Puerto Rico Corporate Guaranty - General

Description

How to fill out Corporate Guaranty - General?

You can invest hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms provides a vast array of legal forms that are vetted by professionals.

You can effortlessly download or print the Puerto Rico Corporate Guaranty - General from the service.

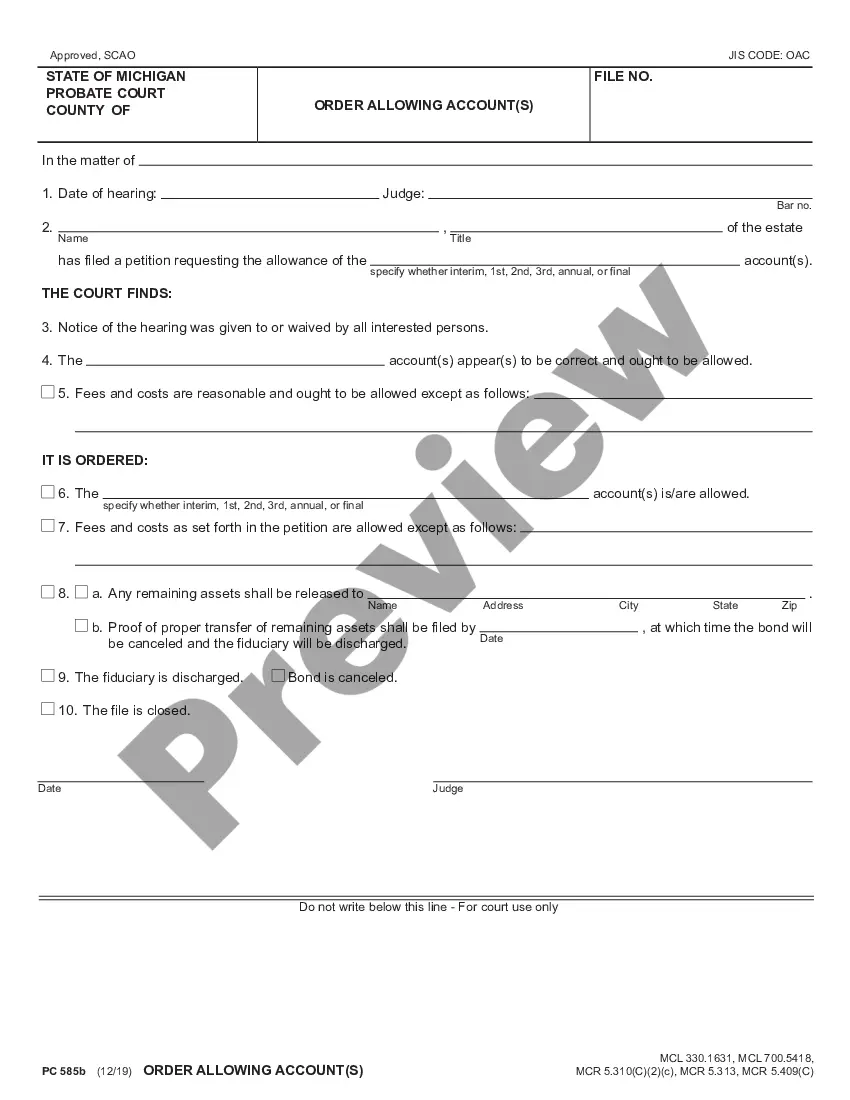

If provided, use the Preview button to browse through the document template as well.

- If you already have a US Legal Forms account, you can sign in and click on the Download button.

- Afterward, you can complete, edit, print, or sign the Puerto Rico Corporate Guaranty - General.

- Each legal document template you purchase is yours for an extended period.

- To obtain another copy of any purchased form, navigate to the My documents section and click on the relevant button.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for your state/area of preference.

- Review the form description to confirm you have chosen the right one.

Form popularity

FAQ

The General Corporation Act in Puerto Rico outlines the regulatory framework for the formation and operation of corporations within the territory. This legislation serves to protect the rights of shareholders and define the responsibilities of corporate management. For businesses, especially those interested in the Puerto Rico Corporate Guaranty - General, it is important to understand how this act influences corporate conduct and compliance.

Finding property records in Puerto Rico is straightforward by accessing the online portal of the Puerto Rico Property Registry. Users can search for property-related information using key details such as the property address or owner’s name. For those navigating legal complexities, referencing the Puerto Rico Corporate Guaranty - General can provide necessary guidance.

To find public records in Puerto Rico, you can visit the Government of Puerto Rico's official website, which provides a wealth of information. Various agencies such as the Department of Justice maintain specific records, and additional resources like local courthouses can be beneficial. Using US Legal Forms can facilitate obtaining the necessary documents related to the Puerto Rico Corporate Guaranty - General.

A US LLC can conduct business in Puerto Rico, but it must register with the Department of State in Puerto Rico. This registration enables the LLC to operate legally and enjoy certain benefits. Understanding the Puerto Rico Corporate Guaranty - General is crucial for LLCs, as it outlines the responsibilities and liabilities associated with corporate operations.

Yes, US companies can operate in Puerto Rico, as it is a US territory. Businesses must comply with local regulations and may benefit from the unique tax incentives. Depending on the nature of the business, the Puerto Rico Corporate Guaranty - General may apply, providing a structured framework for corporate operations on the island.

When a person dies in Puerto Rico, their property is subject to the legal process of succession, which may involve probate if there is a will. If there is no will, the property will be distributed according to local laws. It is important to understand the implications of the Puerto Rico Corporate Guaranty - General when settling estates, as it may impact business interests associated with the property.

To look up a property owner in Puerto Rico, you can access the online database maintained by the Puerto Rico Property Registry. This database allows you to search by property address or identification number. Additionally, you can reach out to local municipal offices for further assistance. Utilizing resources like US Legal Forms can streamline this process, especially for inquiries related to the Puerto Rico Corporate Guaranty - General.

Puerto Rico provides several tax advantages, including lower corporate tax rates and potential exemptions for qualifying businesses. These benefits can help increase profitability and attract new ventures. When utilizing the Puerto Rico Corporate Guaranty - General, you should explore these strategic advantages to maximize your return on investment.

Yes, Puerto Rico imposes corporate taxes, but the rates can be significantly lower than those in the mainland U.S. Companies may qualify for various tax incentives that can further reduce their tax obligations. It's crucial to understand the specifics if you're considering the Puerto Rico Corporate Guaranty - General to ensure you take advantage of all potential savings.

Many individuals view Puerto Rico as a corporate tax haven because of its unique tax incentives designed to attract businesses. The government offers programs that significantly reduce corporate taxes, making it appealing for new investments. If you are exploring the Puerto Rico Corporate Guaranty - General, utilizing these incentives could enhance your business's financial performance.