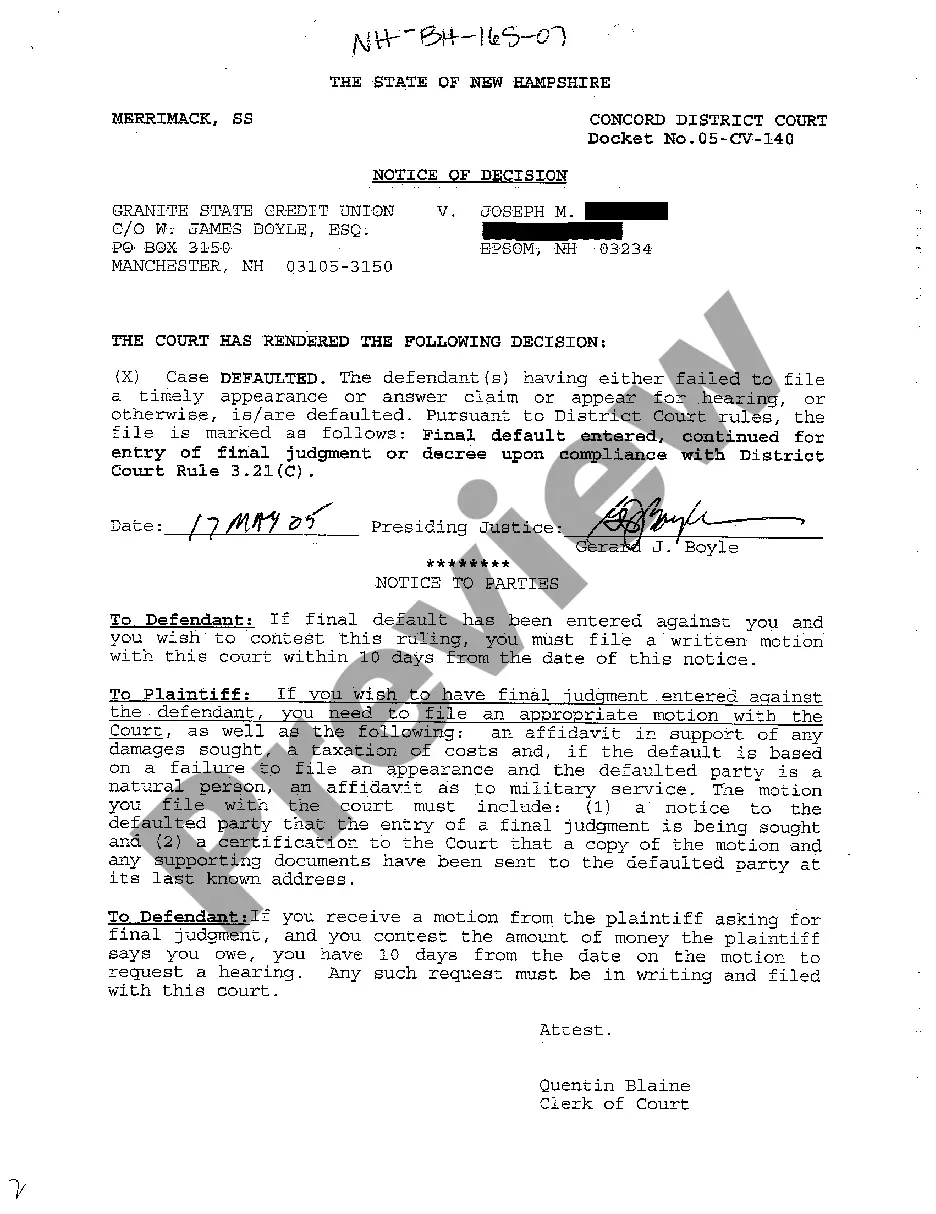

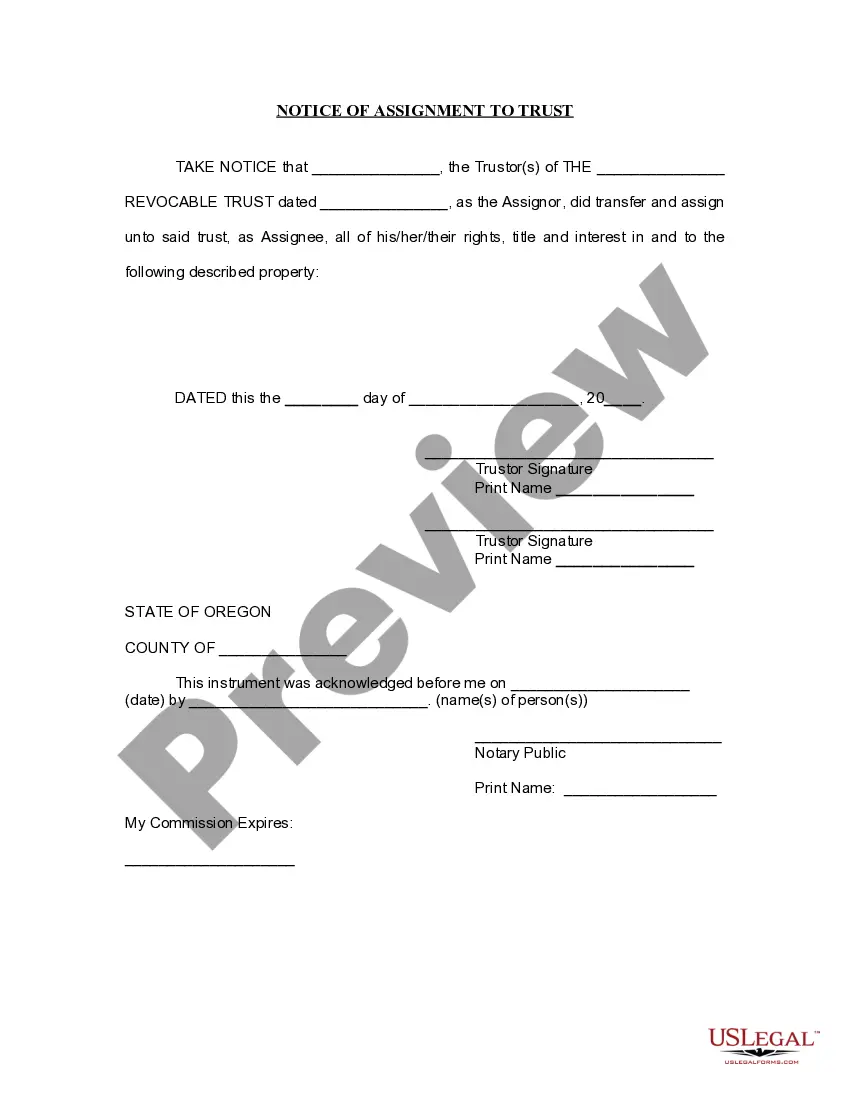

Oregon Notice of Assignment to Living Trust

Description

trustor(s) of the revocable trust transferred and assigned his or her or their rights, title and interest in and to certain described property to the trust.

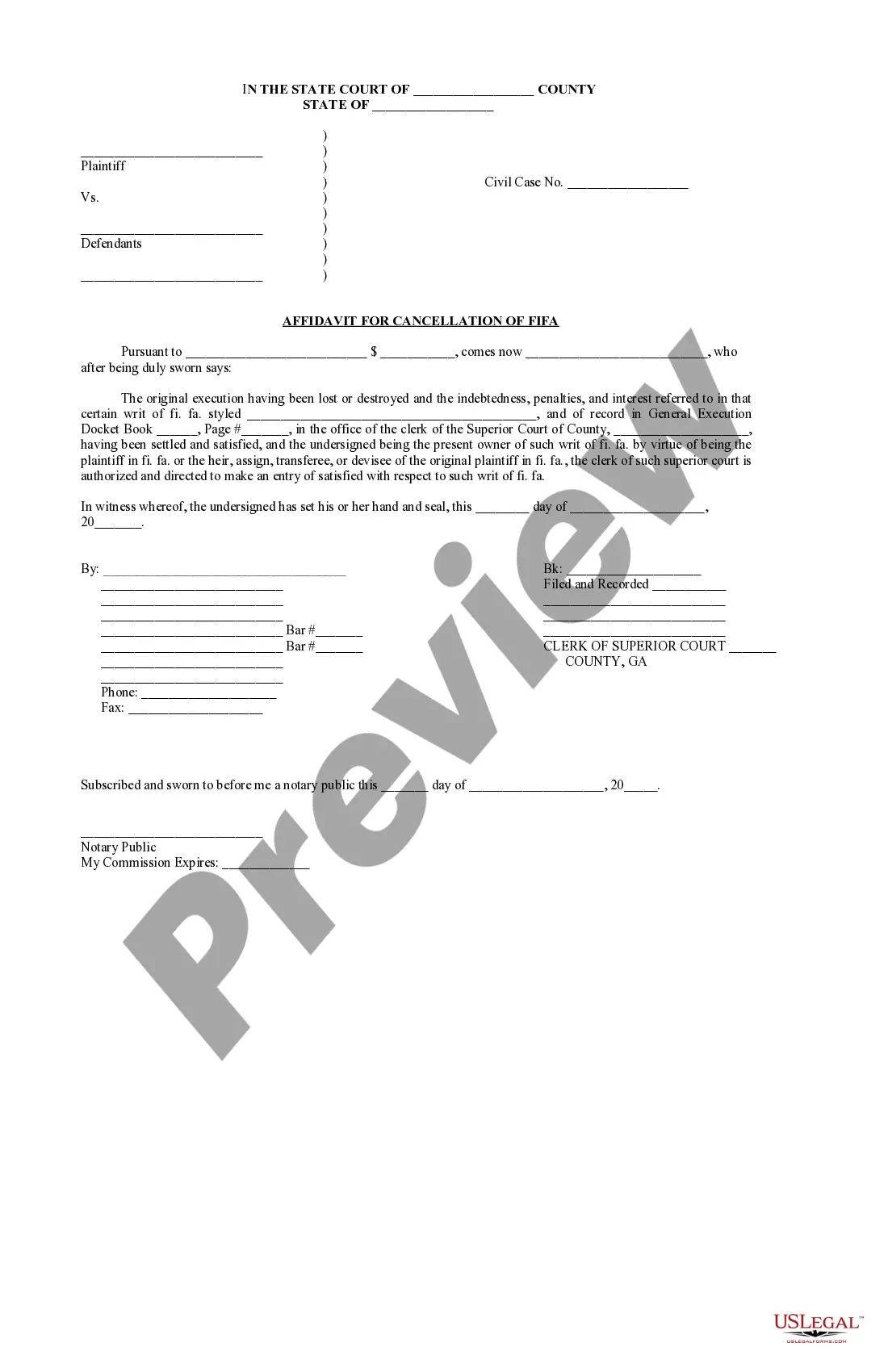

How to fill out Oregon Notice Of Assignment To Living Trust?

In terms of submitting Oregon Notice of Assignment to Living Trust, you probably visualize an extensive procedure that consists of finding a suitable form among hundreds of very similar ones then needing to pay out legal counsel to fill it out for you. Generally speaking, that’s a sluggish and expensive choice. Use US Legal Forms and pick out the state-specific document within clicks.

For those who have a subscription, just log in and then click Download to find the Oregon Notice of Assignment to Living Trust template.

If you don’t have an account yet but need one, stick to the step-by-step manual listed below:

- Be sure the document you’re getting applies in your state (or the state it’s required in).

- Do so by reading the form’s description and also by clicking the Preview option (if offered) to find out the form’s content.

- Click Buy Now.

- Choose the appropriate plan for your financial budget.

- Sign up for an account and select how you want to pay: by PayPal or by credit card.

- Save the file in .pdf or .docx file format.

- Find the file on your device or in your My Forms folder.

Professional legal professionals work on drawing up our samples so that after downloading, you don't need to worry about editing and enhancing content outside of your personal details or your business’s details. Be a part of US Legal Forms and receive your Oregon Notice of Assignment to Living Trust sample now.

Form popularity

FAQ

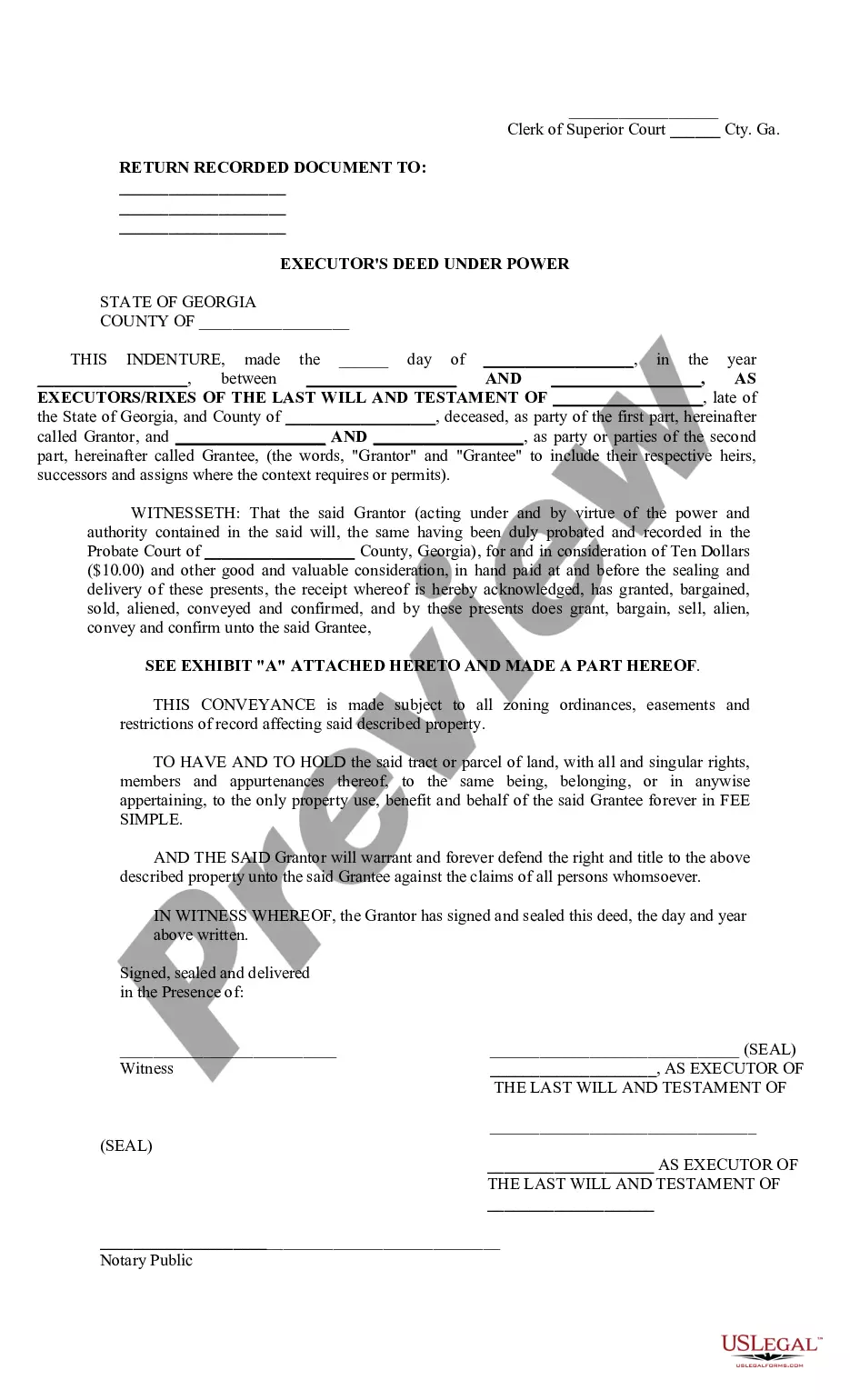

In order to transfer real property held in a living trust, the trustee executes a trustee's deed. The trustee's deed is one in a class of instruments named descriptively after the granting party, rather than the warranty of title conveyed (think administrator's deed, executor's deed, sheriff's deed).

The best way to find a trust is to ask the person who created it or the person who manages it. If the trust owns real estate, then a deed to the trust has probably been recorded in the county where the real estate is.

If a trust holds real estate, the trustee will need to sign a new deed, transferring the property to the new owner - the trust beneficiary.When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed.

A revocable living trust isn't subject to the same kind of rules as a will; it should be valid in any state, no matter where you signed it.If you acquire real estate in your new state, you'll probably want to hold it in the trust, so that it doesn't have to go through probate at your death.

To allow the settlor to keep his estate plans private, the trust instrument is generally not recorded, and the trustee uses the certification of trust in the place of disclosing the entire contents of the trust instrument.

Trusts are transferrable from state to state, but it always makes sense to have your estate plan reviewed when you move.

A basic trust plan may run anywhere from $2,000 to $3,000 or more, depending on complexity. There are additional costs for making changes and administration costs after your death. Different types of trusts and trustees can require different fees for administration and wealth management.

Can I contest a trust in California? Yes, you can contest a trust, and it is more common than most people think.