A guaranty is a contract under which one person agrees to pay a debt or perform a duty if the other person who is bound to pay the debt or perform the duty fails to do so. A guaranty of the payment of a debt is different from a guaranty of the collection of the debt. A guaranty of payment is absolute while a guaranty of collection is conditional.

Puerto Rico Guaranty of Collection of Promissory Note

Description

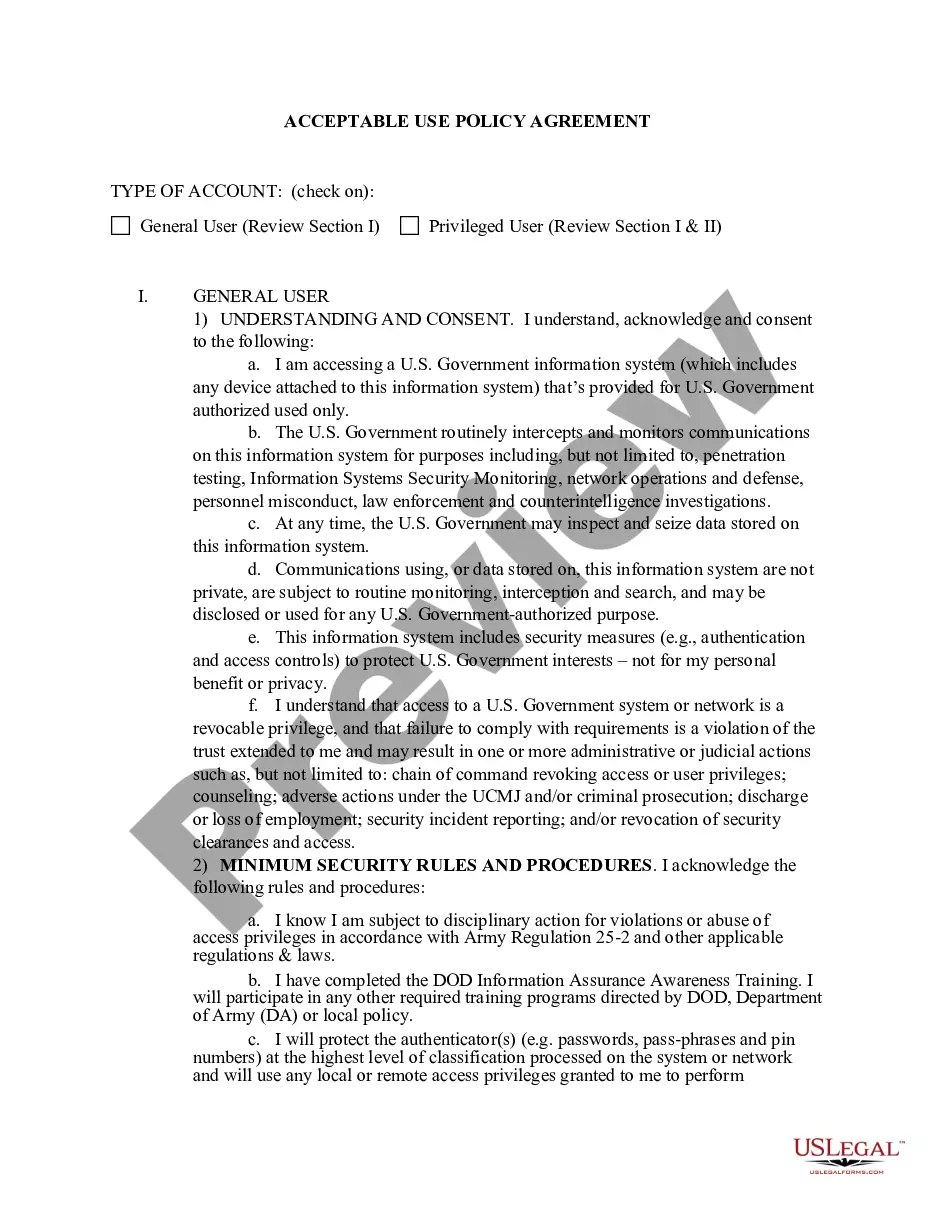

How to fill out Guaranty Of Collection Of Promissory Note?

Have you faced a circumstance where you require documents for either business or personal reasons nearly every day.

There are numerous valid document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers a vast selection of template documents, including the Puerto Rico Guaranty of Collection of Promissory Note, designed to meet state and federal regulations.

Select the pricing plan you desire, complete the necessary information to set up your account, and pay for the transaction using your PayPal or debit/credit card.

Choose a suitable document format and download your version. Access all the document templates you have purchased in the My documents section. You can retrieve another copy of the Puerto Rico Guaranty of Collection of Promissory Note at any time, if needed. Simply access the form to download or print the document template.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Puerto Rico Guaranty of Collection of Promissory Note template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Review function to inspect the form.

- Check the description to ensure you have chosen the correct form.

- If the form does not meet your requirements, use the Research area to locate the form that fits your needs.

- When you find the appropriate form, click Acquire now.

Form popularity

FAQ

Exiting a promissory note typically involves paying off the debt or negotiating a settlement with the lender. It's crucial to communicate openly with the lender about your situation and explore options. If you are considering strategies related to the Puerto Rico Guaranty of Collection of Promissory Note, consulting with legal experts can provide valuable insights.

A promissory note is often unsecured when it lacks collateral to back the promise to repay. In these cases, lenders take on higher risk since they rely only on the borrower's creditworthiness and commitment. Utilizing the Puerto Rico Guaranty of Collection of Promissory Note can help you understand the implications of engaging in unsecured transactions.

Some promissory notes are indeed backed by collateral, creating a secured obligation. When a borrower pledges assets as collateral, it provides lenders with security in case of default. If you're navigating the nuances of promissory notes, especially in Puerto Rico, consider using the Puerto Rico Guaranty of Collection of Promissory Note for clearer guidance.

Typically, a promissory note may be considered a security depending on its specific terms and the context in which it is issued. If the note is issued in an investment context, it may align with the definition of a security under federal and state laws. Understanding the implications of this classification can help you navigate the Puerto Rico Guaranty of Collection of Promissory Note effectively.

Promissory notes can be categorized as either secured or unsecured. A secured promissory note means it has particularly identified collateral tied to it, giving the lender a way to recover their investment. On the other hand, unsecured promissory notes rely solely on the borrower's promise to repay. The Puerto Rico Guaranty of Collection of Promissory Note helps clarify these important distinctions.

In general, notes can be secured or unsecured. A secured note has collateral backing it, offering protection to the lender. Conversely, unsecured notes do not have collateral, making them riskier for lenders. With the Puerto Rico Guaranty of Collection of Promissory Note, understanding the nature of your note is vital.

To fill out a promissory note, start by entering the date, followed by the names of both the lender and borrower. Next, specify the amount being borrowed, the interest rate, and the repayment schedule, along with the relevant terms and conditions. This process can be simplified with a Puerto Rico Guaranty of Collection of Promissory Note template, which guides you through the necessary fields.

The entry of the promissory note refers to its recording in a business's financial records. Typically, this includes documenting the note's terms, date of transaction, and any payments made. Implementing a Puerto Rico Guaranty of Collection of Promissory Note in such entries ensures everything is in compliance with local legal standards.

The format of a promissory note typically includes key sections like the date, the names of the parties involved, the principal amount, interest rate, payment schedule, and signatures. Additionally, a Puerto Rico Guaranty of Collection of Promissory Note may incorporate specific legal language that ensures the note is enforceable. You can create a well-structured promissory note using online templates that comply with Puerto Rico laws.

Getting out of a promissory note can be challenging and often involves negotiations or legal processes. Borrowers should communicate openly with lenders to explore modifications or settlements. It is wise to consider the implications of a Puerto Rico Guaranty of Collection of Promissory Note when seeking an exit strategy. With US Legal Forms, you can find the necessary tools to address such situations effectively.