Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation

Description

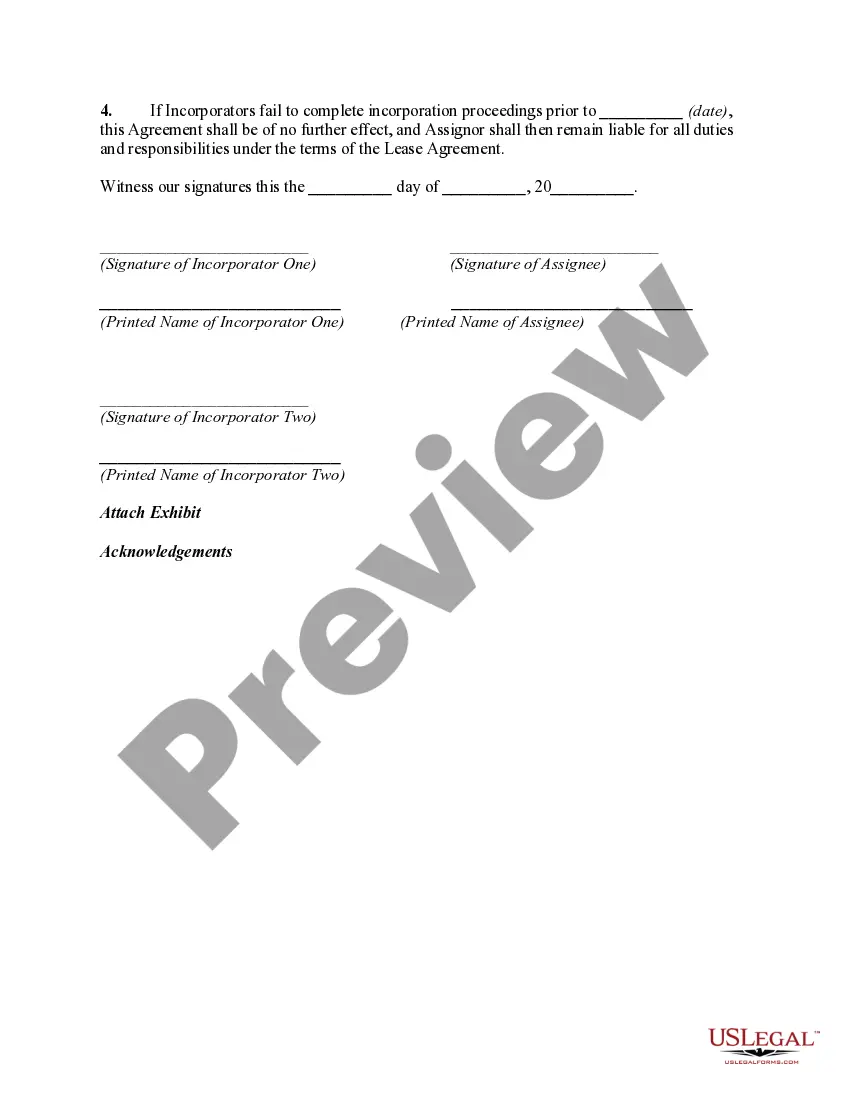

How to fill out Agreement To Assign Lease To Incorporators Forming Corporation?

US Legal Forms - one of the most important repositories of legal documents in the United States - provides a range of legal document templates that you can download or print.

Through the website, you will find thousands of forms for business and personal use, organized by categories, states, or keywords. You can quickly locate the latest versions of forms such as the Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation.

If you already have a subscription, Log In and download the Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation from the US Legal Forms library. The Acquire button will show on every form you view. You can access all previously saved forms in the My documents section of your account.

Every template you add to your account does not expire and belongs to you forever. Therefore, if you wish to download or print another copy, simply go to the My documents section and click on the form you need.

Access the Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal needs and requirements.

- Ensure you have selected the correct form for your area/region. Click the Review button to check the form’s details. Read the form description to confirm that you have chosen the right document.

- If the form does not meet your needs, utilize the Search field at the top of the screen to find one that does.

- If you are satisfied with the document, confirm your choice by clicking the Buy now button. Then, pick the pricing plan you wish and provide your details to register for the account.

- Process the transaction. Use your credit card or PayPal account to complete the purchase.

- Select the format and download the document to your device.

- Make adjustments. Fill out, edit, and print the saved Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation.

Form popularity

FAQ

A lease transfer often refers to the act of handing over the lease rights, which may or may not include obligations, while assignment specifically involves both rights and obligations being transferred to another party. In a Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation, clarifying these distinctions helps prevent misunderstandings and ensures all parties are aware of their responsibilities. Using a clear framework will make your lease transitions more effective.

If a lease is assigned, it means that the original tenant has transferred their rights and responsibilities to another party. This process can be beneficial for both the assignor and assignee, as it allows for smoother transitions in tenancy. In the context of a Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation, understanding the implications of an assignment helps ensure compliance with local laws and landlord expectations.

Yes, a lease agreement can be assigned, but only if the lease terms allow it. Many landlords include specific clauses regarding assignment in their lease documents. A Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation provides a clear framework for how this process works, ensuring you can follow legal guidelines while making your assignment seamless and efficient.

Assignment of lease refers to transferring one's lease rights and obligations to another party, whereas novation involves replacing the original party in the lease agreement with a new party, effectively creating a new contract. In the context of a Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation, it is important to understand that assignment retains the original tenant's obligations, while novation releases them. Knowing these differences helps you choose the right approach for your corporate needs.

The assignment clause in a lease agreement outlines the conditions under which a tenant can transfer their rights and obligations to another party. This clause is crucial in a Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation, as it specifies whether the tenant must obtain landlord approval before making the assignment. Understanding this clause helps you avoid potential disputes and ensures compliance with the terms of your lease.

To form a corporation in Puerto Rico, you must follow several key steps. Start by choosing a unique name for your corporation and file the necessary paperwork with the Puerto Rico Department of State. Additionally, incorporating often involves drafting by-laws and acquiring an Employer Identification Number (EIN). The Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation plays a vital role in this process, providing a structured approach to legally assign leases and operational responsibilities as your corporation takes shape. Utilizing platforms like uslegalforms can simplify your journey through this legal landscape.

Yes, a Puerto Rico entity is considered a US entity due to its status as a territory of the United States. However, there are some differing tax rules and regulations that apply to Puerto Rican entities compared to those based in the mainland US. If you are utilizing the Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation, understanding the nuances of this relationship can help you navigate legal compliance effectively. It’s important to be aware of these distinctions for proper business planning.

A Puerto Rico form 480 is an important tax document used for reporting income in Puerto Rico. This form is particularly useful for individuals and businesses who need to disclose income from multiple sources. Understanding the Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation involves recognizing the role of form 480 in ensuring compliance with local tax laws. It’s essential for maintaining accurate financial records and fulfilling your tax obligations.

Yes, a US citizen living abroad can own an S Corporation, but there are specific requirements to maintain the S Corp status. This includes having a valid U.S. tax identification number and meeting other IRS conditions. Utilizing the Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation can assist in structuring and managing your business from abroad. Understanding these guidelines will help you leverage the advantages of your S Corp efficiently.

Yes, a US citizen can easily start a business in Puerto Rico. The process is streamlined for those familiar with US regulations, and entrepreneurial support is readily available. By using the Puerto Rico Agreement to Assign Lease to Incorporators Forming Corporation, individuals can efficiently navigate business formation in this vibrant locale. Puerto Rico offers a unique blend of resources and an encouraging environment for entrepreneurs.