Puerto Rico Identity Theft Checklist for Minors

Description

How to fill out Identity Theft Checklist For Minors?

Are you presently in the location where you require documents for either business or personal purposes almost every day.

There are numerous legal document templates available online, but locating ones you can trust is not simple.

US Legal Forms provides a vast array of form templates, including the Puerto Rico Identity Theft Checklist for Minors, which can be printed to meet federal and state standards.

Once you locate the appropriate form, click on Buy now.

Choose the pricing plan you prefer, fill in the necessary information to process your payment, and complete the transaction using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Puerto Rico Identity Theft Checklist for Minors template.

- If you do not possess an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Use the Review option to evaluate the document.

- Check the details to make sure you have chosen the correct form.

- If the form is not what you are seeking, utilize the Search field to find the form that fits your needs.

Form popularity

FAQ

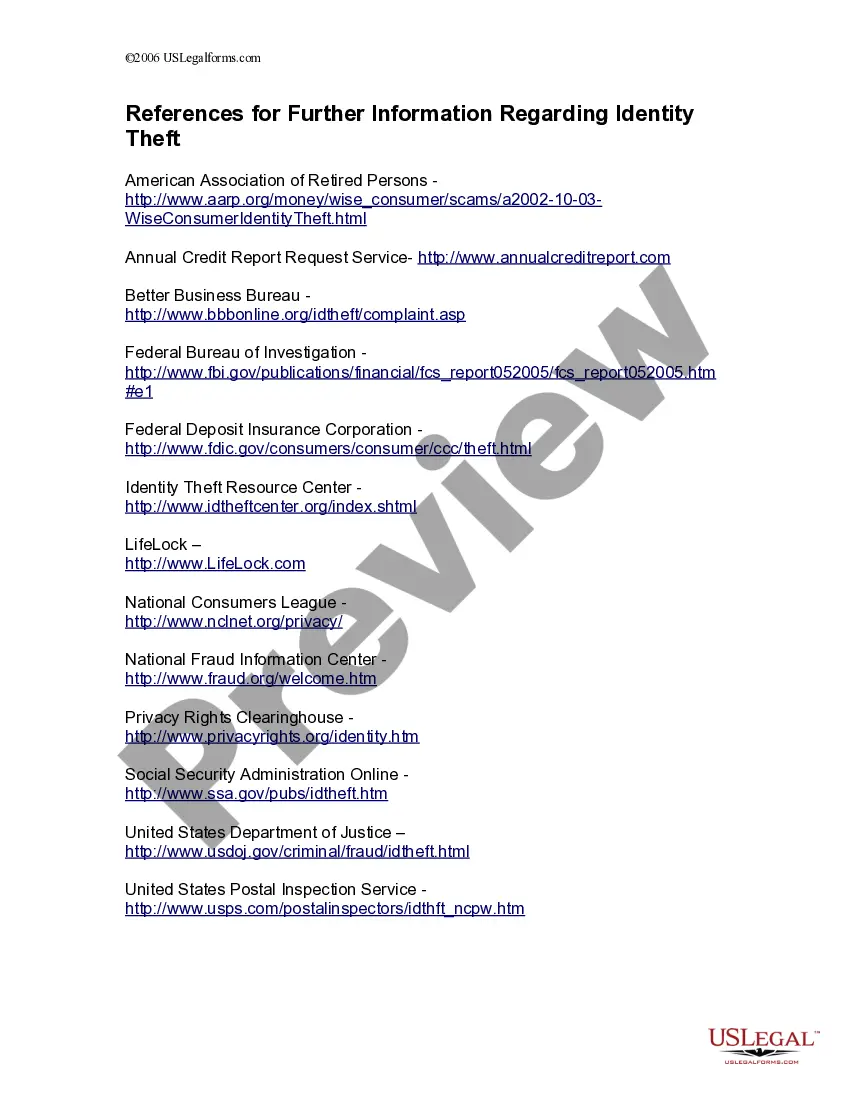

Federal prosecutors work with federal investigative agencies such as the Federal Bureau of Investigation, the United States Secret Service , and the United States Postal Inspection Service to prosecute identity theft and fraud cases.

Fraudsters tend to target children because their financial lives are a relatively blank slate, and the crime can potentially go undetected for a long time. Let's look at how child identity theft happens, the warning signs, and what to do if you suspect your child or grandchild has become a victim of this crime.

Kids are perfect targets for criminals because they have no credit history, and until they are at least teenagers they won't be doing things like applying for credit cards and loans or making big purchases that would raise red flags.

Warning Signs of Child Identity Theft Unexpected bills addressed to your child. Collection notices that arrive by mail or phone, targeting your child. Denial of government benefits for your child on the basis that they've already been paid to someone using your child's Social Security number.

Identity thieves often target children and seniors for their scams. Children are attractive targets due to their clean credit histories, while seniors rarely monitor their credit and may be less likely to recognize scammers. In some cases, the identity thief could even be a family member.

What is child identity theft? Adults are not the only targets of identity theft. In fact, children under the age of 18 can also become victims. Child identity theft happens when someone uses a minor child's personal information, such as name and Social Security number, usually to obtain credit or employment.

The average age of an identity fraud victim is 30-39 years old (FTC) In the US, the most common victims of identity theft are aged 30-39 years old. This is closely followed by those aged 40-49 years old. The least likely age group to fall victim to identity theft by raw numbers are 80+.

But criminals don't only target adults with credit cards, solid credit scores, or savings accounts. ing to Javelin Strategy's 2021 Child Identity Fraud study [*]: One in 50 children were the victims of identity theft last year ? with victims losing $918 million to child identity theft.

Use a credit monitoring service Consider signing up for a credit monitoring service that notifies you when changes are posted to your credit report. This is one of the fastest ways to find out if someone has opened new accounts in your name.

A child's identity is essentially a ?blank slate? for identity thieves. Children don't have credit reports and few parents actively monitor their child's credit or SSN, which means the fraud can go undetected for years.