Puerto Rico Agreement for Purchase of Business Assets from a Corporation

Description

How to fill out Agreement For Purchase Of Business Assets From A Corporation?

Are you currently in a situation where you require documents for either business or personal reasons on a regular basis.

There are numerous legitimate document templates available online, but finding ones you can rely on is challenging.

US Legal Forms offers thousands of form templates, such as the Puerto Rico Agreement for Purchase of Business Assets from a Corporation, designed to comply with federal and state regulations.

Once you find the correct form, click on Purchase now.

Select the payment plan you prefer, enter the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Puerto Rico Agreement for Purchase of Business Assets from a Corporation template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for your correct city/county.

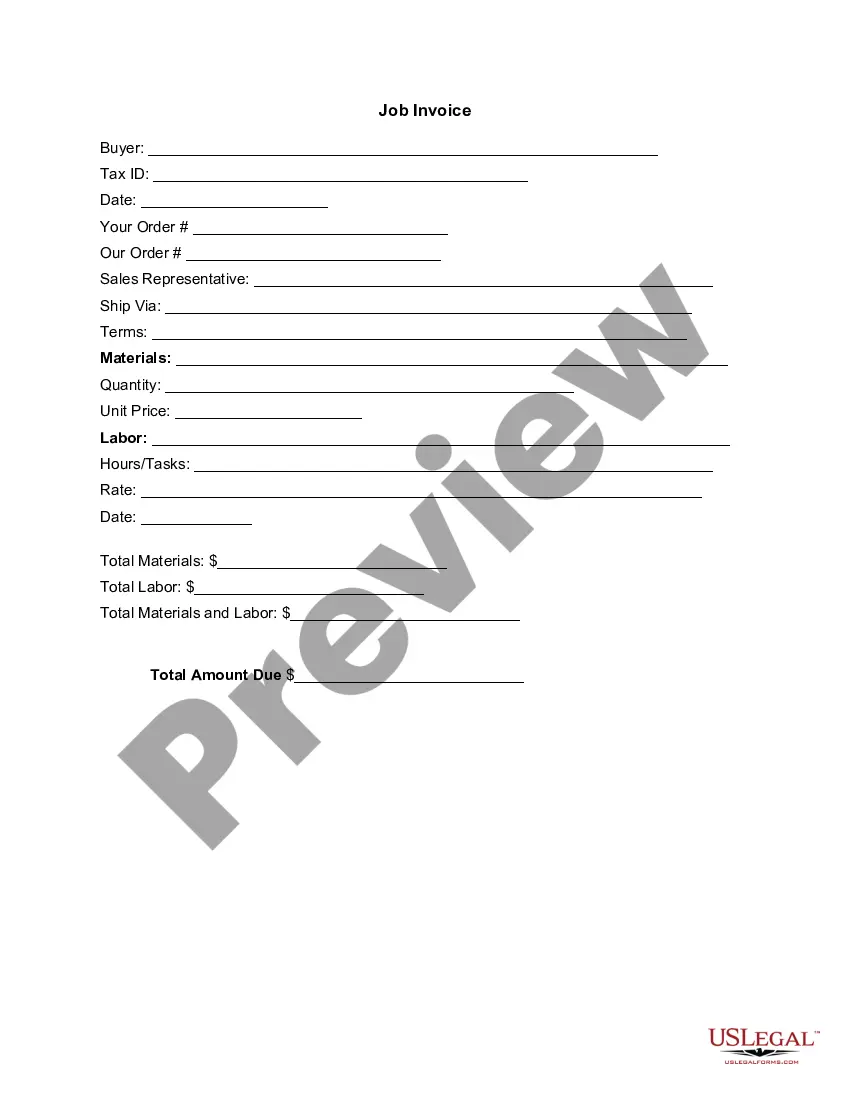

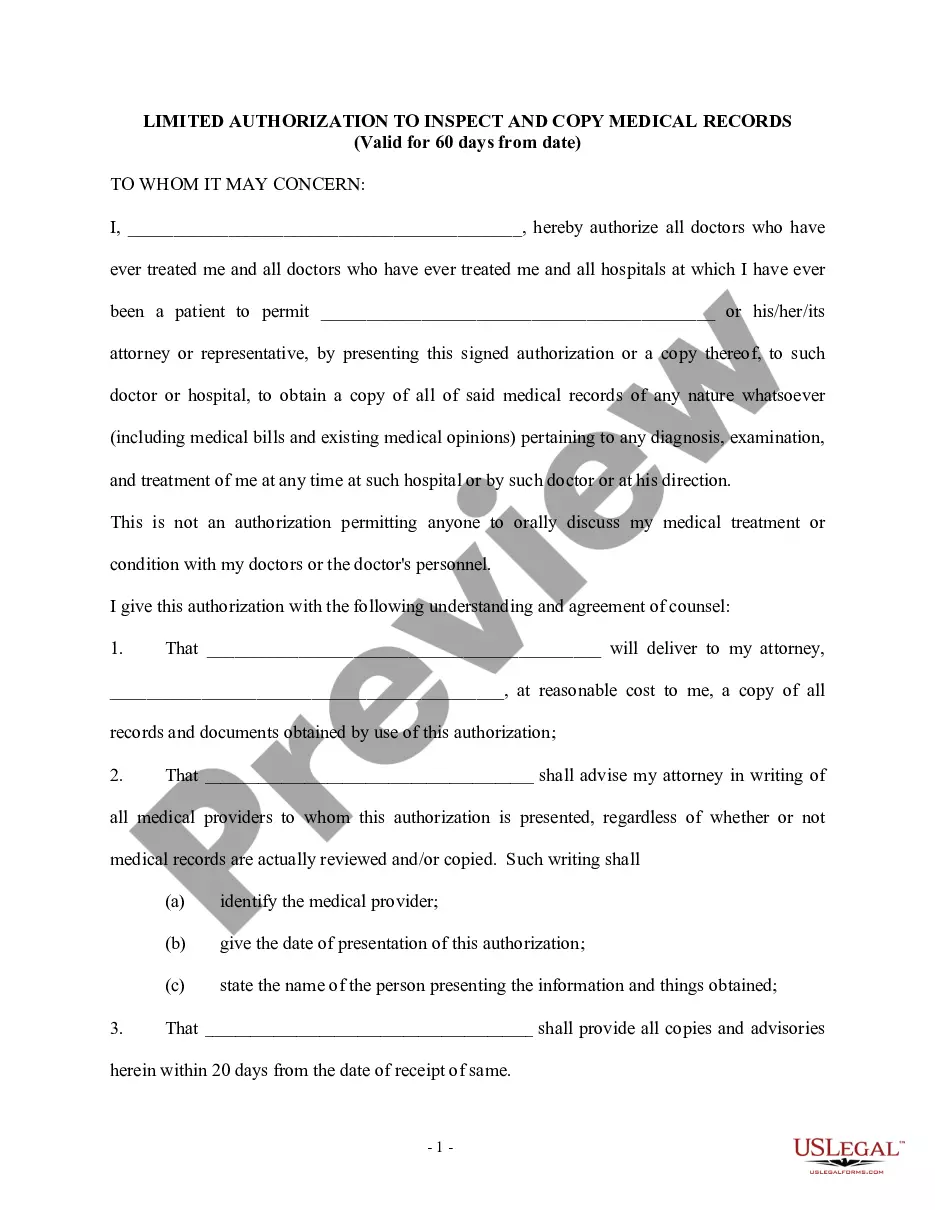

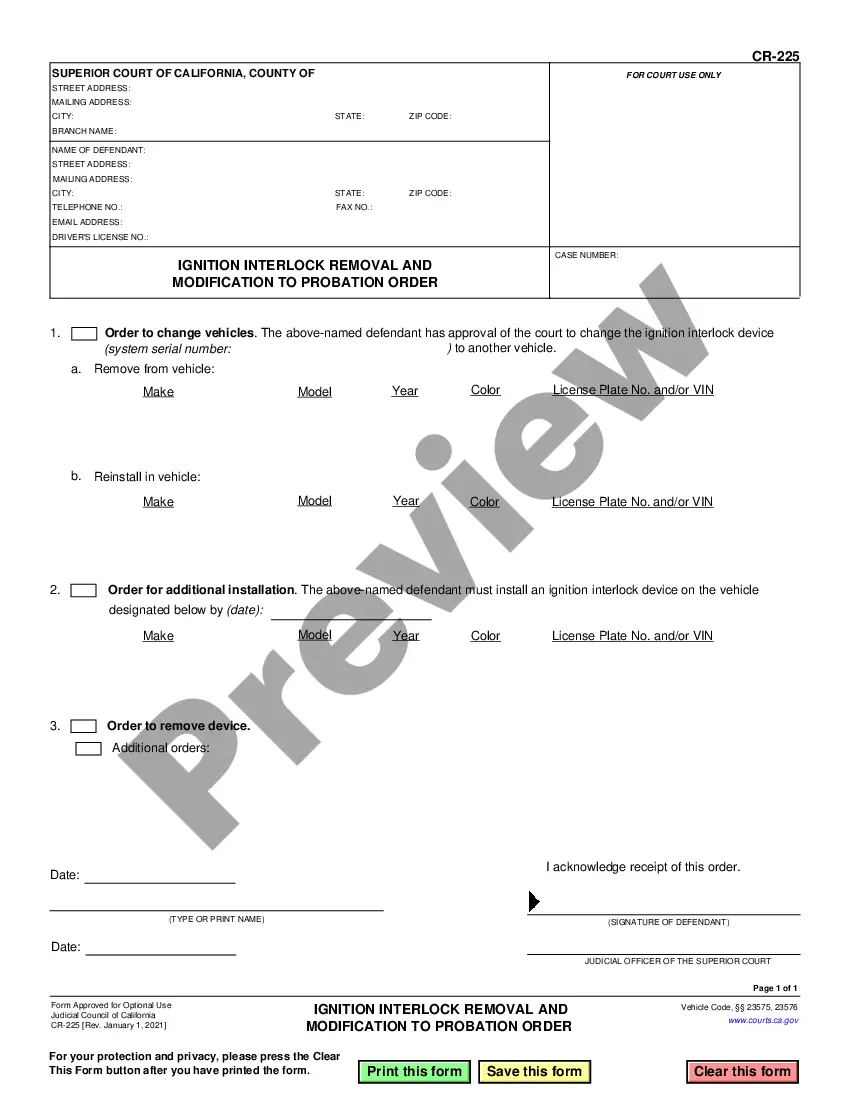

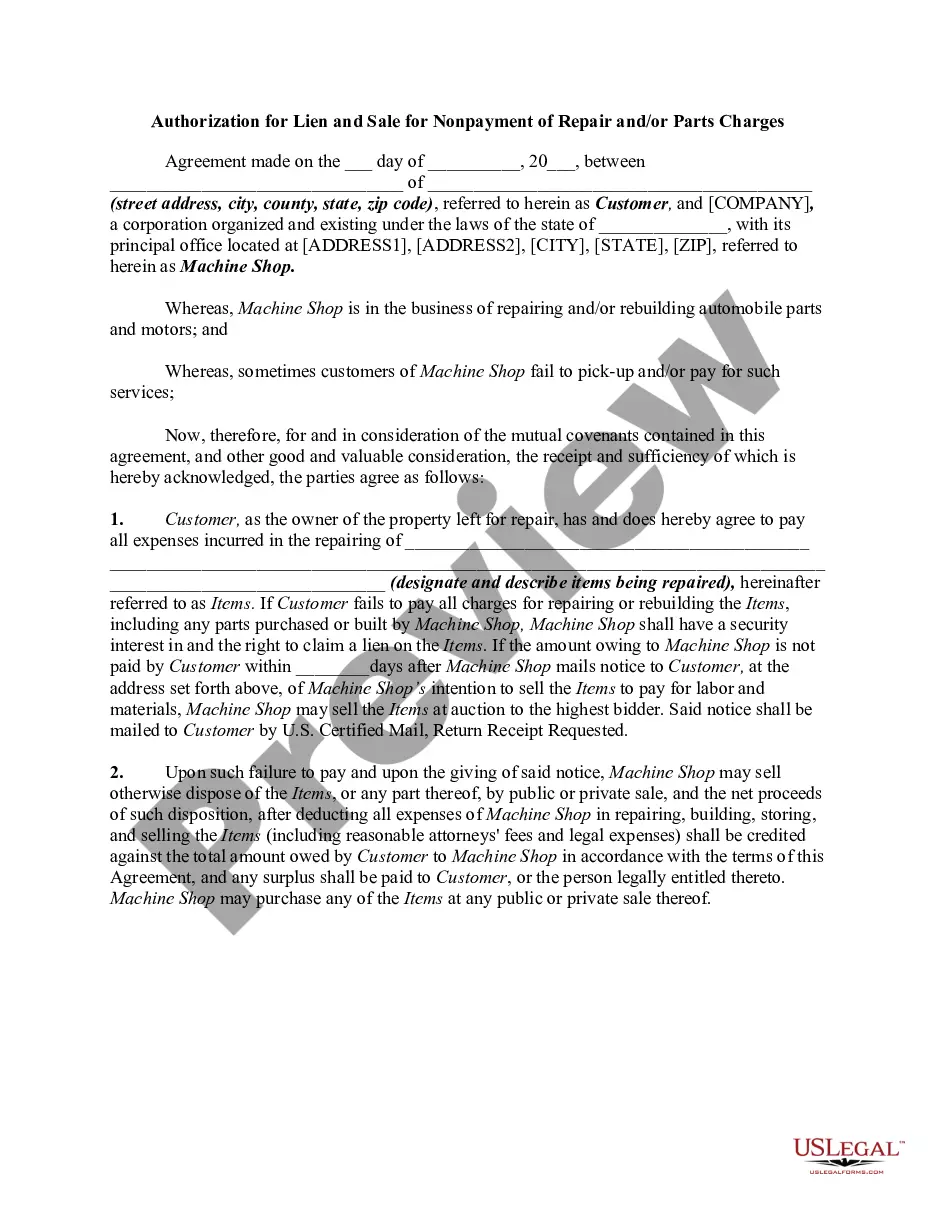

- Use the Preview button to review the form.

- Read the details to ensure you have selected the right form.

- If the form is not what you are looking for, use the Search section to find the form that meets your needs.

Form popularity

FAQ

Business name and registration Register your business name with the local government where your business is located. If you are a corporation, you will also need to register with the Department of State in Puerto Rico, or with the Department of Corporations and Trademarks in the U.S. Virgin Islands.

Filing and forming an LLC in Puerto Rico requires a $250 filing fee. Under Puerto Rico law, an LLC uses a limited liability company agreement, or LLCA, to govern the internal affairs and administration of the LLC. This is valid regardless of what it is called, but the law says that they must be written.

Protection by the U.S.: As a U.S. Territory, Puerto Rico is protected by the U.S. military and government. Exempt from U.S. Taxes: Puerto Rico's Controlled Foreign Corporation (CFC) structure allows income generated from selling products to the United States exempt from U.S. Taxes.

The initial cost to start an LLC in Puerto Rico is $250 to register your business with the Department of State. After that, you'll have a yearly recurring cost of $150 for your Annual Fee, which keeps your LLC current with the state.

In Puerto Rico, a DBA is called a trade name. To register a DBA in Puerto Rico, submit a Trade Name Application to the Puerto Rico Department of State, along with the $150 filing fee.

In conclusion, not registering your business can have serious consequences for your startup. Not only can it leave you liable for financial obligations and subject to fines and other legal penalties, but it also has the potential to damage your company's credibility with customers and investors.