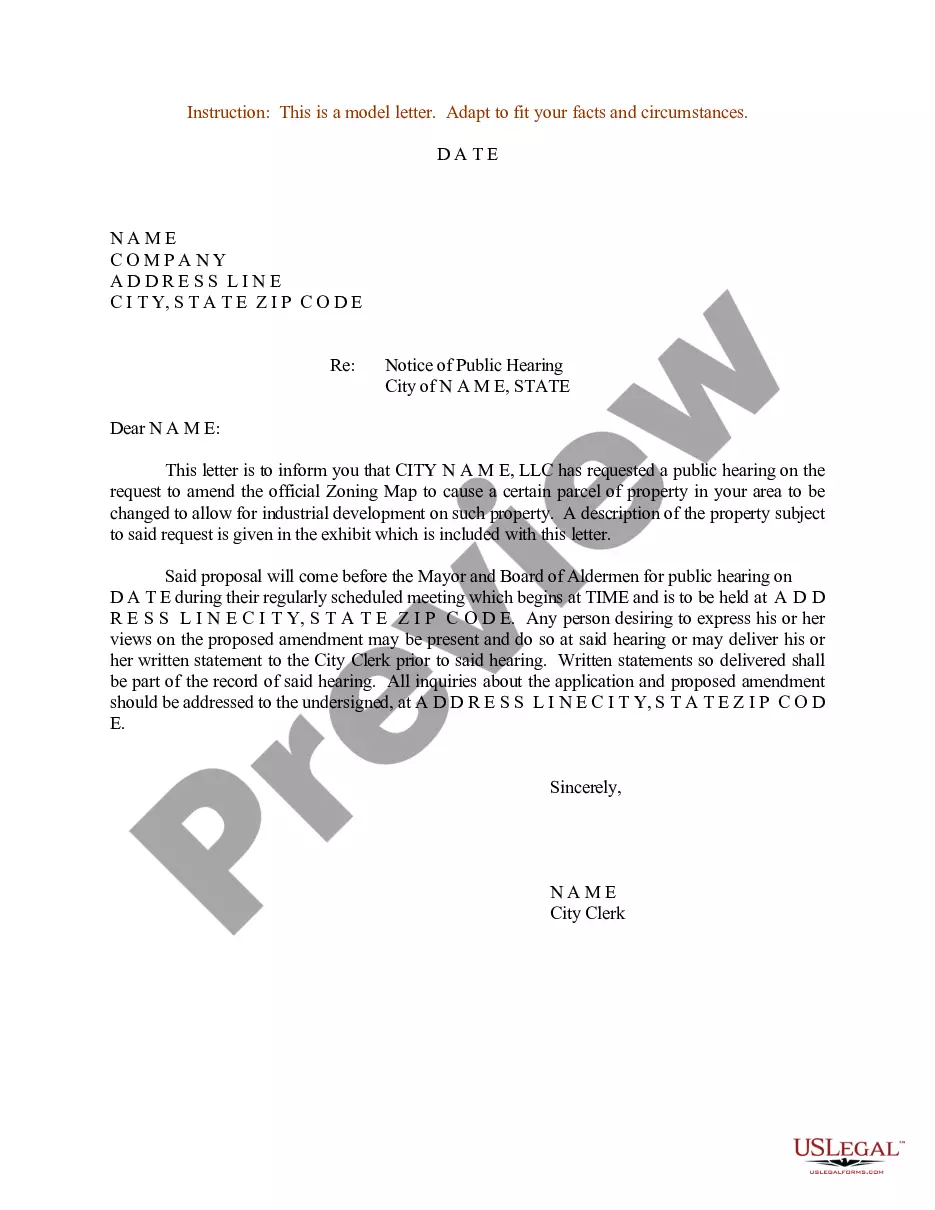

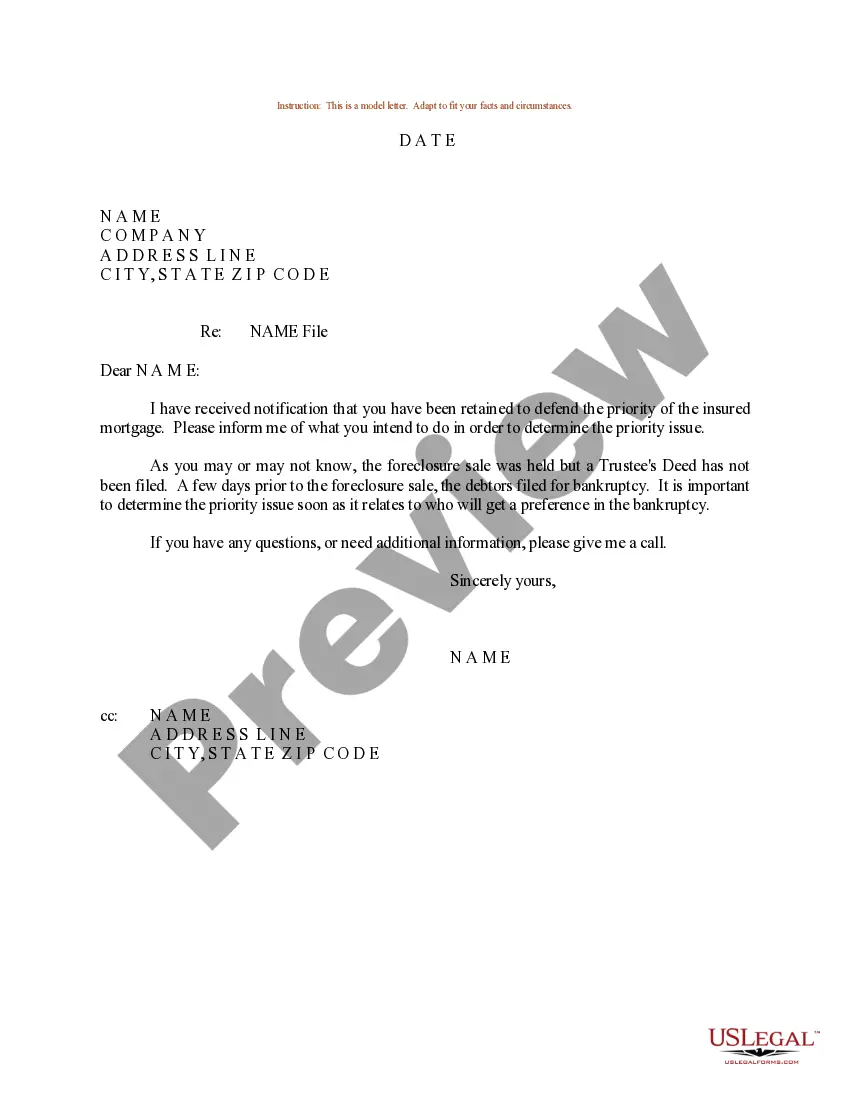

- Use the Preview button to review the document.

- Read the description to confirm that you have selected the correct form.

- If the form isn't what you're looking for, utilize the Search field to find the form that meets your needs.

Form popularity

FAQ

A form 480 is a crucial tax document in Puerto Rico used to disclose various income sources. It ensures that all financial activities are reported accurately to comply with local tax laws. For anyone engaged in a Puerto Rico Triple Net Lease for Industrial Property, understanding how to fill out this form correctly can help prevent tax issues down the line.

Puerto Rico form 482 is used for reporting individuals or entities that provide services or products that might qualify for withholding taxes. This form is significant for businesses that are part of the supply chain. If you deal with a Puerto Rico Triple Net Lease for Industrial Property, knowing about form 482 can simplify your tax responsibilities.

The Net Operating Loss (NOL) limitation in Puerto Rico restricts the amount of loss a business can carry forward to offset taxable income. Understanding these limits is vital for financial planning and tax preparation. If your strategy involves a Puerto Rico Triple Net Lease for Industrial Property, knowing the NOL limitations can impact how profits are reported.

Form 480.7 C is used to report specific types of income, including income from services rendered and certain commercial activities. This form is essential for business owners and self-employed individuals. If you're generating income from a Puerto Rico Triple Net Lease for Industrial Property, you'll need to ensure you report it accurately using this form.

Rule 22 in Puerto Rico pertains to tax incentives that promote economic activity. This regulation encourages businesses to invest in specific sectors, including real estate. If you are considering a Puerto Rico Triple Net Lease for Industrial Property, understanding Rule 22 can help you navigate available tax benefits.

Various entities can qualify for tax exemptions in Puerto Rico, including certain businesses and individuals meeting specific criteria. Generally, these include businesses that create jobs or invest in local development. If your business involves a Puerto Rico Triple Net Lease for Industrial Property, you might benefit from these exemptions, making it a lucrative option.

Yes, a US company can operate in Puerto Rico. However, it must adhere to local regulations and tax requirements. Engaging in a Puerto Rico Triple Net Lease for Industrial Property can be a strategic move for US companies looking to expand their business presence in the island.

A Puerto Rico form 480 is a tax document used by residents and businesses to report income and certain adjustments. This form is crucial for anyone engaged in financial activities in Puerto Rico. When dealing with investments or properties, such as a Puerto Rico Triple Net Lease for Industrial Property, understanding this form ensures compliance with local tax laws.

Qualifying for a triple net lease involves meeting specific financial criteria and demonstrating your ability to manage property expenses. You will typically need to present evidence of income, credit scores, and previous leasing experience. More importantly, ensuring that you're ready to handle additional costs, such as taxes and maintenance, is crucial. By understanding these requirements, you can effectively pursue a Puerto Rico Triple Net Lease for Industrial Property that meets your business needs.

To get approved for a triple net lease, you should demonstrate financial stability and creditworthiness. Landlords often look for reliable tenants with a strong business history and an adequate income to cover all lease expenses. Submitting detailed financial statements and personal guarantees can enhance your application. Consider utilizing resources from uslegalforms to ensure you present a comprehensive and compelling case for your Puerto Rico Triple Net Lease for Industrial Property.