This form is a sample agreement between the owner of property and the contractor agreeing that acceptance by contractor of late payments as described in the agreement do not constitute a waiver of the right to receive timely payments pursuant to the agreement in the future.

Puerto Rico Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments

Description

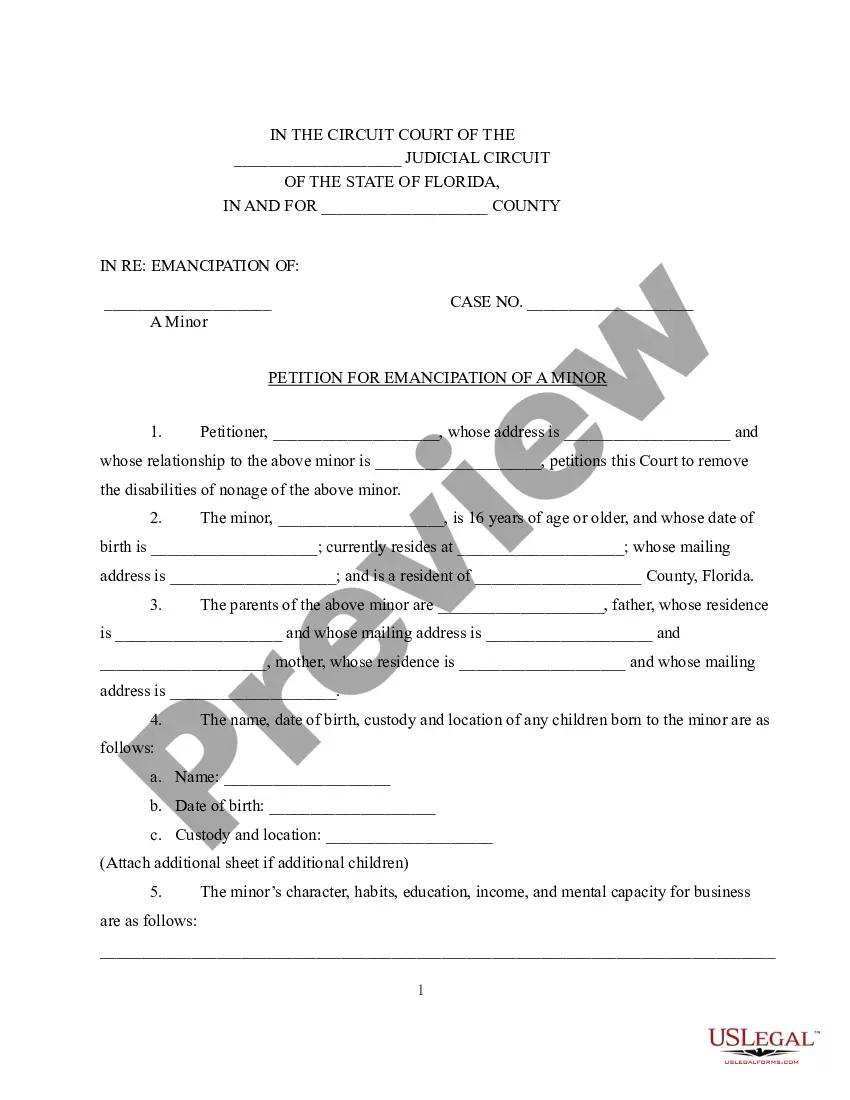

How to fill out Non-Waiver Agreement Between Contractor And Owner Regarding Accepting Late Payments?

US Legal Forms - one of the largest repositories of authentic documents in the USA - offers a broad selection of legal document templates you can download or print.

By utilizing the website, you can discover thousands of documents for business and personal purposes, categorized by types, states, or keywords.

You can access the latest versions of documents such as the Puerto Rico Non-Waiver Agreement between Contractor and Owner Regarding Late Payments in just minutes.

Click the Preview button to examine the content of the document.

Check the document description to confirm that you have chosen the right template.

- If you have a monthly subscription, Log In and obtain the Puerto Rico Non-Waiver Agreement between Contractor and Owner Regarding Late Payments from the US Legal Forms collection.

- The Download button will appear on each document you view.

- You can access all previously acquired documents in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are essential instructions to get started.

- Ensure you select the correct document for your city/state.

Form popularity

FAQ

Yes, the 29 withholding tax exists in Puerto Rico and specifically targets payments made to non-residents and certain payments within the jurisdiction. This tax plays a significant role in the broader tax system of Puerto Rico. Understanding its implications is crucial when entering a Puerto Rico Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments to ensure compliance and financial planning.

The duty tax in Puerto Rico refers to taxes imposed on goods that enter or are sold within the jurisdiction. These taxes help fund government services and programs. Understanding duty tax is vital for contractors and owners when negotiating terms in a Puerto Rico Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments, as it may affect the total project costs.

The 29 withholding in Puerto Rico is a specific tax rate applied to certain payments made to non-residents. It aims to ensure that the government collects taxes on income generated within its jurisdiction. If you are involved in the Puerto Rico Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments, being aware of this withholding can impact your financial planning and compliance.

Source withholding in Puerto Rico refers to the amounts deducted from payments made to individuals or businesses. This practice ensures that the government collects taxes upfront, preventing tax evasion. When entering into a Puerto Rico Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments, it is essential to understand these withholdings to comply with local tax laws.

Yes, you need a contractor license in Puerto Rico if you wish to engage in construction activities. Securing this license ensures you meet all local regulations and standards. Moreover, incorporating a Puerto Rico Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments can provide clarity on payment schedules and protect both parties during the project.

Yes, Puerto Rico requires a license for general contractors to operate legally. The licensing process involves meeting specific criteria and passing examinations. By utilizing a Puerto Rico Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments, you can establish clear financial terms in your projects, supporting compliant and efficient operations.

Yes, Texas generally requires general contractors to obtain a license depending on the specific municipality. While requirements can differ, it is crucial to check local regulations before starting work. If you are managing a project in Texas, adding a Puerto Rico Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments can help solidify financial expectations.

In Puerto Rico, obtaining a business license is essential for operating legally. This license may vary in requirements based on your specific industry and location. Using a Puerto Rico Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments can help clarify payment terms, making financial planning easier as you navigate licensing requirements.

waiver clause explicitly states that accepting a late payment does not waive the right to enforce the payment terms in the future. For instance, in a Puerto Rico NonWaiver Agreement between Contractor and Owner Regarding Accepting Late Payments, this clause protects the owner's rights by ensuring that their actions cannot be interpreted as legitimizing delayed payments. Such a clause fosters transparency and security in business transactions.

A waiver clause specifies instances where a party relinquishes a right or claim. An example within a Puerto Rico Non-Waiver Agreement between Contractor and Owner Regarding Accepting Late Payments could state that if the Owner accepts a late payment once, this does not mean they cannot demand timely payments going forward. Such clauses help in clearly defining the extent of waivers and protecting each party's rights.