Generally, a license in respect of real property (since it is a mere personal privilege), cannot be assigned or transferred by the licensee. A license does not pass with the title to the property, but is only binding between the parties, expiring upon the death of either party. This form is an example of such.

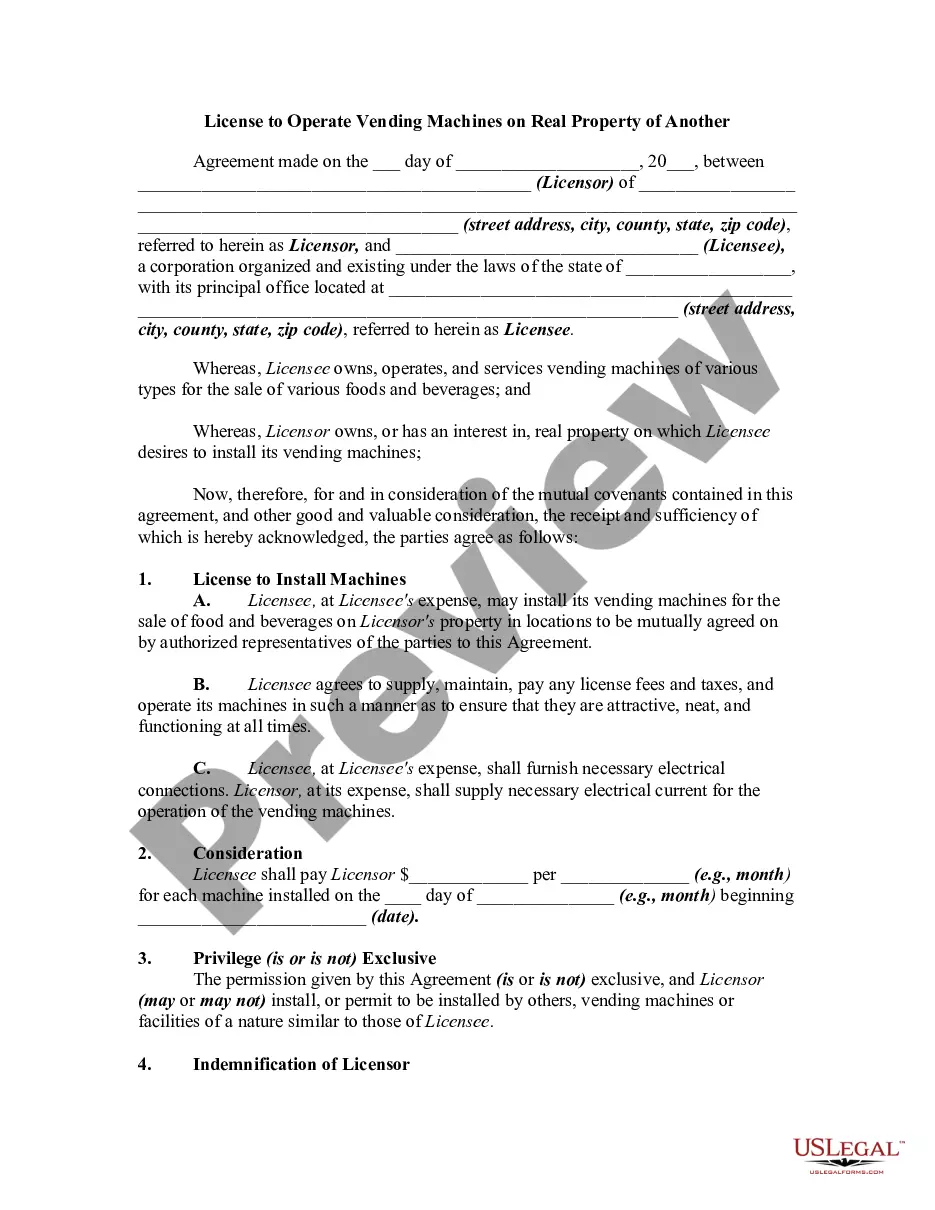

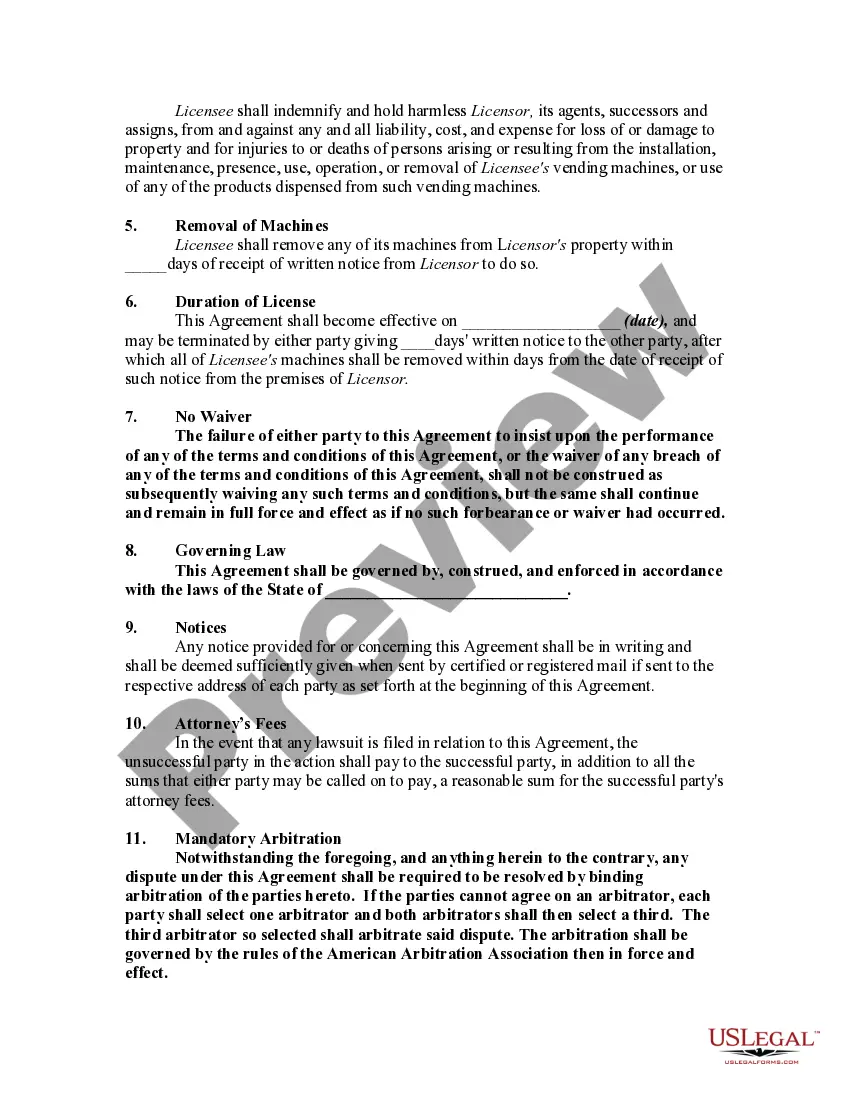

Puerto Rico License to Operate Vending Machines on Real Property of Another

Description

How to fill out License To Operate Vending Machines On Real Property Of Another?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a range of legal document templates that you can download or print.

By using the website, you can discover thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can access the latest versions of forms such as the Puerto Rico License to Operate Vending Machines on Real Property of Another in just a few minutes.

If you already have a monthly subscription, Log In and download the Puerto Rico License to Operate Vending Machines on Real Property of Another from the US Legal Forms collection. The Download button will appear on every form you view. You can find all previously saved forms in the My documents section of your account.

Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then select your preferred pricing plan and provide your details to register for an account.

Complete the transaction. Use your credit card or PayPal account to finalize the payment. Download the form to your device and make modifications. Fill out, edit, print, and sign the saved Puerto Rico License to Operate Vending Machines on Real Property of Another. Each template you added to your account has no expiration date and belongs to you permanently. So, to download or print another copy, just go to the My documents section and click on the form you need. Access the Puerto Rico License to Operate Vending Machines on Real Property of Another with US Legal Forms, the largest collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and specifications.

- If you want to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the correct form for your city/county.

- Click the Preview button to review the form's details.

- Check the form description to confirm you have chosen the right form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

Form popularity

FAQ

To register for sales tax in Puerto Rico, you must complete a registration application with the Department of Treasury. This step is crucial if you have a Puerto Rico License to Operate Vending Machines on Real Property of Another because it allows you to legally collect sales tax on your vending machine sales. You can simplify the process by utilizing platforms like uslegalforms, which provide resources and guidance for your registration.

Eligibility for tax exemption in Puerto Rico typically applies to specific organizations, such as non-profits, government entities, and certain types of businesses. If your business operates under a Puerto Rico License to Operate Vending Machines on Real Property of Another, you may need to meet certain criteria to qualify for an exemption. It's recommended to consult a tax professional or the Department of Treasury for guidance based on your circumstances.

In Puerto Rico, sales tax rules dictate that businesses collecting sales tax must register with the Puerto Rico Department of Treasury. If you hold a Puerto Rico License to Operate Vending Machines on Real Property of Another, you will need to adhere to specific tax rates applied to your vending machine sales. Familiarizing yourself with these rules ensures compliance and helps avoid penalties.

Sales tax nexus in Puerto Rico refers to the connection between a business and the state that requires the business to collect and remit sales tax. If you operate a vending machine under a Puerto Rico License to Operate Vending Machines on Real Property of Another, you may establish nexus based on your physical presence, such as your vending machines or employees within the territory. Understanding this concept is essential as it impacts your tax responsibilities.

Puerto Rico sales tax nexus is established when a business has a physical presence or engages in certain activities within its borders. This includes operating vending machines on real property, hence it is vital to understand your obligations. If you plan to operate and require a Puerto Rico License to Operate Vending Machines on Real Property of Another, ensuring proper nexus compliance will help you avoid potential issues. Consulting with a local expert may provide clarity on your specific situation.

To obtain a seller's permit in Puerto Rico, you need to register with the Puerto Rico Department of Revenue. This involves filling out an application and providing necessary business details. Securing a seller's permit is vital if you want to operate legally, especially when you are looking into a Puerto Rico License to Operate Vending Machines on Real Property of Another. This permit is key for any sales activity in the territory.

Absolutely, a US citizen can start a business in Puerto Rico without any additional restrictions. The process is straightforward, similar to starting a business in any US state. If you are planning to launch a vending machine enterprise, securing a Puerto Rico License to Operate Vending Machines on Real Property of Another will be crucial. It opens doors to a thriving market while ensuring you comply with local laws.

Yes, obtaining a business license in Puerto Rico is necessary for legal operations. Each type of business, including vending machine operations, may require specific licenses. If you aim to secure a Puerto Rico License to Operate Vending Machines on Real Property of Another, you must comply with local regulations and obtain the appropriate licenses. Start by consulting with the local municipality for detailed requirements.

To register for sales tax in Puerto Rico, you should visit the Puerto Rico Department of Finance website. There, you can find the necessary forms and instructions. By completing the registration, you ensure compliance with local laws, especially if you plan to obtain a Puerto Rico License to Operate Vending Machines on Real Property of Another. This step is essential for all businesses, especially those involving vending operations.

Creating a business plan for your vending machine venture involves outlining your goals, target market, and financial projections. Include details about your vending locations, product offerings, and compliance with the Puerto Rico License to Operate Vending Machines on Real Property of Another. Utilizing templates from platforms like US Legal Forms can simplify this process and ensure you cover all essential elements.