Puerto Rico Shareholder and Corporation agreement to issue additional stock to a third party to raise capital

Description

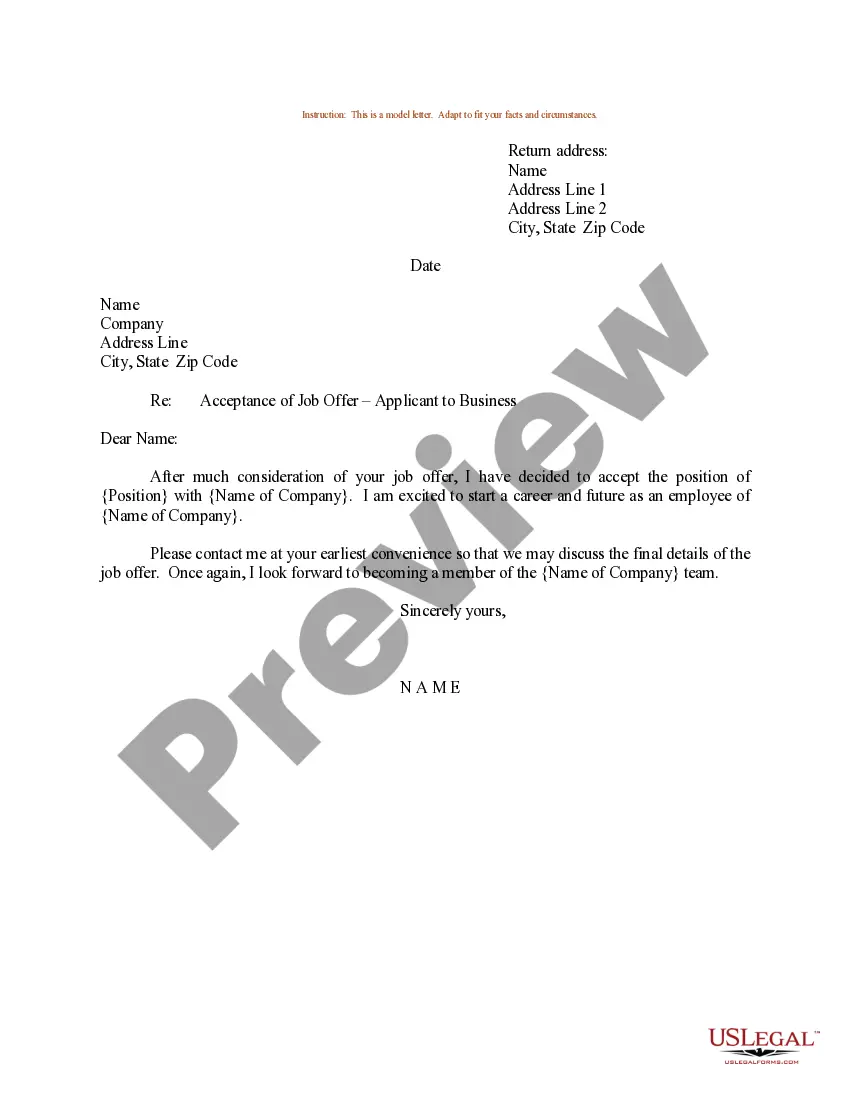

How to fill out Shareholder And Corporation Agreement To Issue Additional Stock To A Third Party To Raise Capital?

If you require to fully, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms available on the web.

Take advantage of the site’s simple and user-friendly search to find the documents you need.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, press the Get now button. Choose the pricing plan you wish and provide your details to register for an account.

Step 5. Complete the payment. You can use either your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to obtain the Puerto Rico Shareholder and Corporation agreement to issue more stock to a third party to increase capital in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to receive the Puerto Rico Shareholder and Corporation agreement to issue more stock to a third party to raise capital.

- You can also access the forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct state/territory.

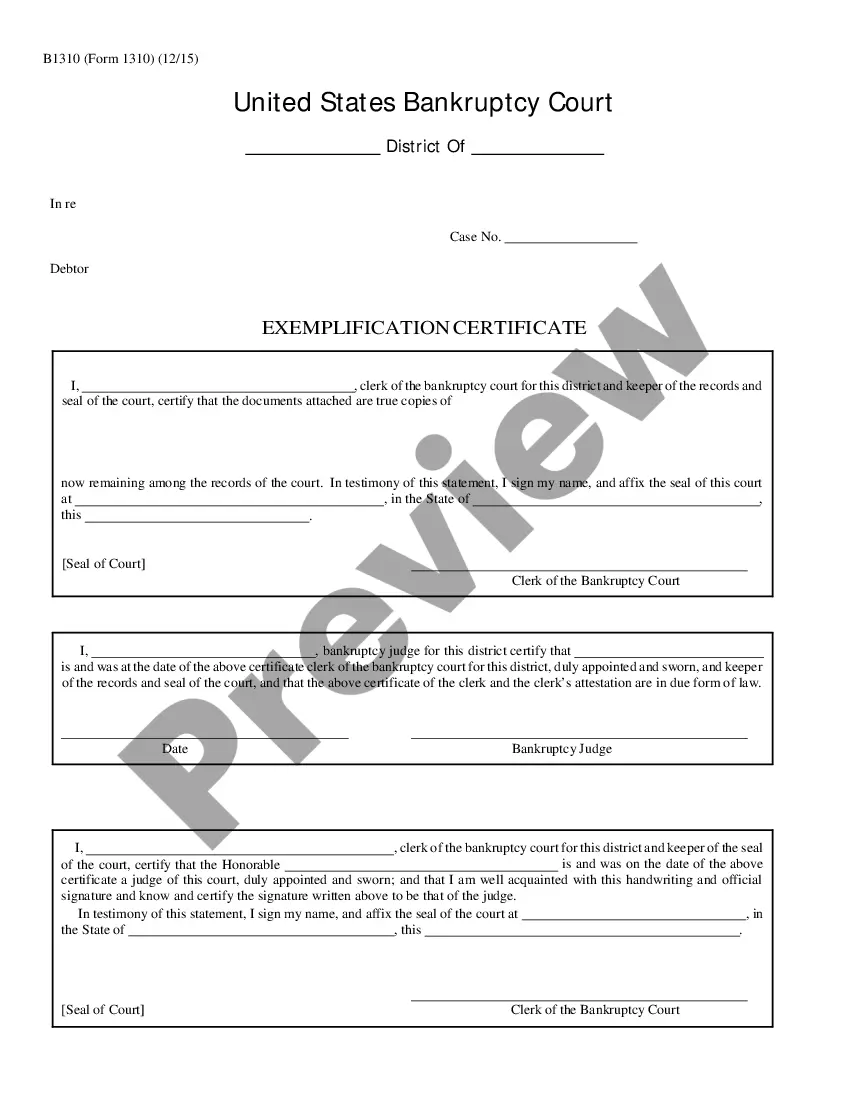

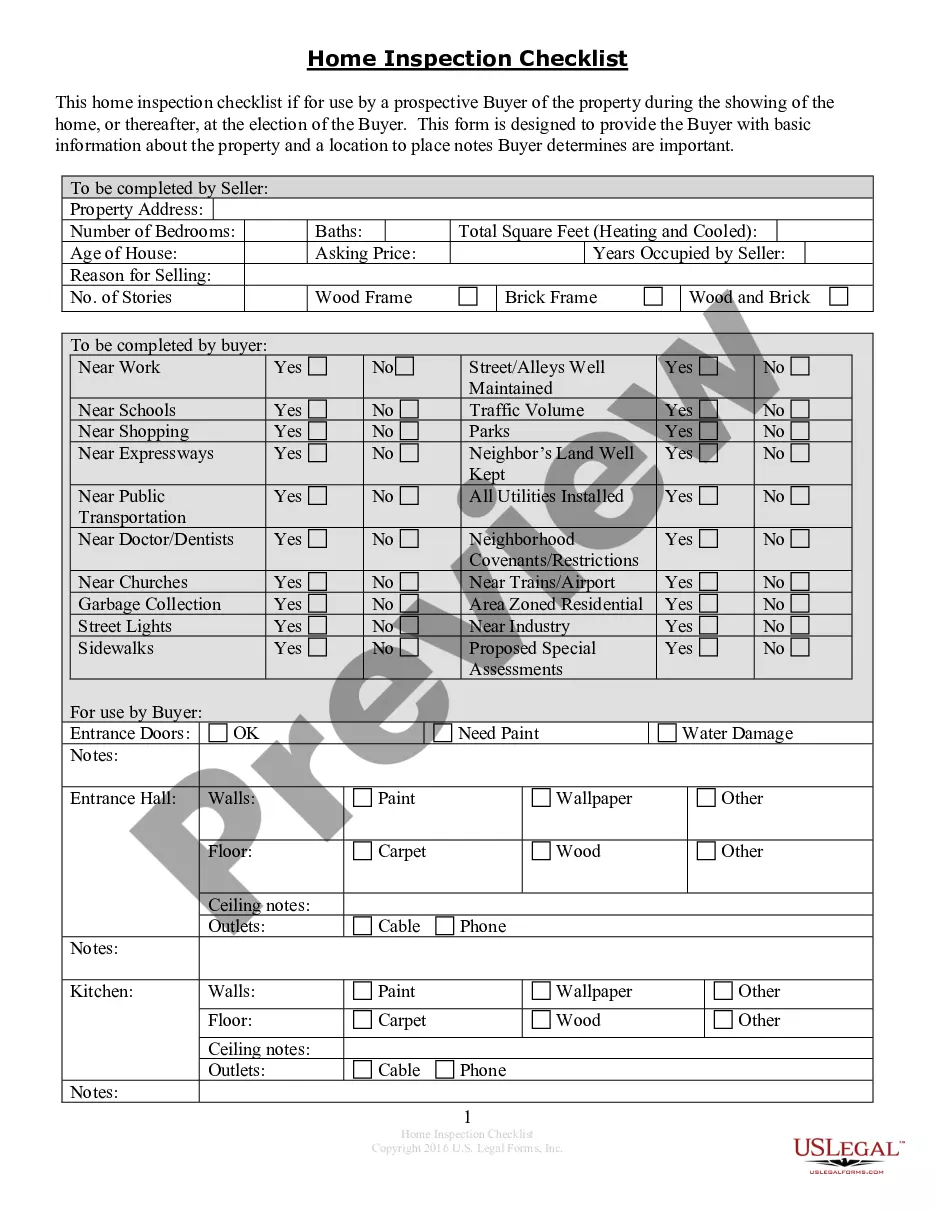

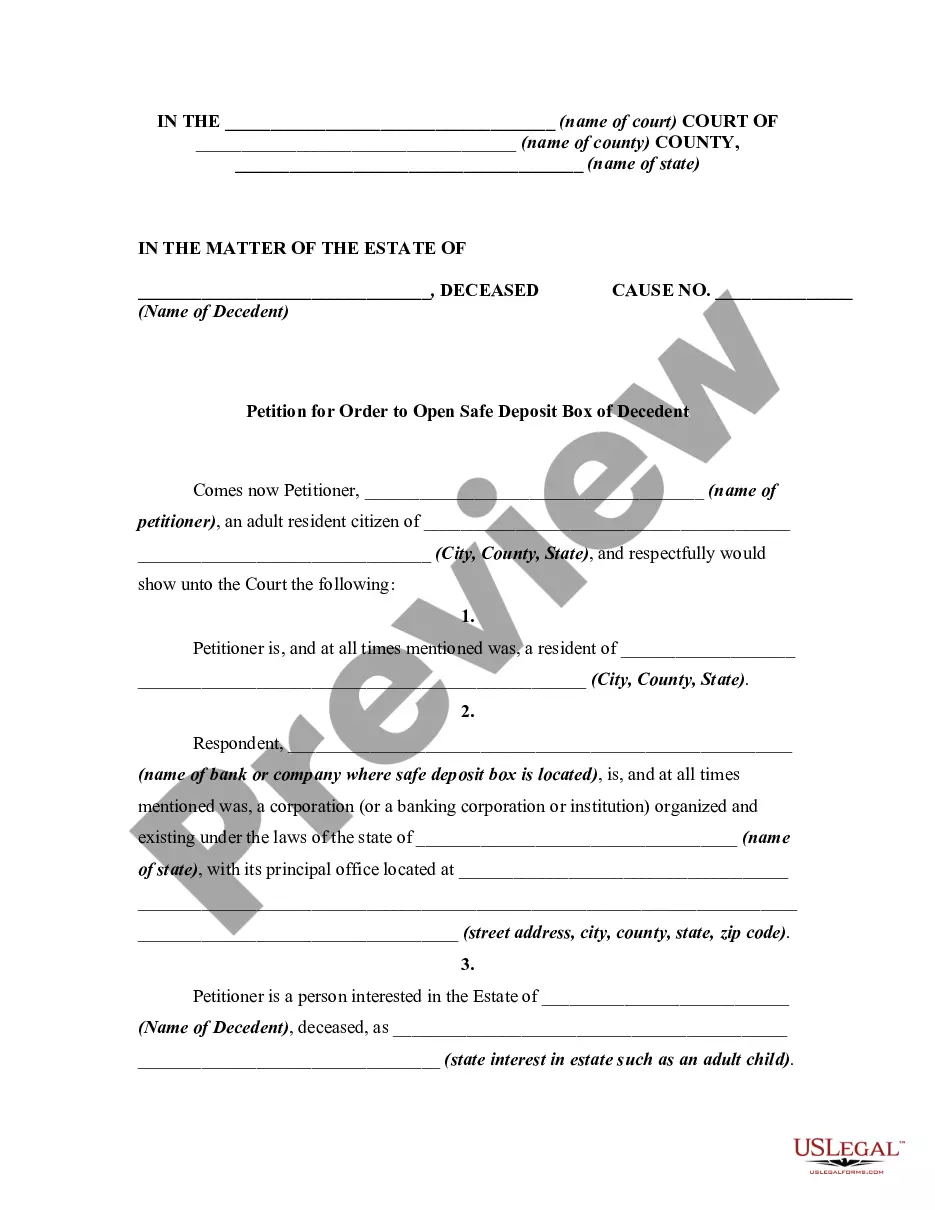

- Step 2. Use the Review option to examine the form’s content. Don’t forget to read through the summary.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Foreign corporations are generally not subject to Canadian corporate tax, so dividends you receive from foreign corporations are not subject to the gross-up, nor are you eligible for the dividend tax credit. Foreign dividends you receive, such as those paid by U.S. or European companies, are fully taxable to you.

A bona fide resident is an individual that is either: A U.S. citizen OR. A U.S. resident alien who's a citizen or national of a country with which the United States has an income tax treaty in effect.

You spent at least 549 days in Puerto Rico throughout the current and previous two tax years, including at least 60 days per tax year. You spent no more than 90 days in the mainland U.S. throughout the tax year.

Dividends from eligible businesses are exempt from Puerto Rican income tax. To be eligible, a company must commit to having at least one employee when annual projected or actual volume of business is more than $3 million.

An individual is considered to be a bona fide resident of Puerto Rico if three tests are met. The individual must be present for at least 183 days during the taxable year in Puerto Rico or satisfy one of the other four presence tests (the presence test).

Dividend income from sources within Puerto Rico is generally subject to a 15% income tax rate.

An individual is considered to be a bona fide resident of Puerto Rico if three tests are met. The individual must be present for at least 183 days during the taxable year in Puerto Rico or satisfy one of the other four presence tests (the presence test).

To qualify for bona fide residence, you must reside in a foreign country for an uninterrupted period that includes an entire tax year. An entire tax year is from January 1 through December 31 for taxpayers who file their income tax returns on a calendar year basis.

Under General Corporation Law, a foreign corporation or a limited liability company must register with the State Department of Puerto Rico before conducting business locally.

Bona fide residents of Puerto Rico generally do not report income received from sources within Puerto Rico on their U.S. income tax return. However, they should report all income received from sources outside Puerto Rico on their U.S. income tax return.