Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust

Description

How to fill out Amendment Of Inter Vivos Trust Agreement For Withdrawal Of Property From Trust?

If you need to gather, obtain, or create legitimate document templates, utilize US Legal Forms, the top selection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to find the documents you require.

Various templates for business and personal purposes are organized by categories and states or keywords. Use US Legal Forms to locate the Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust in just a few clicks.

- If you are an existing US Legal Forms customer, Log In to your account and click on the Download button to fetch the Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust.

- You can also access forms you previously downloaded from the My documents tab in your account.

- If you are utilizing US Legal Forms for the first time, adhere to the following steps.

- Step 1. Ensure you have chosen the form for your corresponding city/state.

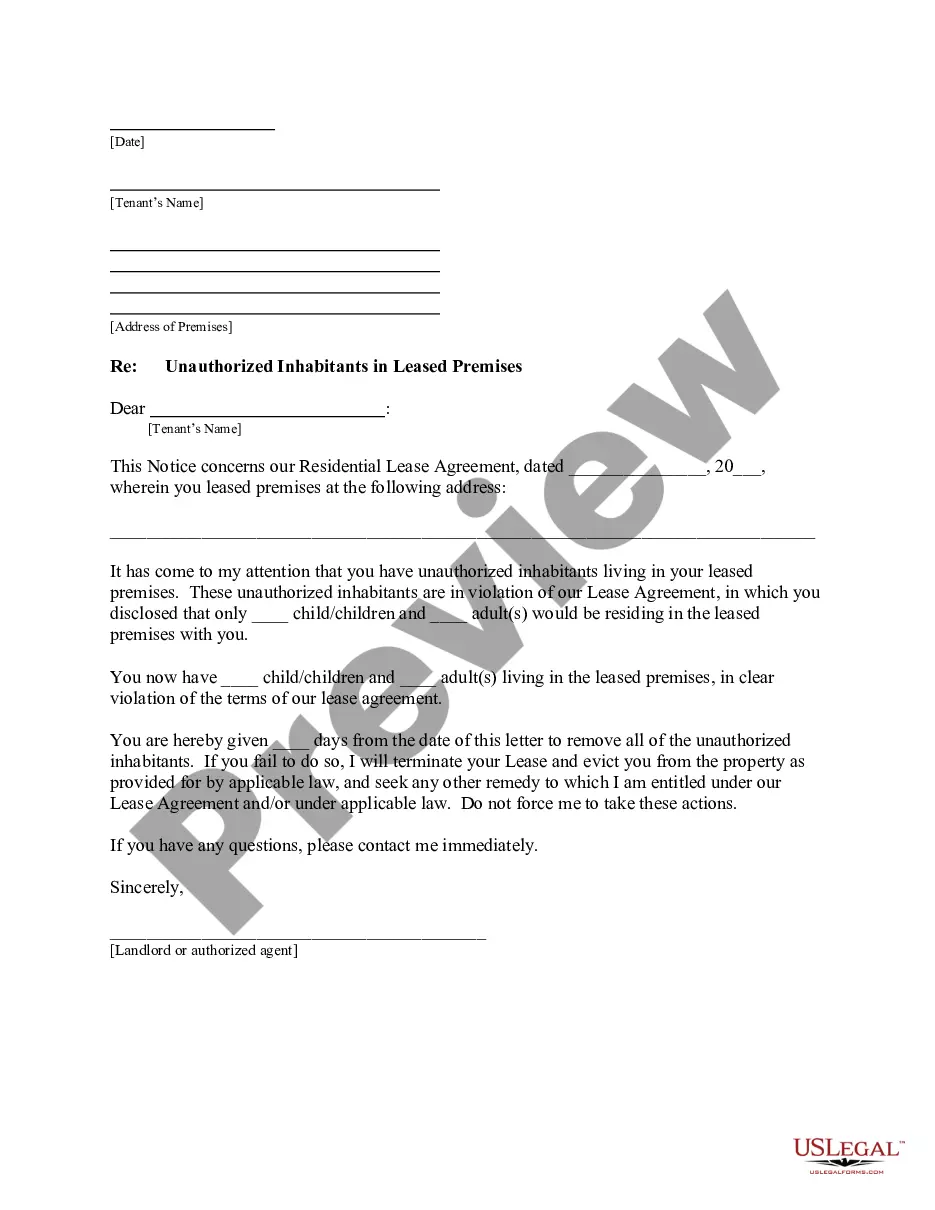

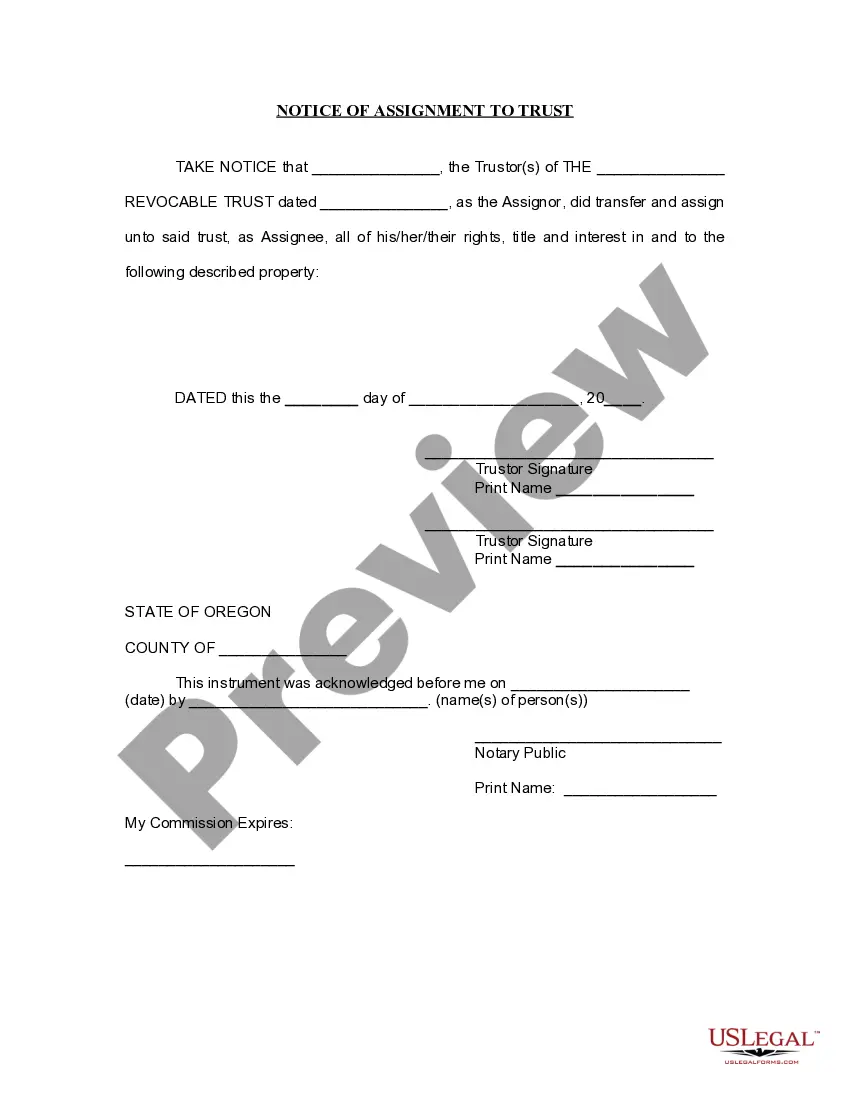

- Step 2. Use the Preview option to review the content of the form.

- Step 3. If you find the form unsatisfactory, utilize the Search field at the top of the screen to locate alternative versions of your legal form template.

- Step 4. Once you have located the form you require, select the Acquire now button.

- Step 5. Complete the purchase process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of your legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust.

- Every legal document template you purchase is yours permanently. You can access every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

- Complete and download, and print the Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust with US Legal Forms.

- There are numerous professional and state-specific forms you can use for your business or personal needs.

Form popularity

FAQ

One of the biggest mistakes parents make when setting up a trust fund is failing to clearly communicate their intentions with their children. This can lead to misunderstandings about the purposes and distributions of the trust. Additionally, not considering amendments, such as a Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, can lead to issues later on. Utilizing platforms like U.S. Legal Forms can help in avoiding such mistakes and guiding you through the setup process.

An amendment to an agreement refers to a formal change made to the existing legal document. In the context of trusts, a Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust allows the trust creator to adjust terms as needed. This can include changing beneficiaries or modifying the withdrawal conditions. Understanding these amendments is crucial for effective trust management.

Yes, you can place a house in a trust in Puerto Rico. This process involves creating a trust where the property is transferred into it, which can provide benefits like avoiding probate. The Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust allows flexibility in managing your assets. U.S. Legal Forms offers resources and templates to streamline this process.

A 1041 amendment form is used to correct or revise a previously filed IRS Form 1041. This is important for trusts that need to update their tax information or reporting. If you are engaging in a Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, understanding the relevance of the 1041 amendment can help ensure compliance with tax laws. Consider reaching out to a tax professional for support with these amendments.

Yes, an inter vivos trust typically needs to file a tax return if it generates income. The trust must report this income using IRS Form 1041. If you are considering a Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, it's essential to understand your tax obligations. Consulting with a tax advisor can help you navigate these requirements effectively.

A trust can be terminated through mutual agreement, fulfillment of its purpose, or by court order. In the context of a Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, you might terminate the trust if the trust property has been fully distributed or if the beneficiaries agree to dissolve it. Understanding these methods helps you make informed decisions regarding your trust. Always seek professional advice to clarify your options.

Yes, an inter vivos trust can be revoked as long as the trust agreement allows for it. If you created a trust in Puerto Rico, you can initiate a Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust. This process allows you to change or revoke the trust terms, providing flexibility to manage your assets. Consider consulting a legal expert for guidance.

Withdrawal rights in a trust refer to the rights of beneficiaries to withdraw assets or property from the trust during the trust's existence. These rights can be explicitly defined in the trust document, allowing beneficiaries to exercise control over their interests. If you seek to clarify or adjust these rights, a Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust might be the solution you need.

The Puerto Rico Trust Act provides the legal framework for creating and managing trusts in Puerto Rico. It outlines the rights and responsibilities of trustees, beneficiaries, and grantors. If you are looking to amend your trust, utilizing a Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust ensures compliance with this act, offering clarity and security for all parties involved.

Yes, Puerto Rico recognizes trusts and has established statutory provisions that govern their creation and administration. This recognition means that residents can enjoy the benefits of trusts, including estate planning and asset protection. If you are considering a Puerto Rico Amendment of Inter Vivos Trust Agreement for Withdrawal of Property from Trust, you can trust that Puerto Rican law supports your efforts.